Spending limits set a fixed cap on expenditures, preventing overspending by restricting the amount that can be spent within a specific period. Spending alarms provide real-time notifications when expenses near or exceed predefined thresholds, enabling proactive monitoring. Combining spending limits with alarms enhances expense control by balancing strict budget enforcement and timely alerts.

Table of Comparison

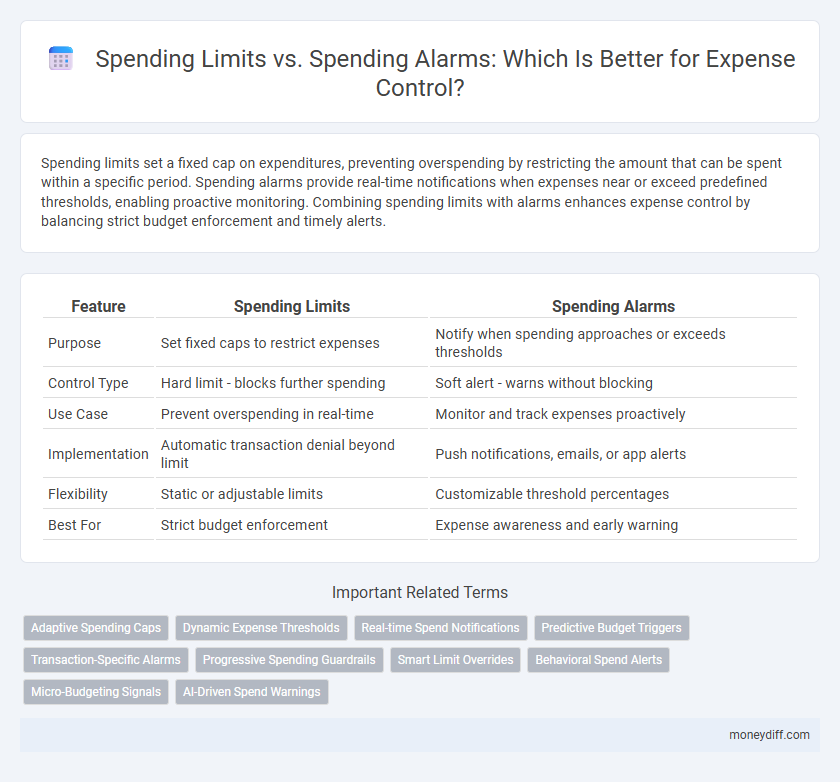

| Feature | Spending Limits | Spending Alarms |

|---|---|---|

| Purpose | Set fixed caps to restrict expenses | Notify when spending approaches or exceeds thresholds |

| Control Type | Hard limit - blocks further spending | Soft alert - warns without blocking |

| Use Case | Prevent overspending in real-time | Monitor and track expenses proactively |

| Implementation | Automatic transaction denial beyond limit | Push notifications, emails, or app alerts |

| Flexibility | Static or adjustable limits | Customizable threshold percentages |

| Best For | Strict budget enforcement | Expense awareness and early warning |

Understanding Spending Limits vs Spending Alarms

Spending limits set a predefined maximum amount that cannot be exceeded, ensuring strict control over budget allocations. Spending alarms notify users when expenses approach or surpass a certain threshold, enabling proactive monitoring without immediate restriction. Understanding the balance between these controls helps optimize expense management by combining prevention with timely alerts.

Key Differences Between Spending Limits and Spending Alarms

Spending limits set a fixed maximum amount that cannot be exceeded, providing strict control over expenses to prevent overspending. Spending alarms trigger notifications when a predetermined threshold is reached, allowing for real-time monitoring without immediately halting transactions. The key difference lies in enforcement: spending limits enforce hard caps, while spending alarms offer flexible alerts for proactive expense management.

Pros and Cons of Spending Limits for Expense Control

Spending limits provide a clear, predefined cap on expenditure, helping prevent overspending by enforcing strict budgetary boundaries. However, they can be inflexible, potentially restricting necessary or unexpected expenses and causing operational delays. Unlike spending alarms, which notify users only when thresholds are approached, limits actively block transactions, offering stronger but less adaptable expense control.

Benefits of Using Spending Alarms in Money Management

Spending alarms provide real-time notifications when expenses approach predefined thresholds, enabling proactive financial control and preventing overspending. Unlike rigid spending limits, alarms offer flexibility by allowing users to adjust behaviors promptly based on immediate feedback. Implementing spending alarms enhances budget adherence and promotes smarter money management through timely alerts and increased awareness.

How to Set Effective Spending Limits

Setting effective spending limits requires analyzing historical expense data to establish realistic monthly or category-specific thresholds that prevent overspending. Integrating these limits with real-time spending alarms enhances control by providing immediate notifications when expenditures approach preset boundaries. Regularly reviewing and adjusting limits based on changing financial behavior ensures sustained budget discipline and optimized expense management.

Integrating Spending Alarms into Your Budgeting Strategy

Integrating spending alarms into your budgeting strategy enhances real-time expense control by alerting you when nearing predefined spending thresholds. Unlike rigid spending limits, alarms provide flexibility and promote proactive financial decisions without immediate restrictions. This approach ensures better cash flow management and reduces the risk of overspending by fostering mindful budget adherence.

Choosing Between Spending Limits and Alarms for Effective Control

Spending limits enforce strict caps on expenses, preventing any transaction from exceeding the set amount, which ensures precise budget adherence. Spending alarms, on the other hand, provide real-time notifications when spending approaches a predefined threshold, enabling proactive management without halting transactions. Choosing between spending limits and alarms depends on whether an organization prioritizes rigid control or flexible awareness for effective expense management.

Common Mistakes When Using Spending Limits or Alarms

Spending limits and spending alarms are essential tools for expense control, but common mistakes include setting overly rigid limits that fail to reflect actual cash flow patterns, causing unnecessary transaction declines and frustration. Users often ignore spending alarms or set thresholds too high, rendering alerts ineffective in preventing overspending. Properly balancing these tools involves regularly reviewing spending habits to adjust limits and alarms for realistic and actionable expense management.

Tools and Apps for Setting Spending Limits and Alarms

Spending limits and spending alarms are essential tools in expense control apps that help users manage their budgets effectively. Many personal finance apps like Mint, YNAB, and PocketGuard enable setting customizable spending limits on categories such as dining or entertainment, automatically alerting users when approaching these thresholds. These apps use real-time notifications and analytics to prevent overspending, promoting disciplined financial habits through clear, automated expense monitoring.

Maximizing Expense Control: Combining Limits and Alarms

Maximizing expense control requires integrating spending limits with spending alarms to provide proactive financial oversight. Spending limits set predefined thresholds to prevent excessive expenditures, while spending alarms trigger real-time alerts when nearing or surpassing those limits. This combination ensures stricter budget adherence and timely intervention in expense management.

Related Important Terms

Adaptive Spending Caps

Adaptive Spending Caps dynamically adjust spending limits based on real-time expense patterns and budget forecasts, offering a more flexible and personalized approach to expense control compared to fixed Spending Alarms. These caps optimize cash flow management by preventing overspending without triggering frequent alarms, ensuring consistent adherence to financial goals.

Dynamic Expense Thresholds

Dynamic expense thresholds enable precise spending limits by automatically adjusting budgets based on real-time financial data and historical trends, ensuring effective cost control. Spending alarms complement these thresholds by providing immediate notifications when expenses approach or exceed set limits, enhancing proactive expense management.

Real-time Spend Notifications

Spending alarms provide real-time spend notifications that alert users immediately when their expenses approach predefined thresholds, enabling proactive budget management and preventing overspending. Spending limits set fixed expense ceilings, but without instant alerts, they may not offer timely warnings to control spending effectively.

Predictive Budget Triggers

Spending limits set predefined maximum thresholds for expenses, while spending alarms use predictive budget triggers that analyze real-time spending patterns to alert users before limits are reached. Predictive budget triggers enhance expense control by forecasting potential overspending and enabling proactive financial management.

Transaction-Specific Alarms

Transaction-specific alarms offer precise monitoring by triggering alerts based on individual expense thresholds, enabling immediate response to unusual or excessive spending. Unlike general spending limits that cap total expenditure, these alarms enhance control by focusing on abnormal transaction patterns, improving budget adherence and fraud prevention.

Progressive Spending Guardrails

Progressive spending guardrails enhance expense control by dynamically adjusting spending limits based on real-time financial behavior, preventing overspending before alarms trigger. Unlike static spending alarms that notify post-threshold breaches, these guardrails proactively manage budgets through continuous monitoring and adaptive constraints.

Smart Limit Overrides

Spending Limits set predefined thresholds to restrict expenses, while Spending Alarms notify users when approaching those thresholds without enforcing restrictions. Smart Limit Overrides enable flexible expense control by allowing authorized adjustments to limits temporarily, ensuring operational needs are met without compromising budget compliance.

Behavioral Spend Alerts

Spending Limits set fixed thresholds to restrict expenses proactively, while Spending Alarms provide behavioral spend alerts that notify users of unusual or unexpected spending patterns for enhanced expense control. Behavioral spend alerts leverage machine learning algorithms to detect anomalies in transaction data, enabling timely interventions and improved financial governance.

Micro-Budgeting Signals

Spending limits set predefined thresholds to restrict expenses within a budget, preventing overspending before it occurs. Spending alarms serve as real-time alerts triggered when expenses approach or exceed micro-budgeting targets, enabling immediate corrective actions for precise expense control.

AI-Driven Spend Warnings

Spending limits set predefined thresholds to restrict expenses, while spending alarms use AI-driven analytics to provide dynamic alerts based on real-time spending patterns and anomalies. AI-driven spend warnings enhance expense control by predicting potential budget overruns and recommending proactive adjustments to optimize financial management.

Spending Limits vs Spending Alarms for expense control. Infographic

moneydiff.com

moneydiff.com