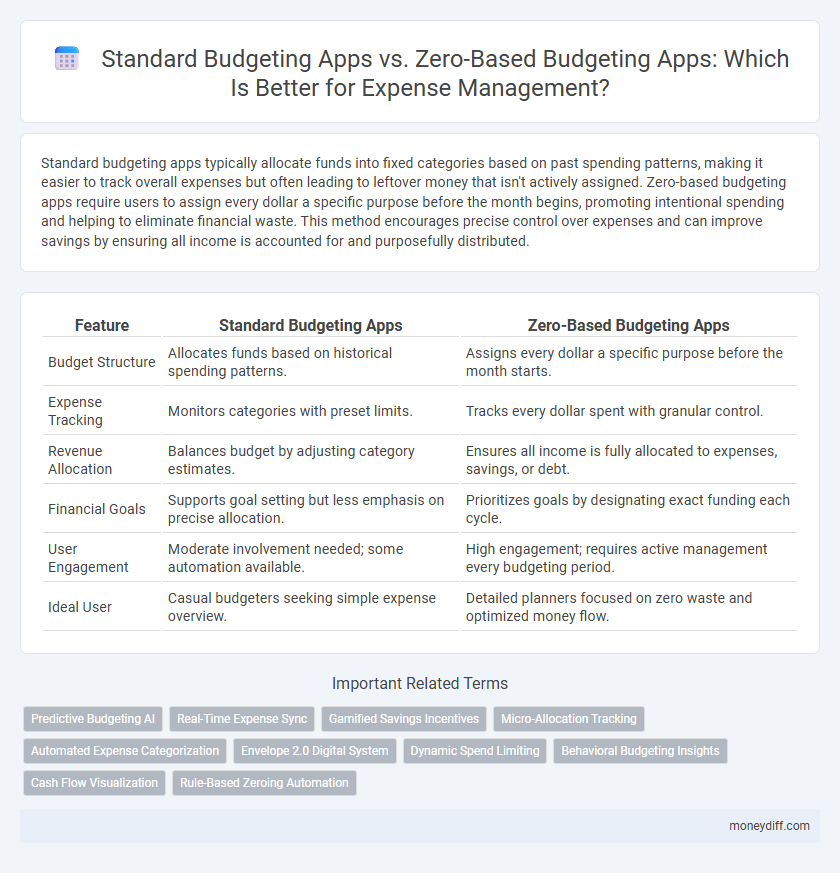

Standard budgeting apps typically allocate funds into fixed categories based on past spending patterns, making it easier to track overall expenses but often leading to leftover money that isn't actively assigned. Zero-based budgeting apps require users to assign every dollar a specific purpose before the month begins, promoting intentional spending and helping to eliminate financial waste. This method encourages precise control over expenses and can improve savings by ensuring all income is accounted for and purposefully distributed.

Table of Comparison

| Feature | Standard Budgeting Apps | Zero-Based Budgeting Apps |

|---|---|---|

| Budget Structure | Allocates funds based on historical spending patterns. | Assigns every dollar a specific purpose before the month starts. |

| Expense Tracking | Monitors categories with preset limits. | Tracks every dollar spent with granular control. |

| Revenue Allocation | Balances budget by adjusting category estimates. | Ensures all income is fully allocated to expenses, savings, or debt. |

| Financial Goals | Supports goal setting but less emphasis on precise allocation. | Prioritizes goals by designating exact funding each cycle. |

| User Engagement | Moderate involvement needed; some automation available. | High engagement; requires active management every budgeting period. |

| Ideal User | Casual budgeters seeking simple expense overview. | Detailed planners focused on zero waste and optimized money flow. |

Introduction: Understanding Budgeting Apps

Standard budgeting apps track expenses by categorizing past spending to create future budgets, offering automated insights and trend analysis. Zero-based budgeting apps require users to allocate every dollar of income to specific categories before spending, promoting intentional financial planning and minimizing waste. Both methods enhance money management but differ in structure and user engagement levels for effective expense control.

What Are Standard Budgeting Apps?

Standard budgeting apps provide users with tools to track income, categorize expenses, and visualize spending patterns through charts and reports. They typically operate on historical spending data to create monthly budgets, helping users maintain control over recurring expenses. These apps offer convenience and automation, enabling users to set budget limits and receive alerts when approaching or exceeding those thresholds.

What Is Zero-Based Budgeting?

Zero-based budgeting allocates every dollar of income to specific expenses, savings, or debt repayment, ensuring no funds remain unassigned. Unlike standard budgeting apps that rely on historical spending patterns, zero-based budgeting apps require users to justify each expense for the upcoming period, promoting intentional money management. This method helps eliminate wasteful spending and increases financial awareness by aligning expenses directly with income.

Key Features of Standard Budgeting Apps

Standard budgeting apps typically offer predefined categories, automated expense tracking, and visual reports to help users monitor spending patterns effectively. These apps integrate with bank accounts to update transactions in real-time, providing a comprehensive financial overview. User-friendly interfaces and customizable alerts enhance the ability to stick to preset budgets and avoid overspending.

Unique Features of Zero-Based Budgeting Apps

Zero-based budgeting apps uniquely allocate every dollar of income to specific expense categories, leaving no unassigned funds, which enhances precise financial control and accountability. These apps often include real-time tracking and customizable budget categories that reflect actual spending needs rather than historical averages. Their detailed allocation process helps users identify unnecessary expenses and prioritize savings, leading to more effective money management compared to standard budgeting apps.

Expense Tracking: Standard vs Zero-Based

Standard budgeting apps offer automated expense tracking with preset categories, enabling users to monitor spending patterns quickly. Zero-based budgeting apps require users to allocate every dollar manually, ensuring expenses align precisely with income and financial goals. This approach promotes detailed oversight of each expense, enhancing control over unnecessary spending.

Ease of Use and User Experience

Standard budgeting apps typically offer intuitive interfaces with pre-set categories, making them accessible for users seeking quick setup and straightforward tracking. Zero-based budgeting apps require users to allocate every dollar explicitly, which can enhance financial control but may introduce complexity that affects ease of use for beginners. User experience in zero-based budgeting apps often appeals to detail-oriented individuals who prioritize comprehensive expense management over simplicity.

Customization and Flexibility

Standard budgeting apps offer preset categories and general templates that may limit customization, making it challenging to address unique financial situations. Zero-based budgeting apps prioritize flexibility by requiring every dollar to be assigned a specific purpose, enabling users to tailor budgets closely to fluctuating expenses and individual goals. This approach fosters personalized money management, ensuring adaptability to changing financial priorities and improved control over spending.

Which Budgeting App Fits Your Financial Goals?

Standard budgeting apps provide a framework for tracking expenses based on historical spending patterns, making them ideal for users who prefer predictable monthly allocations and easy categorization. Zero-based budgeting apps require allocating every dollar of income to specific expenses, savings, or debt payments, perfect for individuals looking for precise financial control and maximizing savings potential. Choosing the right app depends on whether you prioritize simplicity and consistency or detailed accountability and proactive money management.

Conclusion: Choosing the Right Budgeting Tool

Standard budgeting apps offer simplicity with preset categories and historical spending analysis, ideal for users seeking quick setup and basic tracking. Zero-based budgeting apps provide granular control by assigning every dollar a specific purpose, benefiting those aiming for precise expense management and maximizing savings. Selecting the right tool depends on personal financial goals, spending habits, and the level of detail preferred in managing expenses.

Related Important Terms

Predictive Budgeting AI

Standard budgeting apps rely on historical expense data and category averages to forecast spending, while zero-based budgeting apps integrate Predictive Budgeting AI to allocate every dollar actively based on anticipated needs and upcoming financial commitments. Predictive Budgeting AI enhances money management by analyzing real-time transaction patterns and forecasting variable expenses, enabling users to optimize cash flow and avoid overspending.

Real-Time Expense Sync

Standard budgeting apps offer real-time expense sync by automatically importing transactions from linked bank accounts to update budgets instantly. Zero-based budgeting apps provide enhanced control by categorizing every dollar, ensuring real-time tracking aligns expenses precisely with assigned budget categories.

Gamified Savings Incentives

Standard budgeting apps often provide basic tracking features but lack engaging rewards systems, whereas zero-based budgeting apps incorporate gamified savings incentives that motivate users through challenges, badges, and point systems, leading to improved financial discipline. These gamified elements stimulate consistent saving habits by making money management interactive and rewarding, thereby enhancing user commitment to budgeting goals.

Micro-Allocation Tracking

Standard budgeting apps often allocate funds based on preset categories and historical spending patterns, which can overlook detailed tracking of small transactions. Zero-based budgeting apps emphasize micro-allocation tracking by assigning every dollar a specific purpose, ensuring precise control over even the smallest expenses for optimized money management.

Automated Expense Categorization

Standard budgeting apps use automated expense categorization based on preset categories that streamline tracking but may lack flexibility for individualized spending habits. Zero-based budgeting apps enhance money management by assigning every dollar to specific expenses, utilizing automated categorization to ensure no funds are unallocated, improving accuracy and control.

Envelope 2.0 Digital System

Standard budgeting apps often rely on static allocation methods that can overlook nuanced spending patterns, while Zero-based budgeting apps, exemplified by the Envelope 2.0 Digital System, enable precise allocation of every dollar to specific spending categories, fostering proactive expense control and personalized financial planning. This system enhances transparency by digitally replicating the traditional envelope method, allowing users to track real-time balances and adjust budgets dynamically to optimize resource distribution effectively.

Dynamic Spend Limiting

Standard budgeting apps typically use preset categories and historical spending data to allocate funds, providing a fixed budget framework that may lack flexibility. Zero-based budgeting apps employ dynamic spend limiting by assigning every dollar a specific purpose, enabling real-time adjustment of expenses and maximizing financial control.

Behavioral Budgeting Insights

Standard budgeting apps often provide preset categories that encourage habitual spending patterns, while zero-based budgeting apps require assigning every dollar a specific purpose, fostering greater financial awareness and intentional spending. This behavioral approach in zero-based budgeting promotes disciplined money management by reducing unconscious expenses and enhancing goal-oriented financial decisions.

Cash Flow Visualization

Standard budgeting apps often provide basic cash flow visualization through monthly summaries and spending categories, enabling users to track income and expenses over time. Zero-based budgeting apps offer more detailed cash flow management by assigning every dollar a specific job, allowing precise tracking and control of funds for each budget period.

Rule-Based Zeroing Automation

Standard budgeting apps typically allocate funds based on predefined categories and historical spending, lacking dynamic adjustments, whereas zero-based budgeting apps leverage rule-based zeroing automation to ensure every dollar is purposefully assigned, optimizing expense control. This automation enhances financial precision by continuously reallocating surplus funds, eliminating waste, and promoting disciplined money management.

Standard budgeting apps vs Zero-based budgeting apps for money management. Infographic

moneydiff.com

moneydiff.com