Monitoring monthly bills versus subscription stacking reveals distinct challenges in managing expenses effectively. Monthly bills often have fixed amounts and predictable due dates, making budgeting straightforward, while subscription stacking can lead to unnoticed recurring charges and growing costs over time. Prioritizing detailed tracking of all subscriptions alongside regular bill payments enables better financial control and prevents overspending.

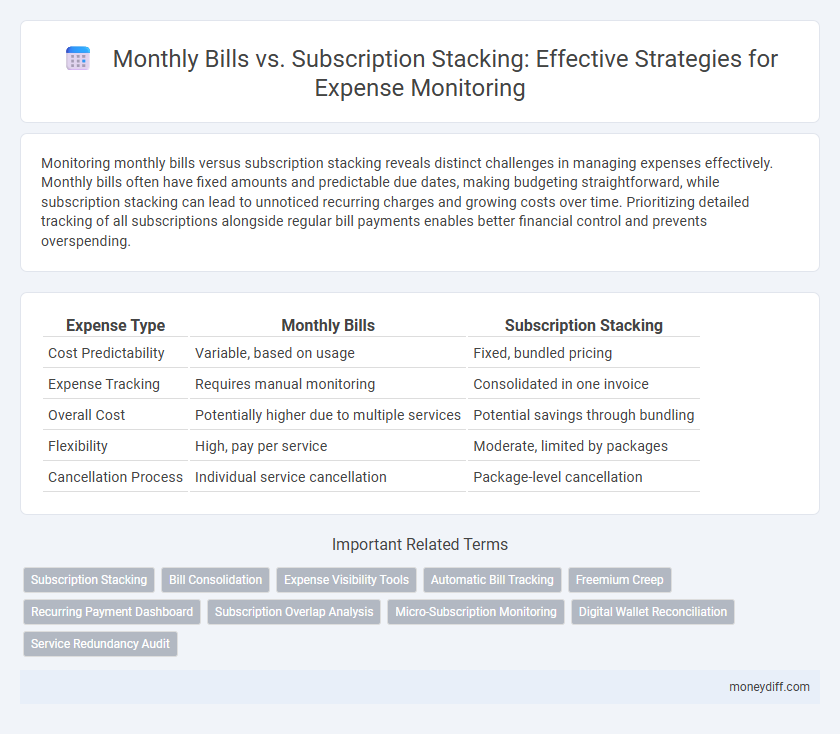

Table of Comparison

| Expense Type | Monthly Bills | Subscription Stacking |

|---|---|---|

| Cost Predictability | Variable, based on usage | Fixed, bundled pricing |

| Expense Tracking | Requires manual monitoring | Consolidated in one invoice |

| Overall Cost | Potentially higher due to multiple services | Potential savings through bundling |

| Flexibility | High, pay per service | Moderate, limited by packages |

| Cancellation Process | Individual service cancellation | Package-level cancellation |

Understanding Monthly Bills and Subscription Stacking

Monthly bills comprise fixed costs like rent, utilities, and phone charges that recur each month, offering predictable expense tracking. Subscription stacking occurs when multiple overlapping subscriptions accumulate unnoticed, leading to inflated monthly expenditures and potential budget strain. Monitoring both fixed monthly bills and subscription services is essential for accurate cost control and optimized financial management.

Key Differences Between Fixed Bills and Subscription Expenses

Fixed monthly bills such as utilities, rent, and insurance have consistent amounts and predictable due dates, making them easier to budget and monitor. Subscription expenses, including streaming services and software memberships, often vary in number and cost due to overlapping services or promotional pricing periods. Monitoring subscription stacking requires tracking frequent changes and cancellations, which differs from the straightforward management of fixed, recurring monthly bills.

The Hidden Costs of Subscription Stacking

Subscription stacking often leads to overlooked expenses that inflate monthly bills beyond initial expectations. These hidden costs accumulate from multiple overlapping services and unused subscriptions, making cost monitoring essential for accurate budget management. Identifying and eliminating redundant subscriptions can significantly reduce overall financial outflow and optimize personal or business expenditure tracking.

Tracking Monthly Bills: Strategies for Success

Tracking monthly bills requires detailed categorization and timely payment reminders to prevent late fees and optimize cash flow. Utilizing budgeting apps optimized for recurring expenses helps identify overlapping subscriptions and avoid unintentional stacking. Regularly reviewing statements and consolidating services can significantly improve cost monitoring and financial control.

Subscription Overload: How Much Are You Really Spending?

Tracking monthly bills alongside subscription stacking reveals hidden expenses that often go unnoticed, contributing to subscription overload. Many individuals underestimate the cumulative cost of multiple recurring subscriptions, which can significantly inflate their monthly spending beyond essential bills. Regularly auditing subscriptions and consolidating services helps accurately monitor costs and prevent financial leakage.

Tools for Monitoring Monthly and Subscription Expenses

Expense tracking tools like Mint and YNAB offer comprehensive dashboards to monitor monthly bills and subscription stacking simultaneously, helping users identify redundant or overlapping services. These platforms integrate bank and credit card data to provide real-time alerts on due dates and unusual charges, streamlining budget management. Leveraging features such as categorization and spending trend analysis, users can optimize their financial planning and prevent subscription fatigue.

The Impact of Subscription Stacking on Your Budget

Subscription stacking can significantly inflate your monthly expenses by accumulating multiple recurring charges that often go unnoticed. Monitoring monthly bills reveals cumulative costs from subscriptions, highlighting areas where cutting redundant services can optimize your budget. Understanding the financial impact of subscription stacking is essential for effective cost management and preventing budget overruns.

Reducing Expenses: Cancel or Keep Subscriptions?

Monitoring monthly bills alongside subscription stacking reveals significant opportunities for reducing expenses by identifying redundant or unused services. Analyzing spending patterns often uncovers overlapping subscriptions that can be consolidated or canceled to lower total costs. Prioritizing essential subscriptions while eliminating unnecessary repetitions enhances budget efficiency and promotes smarter financial management.

Creating a Balanced Approach to Cost Monitoring

Monitoring monthly bills alongside subscription stacking provides a comprehensive view of recurring expenses, enabling precise budget allocation and avoiding unexpected financial strain. Tracking both types of costs helps identify overlapping services and unnecessary subscriptions, optimizing overall cash flow management. Implementing tools that consolidate these expenses ensures timely payments and highlights opportunities to renegotiate or cancel redundant subscriptions, fostering a balanced approach to cost monitoring.

Smart Money Management: Tips for Controlling Recurring Costs

Monitoring monthly bills alongside subscription stacking provides a comprehensive view of recurring expenses, enabling better budget allocation and cost control. Tracking patterns in utility payments, memberships, and digital services helps identify redundant charges and opportunities for consolidation. Implementing automated alerts and reviewing subscriptions quarterly enhances smart money management by preventing overspending and optimizing financial resources.

Related Important Terms

Subscription Stacking

Subscription stacking occurs when multiple similar services overlap, causing unnecessary expense growth in monthly bills that complicates cost monitoring. Identifying and consolidating redundant subscriptions streamlines expenses, enhances budget accuracy, and prevents subscription fatigue.

Bill Consolidation

Bill consolidation streamlines monthly expense tracking by merging multiple charges into a single, manageable payment, reducing the complexity of monitoring subscription stacking. This approach enhances budget accuracy and minimizes oversight risks by providing a clear overview of recurring costs.

Expense Visibility Tools

Expense visibility tools enable users to track monthly bills and identify subscription stacking by consolidating payment data into unified dashboards for real-time monitoring. These tools enhance financial control by highlighting overlapping services and recurring charges, reducing unnecessary expenses and improving budget accuracy.

Automatic Bill Tracking

Automatic bill tracking streamlines monitoring monthly bills and subscription stacking by consolidating payments into a single platform, enabling real-time alerts and seamless expense management. This technology uses AI to detect overlapping services, reduce redundant costs, and ensure timely payments, enhancing financial control and preventing budget overruns.

Freemium Creep

Monitoring monthly bills versus subscription stacking is essential to identify Freemium Creep, where multiple free-tier services accumulate hidden costs over time. Tracking each subscription's usage and comparing it to fixed monthly expenses helps prevent unexpected budget overruns caused by overlooked freemium upgrades.

Recurring Payment Dashboard

A Recurring Payment Dashboard centralizes monitoring of monthly bills and subscription stacking, allowing users to visualize overlapping charges and identify redundant services quickly. This tool enhances cost control by providing detailed insights into recurring expenses, enabling informed budget adjustments and reducing unnecessary financial outflows.

Subscription Overlap Analysis

Subscription overlap analysis identifies redundant monthly expenses by cross-referencing subscription services and recurring bills, enabling precise cost monitoring and reducing unnecessary spending. Tracking overlapping subscriptions reveals opportunities to consolidate or cancel services, optimizing budget allocation and enhancing financial efficiency.

Micro-Subscription Monitoring

Micro-subscription monitoring provides detailed tracking of monthly bills versus subscription stacking, enabling precise identification of recurring expenses often overlooked in aggregated statements. By analyzing individual micro-subscriptions, consumers can optimize budgets and prevent unnecessary financial leakages from overlapping or redundant services.

Digital Wallet Reconciliation

Monitoring monthly bills and subscription stacking through digital wallet reconciliation enhances expense accuracy by automatically categorizing transactions, detecting duplicate charges, and identifying overlapping subscriptions to prevent overspending. This process streamlines cost tracking, ensuring real-time visibility into recurring payments and optimizing budget management.

Service Redundancy Audit

Conducting a Service Redundancy Audit helps identify overlapping subscriptions hidden within monthly bills, enabling precise cost monitoring and elimination of unnecessary expenses. Tracking both recurring charges and subscription stacking reveals redundant services that inflate budgets, facilitating optimized financial management.

Monthly Bills vs Subscription Stacking for cost monitoring. Infographic

moneydiff.com

moneydiff.com