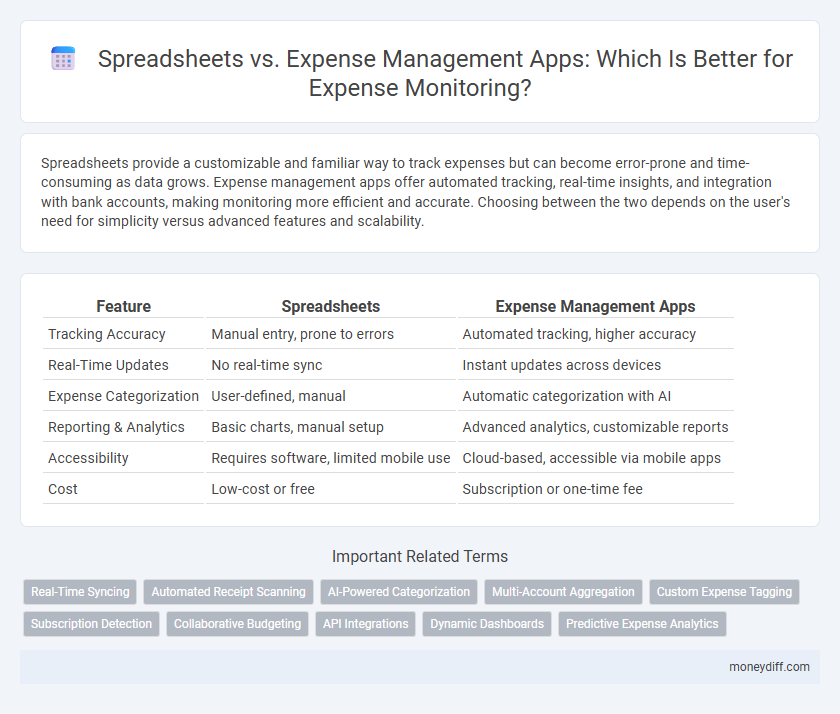

Spreadsheets provide a customizable and familiar way to track expenses but can become error-prone and time-consuming as data grows. Expense management apps offer automated tracking, real-time insights, and integration with bank accounts, making monitoring more efficient and accurate. Choosing between the two depends on the user's need for simplicity versus advanced features and scalability.

Table of Comparison

| Feature | Spreadsheets | Expense Management Apps |

|---|---|---|

| Tracking Accuracy | Manual entry, prone to errors | Automated tracking, higher accuracy |

| Real-Time Updates | No real-time sync | Instant updates across devices |

| Expense Categorization | User-defined, manual | Automatic categorization with AI |

| Reporting & Analytics | Basic charts, manual setup | Advanced analytics, customizable reports |

| Accessibility | Requires software, limited mobile use | Cloud-based, accessible via mobile apps |

| Cost | Low-cost or free | Subscription or one-time fee |

Understanding Spreadsheets for Expense Tracking

Spreadsheets offer a flexible and customizable approach to expense tracking, allowing users to tailor categories, formulas, and reports to their specific financial needs. Their ability to handle detailed data entry and create visual charts provides clear insights into spending patterns without the need for subscription fees. However, mastering functions like pivot tables and conditional formatting is essential to maximize accuracy and efficiency in monitoring expenses.

What Are Expense Management Apps?

Expense management apps are digital tools designed to streamline the tracking, categorization, and analysis of expenses, providing real-time insights into spending patterns and budget adherence. Unlike traditional spreadsheets, these apps automate expense entry through features such as receipt scanning, bank integration, and automatic categorization, which reduces manual errors and saves time. They also offer advanced features like multi-user collaboration, customizable reports, and mobile accessibility, making them essential for efficient financial monitoring and control.

Key Features: Spreadsheets vs Apps

Spreadsheets offer customizable templates and flexible data entry for detailed expense tracking but require manual updates and lack real-time collaboration features. Expense management apps provide automated transaction syncing, receipt capture, and real-time reporting, enhancing accuracy and efficiency. Key features of apps include multi-device access, integration with bank accounts, and AI-driven expense categorization, which spreadsheets typically do not support.

Usability and Learning Curve Comparison

Expense management apps provide a streamlined user interface designed for quick navigation, significantly reducing the learning curve compared to traditional spreadsheets. While spreadsheets offer customizable tracking options, their complexity often leads to user errors and longer setup times. Apps typically include automated data entry and real-time syncing, enhancing usability and efficiency in monitoring expenses.

Customization Capabilities Analyzed

Expense management apps offer robust customization capabilities, allowing users to tailor dashboards, categorize expenses, and set personalized alerts with ease. Spreadsheets provide flexibility through formulas and macros but require advanced skills to achieve the same level of automation and dynamic reporting. Expense management apps integrate with bank accounts and generate real-time insights, optimizing monitoring beyond the static nature of spreadsheets.

Real-Time Synchronization and Accessibility

Expense management apps offer real-time synchronization across multiple devices, ensuring that all expense data is instantly updated and accessible from anywhere. Unlike spreadsheets, which require manual updates and are prone to version control issues, these apps provide seamless accessibility through cloud-based platforms. This enhances transparency and accuracy in monitoring expenses, making financial tracking more efficient and reliable.

Data Security: Spreadsheets vs Apps

Expense management apps typically offer advanced data security features such as encryption, multi-factor authentication, and regular security updates, which spreadsheets often lack. While spreadsheets store data locally or on less secure cloud services, increasing vulnerability to unauthorized access, apps provide centralized, secure storage with controlled access. This enhanced security in expense management apps reduces the risk of data breaches and ensures compliance with privacy regulations.

Collaboration and Sharing Options

Expense management apps offer advanced collaboration features such as real-time multi-user editing, automatic syncing, and role-based access controls, enhancing team visibility and accountability. Spreadsheets require manual updates and sharing, which can lead to version control issues and inconsistent data among collaborators. Dedicated apps also enable seamless sharing through cloud integration and customizable permissions, streamlining expense tracking across departments or projects.

Cost Analysis: Free vs Paid Solutions

Spreadsheets offer a cost-effective way to monitor expenses, allowing detailed customization without upfront fees, but they lack automated cost analysis and real-time data tracking found in paid expense management apps. Paid solutions often include advanced features such as automatic expense categorization, integration with bank accounts, and predictive analytics, enhancing accuracy and saving time despite recurring subscription costs. Choosing between free spreadsheets and paid apps depends on whether budget constraints or the need for streamlined, scalable cost analysis tools take priority.

Which Solution Is Best for Your Money Management Needs?

Spreadsheets offer customization and control for tracking expenses but require manual data entry and lack real-time updates, making them less efficient for ongoing monitoring. Expense management apps provide automated transaction syncing, categorization, and insightful reporting tailored to individual spending habits, enhancing accuracy and convenience. Choosing between the two depends on your preference for hands-on control versus automated, user-friendly features for effective money management.

Related Important Terms

Real-Time Syncing

Expense management apps offer real-time syncing across multiple devices, ensuring instant updates and accuracy in tracking spending. In contrast, spreadsheets require manual updates, increasing the risk of errors and delayed financial insights.

Automated Receipt Scanning

Expense management apps offer automated receipt scanning that instantly captures and categorizes transaction data, reducing manual entry errors common in spreadsheets. This automation enhances accuracy and efficiency in tracking expenses compared to traditional spreadsheet methods.

AI-Powered Categorization

AI-powered categorization in expense management apps enhances accuracy by automatically sorting transactions into precise categories, reducing manual errors common in spreadsheets. These apps leverage machine learning algorithms to identify patterns and update categories dynamically, providing real-time insights that static spreadsheets cannot match.

Multi-Account Aggregation

Expense management apps offer superior multi-account aggregation by automatically consolidating data from various bank accounts, credit cards, and payment platforms into a unified dashboard, improving real-time visibility and accuracy. In contrast, spreadsheets require manual input and reconciliation across multiple sources, increasing the risk of errors and time consumption in monitoring expenses effectively.

Custom Expense Tagging

Custom expense tagging in spreadsheets offers flexible, manual categorization but demands significant time and risks inconsistencies in data entry. Expense management apps automate tagging with AI-driven precision, enhancing accuracy and enabling real-time analytics for optimized financial oversight.

Subscription Detection

Expense management apps feature advanced subscription detection algorithms that automatically identify recurring payments, providing real-time alerts and detailed analytics for better budget control. Spreadsheets rely on manual entry and lack automated subscription tracking, making it challenging to monitor ongoing expenses and detect hidden or forgotten subscriptions efficiently.

Collaborative Budgeting

Expense management apps offer real-time collaborative budgeting features that enable multiple users to track and update expenses simultaneously, reducing errors and improving financial transparency. In contrast, spreadsheets require manual updates and lack seamless integration tools, making collaborative budgeting more prone to mistakes and inefficiencies.

API Integrations

Expense management apps provide seamless API integrations with accounting software, bank feeds, and invoicing platforms, enabling real-time expense tracking and automated data sync. Traditional spreadsheets lack native API connectivity, requiring manual data entry that increases error risk and limits scalability in dynamic financial environments.

Dynamic Dashboards

Dynamic dashboards in expense management apps provide real-time visualization and interactive tracking of spending patterns, surpassing traditional spreadsheets' static and manual data entry limitations. These apps integrate with bank accounts and credit cards to automatically update categories and alerts, enhancing accuracy and time efficiency in monitoring expenses.

Predictive Expense Analytics

Expense management apps leverage predictive expense analytics to forecast spending patterns and identify potential budget overruns, offering real-time insights that spreadsheets lack. Unlike static spreadsheet data, these apps use machine learning algorithms to analyze historical expenses and provide actionable recommendations for more accurate financial planning.

Spreadsheets vs Expense Management Apps for monitoring Infographic

moneydiff.com

moneydiff.com