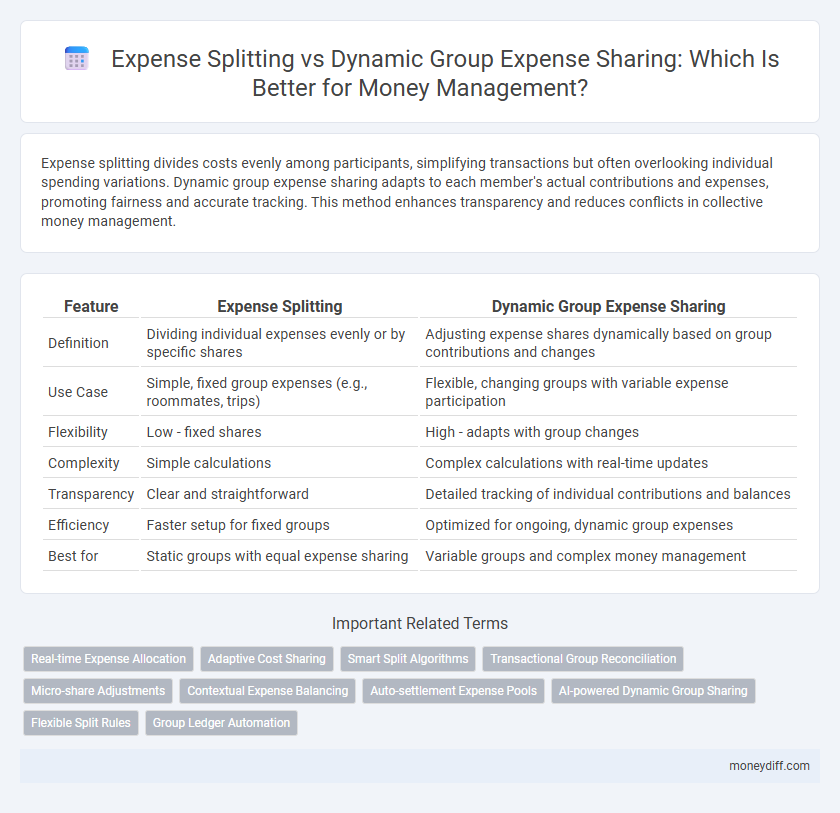

Expense splitting divides costs evenly among participants, simplifying transactions but often overlooking individual spending variations. Dynamic group expense sharing adapts to each member's actual contributions and expenses, promoting fairness and accurate tracking. This method enhances transparency and reduces conflicts in collective money management.

Table of Comparison

| Feature | Expense Splitting | Dynamic Group Expense Sharing |

|---|---|---|

| Definition | Dividing individual expenses evenly or by specific shares | Adjusting expense shares dynamically based on group contributions and changes |

| Use Case | Simple, fixed group expenses (e.g., roommates, trips) | Flexible, changing groups with variable expense participation |

| Flexibility | Low - fixed shares | High - adapts with group changes |

| Complexity | Simple calculations | Complex calculations with real-time updates |

| Transparency | Clear and straightforward | Detailed tracking of individual contributions and balances |

| Efficiency | Faster setup for fixed groups | Optimized for ongoing, dynamic group expenses |

| Best for | Static groups with equal expense sharing | Variable groups and complex money management |

Understanding Expense Splitting vs Dynamic Group Expense Sharing

Expense splitting involves dividing costs evenly or by predetermined shares among participants, making it straightforward for fixed-group scenarios. Dynamic group expense sharing adapts to fluctuating participants and varying contribution amounts, offering greater flexibility for irregular or evolving financial interactions. Understanding these methods enhances accurate tracking and equitable money management within both stable and variable expense groups.

Key Differences Between Traditional Expense Splitting and Dynamic Sharing

Traditional expense splitting usually divides costs evenly among participants, making it simple but often inaccurate for shared financial responsibilities. Dynamic group expense sharing adapts to individual contributions and expenses, allowing more precise allocation based on actual spending and usage. This approach enhances fairness and transparency in money management by accommodating variable shares and fluctuating group dynamics.

Benefits of Expense Splitting for Money Management

Expense splitting enhances financial transparency by clearly allocating each participant's share, reducing confusion and disputes in money management. It simplifies tracking individual contributions and expenditures, enabling better budget control and financial planning. By providing a straightforward approach, expense splitting ensures equitable cost distribution, promoting accountability and trust among group members.

Advantages of Dynamic Group Expense Sharing

Dynamic group expense sharing streamlines money management by automatically tracking and allocating costs based on real-time expenses and contributions within the group. This method reduces errors and simplifies settlement, ensuring transparency and fairness among members. It enhances efficiency compared to traditional expense splitting, which often requires manual calculations and individual adjustments.

Common Challenges in Managing Shared Expenses

Shared expenses often lead to confusion due to unclear allocations and uneven payment contributions, causing disputes among group members. Tracking multiple payments and reimbursing individuals accurately becomes cumbersome without an organized system. Both expense splitting and dynamic group expense sharing methods struggle with real-time updates and transparency, complicating effective money management in group settings.

Choosing the Right Method for Your Group Dynamics

Expense splitting works best for fixed, predictable costs among small, consistent groups, ensuring straightforward tracking and equal shares. Dynamic group expense sharing adapts to fluctuating participation and varying contributions, ideal for larger or irregular groups with diverse spending habits. Selecting the right method depends on group size, spending patterns, and the need for flexibility in tracking expenses.

Essential Tools and Apps for Expense Sharing

Expense splitting tools like Splitwise and Tricount simplify dividing bills evenly among participants, ensuring transparent and accurate tracking of individual contributions. Dynamic group expense sharing apps such as Settle Up and Venmo offer flexible solutions to accommodate varying amounts and changing group members, enhancing adaptability in managing shared costs. These essential apps provide real-time updates, seamless integration with payment platforms, and detailed expense summaries to optimize money management within groups.

Best Practices for Transparent Group Money Management

Expense splitting relies on fixed, individual contributions based on predetermined shares, ensuring clear accountability but limited flexibility. Dynamic group expense sharing adapts contributions in real-time based on members' varying incomes and expenditures, promoting fairness and reducing financial stress. Best practices for transparent group money management include using digital tools with detailed transaction histories, regular expense reviews, and open communication to maintain trust and clarity.

Case Scenarios: When to Use Expense Splitting or Dynamic Sharing

Expense splitting suits fixed, predefined groups where costs are evenly divided, such as roommates sharing rent or coworkers splitting a group lunch bill. Dynamic group expense sharing excels in flexible, changing groups with varied contributions, like friends on a trip with different activities and participants joining or leaving. Choosing between them depends on group stability, expense variability, and fairness requirements for accurate money management.

Improving Financial Accountability in Group Settings

Expense splitting simplifies financial accountability by dividing costs equally among group members, ensuring transparency in shared spending. Dynamic group expense sharing enhances this by allowing variable contributions based on individual usage or agreements, promoting fairness and accurate tracking. Implementing dynamic models improves money management, reduces disputes, and fosters trust within group financial interactions.

Related Important Terms

Real-time Expense Allocation

Real-time expense allocation in dynamic group expense sharing allows instantaneous tracking and adjustment of individual contributions, enhancing accuracy and transparency compared to traditional expense splitting. This method leverages digital platforms to automate transactions, minimize disputes, and provide up-to-date financial balances among group members.

Adaptive Cost Sharing

Adaptive cost sharing in expense splitting enhances money management by allocating costs based on individual usage or benefit, improving fairness and accuracy compared to static group expense sharing models. Dynamic group expense sharing adjusts contributions in real-time as expenses and group compositions change, optimizing financial transparency and reducing conflicts among participants.

Smart Split Algorithms

Smart Split Algorithms enhance expense splitting by automatically analyzing individual contributions and consumption patterns, ensuring precise settlements within groups. Dynamic group expense sharing leverages these algorithms to adapt real-time adjustments based on evolving spending behaviors, optimizing fairness and minimizing manual reconciliation.

Transactional Group Reconciliation

Expense splitting divides costs evenly or by predefined shares among group members, simplifying transactional tracking but often lacking flexibility for varied contributions. Dynamic group expense sharing enhances transactional group reconciliation by allowing real-time adjustments based on individual payments and benefits, ensuring precise balance and accountability in shared money management.

Micro-share Adjustments

Expense splitting allows fixed allocation of costs among predefined participants, often leading to rigid settlements, whereas dynamic group expense sharing incorporates micro-share adjustments that enable precise and flexible redistribution of minor discrepancies in individual contributions, enhancing accuracy in group money management. These micro-share adjustments optimize financial accountability by automatically correcting small variances, reducing the need for manual reconciliation and ensuring equitable cost-sharing.

Contextual Expense Balancing

Expense splitting divides costs evenly among participants, simplifying individual share calculations but often overlooking varying contribution levels or usage patterns. Dynamic group expense sharing adapts to real-time spending behaviors and contextual factors, enabling precise contextual expense balancing that reflects each member's actual financial responsibility.

Auto-settlement Expense Pools

Auto-settlement Expense Pools streamline expense splitting by automatically calculating and distributing shared costs among group members, reducing manual tracking errors and simplifying money management. Dynamic group expense sharing adapts to fluctuating group members and variable expenses, using real-time allocation algorithms to maintain accurate, transparent settlement balances.

AI-powered Dynamic Group Sharing

AI-powered Dynamic Group Sharing revolutionizes expense management by automatically categorizing and allocating costs based on real-time participation and individual spending patterns, ensuring precise and fair distribution. This advanced method outperforms traditional expense splitting by adapting to changing group dynamics and reducing manual errors for optimized financial transparency.

Flexible Split Rules

Flexible split rules in expense splitting allow users to customize how expenses are divided among group members based on specific criteria such as percentage, exact amounts, or share adjustments, enhancing accuracy and fairness in money management. Dynamic group expense sharing adapts these flexible rules in real-time to reflect changes in group size or individual contributions, promoting seamless and transparent financial coordination.

Group Ledger Automation

Expense splitting typically involves dividing costs equally or by predefined shares among group members, while dynamic group expense sharing adapts allocations based on real-time contributions and usage, enhancing accuracy in group ledger automation. Automated ledger systems streamline reconciliation by instantly updating each member's balance, reducing manual errors and improving transparency in collective money management.

Expense splitting vs Dynamic group expense sharing for money management. Infographic

moneydiff.com

moneydiff.com