Fixed expenses are predictable, recurring costs such as rent, utilities, and insurance that remain constant each month, providing a stable framework for budgeting. Sinking funds involve setting aside money gradually over time for future, often irregular expenses like car repairs or vacation, ensuring funds are available when needed without disrupting monthly budgets. Combining fixed expenses planning with sinking funds allows for more accurate cash flow management and reduces financial stress by proactively preparing for both regular and unexpected costs.

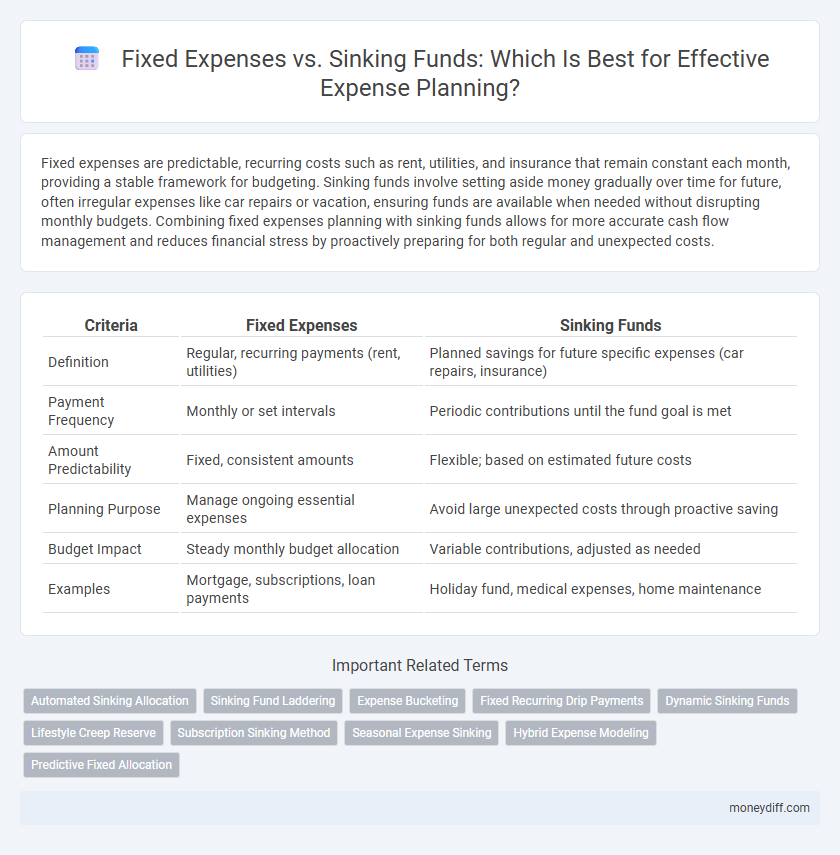

Table of Comparison

| Criteria | Fixed Expenses | Sinking Funds |

|---|---|---|

| Definition | Regular, recurring payments (rent, utilities) | Planned savings for future specific expenses (car repairs, insurance) |

| Payment Frequency | Monthly or set intervals | Periodic contributions until the fund goal is met |

| Amount Predictability | Fixed, consistent amounts | Flexible; based on estimated future costs |

| Planning Purpose | Manage ongoing essential expenses | Avoid large unexpected costs through proactive saving |

| Budget Impact | Steady monthly budget allocation | Variable contributions, adjusted as needed |

| Examples | Mortgage, subscriptions, loan payments | Holiday fund, medical expenses, home maintenance |

Understanding Fixed Expenses in Personal Finance

Fixed expenses in personal finance refer to consistent, recurring costs such as rent, mortgage payments, insurance premiums, and subscription services that remain stable each month. Understanding these expenses is crucial for accurate budgeting, as they form the foundation of mandatory financial obligations that must be covered before allocating funds to variable spending or savings. Proper management of fixed expenses ensures cash flow stability and helps prevent overspending in other categories.

What Are Sinking Funds and How Do They Work?

Sinking funds are savings accounts designated for specific future expenses, helping individuals manage non-monthly or irregular costs by setting aside money gradually. Unlike fixed expenses, which are regular and predictable costs such as rent or utilities, sinking funds allow for planned financial preparation for items like car repairs, vacations, or annual insurance premiums. By allocating smaller amounts consistently, sinking funds reduce financial strain and improve overall budget stability.

Key Differences Between Fixed Expenses and Sinking Funds

Fixed expenses represent consistent, recurring costs such as rent, utilities, and loan payments that remain the same each month, providing predictable budget allocations. Sinking funds involve setting aside money gradually for specific future expenses like car repairs or vacations, allowing for flexible savings without affecting monthly fixed costs. The key difference lies in fixed expenses being mandatory and regular, while sinking funds are discretionary savings designed to manage irregular, anticipated costs.

Why Proper Expense Planning Matters

Proper expense planning distinguishes fixed expenses, such as rent and utilities, which remain constant monthly, from sinking funds designed to cover irregular costs like car repairs or annual insurance premiums. Allocating budgets accurately prevents cash flow shortages and ensures funds are available when non-recurring expenses occur. Effective management of fixed expenses and sinking funds improves financial stability and supports long-term savings goals.

Common Examples of Fixed Expenses

Common examples of fixed expenses include rent or mortgage payments, car insurance premiums, property taxes, and monthly subscription services like internet or streaming platforms. These expenses remain constant each month, providing predictable costs that facilitate accurate budgeting. In contrast, sinking funds are savings set aside for future variable expenses, making fixed expenses essential for stable financial planning.

Setting Up Sinking Funds for Irregular Costs

Setting up sinking funds for irregular costs enables precise financial planning by allocating specific amounts regularly toward future expenses such as car repairs, medical bills, or holiday gifts. Unlike fixed expenses that remain constant monthly obligations like rent or utilities, sinking funds accommodate fluctuating costs by spreading the financial burden over time. This strategy prevents budget shortfalls and reduces reliance on credit during unexpected or seasonal expenditures.

Pros and Cons of Relying on Fixed Expenses

Relying on fixed expenses provides predictability and simplifies budgeting by assigning consistent amounts to regular costs such as rent, utilities, and subscriptions. However, this approach lacks flexibility and may lead to insufficient funds for irregular or unexpected expenses, causing financial stress. Fixed expenses do not account for fluctuating needs, often resulting in overspending or missed opportunities to save through sinking funds.

Advantages of Using Sinking Funds for Budgeting

Sinking funds provide precise financial control by allocating specific amounts for upcoming fixed expenses, reducing the risk of overspending or borrowing. This method enhances budgeting accuracy and ensures funds are readily available when payments are due, promoting discipline and peace of mind. Using sinking funds also allows for flexibility in managing varying expense timelines, improving overall financial planning efficiency.

Integrating Fixed Expenses and Sinking Funds in Your Budget

Integrating fixed expenses and sinking funds in your budget enhances financial stability by ensuring essential bills are covered while preparing for irregular or future costs. Fixed expenses such as rent, utilities, and subscriptions provide a baseline for monthly budgeting, while sinking funds allocate funds progressively for expenses like car maintenance, insurance premiums, or holiday gifts. This combined approach helps prevent cash flow disruptions and promotes disciplined saving, facilitating comprehensive financial planning.

Tips for Balancing Fixed Expenses and Sinking Funds Successfully

Establish a clear budget that allocates a specific portion of income to fixed expenses such as rent, utilities, and insurance, while systematically funding sinking funds for irregular costs like car repairs or annual subscriptions. Track monthly spending with financial tools to ensure fixed expenses are met without shortfall and maintain consistent contributions to sinking funds to avoid financial strain during unexpected expenses. Regularly review and adjust allocations based on income changes or expense fluctuations to maintain a sustainable balance between fixed commitments and savings for future liabilities.

Related Important Terms

Automated Sinking Allocation

Automated sinking allocation streamlines managing fixed expenses versus sinking funds by systematically setting aside money for future payments, reducing budgeting stress and preventing missed bills. This approach enhances financial discipline by ensuring consistent savings are allocated toward anticipated expenses, distinguishing it from fixed expenses that require regular, non-negotiable payments.

Sinking Fund Laddering

Sinking fund laddering involves systematically allocating funds into staggered, time-based savings accounts to cover upcoming fixed expenses, enhancing financial organization and reducing reliance on credit. This strategy ensures timely availability of cash for scheduled payments while optimizing interest earnings across various saving periods.

Expense Bucketing

Fixed expenses represent consistent, recurring costs such as rent, utilities, and insurance, forming a stable foundation for budgeting. Sinking funds involve setting aside money progressively for future, predictable expenses like car maintenance or holiday spending, enabling more precise expense bucketing and preventing financial strain.

Fixed Recurring Drip Payments

Fixed recurring drip payments represent consistent, predetermined expenses such as rent, subscriptions, and loan repayments, forming the backbone of fixed expenses in budgeting. Utilizing sinking funds helps allocate money gradually over time for upcoming non-recurring costs, ensuring financial stability while managing both fixed expenses and future liabilities effectively.

Dynamic Sinking Funds

Dynamic sinking funds adapt to fluctuating financial goals by adjusting monthly contributions based on upcoming expense projections, unlike fixed expenses which remain constant and predictable. This flexible approach enhances cash flow management and ensures targeted savings align with variable or anticipated costs over time.

Lifestyle Creep Reserve

Fixed expenses provide predictable monthly costs, while sinking funds allocate specific amounts over time for upcoming irregular expenses, preventing lifestyle creep by reserving funds for lifestyle upgrades only when genuinely affordable. Maintaining a dedicated Lifestyle Creep Reserve within sinking funds helps control impulsive spending increases, ensuring long-term financial stability and disciplined expense planning.

Subscription Sinking Method

Fixed expenses represent recurring costs such as rent or utilities that remain constant each month, while sinking funds organize savings specifically for future large or irregular payments. The Subscription Sinking Method allocates a targeted amount regularly into a sinking fund for subscriptions, ensuring smooth, planned coverage of annual or periodic fees without disrupting monthly budgeting.

Seasonal Expense Sinking

Seasonal expense sinking funds allocate money regularly to cover predictable, recurring seasonal costs like holiday gifts or property taxes, ensuring funds are available without impacting monthly fixed expenses such as rent or utilities. This approach enhances expense planning by separating variable seasonal costs from fixed obligations, improving cash flow management and financial stability.

Hybrid Expense Modeling

Hybrid expense modeling combines fixed expenses such as rent and utilities with sinking funds allocated for future irregular costs like vehicle maintenance and annual insurance premiums. This approach enhances financial stability by balancing predictable monthly obligations and saving systematically for upcoming large expenditures.

Predictive Fixed Allocation

Predictive fixed allocation in expense planning ensures consistent budgeting by assigning a predetermined amount to fixed expenses, providing financial stability and clarity. Sinking funds complement this approach by gradually accumulating savings for future large purchases, reducing the risk of budget shortfalls and unexpected financial strain.

Fixed expenses vs Sinking funds for expense planning. Infographic

moneydiff.com

moneydiff.com