The cash envelope system offers a tangible way to control overspending by physically dividing cash into categories, making budget limits clear and immediate. Expense automation apps track spending digitally and provide real-time alerts, categorizing expenses automatically to help users stay within their financial goals. Combining both methods can enhance control by pairing hands-on budgeting with smart technology for comprehensive expense management.

Table of Comparison

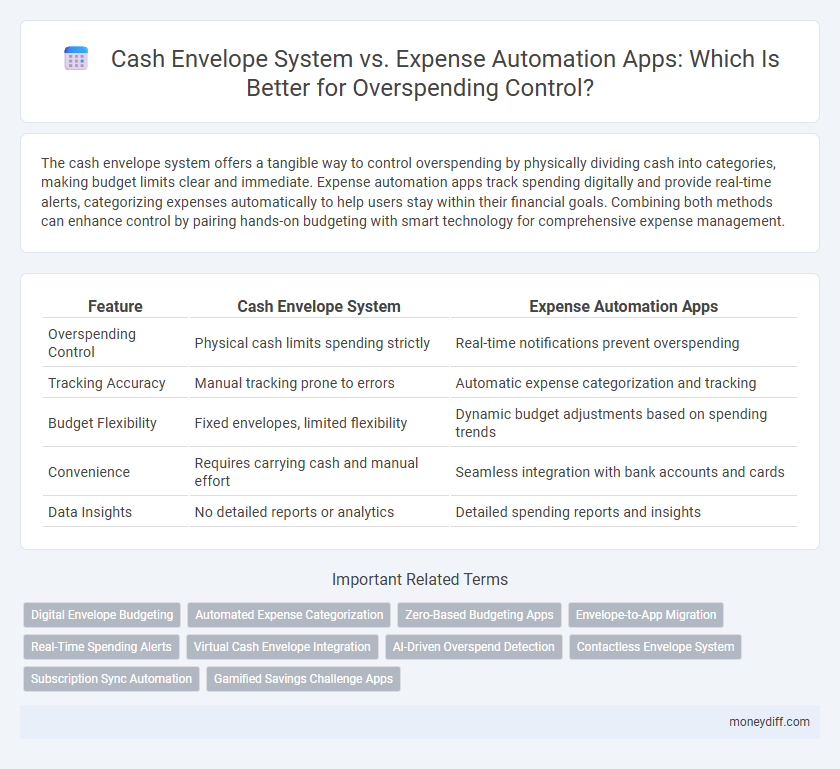

| Feature | Cash Envelope System | Expense Automation Apps |

|---|---|---|

| Overspending Control | Physical cash limits spending strictly | Real-time notifications prevent overspending |

| Tracking Accuracy | Manual tracking prone to errors | Automatic expense categorization and tracking |

| Budget Flexibility | Fixed envelopes, limited flexibility | Dynamic budget adjustments based on spending trends |

| Convenience | Requires carrying cash and manual effort | Seamless integration with bank accounts and cards |

| Data Insights | No detailed reports or analytics | Detailed spending reports and insights |

Introduction: Tackling Overspending with Smart Money Tools

The cash envelope system allocates physical cash into labeled envelopes for precise spending control, effectively limiting overspending by making individuals more conscious of their budget. Expense automation apps track transactions in real time, categorize expenses, and provide insights through analytics, enhancing budget adherence and reducing financial leaks automatically. Both methods offer strategic advantages in managing overspending, with the cash envelope system emphasizing tactile budgeting and expense automation apps prioritizing convenience and data-driven decision making.

Cash Envelope System: Classic Approach to Expense Control

The Cash Envelope System offers a tactile and disciplined approach to budgeting by allocating fixed cash amounts to specific spending categories, ensuring spending stays within set limits. This method fosters greater awareness of expenses and reduces the risk of overspending through physical cash constraints, eliminating reliance on digital tracking errors. While expense automation apps provide convenience and real-time monitoring, the cash envelope system remains a highly effective, low-tech tool for consumers seeking strict control over discretionary spending.

How Expense Automation Apps Revolutionize Budgeting

Expense automation apps revolutionize budgeting by providing real-time tracking and categorization of spending, allowing users to identify overspending patterns effortlessly. Unlike the cash envelope system, which relies on manual cash allocation, these apps use AI-driven analytics to send instant alerts and recommendations for staying within budget. Integration with bank accounts and credit cards ensures seamless updates and accurate expense monitoring, enhancing financial discipline and control.

Key Features Comparison: Envelopes vs Automation Apps

The cash envelope system relies on physically allocating budgeted cash into labeled envelopes to control overspending, enhancing tangible spending awareness and discipline. Expense automation apps use real-time transaction tracking, customizable alerts, and AI-driven insights to monitor spending patterns and provide instant notifications for budget limits. While envelopes promote manual handling and simplicity, automation apps offer comprehensive data analysis and seamless integration with bank accounts for more precise overspending control.

Overspending Triggers: Manual Awareness vs Digital Alerts

Cash envelope systems rely on manual tracking and physical cash to create heightened awareness of spending limits, directly addressing overspending triggers through tactile budgeting. Expense automation apps offer real-time digital alerts and expenditure categorization, enabling immediate intervention when overspending thresholds are approached. Combining manual awareness with automated notifications enhances financial discipline by targeting behavioral triggers through both conscious control and technology-driven reminders.

Ease of Use: Physical Cash Handling or Automated Tracking?

The cash envelope system offers straightforward physical cash handling, making it easy for users to visually manage spending limits and avoid overspending. Expense automation apps provide seamless real-time tracking and categorize expenses automatically, reducing manual effort and enhancing accuracy. While the envelope system relies on tangible budgeting methods, automation apps offer convenience through digital integration and instant notifications, catering to different user preferences in overspending control.

Flexibility and Customization: Which System Adapts Better?

The cash envelope system offers tangible control and flexibility by allowing users to allocate specific budget amounts to physical envelopes, reinforcing spending limits through direct cash handling. Expense automation apps provide greater customization by integrating real-time tracking, personalized alerts, and dynamic category adjustments, adapting effortlessly to changing financial goals. For users seeking adaptable and data-driven oversight, automation apps generally offer superior flexibility and customization compared to the traditional envelope method.

Security and Fraud Protection: Cash vs Digital Safeguards

Cash envelope systems provide physical control over spending, minimizing digital fraud risks but are susceptible to theft or loss without recovery mechanisms. Expense automation apps employ advanced encryption and multi-factor authentication, offering robust protection against unauthorized access and real-time fraud alerts. Digital safeguards include automatic transaction monitoring and alerts, enhancing security while cash relies on personal vigilance.

Real-Life Success Stories: Envelope Users vs App Users

Cash envelope system users report tangible improvements in spending discipline through physical cash limits, enabling heightened awareness of cash flow during daily purchases. Expense automation app users benefit from real-time tracking and data analytics, with success stories highlighting reduced overspending by leveraging budget notifications and category-based spending insights. Comparative studies reveal envelope users excel in tangible budgeting control, whereas app users achieve higher accuracy in expense monitoring and long-term financial adjustments.

Choosing the Best Fit: Which Overspending Strategy Works for You?

The Cash Envelope System offers a tactile, budget-focused approach by allocating physical cash into designated categories, helping users visually track and limit overspending. Expense automation apps streamline financial management with real-time tracking, alerts, and customizable spending limits, ensuring users stay within their budgets effortlessly. Selecting the best strategy depends on personal preferences for manual control versus digital convenience and the complexity of individual budgeting needs.

Related Important Terms

Digital Envelope Budgeting

Digital Envelope Budgeting integrates traditional cash envelope principles with expense automation apps, enabling users to allocate funds into virtual categories while tracking spending in real-time through synced bank accounts. This hybrid method enhances overspending control by combining tangible budget limits with automated alerts and detailed expense analytics.

Automated Expense Categorization

Automated expense categorization in expense automation apps provides real-time tracking and detailed insights, reducing human error and saving time compared to the manual allocation required by the cash envelope system. This automation enhances precision in overspending control by automatically sorting transactions into predefined categories, enabling users to quickly identify and adjust spending habits.

Zero-Based Budgeting Apps

Zero-based budgeting apps enhance overspending control by allocating every dollar a specific purpose, ensuring no funds remain unassigned and promoting disciplined financial management. Cash envelope systems provide tangible spending limits through physical cash allocation but lack the dynamic tracking and real-time analytics of expense automation apps, which streamline budget adjustments and optimize expense monitoring.

Envelope-to-App Migration

The transition from the cash envelope system to expense automation apps enhances overspending control by providing real-time tracking and categorization of expenses, eliminating the need for physical cash management. Expense automation apps leverage data analytics and alerts to enforce budget limits, offering greater precision and convenience compared to the manual envelope method.

Real-Time Spending Alerts

Cash envelope systems provide tactile control by physically limiting funds and fostering budgeting discipline, but real-time spending alerts in expense automation apps offer instantaneous notifications to prevent overspending and enhance financial awareness. Expense automation apps integrate bank data and AI-driven analysis to deliver precise, personalized alerts that adapt to spending patterns, surpassing the manual tracking limitations of cash envelopes.

Virtual Cash Envelope Integration

Virtual cash envelope integration combines the tactile budgeting control of the traditional cash envelope system with the convenience of expense automation apps, enabling real-time tracking and instant category updates to prevent overspending. This hybrid approach leverages digital notifications and automated fund allocations while maintaining strict spending limits, optimizing financial discipline through seamless virtual management.

AI-Driven Overspend Detection

The Cash Envelope System provides a tactile budgeting method by allocating fixed cash amounts to categories, limiting overspending through physical constraints. In contrast, Expense Automation Apps use AI-driven overspend detection to analyze real-time spending patterns, sending instant alerts and predictive insights to prevent budget breaches efficiently.

Contactless Envelope System

The Contactless Envelope System digitizes the traditional cash envelope method, allowing users to allocate budgets across virtual envelopes for precise tracking and overspending control without physical cash. Expense automation apps integrate real-time transaction monitoring and AI-driven alerts, enhancing spending discipline while reducing manual management efforts.

Subscription Sync Automation

Cash envelope systems provide physical budgeting by allocating cash into designated envelopes, which helps control overspending through tangible limits but lacks real-time tracking capabilities. Expense automation apps with subscription sync automation offer seamless monitoring and management of recurring payments, enabling precise control over overspending by automatically categorizing and alerting users about subscription renewals and unexpected charges.

Gamified Savings Challenge Apps

Gamified savings challenge apps leverage engaging game mechanics to motivate users in controlling overspending by setting goals and rewarding consistent budgeting efforts, unlike traditional cash envelope systems that rely on physical money division and manual tracking. These apps provide real-time expense monitoring and personalized challenges, enhancing financial discipline with interactive features that boost user commitment and long-term saving habits.

Cash envelope system vs Expense automation apps for overspending control. Infographic

moneydiff.com

moneydiff.com