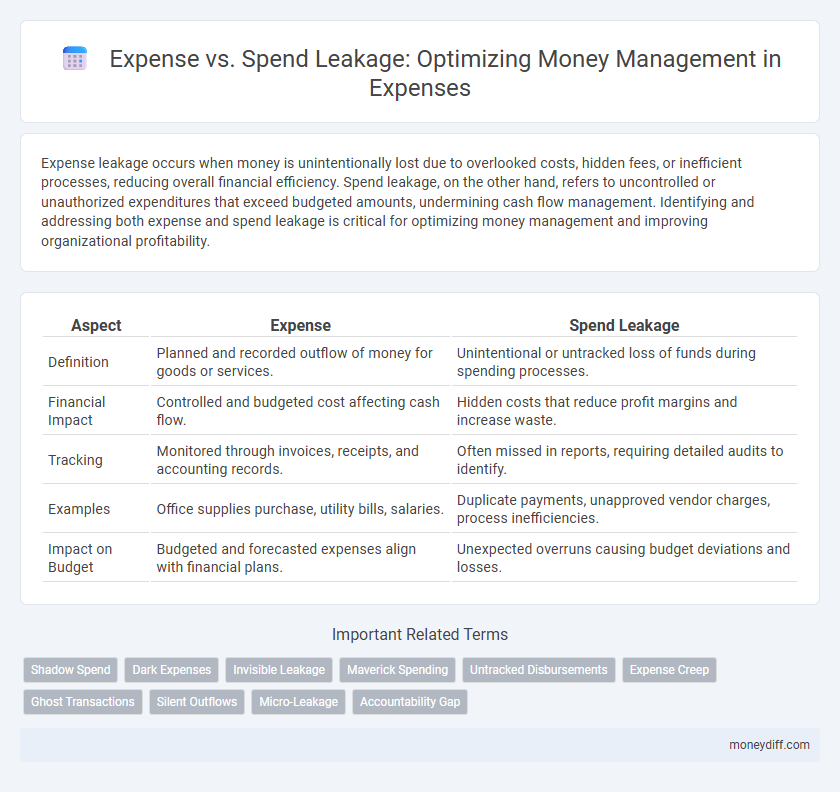

Expense leakage occurs when money is unintentionally lost due to overlooked costs, hidden fees, or inefficient processes, reducing overall financial efficiency. Spend leakage, on the other hand, refers to uncontrolled or unauthorized expenditures that exceed budgeted amounts, undermining cash flow management. Identifying and addressing both expense and spend leakage is critical for optimizing money management and improving organizational profitability.

Table of Comparison

| Aspect | Expense | Spend Leakage |

|---|---|---|

| Definition | Planned and recorded outflow of money for goods or services. | Unintentional or untracked loss of funds during spending processes. |

| Financial Impact | Controlled and budgeted cost affecting cash flow. | Hidden costs that reduce profit margins and increase waste. |

| Tracking | Monitored through invoices, receipts, and accounting records. | Often missed in reports, requiring detailed audits to identify. |

| Examples | Office supplies purchase, utility bills, salaries. | Duplicate payments, unapproved vendor charges, process inefficiencies. |

| Impact on Budget | Budgeted and forecasted expenses align with financial plans. | Unexpected overruns causing budget deviations and losses. |

Understanding Expense vs. Spend Leakage

Expense refers to the recorded outflows of money for goods or services, accurately reflecting budgeting and financial planning, while spend leakage occurs when authorized funds are used inefficiently or without proper oversight, leading to untracked or unnecessary costs. Understanding the difference helps businesses identify gaps where money is spent but not accounted for, improving cash flow management and reducing financial waste. Effective expense tracking systems and real-time spend analytics are crucial tools to detect and minimize spend leakage, enhancing overall financial control.

Key Differences Between Expense and Spend Leakage

Expense refers to the total amount recorded for goods or services consumed during a specific period, reflecting planned or expected financial outflows. Spend leakage occurs when actual spending deviates from budgeted expenses due to inefficiencies, unauthorized purchases, or errors, leading to financial loss or wasted resources. Identifying spend leakage is crucial for accurate expense management and improving organizational cost control.

Common Causes of Spend Leakage in Money Management

Spend leakage in money management often occurs due to untracked minor purchases, subscription overlaps, and unauthorized expenses. Inadequate expense monitoring and lack of real-time reporting contribute significantly to unnoticed financial outflows. Implementing automated expense tracking systems and regular audits helps identify and prevent spend leakage effectively.

Identifying Hidden Expenses in Your Budget

Hidden expenses in your budget often lead to significant spend leakage, eroding financial goals without obvious signs. Detailed tracking of subscriptions, small recurring fees, and infrequent purchases reveals expense patterns often overlooked in standard budgeting. Implementing expense categorization and regular audits enhances visibility, reducing unnoticed spend leakage and improving overall money management.

Impact of Spend Leakage on Financial Health

Spend leakage directly reduces available funds by unnoticed or unauthorized expenditures, weakening overall financial health and stability. Untracked spending increases the risk of budget overruns and debt accumulation, undermining long-term financial goals. Effective money management requires identifying and controlling spend leakage to preserve resources and ensure accurate expense forecasting.

Strategies to Control and Monitor Expenses

Implementing real-time expense tracking software enables the identification of spend leakage by categorizing and analyzing transaction patterns for inefficiencies. Establishing strict budget controls with automated alerts for threshold breaches helps prevent unauthorized or excessive expenditures. Regular audits combined with employee training on expense policies further enhance accountability and reduce financial leakage in organizational money management.

Tools for Detecting Spend Leakage

Tools for detecting spend leakage utilize advanced analytics and machine learning algorithms to track unauthorized or inefficient expenditures in real time. Expense management software integrates with financial systems to identify patterns of overspending or fraudulent transactions, enabling organizations to optimize their budgets. Automated alerts and detailed reporting features help businesses proactively address spend leakage, reducing unnecessary costs and improving overall financial control.

Best Practices for Preventing Spend Leakage

Implementing strict budget controls and real-time expense tracking are essential best practices for preventing spend leakage in money management. Leveraging automated expense management software with detailed analytics can identify unauthorized expenditures and enforce compliance. Establishing clear approval workflows and regular audits further minimizes the risk of hidden costs and optimizes financial oversight.

Expense Tracking vs. Spend Leakage Detection

Expense tracking provides a detailed record of all outflows, enabling accurate budgeting and financial analysis. Spend leakage detection identifies unauthorized or excessive spending outside established budgets, highlighting potential areas of financial loss. Combining both methods enhances money management by ensuring accountability and minimizing wasteful expenditures.

Optimizing Money Management by Reducing Spend Leakage

Expense management focuses on tracking allocated costs, while spend leakage occurs when uncontrolled purchases bypass budget controls, leading to unnecessary financial losses. Reducing spend leakage through automated approvals and real-time monitoring optimizes money management by ensuring all expenditures align with financial policies. Implementing spend analytics and employee compliance programs enhances transparency, minimizing hidden expenses and improving overall budget accuracy.

Related Important Terms

Shadow Spend

Shadow Spend represents untracked expenses that bypass formal budgeting controls, causing significant spend leakage and impacting overall money management accuracy. Identifying and controlling Shadow Spend is crucial to prevent unaccounted costs and improve financial transparency within organizations.

Dark Expenses

Dark expenses represent hidden or unrecorded financial outflows that contribute significantly to expense leakage, undermining accurate money management and budget adherence. Identifying and controlling these dark expenses is essential for reducing spend leakage and enhancing overall financial transparency.

Invisible Leakage

Invisible leakage in money management occurs when small, untracked expenses accumulate unnoticed, eroding overall budgets more than obvious spending. Unlike direct spend leakage, this hidden outflow requires detailed analysis of recurring micro-transactions and subscription fees to fully control expense patterns.

Maverick Spending

Maverick spending, a key factor in spend leakage, occurs when employees bypass approved procurement processes, leading to uncontrolled expenses that reduce overall budget efficiency. Identifying and controlling these off-policy expenditures is critical for accurate expense management and to minimize financial losses in organizations.

Untracked Disbursements

Untracked disbursements contribute significantly to spend leakage by bypassing formal expense recording systems, resulting in inaccurate financial reporting and budget overruns. Effective money management requires identifying and controlling these hidden expenses to maintain comprehensive expense tracking and optimize cash flow.

Expense Creep

Expense creep refers to the gradual increase in discretionary spending that often goes unnoticed, leading to significant budget overruns and hidden financial leakage. Identifying and controlling expense creep is crucial for accurate money management, as it directly impacts cash flow and reduces the ability to save or invest effectively.

Ghost Transactions

Expense leakage occurs when recorded expenses, such as ghost transactions--unauthorized or duplicate charges--inflate financial outflows without actual spending, distorting budget accuracy. Spend leakage refers to unnoticed or untracked outflows, with ghost transactions representing a critical subset that undermines effective money management by causing discrepancies between reported expenses and real spending.

Silent Outflows

Silent outflows represent untracked, recurring expenses that cause significant spend leakage in money management, often unnoticed due to their low transaction visibility. Addressing these hidden costs through automated tracking tools and detailed expense categorization reduces financial waste and improves overall budget accuracy.

Micro-Leakage

Micro-leakage in expense management refers to small, often unnoticed outflows of money that cumulatively impact overall financial health more than large, obvious expenditures. Identifying and controlling these minute, frequent spend leakages is crucial for optimizing budgets and improving personal or organizational money management efficiency.

Accountability Gap

Expense leakage occurs when organizational spending is inaccurately tracked or categorized, creating blind spots in financial reporting, whereas spend leakage specifically refers to uncontrolled or unauthorized expenditures escaping budget oversight. The accountability gap arises when there is a lack of clear ownership or responsibility for identifying and addressing these leakages, leading to inefficiencies in money management and increased financial risks.

Expense vs Spend Leakage for money management. Infographic

moneydiff.com

moneydiff.com