Recurring bills often drain budgets due to fixed charges that accumulate monthly, making expense management challenging. Bill negotiation services target these ongoing expenses by leveraging expert strategies to reduce rates and identify hidden fees. Employing bill negotiation can result in significant savings and improved cash flow without the hassle of constant bill tracking.

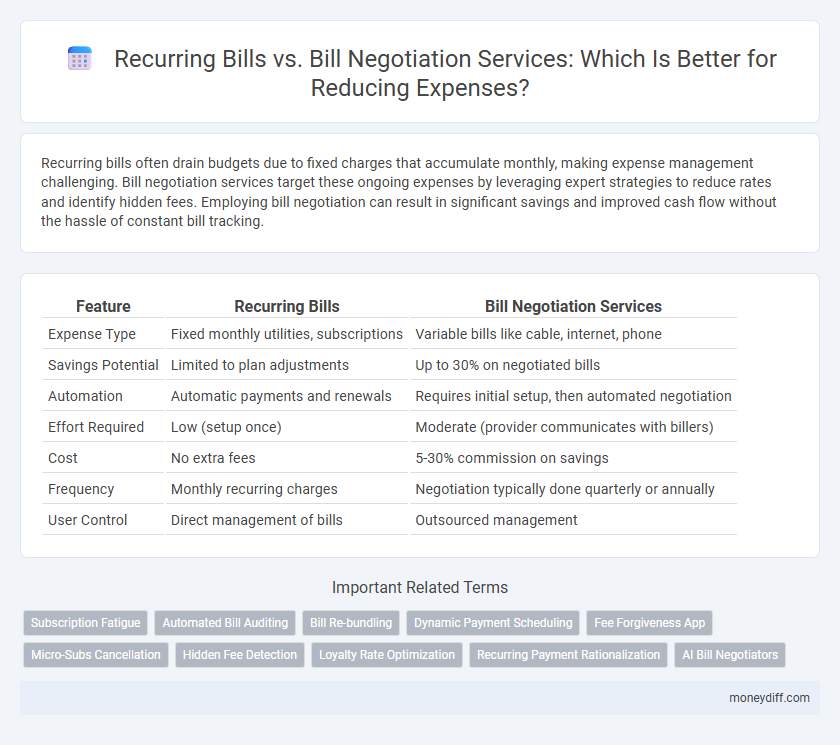

Table of Comparison

| Feature | Recurring Bills | Bill Negotiation Services |

|---|---|---|

| Expense Type | Fixed monthly utilities, subscriptions | Variable bills like cable, internet, phone |

| Savings Potential | Limited to plan adjustments | Up to 30% on negotiated bills |

| Automation | Automatic payments and renewals | Requires initial setup, then automated negotiation |

| Effort Required | Low (setup once) | Moderate (provider communicates with billers) |

| Cost | No extra fees | 5-30% commission on savings |

| Frequency | Monthly recurring charges | Negotiation typically done quarterly or annually |

| User Control | Direct management of bills | Outsourced management |

Understanding Recurring Bills: A Quick Overview

Recurring bills represent consistent, scheduled expenses such as utilities, subscriptions, and memberships that significantly impact monthly budgets. Monitoring these bills enables identification of unnecessary charges and potential savings by adjusting service plans or usage. Bill negotiation services leverage expertise and industry knowledge to reduce recurring expenses by securing lower rates and eliminating hidden fees.

What Are Bill Negotiation Services?

Bill negotiation services specialize in reducing recurring bills by leveraging expertise and industry connections to secure lower rates on utilities, insurance, and other regular expenses. These services analyze your current bills, identify overcharges or outdated pricing, and negotiate directly with providers on your behalf to achieve savings. By using bill negotiation services, consumers can decrease monthly expenses without altering their usage or service plans.

Types of Recurring Bills Impacting Your Budget

Types of recurring bills significantly impacting your budget include utilities, subscription services, insurance premiums, and rental payments. Each category presents opportunities for expense reduction through bill negotiation services that secure lower rates or discounts. Optimizing these recurring expenses can lead to substantial monthly savings and improved financial stability.

Benefits of Tracking Recurring Expenses

Tracking recurring expenses offers clear visibility into regular payment obligations, enabling better budget management and identifying unnecessary or inflated charges for potential savings. It facilitates timely bill negotiation services by providing accurate billing histories that strengthen negotiating positions with service providers. Consistent monitoring helps prevent late fees and service interruptions, ultimately supporting more effective expense reduction strategies.

How Bill Negotiation Services Operate

Bill negotiation services actively analyze monthly recurring bills such as utilities, cable, and internet to identify potential savings by leveraging industry knowledge and vendor relationships. They negotiate directly with service providers to secure lower rates or promotional offers, often based on market benchmarks and customer usage patterns. This proactive approach contrasts with recurring bill payments by targeting cost reduction rather than mere expense management.

Comparing DIY Bill Tracking vs. Professional Negotiation

Tracking recurring bills through DIY methods allows individuals to monitor expenses regularly and identify potential savings but often lacks the expertise to maximize reductions. Professional bill negotiation services leverage industry knowledge and vendor relationships to secure better rates and eliminate hidden fees, delivering higher expense reduction than typical DIY approaches. Data shows that households using negotiation services can save up to 30% on recurring bills compared to only 5-10% savings from self-managed tracking.

Cost Savings: Recurring Bill Analysis vs. Negotiation Services

Recurring bill analysis identifies fixed monthly expenses, enabling organizations to track and optimize repetitive costs for consistent savings. Bill negotiation services leverage provider relationships and market data to lower rates on telecommunications, utilities, and subscription fees, often resulting in immediate, significant reductions. Combining recurring bill analysis with negotiation services maximizes cost savings by targeting both predictable expenses and variable charges.

Evaluating the Risks of Bill Negotiation Agencies

Bill negotiation services carry risks such as hidden fees, inconsistent savings, and potential privacy concerns when sharing sensitive financial information. Recurring bills management offers more predictable expense control but may lack flexibility in adapting to changing service plans. Evaluating these risks is crucial to ensure bill negotiation agencies provide transparent outcomes and safeguard client data effectively.

Choosing the Best Money Management Approach for Recurring Bills

Recurring bills often represent a fixed, predictable expense that requires strategic management to prevent unnecessary overspending. Bill negotiation services offer a targeted approach by leveraging expert knowledge and market rates to reduce the cost of utilities, subscriptions, and other recurring charges. Choosing the best money management approach depends on balancing convenience and potential savings, where negotiation services can significantly lower bills but may involve fees, while self-management demands consistent tracking and timely payments.

Tips for Sustainable Expense Reduction

Automating recurring bills ensures consistent payment, minimizing late fees and improving credit scores, which contributes to long-term financial stability. Leveraging bill negotiation services targets variable expenses by securing lower rates on utilities, insurance, and subscriptions, offering immediate savings and reducing overall expenditure trends. Combining both strategies fosters sustainable expense reduction by maintaining predictable costs and actively lowering fluctuating bills.

Related Important Terms

Subscription Fatigue

Subscription fatigue leads many consumers to overlook recurring bills, causing unnecessary expenses to accumulate. Bill negotiation services offer targeted reduction strategies by identifying and lowering costs in long-term subscriptions, effectively combating hidden overcharges and optimizing monthly spending.

Automated Bill Auditing

Automated bill auditing leverages AI algorithms to systematically analyze recurring bills, identifying discrepancies and errors that traditional bill negotiation services might overlook. This technology streamlines expense reduction by continuously monitoring and validating charges, ensuring optimal savings without the need for manual intervention.

Bill Re-bundling

Bill re-bundling consolidates multiple recurring bills into a single, often lower-cost package, streamlining expense management and maximizing savings. This strategy offers a more reliable reduction than bill negotiation services, which focus on one-time discounts rather than ongoing optimization of bundled expenses.

Dynamic Payment Scheduling

Dynamic payment scheduling empowers consumers to better manage recurring bills by adjusting payment dates to optimize cash flow and avoid penalties, directly impacting expense reduction. Bill negotiation services complement this by leveraging expertise to lower bill amounts, creating a comprehensive strategy for managing and minimizing ongoing expenses.

Fee Forgiveness App

Recurring bills often lead to unnoticed expenses, making Fee Forgiveness App's bill negotiation services a powerful tool for expense reduction by identifying and eliminating unnecessary fees. This app leverages advanced algorithms to negotiate with service providers, ensuring lower bills and long-term savings without the hassle of manual tracking.

Micro-Subs Cancellation

Micro-subs cancellation targets eliminating small, recurring charges that accumulate unnoticed, offering immediate expense reduction without the need for ongoing negotiations. Unlike bill negotiation services that renegotiate rates periodically, micro-subs cancellation provides a one-time cleanup of hidden costs, streamlining budget control and boosting savings efficiency.

Hidden Fee Detection

Recurring bills often include hidden fees that can accumulate unnoticed, increasing overall expenses significantly. Bill negotiation services specialize in detecting and eliminating these hidden charges, leading to more effective expense reduction and improved financial management.

Loyalty Rate Optimization

Recurring bills provide predictable expense tracking but often lack customized cost-saving options, while bill negotiation services actively reduce costs by leveraging market rates and provider incentives. Effective loyalty rate optimization balances consistent payment schedules with targeted negotiation strategies to maximize long-term savings and minimize unnecessary spending.

Recurring Payment Rationalization

Recurring payment rationalization reduces expenses by analyzing and eliminating unnecessary subscriptions, optimizing recurring bills for cost savings. Bill negotiation services complement this by leveraging expert strategies to lower recurring charges, enhancing overall expense management efficiency.

AI Bill Negotiators

AI bill negotiators leverage advanced algorithms and machine learning to analyze recurring bills, identifying potential savings by negotiating lower rates automatically; this approach often yields higher expense reductions compared to manually managing recurring bills. Enhanced by real-time data processing and personalized negotiation strategies, AI systems streamline cost-cutting efforts, optimize monthly expenses, and reduce the need for ongoing manual intervention.

Recurring bills vs Bill negotiation services for expense reduction. Infographic

moneydiff.com

moneydiff.com