Receipts management involves manually organizing and storing paper or digital receipts to track expenses, which can be time-consuming and prone to loss or errors. Digital receipt wallets streamline money management by automatically capturing, categorizing, and storing receipts in one secure app, enhancing expense tracking accuracy and convenience. Utilizing digital receipt wallets improves budgeting, reduces clutter, and simplifies tax preparation compared to traditional receipts management.

Table of Comparison

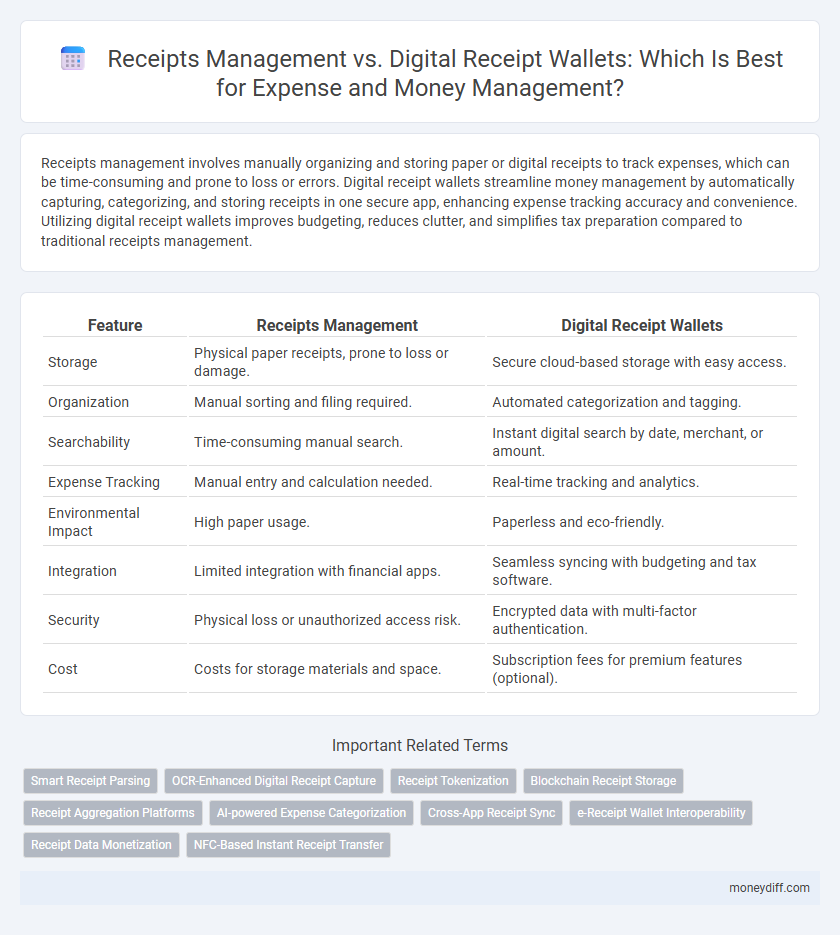

| Feature | Receipts Management | Digital Receipt Wallets |

|---|---|---|

| Storage | Physical paper receipts, prone to loss or damage. | Secure cloud-based storage with easy access. |

| Organization | Manual sorting and filing required. | Automated categorization and tagging. |

| Searchability | Time-consuming manual search. | Instant digital search by date, merchant, or amount. |

| Expense Tracking | Manual entry and calculation needed. | Real-time tracking and analytics. |

| Environmental Impact | High paper usage. | Paperless and eco-friendly. |

| Integration | Limited integration with financial apps. | Seamless syncing with budgeting and tax software. |

| Security | Physical loss or unauthorized access risk. | Encrypted data with multi-factor authentication. |

| Cost | Costs for storage materials and space. | Subscription fees for premium features (optional). |

Introduction to Expense Tracking: Receipts vs Digital Wallets

Expense tracking relies heavily on effective receipts management, which involves organizing and storing paper receipts for accurate record-keeping and budget monitoring. Digital receipt wallets offer a streamlined alternative, automatically capturing and categorizing purchase data to enhance real-time money management and reduce manual entry errors. Both methods contribute to financial transparency, but digital wallets provide greater convenience through integration with budgeting apps and instant access to transaction histories.

What is Traditional Receipts Management?

Traditional receipts management involves collecting, organizing, and storing physical paper receipts to track expenses and enable accurate accounting. This method relies on manual processes such as filing, categorizing by date or vendor, and retaining receipts for tax or reimbursement purposes. While straightforward, it can be time-consuming, prone to loss or damage, and less efficient compared to digital solutions.

Exploring Digital Receipt Wallets in Modern Finance

Digital receipt wallets streamline expense tracking by automatically organizing and storing digital copies of receipts, enhancing accuracy and reducing the risk of lost paper receipts. These wallets integrate with financial management apps to provide real-time spending insights, improve budgeting, and simplify tax preparation. By leveraging OCR technology and secure cloud storage, digital receipt wallets transform traditional receipt management into a seamless, efficient component of modern personal finance.

Key Differences: Paper Receipts and Digital Alternatives

Receipts management traditionally involves organizing physical paper receipts, which can be prone to loss, damage, and clutter, hindering efficient expense tracking. Digital receipt wallets store electronic copies of receipts, enabling automatic categorization, easy access, and seamless integration with expense management software. The key differences lie in accessibility, security, and the ability to analyze spending patterns digitally, making digital receipts a more sustainable and efficient solution for money management.

Benefits of Traditional Receipts Management

Traditional receipts management offers a tangible paper trail that enhances expense verification and audit accuracy, reducing the risk of digital errors or data loss. Physical receipts provide a straightforward method for tracking spending without reliance on technology, which can be especially beneficial in environments with limited digital access or for users preferring non-digital records. This approach supports thorough documentation for tax purposes and reimbursement processes, ensuring compliance with established financial regulations.

Advantages of Digital Receipt Wallets for Expense Control

Digital receipt wallets streamline expense management by automatically organizing and categorizing receipts, reducing manual entry errors and saving valuable time. They enhance budget tracking with real-time expense updates and integrate seamlessly with financial apps for better cash flow analysis. Features like easy access, searchability, and cloud storage improve record-keeping and support efficient tax preparation.

Challenges with Manual Receipts Organization

Manual receipts organization poses significant challenges such as time-consuming sorting, loss of physical receipts, and difficulty in tracking expenses accurately. Paper receipts often fade or get damaged, leading to incomplete financial records and increased risk of errors. Digital receipt wallets streamline expense management by securely storing receipts in a searchable format, reducing manual workload and improving accuracy in money management.

Security and Privacy in Digital Receipt Storage

Digital receipt wallets offer enhanced security through encrypted storage and multi-factor authentication, significantly reducing the risk of unauthorized access compared to paper receipts. Privacy controls in digital platforms allow users to manage data sharing preferences, ensuring sensitive purchase information remains confidential. Traditional receipt management lacks these robust protections, increasing vulnerability to loss, theft, and data breaches.

Integration of Receipt Management with Budgeting Apps

Integrating receipt management with budgeting apps enhances expense tracking by automatically categorizing purchases and syncing transaction data in real time. Digital receipt wallets streamline this process by capturing, storing, and organizing receipts directly within budgeting platforms, reducing manual entry errors and improving financial accuracy. This seamless integration empowers users to monitor spending habits, set realistic budgets, and optimize cash flow management efficiently.

Choosing the Best Solution for Personal Money Management

Receipts management offers a tangible way to track expenses through physical copies, providing detailed records for budgeting and tax purposes. Digital receipt wallets streamline money management by automatically organizing and categorizing purchases, enhancing convenience and reducing paper clutter. Choosing the best solution depends on personal preferences for accessibility, organization, and integration with financial tools.

Related Important Terms

Smart Receipt Parsing

Smart Receipt Parsing enables automatic extraction of key data such as vendor, date, and amount from physical receipts, streamlining expense tracking and reducing manual entry errors. Digital receipt wallets leverage this technology to consolidate all receipts in one secure platform, enhancing real-time money management and simplifying financial record keeping.

OCR-Enhanced Digital Receipt Capture

OCR-enhanced digital receipt capture automates expense tracking by extracting key data such as vendor, date, and total amount directly from receipts, reducing manual entry errors and saving time. Digital receipt wallets centralize this information, enabling seamless integration with budgeting apps and real-time expense analysis for more effective money management.

Receipt Tokenization

Receipt tokenization transforms physical receipts into secure, digital tokens that simplify expense tracking and reduce fraud risks, enhancing overall money management efficiency. Digital receipt wallets leverage this technology to centralize and automate expense categorization, providing users with real-time insights and better budget control.

Blockchain Receipt Storage

Blockchain receipt storage enhances receipt management by providing a secure, immutable ledger that prevents tampering and streamlines expense verification. Digital receipt wallets integrated with blockchain enable real-time tracking, automated audit trails, and seamless synchronization with financial management systems for optimized money management.

Receipt Aggregation Platforms

Receipt aggregation platforms streamline expense tracking by consolidating digital and paper receipts into a unified dashboard, enhancing accuracy and reducing manual entry errors. Integrating these platforms with digital receipt wallets improves money management through real-time expense categorization and automated budget analysis.

AI-powered Expense Categorization

AI-powered expense categorization enhances receipts management by automatically sorting and analyzing physical and scanned receipts, reducing manual data entry and improving accuracy. Digital receipt wallets leverage this technology to consolidate expenses in real-time, enabling seamless tracking, budget adherence, and personalized financial insights.

Cross-App Receipt Sync

Cross-app receipt sync in digital receipt wallets enhances money management by automatically consolidating purchase data from multiple platforms into a single, organized interface. This seamless integration reduces manual entry errors and enables real-time expense tracking, outperforming traditional receipts management systems in efficiency and accuracy.

e-Receipt Wallet Interoperability

e-Receipt wallets enable seamless aggregation and categorization of digital receipts from multiple retailers, enhancing expense tracking accuracy and convenience compared to traditional paper receipt management. Interoperability standards for e-Receipt wallets facilitate secure data sharing across financial apps and platforms, promoting comprehensive money management and streamlined reimbursement processes.

Receipt Data Monetization

Receipts management systems enable businesses to organize and extract valuable purchase insights, while digital receipt wallets enhance money management by consolidating data for personalized offers and financial tracking. Leveraging receipt data monetization through digital wallets unlocks revenue streams via targeted advertising, consumer behavior analytics, and loyalty program integration.

NFC-Based Instant Receipt Transfer

NFC-based instant receipt transfer enhances receipts management by enabling seamless and immediate digital capture, reducing paper clutter and improving expense tracking accuracy. Digital receipt wallets integrated with NFC technology facilitate real-time expense categorization and automated auditing, optimizing money management and simplifying reimbursement processes.

Receipts management vs Digital receipt wallets for money management. Infographic

moneydiff.com

moneydiff.com