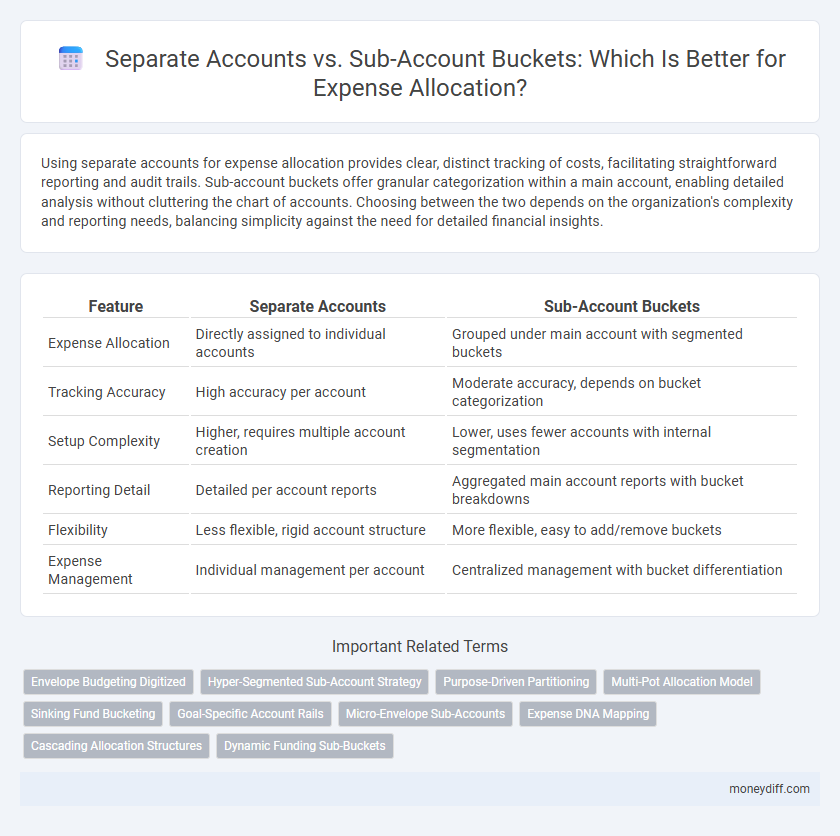

Using separate accounts for expense allocation provides clear, distinct tracking of costs, facilitating straightforward reporting and audit trails. Sub-account buckets offer granular categorization within a main account, enabling detailed analysis without cluttering the chart of accounts. Choosing between the two depends on the organization's complexity and reporting needs, balancing simplicity against the need for detailed financial insights.

Table of Comparison

| Feature | Separate Accounts | Sub-Account Buckets |

|---|---|---|

| Expense Allocation | Directly assigned to individual accounts | Grouped under main account with segmented buckets |

| Tracking Accuracy | High accuracy per account | Moderate accuracy, depends on bucket categorization |

| Setup Complexity | Higher, requires multiple account creation | Lower, uses fewer accounts with internal segmentation |

| Reporting Detail | Detailed per account reports | Aggregated main account reports with bucket breakdowns |

| Flexibility | Less flexible, rigid account structure | More flexible, easy to add/remove buckets |

| Expense Management | Individual management per account | Centralized management with bucket differentiation |

Understanding Separate Accounts vs. Sub-Account Buckets

Separate accounts provide distinct ledgers for tracking expenses independently, offering clear financial boundaries and simplified reporting for specific categories or departments. Sub-account buckets operate within a primary account, enabling granular expense allocation without the need for multiple account setups, facilitating detailed budget management under a unified account structure. Choosing between separate accounts and sub-account buckets depends on the desired level of detail, reporting complexity, and organizational accounting practices.

Defining Your Expense Allocation Goals

Defining your expense allocation goals requires understanding whether granular tracking or simplified reporting best suits your financial management needs. Separate accounts offer distinct categorizations for precise expense monitoring, while sub-account buckets provide hierarchical grouping for streamlined analysis. Aligning your allocation strategy with budgeting accuracy and reporting clarity enhances overall expense control and decision-making.

Pros and Cons of Separate Accounts

Separate accounts provide clear, straightforward tracking of expenses for each category or department, reducing the risk of misallocation and simplifying audit processes. However, maintaining multiple accounts can increase administrative overhead and complicate reconciliation efforts due to the need for consistent monitoring and updating across all accounts. This method also limits flexibility compared to sub-account buckets, which allow more granular categorization within a single account while streamlining financial management.

Advantages of Using Sub-Account Buckets

Using sub-account buckets for expense allocation allows for granular tracking and improved financial analysis by categorizing expenses within a primary account. This method enhances budget control and reporting accuracy by enabling detailed breakdowns without cluttering the chart of accounts. Sub-account buckets also facilitate easier reconciliation and compliance by maintaining a clear audit trail linked to specific expense activities.

Cost and Fees Comparison

Separate accounts for expense allocation often incur higher banking fees and administrative costs due to maintaining multiple distinct accounts. Sub-account buckets consolidate expenses under a single master account, reducing overall fees and simplifying transaction tracking, leading to lower operational costs. Cost efficiency favors sub-account buckets for organizations aiming to optimize expense management without sacrificing detail.

Ease of Tracking Expenses

Separate accounts provide clear and distinct records for each expense category, simplifying audit trails and financial reporting. Sub-account buckets offer detailed tracking within a single main account, enhancing granularity without overwhelming account structures. Using sub-accounts enables more precise allocation and monitoring of specific expenses while maintaining overall organizational clarity.

Flexibility and Accessibility

Separate accounts provide greater flexibility by allowing distinct tracking and management of expenses, enabling precise allocation and reporting for diverse budget categories. Sub-account buckets enhance accessibility by consolidating expenses under a primary account, offering simplified oversight while maintaining organized categorization. Choosing between separate accounts and sub-account buckets depends on the desired balance of granular control versus streamlined visibility in expense allocation.

Security and Fraud Protection

Separate accounts enhance security by isolating expenses, reducing the risk of unauthorized access spreading across funds. Sub-account buckets streamline expense tracking within a single account but may expose the entire account to fraud if compromised. Implementing multi-factor authentication and transaction monitoring is critical in both methods to safeguard against fraudulent activities.

Impact on Financial Discipline

Separate accounts for expense allocation enhance financial discipline by providing clear boundaries for each budget category, reducing the risk of fund mismanagement and overspending. Sub-account buckets offer detailed tracking within a primary account, improving expense visibility and enabling more precise budget adjustments. Both methods influence financial discipline by enforcing accountability, but separate accounts typically deliver stronger control through explicit segregation of funds.

Choosing the Right Strategy for Your Budget

Selecting between separate accounts and sub-account buckets for expense allocation hinges on your organization's budgeting complexity and reporting needs. Separate accounts provide clear, distinct tracking favorable for diverse expense categories, while sub-account buckets allow for more granular tracking within a broader category, enhancing detailed analysis without duplicating account structures. Evaluating transaction volume, reporting requirements, and ease of reconciliation will guide effective budget management and expense transparency.

Related Important Terms

Envelope Budgeting Digitized

Envelope budgeting digitized enhances expense allocation by using separate accounts to track distinct spending categories independently, ensuring precise control over each budget segment. Sub-account buckets streamline management within a primary account, allowing flexible allocation of funds while maintaining a consolidated view for overall expense monitoring.

Hyper-Segmented Sub-Account Strategy

Hyper-segmented sub-account strategies enable precise expense allocation by dividing a primary account into numerous detailed sub-accounts, facilitating granular tracking and enhanced financial analysis. This method improves budget control and reporting accuracy compared to separate accounts, which often lead to fragmented data and less flexible management.

Purpose-Driven Partitioning

Separate accounts provide clear, purpose-driven partitioning by isolating expenses for distinct business functions or projects, enabling precise tracking and reporting. Sub-account buckets allow granular categorization within a main account, facilitating detailed expense allocation without creating multiple independent accounts, enhancing budget control and financial analysis.

Multi-Pot Allocation Model

The Multi-Pot Allocation Model leverages sub-account buckets to categorize expenses within a single master account, enhancing granular tracking and simplifying budget oversight. Separate accounts for expense allocation often lead to fragmented reporting and increased reconciliation efforts compared to the streamlined structure of multi-pot sub-accounts.

Sinking Fund Bucketing

Sinking Fund Bucketing allocates expenses into distinct sub-accounts within a primary account, enhancing financial tracking precision and control over specific obligations. This method improves budgeting accuracy by segregating funds for future expenses, contrasting with separate accounts which may dilute oversight by dispersing funds across multiple standalone accounts.

Goal-Specific Account Rails

Goal-specific account rails streamline expense allocation by creating separate accounts dedicated to distinct financial objectives, enhancing transparency and control over budget tracking. Sub-account buckets enable detailed categorization under a primary account, facilitating granular management without fragmenting overall financial oversight.

Micro-Envelope Sub-Accounts

Micro-Envelope Sub-Accounts offer granular control over expense allocation by categorizing funds into specific, purpose-driven buckets within a main account, ensuring precise tracking and budgeting. This approach enhances financial clarity and flexibility compared to maintaining separate accounts, which may fragment data and complicate consolidated financial analysis.

Expense DNA Mapping

Expense DNA mapping enhances accuracy in financial reporting by using separate accounts, enabling precise tracking of individual expense categories with distinct general ledger codes. Sub-account buckets offer flexibility within a primary account for detailed allocation but may complicate data aggregation and reduce clarity in expense trend analysis.

Cascading Allocation Structures

Cascading allocation structures in expense management leverage sub-account buckets within a master account to enable precise tracking and layered cost distribution, enhancing financial clarity and control. Separate accounts offer simplicity but lack the flexibility and hierarchical visibility provided by cascading sub-accounts, which streamline complex allocation processes across multiple departments or projects.

Dynamic Funding Sub-Buckets

Dynamic funding sub-buckets enable precise expense allocation within master accounts by automatically adjusting fund distribution based on real-time budget utilization and transaction patterns. This granular control enhances financial tracking and reporting accuracy compared to static separate accounts, optimizing cash flow management and resource allocation.

Separate Accounts vs Sub-Account Buckets for expense allocation. Infographic

moneydiff.com

moneydiff.com