Manual bill pay requires tracking due dates and entering payments individually, which can lead to missed deadlines and late fees, increasing overall expenses. Subscription management tools automate payments, provide reminders, and consolidate multiple subscriptions, enabling better oversight and reducing the risk of unnecessary charges. This streamlined approach improves budgeting accuracy and optimizes expense control by preventing unexpected or redundant expenses.

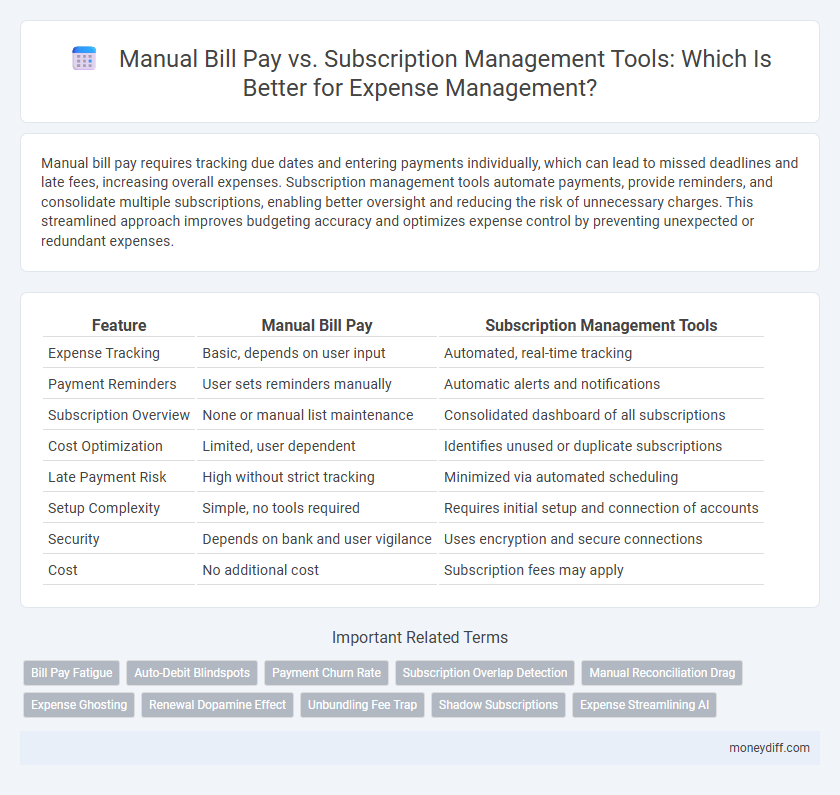

Table of Comparison

| Feature | Manual Bill Pay | Subscription Management Tools |

|---|---|---|

| Expense Tracking | Basic, depends on user input | Automated, real-time tracking |

| Payment Reminders | User sets reminders manually | Automatic alerts and notifications |

| Subscription Overview | None or manual list maintenance | Consolidated dashboard of all subscriptions |

| Cost Optimization | Limited, user dependent | Identifies unused or duplicate subscriptions |

| Late Payment Risk | High without strict tracking | Minimized via automated scheduling |

| Setup Complexity | Simple, no tools required | Requires initial setup and connection of accounts |

| Security | Depends on bank and user vigilance | Uses encryption and secure connections |

| Cost | No additional cost | Subscription fees may apply |

Manual Bill Pay vs Subscription Management Tools: An Overview

Manual bill pay requires individuals to track due dates and payments themselves, increasing the risk of late fees and missed expenses. Subscription management tools automate tracking recurring payments, providing consolidated views and reminders to optimize cash flow and budgeting accuracy. Integrating subscription management software reduces financial stress by streamlining expense monitoring and preventing unnecessary charges.

Key Differences Between Manual and Automated Payment Methods

Manual bill pay requires users to track due dates and enter payment details for each transaction, increasing the risk of missed or late payments. Subscription management tools automate recurring payments, providing reminders, expense categorization, and centralized control to streamline financial tracking. Automated methods reduce human error and improve budgeting accuracy compared to manual processes.

Time Efficiency: Manual Bill Payment vs. Automated Tools

Manual bill payment consumes significant time due to repetitive tasks like logging in to multiple accounts and verifying statements. Subscription management tools automate payment scheduling, notifications, and expense tracking, drastically reducing time spent on financial administration. Automation also minimizes errors and late fees, enhancing overall time efficiency in money management.

Accuracy and Error Reduction: Which Method Performs Better?

Manual bill pay often leads to human errors such as missed payments, incorrect amounts, or duplicate transactions, reducing overall accuracy. Subscription management tools automate payment schedules, provide real-time updates, and generate detailed reports, significantly minimizing errors and enhancing financial tracking. Data shows businesses using automated tools experience up to 70% fewer billing mistakes compared to manual methods.

Tracking Expenses: Manual Logs vs. Digital Subscription Managers

Manual bill pay relies on handwritten or spreadsheet-based logs that can be prone to human error and time-consuming to update, often resulting in missed payments or overlooked expenses. Digital subscription management tools automate tracking by consolidating all recurring charges into a single dashboard with real-time notifications and categorized expense reports. These tools enhance accuracy, provide predictive billing insights, and help users maintain control over their cash flow with minimal manual intervention.

Security and Privacy: Protecting Your Financial Data

Manual bill pay requires careful handling of sensitive information to avoid data breaches, relying heavily on user vigilance for security. Subscription management tools often use encrypted connections and secure authentication protocols designed to protect financial data from unauthorized access. Leveraging advanced privacy features, these tools can reduce the risk of identity theft and unauthorized payments by automating secure transactions and data storage.

Cost Implications: Are Subscription Tools Worth the Investment?

Manual bill pay may seem cost-effective initially due to the absence of subscription fees, but it often incurs hidden expenses like late payment penalties and time costs. Subscription management tools provide automated tracking and timely payments, reducing the risk of fees and potentially offering savings that outweigh their monthly or annual costs. Evaluating the total cost of ownership, including time saved and avoided penalties, demonstrates that subscription tools can be a financially prudent investment for efficient money management.

Flexibility and Control Over Your Finances

Manual bill pay offers direct control over each payment, allowing users to adjust amounts and schedules on the fly, which provides maximum flexibility for variable expenses. Subscription management tools automate recurring charges, reducing the risk of late payments but may limit custom adjustments and require oversight to avoid unwanted renewals. Balancing these approaches enhances financial control by combining hands-on payment customization with streamlined subscription tracking.

Reducing Late Fees: Manual Tracking vs. Auto-Pay Features

Manual bill pay relies heavily on individual diligence, increasing the risk of missed payments and costly late fees due to human error or oversight. Subscription management tools leverage auto-pay features that automatically process payments on due dates, ensuring timely transactions and significantly reducing the likelihood of late fees. Utilizing automated systems enhances financial discipline, minimizes payment delays, and optimizes overall expense management.

Choosing the Best Approach for Effective Money Management

Manual bill pay requires tracking due dates and amounts individually, which can increase the risk of late payments and overlooked expenses. Subscription management tools automate recurring payments, provide reminders, and offer insights into spending patterns, improving budget accuracy. Selecting the best approach depends on balancing control preferences with convenience and leveraging tools that enhance timely payments and comprehensive expense tracking.

Related Important Terms

Bill Pay Fatigue

Manual bill pay often leads to bill pay fatigue due to repetitive tasks and frequent payment scheduling, increasing the risk of missed or late payments. Subscription management tools automate recurring payments and provide consolidated tracking, reducing cognitive load and improving overall expense control.

Auto-Debit Blindspots

Manual bill pay often leads to missed deadlines and forgotten payments, increasing late fees and financial penalties, while subscription management tools provide automated tracking and alerts to identify auto-debit blindspots, helping users avoid unexpected charges and optimize cash flow. These tools consolidate recurring expenses into a single dashboard, enabling easier monitoring and timely adjustments to subscription plans for improved expense management.

Payment Churn Rate

Manual bill pay often leads to higher payment churn rates due to missed or late payments, increasing the risk of penalties and impacting credit scores. Subscription management tools automate recurring payments, significantly reducing payment churn rates by ensuring timely transactions and increasing overall financial stability.

Subscription Overlap Detection

Subscription management tools enhance expense tracking by automatically identifying subscription overlap, minimizing redundant payments and optimizing budget allocation. Manual bill pay often lacks this automated overlap detection, increasing the risk of missed savings and inefficient money management.

Manual Reconciliation Drag

Manual bill pay requires users to individually track and reconcile each payment, often leading to time-consuming manual reconciliation drag that increases the risk of errors and overlooked expenses. Subscription management tools automate payment tracking and reconciliation processes, significantly reducing manual effort and improving accuracy in expense management.

Expense Ghosting

Manual bill pay often leads to expense ghosting due to missed or forgotten payments, causing inaccurate tracking and budget discrepancies. Subscription management tools automatically monitor recurring charges, reducing expense ghosting by providing real-time alerts and consolidated oversight.

Renewal Dopamine Effect

Manual bill pay requires active engagement each payment cycle, often triggering a renewal dopamine effect that temporarily boosts satisfaction when tasks are completed. Subscription management tools automate payments and reminders, reducing cognitive load but potentially diminishing the renewal dopamine effect due to less frequent conscious interaction with bills.

Unbundling Fee Trap

Manual bill pay often incurs hidden fees and timing errors that lead to higher overall costs, while subscription management tools streamline payments by automating tracking and avoiding unbundling fee traps associated with individual transactions. Leveraging software that consolidates bills prevents fragmented charges and improves budget accuracy by reducing late payment penalties and overdraft fees.

Shadow Subscriptions

Manual bill pay often leads to overlooked shadow subscriptions, causing unexpected expenses that disrupt budget accuracy; subscription management tools automatically track recurring payments and identify hidden or forgotten services, ensuring comprehensive spending visibility and better financial control. Utilizing subscription management software reduces the risk of duplicate charges and unauthorized renewals, enhancing money management efficiency compared to manual methods.

Expense Streamlining AI

Expense Streamlining AI leverages advanced algorithms to automate manual bill pay processes and optimize subscription management tools, reducing errors and enhancing cash flow visibility. Integrating AI-driven expense tracking enables real-time monitoring, predicts recurring costs, and streamlines financial workflows for improved budget control.

Manual bill pay vs Subscription management tools for money management. Infographic

moneydiff.com

moneydiff.com