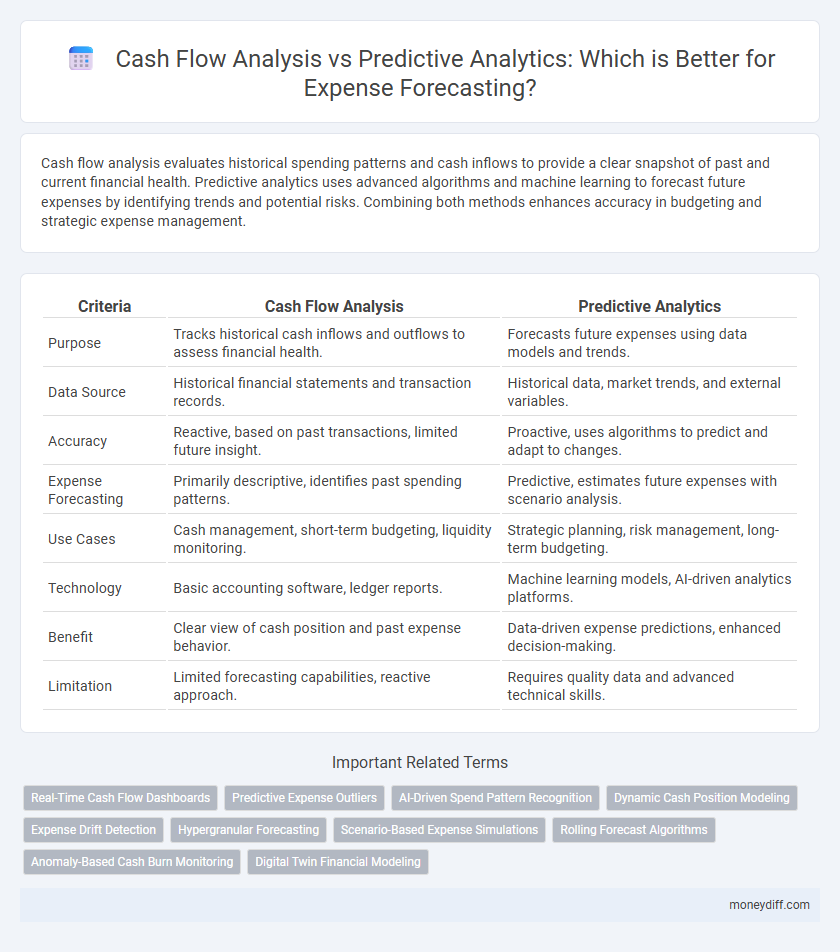

Cash flow analysis evaluates historical spending patterns and cash inflows to provide a clear snapshot of past and current financial health. Predictive analytics uses advanced algorithms and machine learning to forecast future expenses by identifying trends and potential risks. Combining both methods enhances accuracy in budgeting and strategic expense management.

Table of Comparison

| Criteria | Cash Flow Analysis | Predictive Analytics |

|---|---|---|

| Purpose | Tracks historical cash inflows and outflows to assess financial health. | Forecasts future expenses using data models and trends. |

| Data Source | Historical financial statements and transaction records. | Historical data, market trends, and external variables. |

| Accuracy | Reactive, based on past transactions, limited future insight. | Proactive, uses algorithms to predict and adapt to changes. |

| Expense Forecasting | Primarily descriptive, identifies past spending patterns. | Predictive, estimates future expenses with scenario analysis. |

| Use Cases | Cash management, short-term budgeting, liquidity monitoring. | Strategic planning, risk management, long-term budgeting. |

| Technology | Basic accounting software, ledger reports. | Machine learning models, AI-driven analytics platforms. |

| Benefit | Clear view of cash position and past expense behavior. | Data-driven expense predictions, enhanced decision-making. |

| Limitation | Limited forecasting capabilities, reactive approach. | Requires quality data and advanced technical skills. |

Understanding Cash Flow Analysis in Expense Management

Cash Flow Analysis in expense management involves tracking the actual inflows and outflows of cash to assess the company's liquidity and operational efficiency. It provides real-time visibility into payment cycles, helping identify periods of surplus or shortfall to optimize budget allocation and control discretionary spending. Accurate cash flow analysis supports better decision-making by highlighting immediate financial constraints and ensuring timely expense coverage.

The Role of Predictive Analytics in Forecasting Expenses

Predictive analytics utilizes historical expense data and machine learning algorithms to generate accurate forecasts, improving budget planning and cost management. By identifying spending patterns and potential anomalies, it enables proactive decision-making and reduces financial risks. Cash flow analysis provides a snapshot of current inflows and outflows, but predictive analytics offers deeper insights for anticipating future expenses and optimizing resource allocation.

Key Differences Between Cash Flow Analysis and Predictive Analytics

Cash flow analysis primarily tracks historical inflows and outflows to determine current financial liquidity, while predictive analytics uses statistical models and machine learning algorithms to forecast future expenses and revenues. Cash flow analysis offers a snapshot of past and present financial health, whereas predictive analytics provides forward-looking insights that help identify potential risks and opportunities. The key difference lies in cash flow analysis's reliance on historical data versus predictive analytics' emphasis on forecasting based on patterns and external variables.

Benefits of Cash Flow Analysis for Business Expenses

Cash flow analysis provides businesses with real-time insights into their expense patterns, enabling more accurate management of cash availability and payment schedules. It helps identify periods of potential shortfalls, facilitating proactive measures to maintain liquidity and avoid overdue liabilities. This approach supports informed decision-making by highlighting immediate financial health, which is crucial for efficient expense forecasting and operational stability.

How Predictive Analytics Enhances Expense Forecast Accuracy

Predictive analytics leverages historical expense data and advanced machine learning algorithms to identify spending patterns and anticipate future costs with higher precision than traditional cash flow analysis. By incorporating variables such as market trends, seasonal fluctuations, and operational changes, predictive models generate dynamic forecasts that adapt to evolving business conditions. This enhanced accuracy in expense forecasting enables more effective budgeting, resource allocation, and strategic decision-making.

Data Requirements for Effective Expense Forecasting

Cash flow analysis for expense forecasting relies heavily on historical transactional data and real-time cash inflow and outflow records to provide accurate short-term expense predictions. Predictive analytics enhances expense forecasting by integrating larger datasets, including market trends, economic indicators, and organizational behavior patterns, allowing for more dynamic and long-term projections. Effective expense forecasting requires high-quality, comprehensive data inputs such as detailed expense categories, vendor histories, and seasonality factors to improve both cash flow analysis and predictive model accuracy.

Limitations of Traditional Cash Flow Analysis

Traditional cash flow analysis relies heavily on historical data, which limits its ability to anticipate sudden market changes or unexpected expenses. It often fails to incorporate complex variables such as seasonality, economic indicators, and consumer behavior trends that predictive analytics can model. Consequently, using only cash flow analysis may result in less accurate expense forecasting and inadequate financial planning.

Integrating Predictive Analytics with Cash Flow Management

Integrating predictive analytics with cash flow management enhances expense forecasting accuracy by leveraging historical data patterns and real-time financial metrics. Predictive models identify potential cash shortfalls and optimize spending strategies, improving liquidity management and reducing financial risks. This synergy enables dynamic budgeting and more informed decision-making, fostering proactive expense control and sustainable cash flow health.

Choosing the Right Method for Your Expense Forecasting Needs

Cash flow analysis provides a historical view of expense patterns, helping businesses understand past spending behavior and current liquidity. Predictive analytics uses advanced algorithms and machine learning to forecast future expenses based on various data inputs, offering more accurate and dynamic projections. Selecting the right method depends on the complexity of your financial data and the need for real-time adaptability versus traditional trend analysis.

Future Trends in Expense Forecasting: From Cash Flow to AI-Driven Analytics

Future trends in expense forecasting reveal a shift from traditional cash flow analysis to AI-driven predictive analytics, enabling more accurate and real-time expense management. Advanced machine learning algorithms analyze historical expense data and external factors to forecast future spending patterns and budget needs. This transition enhances financial planning by providing dynamic insights, reducing risks, and optimizing resource allocation in corporate expense management.

Related Important Terms

Real-Time Cash Flow Dashboards

Real-time cash flow dashboards provide dynamic visualization of current expenses and income, enabling businesses to monitor liquidity instantly and make informed financial decisions. Unlike predictive analytics, which forecasts future expenses based on historical data and trends, these dashboards emphasize up-to-the-minute accuracy for tactical cash management and immediate operational adjustments.

Predictive Expense Outliers

Predictive analytics identifies expense outliers by analyzing historical cash flow patterns and detecting anomalies that traditional cash flow analysis might overlook. Using machine learning algorithms, predictive expense outliers forecasting enables more accurate budget adjustments and risk management in financial planning.

AI-Driven Spend Pattern Recognition

AI-driven spend pattern recognition enhances cash flow analysis by identifying recurring expense trends and anomalies, enabling more accurate and dynamic forecasting. Predictive analytics leverages machine learning algorithms to anticipate future expenses, optimizing budget allocation and reducing financial risk.

Dynamic Cash Position Modeling

Dynamic Cash Position Modeling leverages predictive analytics to enhance expense forecasting by continuously updating cash flow projections based on real-time data and market trends, enabling more accurate anticipation of future financial needs. Unlike traditional cash flow analysis, this approach integrates machine learning algorithms to identify patterns and anomalies, optimizing liquidity management and reducing the risk of cash shortages.

Expense Drift Detection

Cash flow analysis provides a historical view of expense patterns, identifying irregularities and cash outflows, while predictive analytics leverages machine learning algorithms to detect expense drift, enabling proactive forecasting and early identification of abnormal expenditure trends. Expense drift detection enhances financial accuracy by continuously monitoring deviations from expected costs, reducing budget overruns and improving fiscal planning.

Hypergranular Forecasting

Cash flow analysis provides historical expense patterns essential for identifying past spending trends, while predictive analytics leverages hypergranular forecasting techniques using detailed transactional data and machine learning models to deliver precise, real-time expense predictions. Hypergranular forecasting breaks down expenses into micro-categories, enabling businesses to anticipate cash outflows with enhanced accuracy and optimize budgeting strategies.

Scenario-Based Expense Simulations

Scenario-based expense simulations enhance cash flow analysis by modeling multiple financial outcomes, enabling more precise identification of potential risks and opportunities. Predictive analytics leverages historical expense data and machine learning algorithms to forecast future costs, improving budgeting accuracy and strategic financial planning.

Rolling Forecast Algorithms

Rolling forecast algorithms enhance expense forecasting by continuously updating cash flow analysis with real-time financial data, improving the accuracy and responsiveness of predictions. This dynamic approach allows organizations to adjust budgets and manage expenses proactively, reducing the risk of cash shortfalls and optimizing resource allocation.

Anomaly-Based Cash Burn Monitoring

Anomaly-based cash burn monitoring detects irregular expense patterns by analyzing cash flow data in real time, providing more accurate insights than traditional cash flow analysis methods. Predictive analytics enhances expense forecasting by using machine learning models to anticipate deviations before they occur, optimizing budget management and reducing unexpected cash shortages.

Digital Twin Financial Modeling

Cash Flow Analysis provides a historical view of expense trends, while Predictive Analytics leverages machine learning algorithms to forecast future costs with greater accuracy; Digital Twin Financial Modeling integrates real-time financial data to simulate multiple expense scenarios, enhancing precision in forecasting and decision-making. This advanced modeling approach enables organizations to proactively manage liquidity and optimize resource allocation by visualizing potential financial outcomes in a dynamic, virtual environment.

Cash Flow Analysis vs Predictive Analytics for expense forecasting. Infographic

moneydiff.com

moneydiff.com