Expense refers to the total amount of money spent on operational activities, while burn rate specifically measures the speed at which a company uses its cash reserves over a given period. Monitoring both expense and burn rate is crucial for effective money management, as it helps businesses understand their spending patterns and ensure sustainable cash flow. Accurate tracking prevents overspending and supports strategic financial planning to maintain long-term viability.

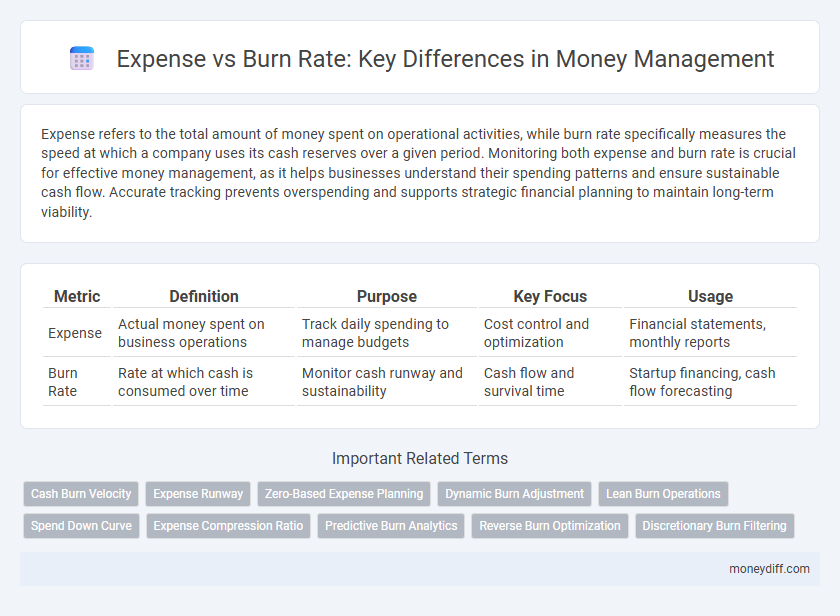

Table of Comparison

| Metric | Definition | Purpose | Key Focus | Usage |

|---|---|---|---|---|

| Expense | Actual money spent on business operations | Track daily spending to manage budgets | Cost control and optimization | Financial statements, monthly reports |

| Burn Rate | Rate at which cash is consumed over time | Monitor cash runway and sustainability | Cash flow and survival time | Startup financing, cash flow forecasting |

Understanding Expense vs Burn Rate

Expense refers to the actual amount of money spent on operating costs, while burn rate measures the speed at which a company uses its cash reserves over a specific period. Understanding the difference between expense and burn rate helps businesses manage cash flow effectively by identifying how quickly funds are depleting relative to incurred costs. Tracking both metrics is essential for forecasting financial health and planning sustainable growth strategies.

Key Differences Between Expense and Burn Rate

Expense refers to the total amount of money spent by a business within a specific period, covering operational costs and one-time purchases. Burn rate measures the speed at which a company consumes its available capital, indicating how quickly cash reserves are being depleted. Understanding the difference is crucial for money management because expenses represent individual outflows, while the burn rate reflects the overall financial health and sustainability of the business over time.

Why Burn Rate Matters in Financial Planning

Burn rate measures how quickly a company spends its available capital, providing critical insight into cash flow sustainability beyond simple expense tracking. Monitoring burn rate helps businesses forecast runway duration, enabling proactive adjustments to avoid liquidity crises. Understanding burn rate ensures more strategic financial planning, aligning spending with growth objectives and investment timelines.

Calculating Your Monthly Expenses

Calculating your monthly expenses involves tracking all fixed and variable costs such as rent, utilities, salaries, and supplies to gain a clear picture of cash outflow. Understanding expenses helps differentiate between total costs and burn rate, which specifically measures the speed at which your available capital is depleted. Accurate expense tracking supports better financial forecasting and cash flow management for sustainable business operations.

How to Determine Your Burn Rate

To determine your burn rate, calculate the total expenses incurred over a specific period, typically monthly, then subtract any revenue earned to find the net cash outflow. Track all fixed and variable costs, including rent, salaries, utilities, and marketing expenses, to ensure an accurate assessment. Understanding burn rate helps forecast how long current funds will last, guiding effective budget adjustments and financial planning.

Expense Tracking Techniques for Effective Money Management

Expense tracking techniques such as categorizing transactions, using budgeting apps, and maintaining detailed financial records enhance visibility into spending patterns, enabling more accurate management of both expenses and burn rate. Monitoring daily and monthly expenses against the burn rate helps identify unnecessary costs and adjust budgets proactively to sustain cash flow. Leveraging automated tools and regular expense reconciliations supports informed decision-making for optimizing money management.

Burn Rate Analysis for Personal and Business Finances

Burn rate analysis is crucial for understanding how quickly funds are being depleted in both personal and business finances, providing a clear metric beyond simple expense tracking. Monitoring the burn rate helps identify if spending patterns are sustainable relative to income or capital reserves, enabling proactive adjustments to avoid financial shortfalls. Accurate burn rate calculations factor in fixed and variable expenses over time, offering a comprehensive perspective on cash flow stability and financial health.

Controlling Expenses to Reduce Burn Rate

Controlling expenses directly impacts the burn rate by limiting cash outflows and extending the runway for financial stability. Precise tracking of fixed and variable costs allows businesses to identify inefficiencies and implement cost-saving strategies. Reducing unnecessary expenditures effectively slows the burn rate, preserving capital for critical operations and strategic investments.

Strategies to Optimize Burn Rate and Sustain Cash Flow

Effective strategies to optimize burn rate and sustain cash flow include closely monitoring expense categories to identify and eliminate non-essential spending. Implementing budget controls and forecasting cash flow helps maintain a balanced burn rate aligned with revenue inflows, ensuring liquidity. Leveraging cost-saving measures such as negotiating supplier contracts and adopting scalable operational models further enhances financial sustainability.

Expense vs Burn Rate: Best Practices for Financial Health

Expense refers to the actual costs incurred during business operations, while burn rate measures the speed at which a company spends its available cash. Monitoring burn rate alongside expenses helps maintain financial health by ensuring spending aligns with revenue streams and cash reserves. Implementing strict budget controls and regularly analyzing both metrics allows for proactive adjustments to avoid financial shortfalls.

Related Important Terms

Cash Burn Velocity

Cash Burn Velocity measures the speed at which a company consumes its cash reserves, providing a dynamic insight beyond static monthly expenses. Tracking this rate helps optimize burn versus revenue inflow, ensuring sustainable financial management and prolonging runway efficiency.

Expense Runway

Expense runway measures how long company funds will last based on current expenses, offering a clear perspective on financial sustainability beyond just burn rate. Tracking expense runway aids in optimizing budget allocations and forecasting cash flow needs to prevent premature depletion of resources.

Zero-Based Expense Planning

Zero-Based Expense Planning ensures each dollar is allocated purposefully, contrasting with Burn Rate analysis which measures overall cash outflow speed. This approach enhances financial control by scrutinizing every expense category from zero, optimizing budget efficiency and reducing unnecessary spending.

Dynamic Burn Adjustment

Dynamic Burn Adjustment optimizes cash flow by continuously aligning expenses with real-time revenue fluctuations and operational priorities, ensuring sustainable financial health. This method contrasts static expense tracking by enabling adaptive budget reallocations and more accurate forecasting of the burn rate to prevent liquidity shortfalls.

Lean Burn Operations

Expense tracking identifies individual outflows, whereas burn rate measures the overall cash depletion in lean burn operations, providing a critical metric for sustainable financial management. Optimizing burn rate with controlled expenses ensures sufficient runway and resource allocation for startups prioritizing cost-efficiency.

Spend Down Curve

Expense represents actual cash outflows tracked over specific periods, while burn rate measures the pace at which a company depletes its available capital. The Spend Down Curve visually illustrates the acceleration or deceleration of expenses against burn rate, crucial for forecasting runway and optimizing financial strategy.

Expense Compression Ratio

Expense Compression Ratio measures the efficiency of expense reduction relative to the total expenses, providing a critical metric for optimizing cost management and improving burn rate sustainability. Monitoring this ratio enables businesses to balance operational spending with cash flow constraints, ensuring a strategic approach to managing burn rate while minimizing unnecessary expenses.

Predictive Burn Analytics

Expense tracking provides detailed insight into past and current financial outflows, while Predictive Burn Analytics uses historical expense data combined with cash flow trends to forecast future burn rates accurately. This approach enables proactive budget adjustments and optimized cash management by anticipating when funds will be depleted.

Reverse Burn Optimization

Reverse Burn Optimization strategically reduces monthly expenses to extend runway and improve cash flow efficiency, contrasting traditional burn rate which primarily tracks total outflow. By targeting non-essential costs, this approach enhances financial sustainability and supports adaptive budgeting in dynamic market conditions.

Discretionary Burn Filtering

Discretionary burn filtering distinguishes between essential expenses and optional expenditures to provide a clearer picture of actual cash outflow beyond fixed costs. This method enables more accurate tracking of burn rate by isolating controllable spending, helping businesses optimize budget allocation and extend runway.

Expense vs Burn Rate for money management. Infographic

moneydiff.com

moneydiff.com