Monthly bills provide a structured overview of expenses, allowing for predictable budgeting and financial planning. Real-time expense alerts offer immediate insights into spending, helping to prevent overspending and identify unauthorized transactions quickly. Combining both methods enhances financial control by balancing long-term tracking with instant awareness.

Table of Comparison

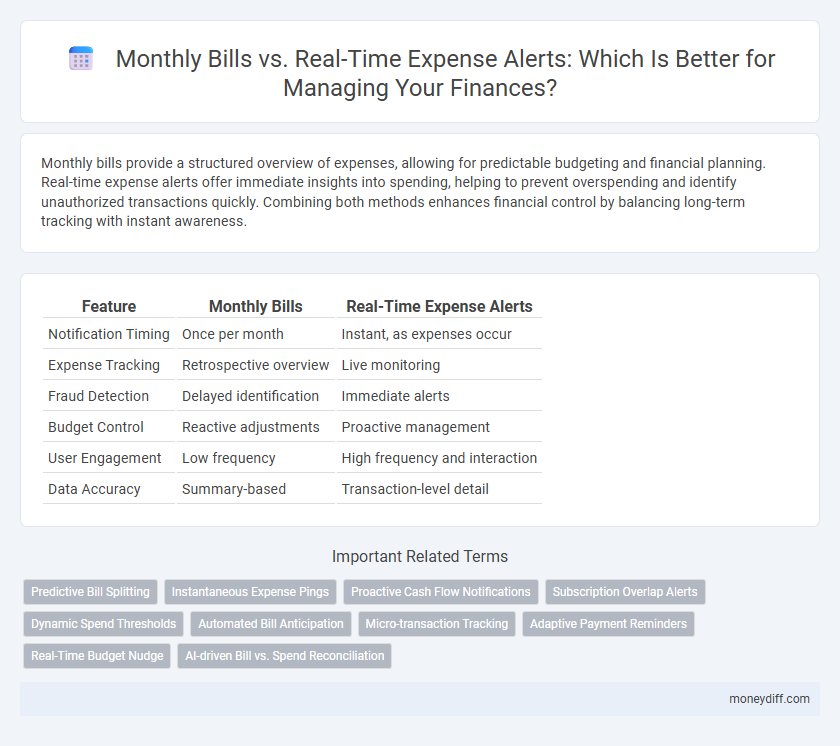

| Feature | Monthly Bills | Real-Time Expense Alerts |

|---|---|---|

| Notification Timing | Once per month | Instant, as expenses occur |

| Expense Tracking | Retrospective overview | Live monitoring |

| Fraud Detection | Delayed identification | Immediate alerts |

| Budget Control | Reactive adjustments | Proactive management |

| User Engagement | Low frequency | High frequency and interaction |

| Data Accuracy | Summary-based | Transaction-level detail |

Understanding Monthly Bills: Pros and Cons

Monthly bills provide a clear overview of recurring expenses, simplifying budget planning and cash flow management. However, relying solely on monthly statements can delay the identification of unexpected charges or overspending, increasing the risk of financial surprises. Real-time expense alerts complement monthly bills by offering immediate notifications, but monthly billing remains essential for tracking long-term spending patterns and verifying overall account accuracy.

The Rise of Real-Time Expense Alerts

Real-time expense alerts have transformed personal finance management by providing immediate notifications of transactions, allowing consumers to monitor spending instantly and avoid unexpected fees. Monthly bills offer a traditional overview of expenses but lack the immediacy that real-time alerts provide, which enhances budgeting accuracy and fraud detection. The increasing adoption of mobile banking apps and AI-driven financial tools fuels the rise of real-time expense alerts, empowering users to stay informed and in control of their financial health every moment.

How Monthly Bills Help Budgeting

Monthly bills provide a fixed framework that simplifies budgeting by offering predictable expense amounts each month, enabling more accurate financial planning. Knowing exact payment deadlines for utilities, rent, and subscriptions reduces the risk of missed payments and late fees. This structured approach allows individuals to allocate funds efficiently, ensuring essential expenses are prioritized within their monthly budget.

Immediate Benefits of Real-Time Tracking

Real-time expense alerts provide instant notifications for transactions, enabling immediate budget adjustments and preventing overspending. Unlike monthly bills that summarize costs retroactively, real-time tracking enhances financial control by highlighting irregular or unauthorized expenses as they occur. This proactive approach reduces late fees and supports more accurate, up-to-date financial planning.

Comparing Financial Awareness: Static vs Dynamic

Monthly bills provide a static overview of expenses, offering a scheduled snapshot of financial obligations that helps in long-term budgeting and planning. Real-time expense alerts deliver dynamic updates, enhancing financial awareness by instantly notifying users of transactions, which allows for immediate adjustments and better control over day-to-day spending. Comparing these methods highlights that static billing promotes structured financial tracking, while dynamic alerts foster proactive management and reduce the risk of overspending.

Avoiding Overspending with Instant Notifications

Monthly bills provide a fixed overview of recurring expenses but often delay awareness of overspending. Real-time expense alerts send instant notifications at the moment of transaction, enabling immediate budget adjustments and preventing unnecessary expenditures. Utilizing real-time alerts enhances financial control by reducing the risk of exceeding spending limits through timely updates.

Monthly Bills and Long-Term Financial Planning

Monthly bills provide a structured framework for tracking fixed expenses such as rent, utilities, and subscriptions, which is essential for long-term financial planning and budgeting. Consistent payment schedules enable individuals to forecast cash flow accurately and allocate funds for savings or investments. Monitoring monthly bills aids in identifying patterns of recurring costs, helping to manage debt and avoid late fees over time.

Real-Time Alerts for Fraud Detection

Real-time expense alerts provide immediate notifications for suspicious transactions, significantly enhancing fraud detection compared to traditional monthly bills. These alerts enable users to quickly identify and respond to unauthorized charges, reducing financial loss and improving account security. Integrating real-time monitoring systems with banking apps increases the effectiveness of preventing fraudulent activities.

Integration with Budgeting Apps: Monthly vs Real-Time

Monthly bills provide a structured overview of fixed expenses, but real-time expense alerts offer immediate notifications that enhance integration with budgeting apps by tracking spending as it happens. Budgeting apps synced with real-time alerts enable users to adjust their budgets promptly, improving financial control and preventing overspending. This dynamic integration ensures more accurate and up-to-date financial data compared to relying solely on monthly bill summaries.

Choosing the Best Expense Management Approach

Monthly bills provide a structured overview of recurring expenses, allowing for predictable budgeting but often missing immediate fluctuations. Real-time expense alerts offer instant notifications for transactions, enhancing spending awareness and fraud prevention. Selecting the best expense management approach depends on balancing predictability with timely insights to optimize financial control.

Related Important Terms

Predictive Bill Splitting

Predictive bill splitting leverages real-time expense alerts to analyze monthly bills, enabling precise allocation of costs before due dates and reducing financial surprises. Integrating AI-driven insights enhances budget management by forecasting shared expenses, ensuring timely payments and clearer expense tracking.

Instantaneous Expense Pings

Instantaneous expense pings provide real-time alerts that help track spending immediately, reducing the risk of surprise charges on monthly bills. This immediate notification system enhances budget management by allowing users to adjust their expenses on the spot, promoting financial discipline and preventing overspending.

Proactive Cash Flow Notifications

Real-time expense alerts provide immediate updates on spending, enabling proactive cash flow management by preventing overdrafts and identifying unusual charges early. Monthly bills offer a summary of expenses but lack the timely insights necessary for agile financial decisions and effective cash flow control.

Subscription Overlap Alerts

Subscription overlap alerts help users identify and avoid duplicate charges across multiple monthly bills by providing real-time notifications on recurring service expenses. This proactive monitoring reduces unnecessary costs and improves budget management by ensuring users only pay for active and intended subscriptions.

Dynamic Spend Thresholds

Dynamic spend thresholds in monthly bills allow automated adjustments based on historical spending patterns, reducing surprises in budget management. Real-time expense alerts leverage these thresholds to instantly notify users about unusual charges, enhancing proactive financial control and preventing overspending.

Automated Bill Anticipation

Automated bill anticipation leverages real-time expense alerts to predict and manage upcoming monthly bills, reducing the risk of late payments and improving cash flow control. This technology integrates transaction data and due dates to provide timely notifications, enabling proactive financial planning and minimizing unexpected expense spikes.

Micro-transaction Tracking

Monthly bills often delay the visibility of small, frequent charges, whereas real-time expense alerts provide immediate updates on micro-transactions, enabling precise tracking and better budget control. This real-time monitoring minimizes unexpected overdrafts and improves financial management by capturing every minor expense as it occurs.

Adaptive Payment Reminders

Adaptive payment reminders leverage real-time expense alerts to provide personalized notifications that align with users' spending patterns, reducing missed payments and late fees. This technology dynamically adjusts reminder timing based on monthly bill due dates and actual transaction behavior, enhancing financial management and cash flow control.

Real-Time Budget Nudge

Real-time expense alerts provide instant notifications on spending activities, enabling users to maintain better control over their budget by promptly addressing overspending. Unlike monthly bills, these budget nudges promote proactive financial decisions, reducing the risk of exceeding set limits and improving overall expense management.

AI-driven Bill vs. Spend Reconciliation

AI-driven bill vs. spend reconciliation enhances expense management by instantly comparing monthly bills with real-time expense alerts, identifying discrepancies and preventing overspending. This advanced technology leverages machine learning algorithms to ensure accurate tracking, optimize budgeting, and provide timely notifications for any irregularities in financial transactions.

Monthly Bills vs Real-Time Expense Alerts for Expense Infographic

moneydiff.com

moneydiff.com