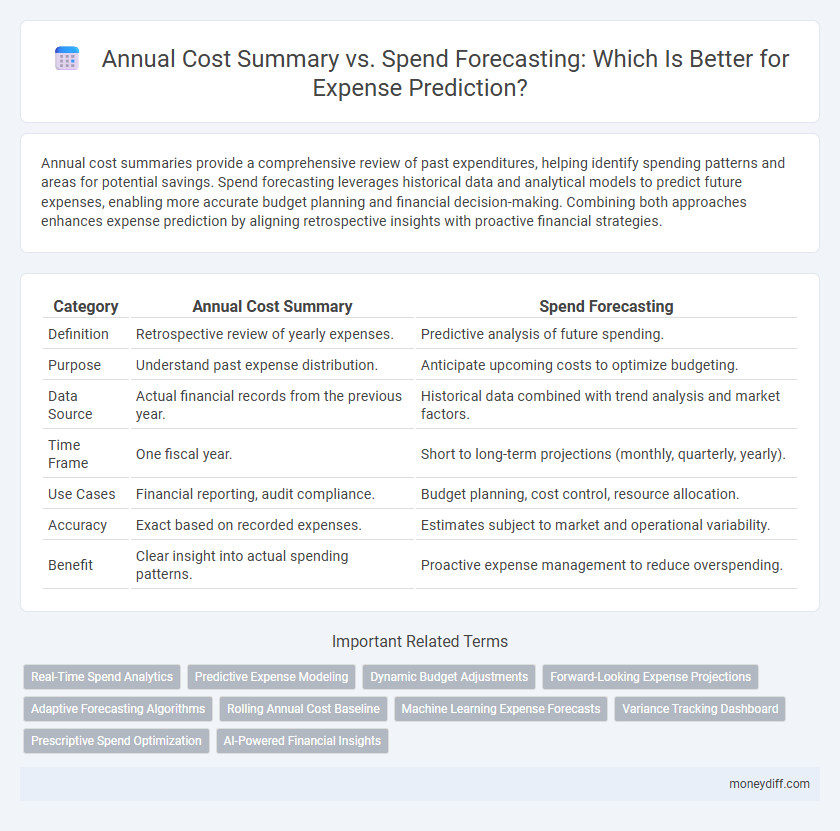

Annual cost summaries provide a comprehensive review of past expenditures, helping identify spending patterns and areas for potential savings. Spend forecasting leverages historical data and analytical models to predict future expenses, enabling more accurate budget planning and financial decision-making. Combining both approaches enhances expense prediction by aligning retrospective insights with proactive financial strategies.

Table of Comparison

| Category | Annual Cost Summary | Spend Forecasting |

|---|---|---|

| Definition | Retrospective review of yearly expenses. | Predictive analysis of future spending. |

| Purpose | Understand past expense distribution. | Anticipate upcoming costs to optimize budgeting. |

| Data Source | Actual financial records from the previous year. | Historical data combined with trend analysis and market factors. |

| Time Frame | One fiscal year. | Short to long-term projections (monthly, quarterly, yearly). |

| Use Cases | Financial reporting, audit compliance. | Budget planning, cost control, resource allocation. |

| Accuracy | Exact based on recorded expenses. | Estimates subject to market and operational variability. |

| Benefit | Clear insight into actual spending patterns. | Proactive expense management to reduce overspending. |

Understanding Annual Cost Summary

The Annual Cost Summary provides a comprehensive overview of past expenses, highlighting spending trends and categorizing costs by department, project, or vendor to facilitate accurate financial analysis. It enables organizations to identify historical patterns and areas of overspending, which serve as a critical foundation for future budget planning and control. Understanding this summary is essential for aligning expense forecasting models with actual financial performance, improving the accuracy of spend forecasting.

What Is Spend Forecasting in Expense Management?

Spend forecasting in expense management utilizes historical annual cost summaries and real-time data analysis to predict future expenses accurately. This method enables organizations to allocate budgets effectively, minimize overspending, and identify potential cost-saving opportunities. Enhanced precision in spend forecasting improves financial planning, supports strategic decision-making, and optimizes resource management.

Key Differences Between Annual Cost Summary and Spend Forecasting

Annual cost summary provides a historical overview of actual expenses incurred within a specific fiscal year, offering concrete data for budget evaluation. Spend forecasting utilizes predictive analytics and trend analysis to estimate future expenditures, enabling proactive financial planning. The key difference lies in annual cost summary's retrospective accuracy versus spend forecasting's forward-looking projections for optimized expense prediction.

Benefits of Annual Cost Summary for Financial Planning

Annual Cost Summary provides a comprehensive overview of total expenses over a fiscal year, enabling accurate baseline measurement for budgeting. It helps identify spending patterns, optimize resource allocation, and detect cost-saving opportunities. Leveraging historical annual cost data enhances financial forecasting accuracy and supports strategic expense management.

The Role of Spend Forecasting in Predicting Expenses

Spend forecasting plays a crucial role in predicting expenses by analyzing historical data, market trends, and budget patterns to generate accurate future cost estimates. Unlike annual cost summaries that provide retrospective insights, spend forecasting enables proactive financial planning and risk management through predictive analytics. This approach helps organizations optimize resource allocation, avoid budget overruns, and improve overall expense management efficiency.

Integrating Annual Cost Summaries with Forecasting Tools

Integrating annual cost summaries with spend forecasting tools enhances expense prediction accuracy by combining historical data with real-time analytics. This approach enables organizations to identify spending patterns, anticipate budget variances, and optimize resource allocation effectively. Leveraging both data sets increases forecast reliability, supporting strategic financial planning and cost control initiatives.

Common Challenges in Expense Prediction

Annual cost summaries provide historical data but often fail to capture dynamic market conditions and unexpected expense variations, leading to inaccurate forecasts. Spend forecasting relies on predictive analytics and real-time data integration but encounters challenges such as data quality issues, inconsistent categorization, and rapidly changing vendor contracts. Both methods struggle with sudden economic shifts and inaccurate assumptions that impact overall expense prediction accuracy.

Best Practices for Accurate Spend Forecasting

Analyzing historical annual cost summaries provides a foundational dataset essential for accurate spend forecasting in expense prediction. Incorporating trend analysis and seasonality patterns enhances the precision of future expenditure estimates, enabling organizations to allocate resources effectively. Utilizing advanced analytics and regularly updating forecasting models based on real-time expense data ensures continuous improvement in forecasting accuracy.

Leveraging Data Analytics for Cost Summaries and Forecasts

Leveraging data analytics enhances accuracy in annual cost summaries by identifying spending patterns and anomalies across various expense categories. Advanced forecasting models utilize historical data and predictive algorithms to project future expenditures, enabling proactive budget adjustments. Integrating real-time analytics with spend forecasting supports dynamic expense prediction, optimizing financial planning and resource allocation.

Choosing the Right Method for Budget Optimization

Annual cost summaries provide a historical baseline by aggregating previous expenses, enabling businesses to identify spending patterns and set realistic budgets. Spend forecasting leverages predictive analytics and real-time data to anticipate future expenses, allowing for dynamic adjustments and more accurate budget optimization. Selecting the right method depends on the organization's need for accuracy versus simplicity, with a hybrid approach often delivering the best balance between historical insight and forward-looking precision.

Related Important Terms

Real-Time Spend Analytics

Real-time spend analytics enhances expense prediction by providing dynamic insights beyond traditional annual cost summaries, capturing immediate fluctuations and patterns in expenditure. Integrating these analytics enables more accurate spend forecasting, optimizing budget allocation and financial planning through up-to-date data-driven decisions.

Predictive Expense Modeling

Annual cost summary provides historical data analysis essential for understanding past expenditure trends, while spend forecasting leverages predictive expense modeling techniques such as machine learning algorithms and time series analysis to accurately anticipate future costs. Integrating these predictive models enhances budgeting accuracy by identifying expense patterns, seasonality, and potential cost overruns before they occur.

Dynamic Budget Adjustments

Annual cost summaries provide historical expenditure data essential for identifying spending patterns, while spend forecasting utilizes predictive analytics to project future expenses accurately. Dynamic budget adjustments leverage real-time forecasts to optimize resource allocation and improve financial agility in managing expenses.

Forward-Looking Expense Projections

Annual cost summaries provide historical spending data crucial for identifying past expense patterns, while spend forecasting utilizes predictive analytics to generate forward-looking expense projections that enhance budgeting accuracy and financial planning. Combining historical annual cost summaries with advanced forecasting models enables businesses to anticipate future expenses, optimize cash flow, and allocate resources more effectively.

Adaptive Forecasting Algorithms

Adaptive forecasting algorithms leverage historical annual cost summaries and real-time spend data to enhance expense prediction accuracy, dynamically adjusting to changing financial patterns. These models integrate past expenditure trends with predictive analytics, enabling more precise and responsive budget management compared to static spend forecasting methods.

Rolling Annual Cost Baseline

The Rolling Annual Cost Baseline provides a dynamic framework for monitoring expenses by continuously updating historical spending data to reflect current trends, enhancing accuracy in spend forecasting. This approach enables more precise expense prediction compared to static annual cost summaries, allowing organizations to better allocate budgets and manage financial risks.

Machine Learning Expense Forecasts

Machine learning expense forecasts leverage historical data patterns from annual cost summaries to enhance the accuracy of spend forecasting, enabling predictive insights that optimize budget planning. These models continuously adapt to real-time expense variations, improving forecasting precision beyond traditional methods by identifying complex trends and anomalies.

Variance Tracking Dashboard

The Variance Tracking Dashboard enables precise comparison between Annual Cost Summary and Spend Forecasting by highlighting deviations in expense predictions, facilitating real-time budget adjustments. This tool enhances financial accuracy by tracking variances and providing actionable insights for optimizing expenditure management.

Prescriptive Spend Optimization

Annual cost summaries provide historical expense data, while spend forecasting uses predictive analytics to anticipate future expenditures with greater accuracy. Prescriptive spend optimization leverages this forecast to recommend strategic actions that minimize costs and maximize budget efficiency.

AI-Powered Financial Insights

AI-powered financial insights leverage historical annual cost summaries to enhance spend forecasting accuracy, enabling precise expense prediction and budget optimization. Machine learning algorithms analyze past expense patterns to identify trends, forecast future costs, and provide actionable recommendations for effective financial planning.

Annual cost summary vs Spend forecasting for expense prediction. Infographic

moneydiff.com

moneydiff.com