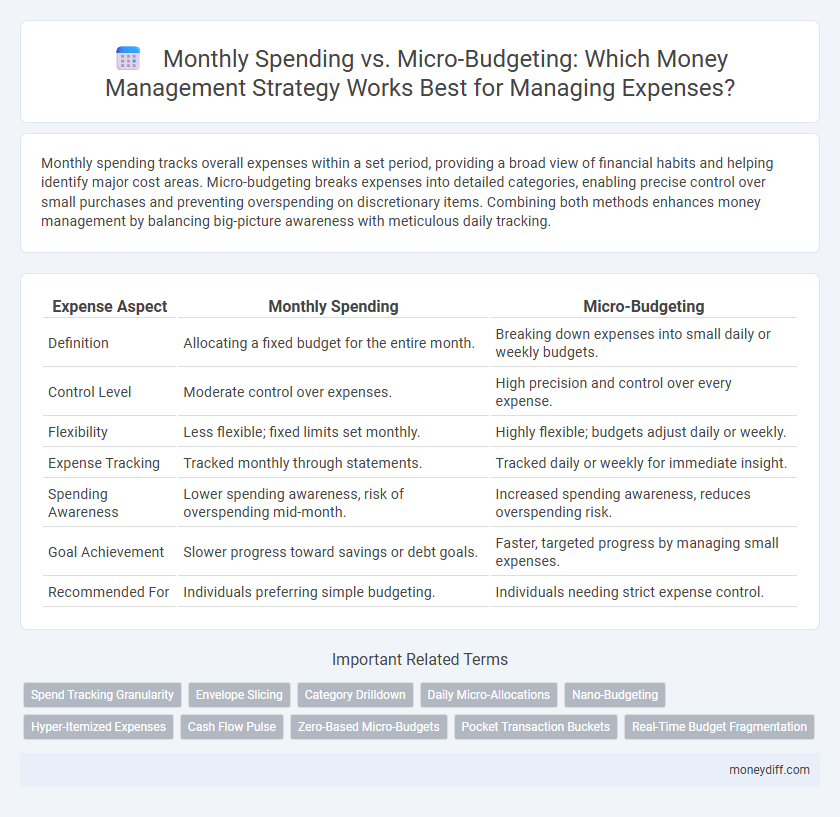

Monthly spending tracks overall expenses within a set period, providing a broad view of financial habits and helping identify major cost areas. Micro-budgeting breaks expenses into detailed categories, enabling precise control over small purchases and preventing overspending on discretionary items. Combining both methods enhances money management by balancing big-picture awareness with meticulous daily tracking.

Table of Comparison

| Expense Aspect | Monthly Spending | Micro-Budgeting |

|---|---|---|

| Definition | Allocating a fixed budget for the entire month. | Breaking down expenses into small daily or weekly budgets. |

| Control Level | Moderate control over expenses. | High precision and control over every expense. |

| Flexibility | Less flexible; fixed limits set monthly. | Highly flexible; budgets adjust daily or weekly. |

| Expense Tracking | Tracked monthly through statements. | Tracked daily or weekly for immediate insight. |

| Spending Awareness | Lower spending awareness, risk of overspending mid-month. | Increased spending awareness, reduces overspending risk. |

| Goal Achievement | Slower progress toward savings or debt goals. | Faster, targeted progress by managing small expenses. |

| Recommended For | Individuals preferring simple budgeting. | Individuals needing strict expense control. |

Understanding Monthly Spending: An Overview

Understanding monthly spending involves tracking all fixed and variable expenses within a typical 30-day cycle, providing a comprehensive snapshot of financial obligations and discretionary spending patterns. This assessment highlights key categories such as housing, utilities, groceries, transportation, and entertainment, enabling individuals to identify areas for potential savings or adjustments. Accurate monthly spending insights form the foundation for effective micro-budgeting strategies, where granular expense allocation enhances control over financial goals and cash flow management.

What Is Micro-Budgeting?

Micro-budgeting is a detailed approach to money management that breaks down monthly spending into smaller, specific categories, allowing precise tracking of every expense. This method enhances financial control by allocating exact amounts for needs such as groceries, utilities, entertainment, and savings, minimizing overspending. By focusing on incremental expense limits, micro-budgeting promotes disciplined spending habits and improved overall financial health.

Key Differences: Monthly Spending vs. Micro-Budgeting

Monthly spending tracks broad expenses over extended periods, providing a general overview of financial outflows. Micro-budgeting breaks down expenditures into granular categories, enabling precise control and immediate adjustments. This detailed approach enhances spending awareness and helps identify specific areas for cost-saving opportunities.

Benefits of Monthly Spending Approaches

Monthly spending approaches provide a clear overview of total expenses, helping individuals track and control their cash flow effectively. This method simplifies financial planning by allocating fixed amounts to essential categories, reducing the risk of overspending and easing bill payments. It also promotes long-term savings by enabling users to identify trends and adjust discretionary spending accordingly.

Micro-Budgeting for Precise Money Management

Micro-budgeting allows for detailed tracking of every expense, enabling precise control over monthly spending and preventing unnecessary overspending. By allocating small, specific amounts to various categories, individuals can optimize resource distribution and quickly identify areas to cut costs. This granular approach to money management enhances financial discipline and improves savings outcomes.

Common Pitfalls in Monthly Spending Plans

Monthly spending plans often fail due to overlooked variable expenses and inaccurate income forecasts, leading to budget shortfalls. Micro-budgeting offers detailed tracking of every expense, reducing the risk of overspending by increasing financial awareness and control. Common pitfalls include underestimating irregular costs and neglecting emergency funds, which micro-budgeting helps mitigate through precise allocation and real-time adjustments.

Micro-Budgeting Tools and Apps

Micro-budgeting tools and apps provide detailed tracking by categorizing every expense to optimize monthly spending, promoting precise financial control. Applications like YNAB (You Need A Budget) and Mint enable users to allocate small budget segments, monitor real-time expenditures, and adjust allocations dynamically. These platforms enhance money management efficiency by fostering disciplined spending habits and preventing budget overruns.

Which Method Suits Your Financial Goals?

Monthly spending offers a broad overview of your finances, ideal for those aiming to track overall expenses and set long-term savings goals, while micro-budgeting breaks down expenses into precise categories, favoring individuals seeking strict control over every penny. Choosing between monthly spending and micro-budgeting depends on your financial goals, spending habits, and commitment level to detailed tracking. For substantial debt reduction or aggressive savings, micro-budgeting provides actionable insights, whereas monthly spending is sufficient for maintaining general financial awareness and stability.

Transitioning from Monthly Spending to Micro-Budgeting

Transitioning from monthly spending to micro-budgeting enhances financial control by breaking expenses into daily or weekly segments, allowing for precise tracking and immediate adjustments. This method reduces overspending by promoting awareness of small, routine expenditures that often go unnoticed in monthly budgets. Micro-budgeting fosters disciplined financial habits, improving savings and reducing unnecessary costs through continuous monitoring.

Tips for Effective Money Management with Any Method

Track all expenses meticulously to identify spending patterns and adjust budgets accordingly, ensuring financial goals are met regardless of using monthly spending or micro-budgeting. Prioritize essential expenses first and allocate funds for savings to maintain a balanced financial plan. Regularly review and update your budget to reflect changes in income or priorities for sustained money management success.

Related Important Terms

Spend Tracking Granularity

Monthly spending provides a broad overview of expenses, often obscuring small, frequent purchases that accumulate over time. Micro-budgeting enhances spend tracking granularity by categorizing every transaction, enabling precise control and revealing hidden spending patterns that improve financial decision-making.

Envelope Slicing

Envelope slicing in micro-budgeting divides monthly spending into specific categories, allowing precise control over expenses by allocating fixed amounts to each envelope. This method enhances financial discipline by preventing overspending and promoting targeted savings within predetermined budget limits.

Category Drilldown

Monthly spending analysis provides a comprehensive overview of expenses across major categories, allowing identification of high-cost areas and trends. Micro-budgeting enhances precision by breaking down expenditures into granular subcategories, facilitating targeted adjustments and more effective control over discretionary spending.

Daily Micro-Allocations

Daily micro-allocations in micro-budgeting optimize expense tracking by dividing monthly spending into manageable, precise amounts, enhancing control over discretionary spending and reducing financial stress. Implementing this granular approach improves cash flow management, promotes savings habits, and provides real-time insights for adjusting spending behavior effectively.

Nano-Budgeting

Nano-budgeting refines monthly spending by breaking expenses into ultra-specific categories, enabling precise tracking and minimizing unnecessary costs. This granular approach surpasses traditional micro-budgeting by fostering disciplined financial habits and maximizing savings potential through real-time adjustments.

Hyper-Itemized Expenses

Hyper-itemized expenses in monthly spending enable precise tracking of every small purchase, transforming traditional budgets into micro-budgeting models that offer granular control over financial resources. This approach maximizes cost-efficiency by highlighting detailed spending patterns, facilitating smarter adjustments and preventing budget overruns.

Cash Flow Pulse

Monthly spending analysis reveals patterns in cash outflow, enabling precise tracking of expenses and identifying opportunities for cost reduction. Micro-budgeting, as integrated in Cash Flow Pulse, offers real-time monitoring of small transactions to optimize daily spending and improve overall financial control.

Zero-Based Micro-Budgets

Zero-based micro-budgets allocate every dollar of monthly spending to specific categories, eliminating untracked expenses and enhancing financial control. This approach improves money management by ensuring no funds remain unassigned, promoting accountability and optimized budgeting.

Pocket Transaction Buckets

Pocket Transaction Buckets enable precise tracking of monthly spending by categorizing expenses into micro-budget segments, enhancing control over financial outflows. This method promotes disciplined money management by allocating specific funds to distinct spending categories, minimizing overspending and maximizing savings efficiency.

Real-Time Budget Fragmentation

Real-time budget fragmentation enables precise tracking of monthly spending by breaking expenses into micro-budgets for specific categories, enhancing control over cash flow and preventing overspending. This granular approach leverages digital tools to update budget allocations instantly, ensuring accurate financial management and immediate adjustments based on actual expenditure patterns.

Monthly spending vs Micro-budgeting for money management. Infographic

moneydiff.com

moneydiff.com