The traditional Envelope System offers a physical method of budgeting by allocating cash into labeled envelopes, providing tangible control over spending limits. In contrast, the Digital Envelope System uses mobile apps or software to categorize expenses virtually, enhancing convenience and real-time tracking without handling cash. Both systems aim to manage expenses effectively, but digital solutions often provide advanced features like notifications, syncing across devices, and integration with bank accounts for greater accuracy and flexibility.

Table of Comparison

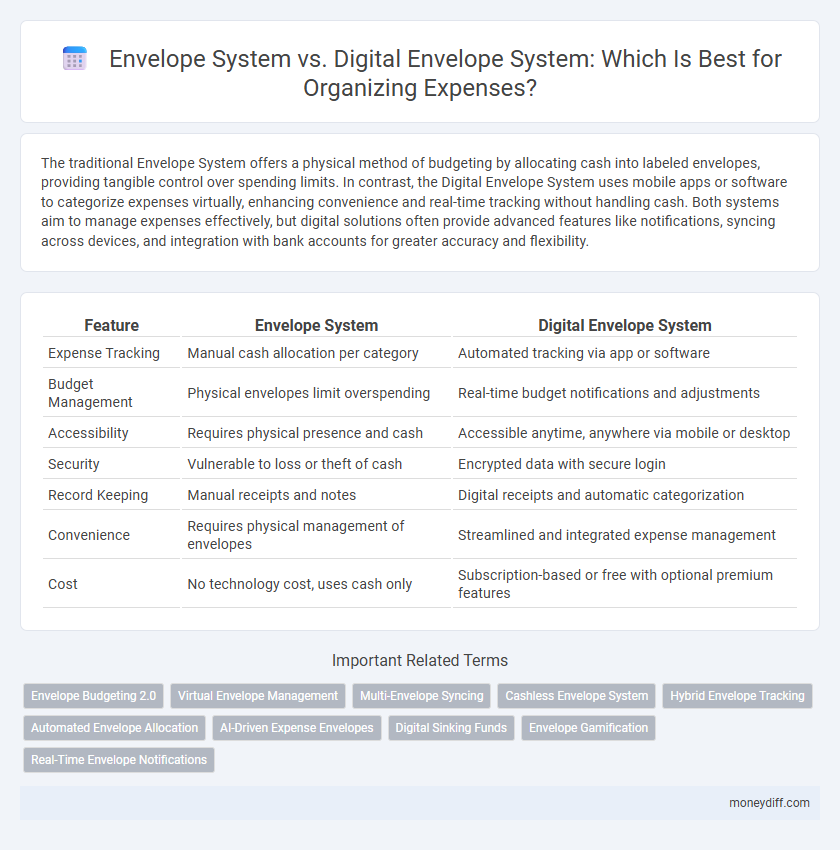

| Feature | Envelope System | Digital Envelope System |

|---|---|---|

| Expense Tracking | Manual cash allocation per category | Automated tracking via app or software |

| Budget Management | Physical envelopes limit overspending | Real-time budget notifications and adjustments |

| Accessibility | Requires physical presence and cash | Accessible anytime, anywhere via mobile or desktop |

| Security | Vulnerable to loss or theft of cash | Encrypted data with secure login |

| Record Keeping | Manual receipts and notes | Digital receipts and automatic categorization |

| Convenience | Requires physical management of envelopes | Streamlined and integrated expense management |

| Cost | No technology cost, uses cash only | Subscription-based or free with optional premium features |

Understanding the Traditional Envelope System

The Traditional Envelope System involves allocating physical cash into labeled envelopes for specific expense categories, ensuring controlled spending and clear budgeting. This method promotes discipline by limiting expenditures to the cash available within each envelope, reducing the risk of overspending. Despite its tangible approach, it requires manual tracking and physical presence to access funds, which can be less convenient compared to digital alternatives.

What is the Digital Envelope System?

The Digital Envelope System is an expense management method that uses virtual envelopes to allocate budgets for different spending categories, mirroring the traditional cash envelope system but with digital tools and apps. This system enhances financial tracking by automatically categorizing transactions, enabling users to monitor and control their spending in real-time. Digital envelope apps often integrate with bank accounts, providing seamless synchronization and insightful analytics for optimized budget adherence.

Key Differences Between Traditional and Digital Envelopes

The Envelope System uses physical cash divided into labeled envelopes for different expense categories, enabling tactile budgeting and easy visual tracking. In contrast, the Digital Envelope System employs software or apps to allocate virtual funds into categorized budgets, offering real-time updates and automated expense monitoring. Traditional envelopes limit transaction speed and accessibility, while digital systems provide enhanced integration with bank accounts and detailed spending analytics.

Advantages of Using Physical Envelopes for Expense Control

Physical envelopes offer tactile accountability, making it easier to track cash expenses and limit overspending by restricting funds to a specific envelope. This method enhances budget discipline through visual reminders and physical separation of money, reducing the risk of digital oversights or technical errors. Users benefit from immediate, straightforward access without reliance on electronic devices or internet connectivity, ensuring consistent expense control.

Benefits of Adopting a Digital Envelope System

Adopting a digital envelope system enhances expense organization by providing real-time tracking and automatic categorization of spending, reducing the risk of overspending and improving budget accuracy. Digital systems offer seamless integration with banking apps and notifications, ensuring immediate updates and greater control over financial goals. This approach increases efficiency through easy adjustments of budgets and detailed analytics, supporting smarter spending decisions compared to traditional paper envelopes.

Common Challenges With Physical Envelopes

Physical envelope systems for expense organization often face challenges such as easy misplacement, limited space for receipts, and lack of real-time tracking. Paper envelopes are also prone to wear and tear, making it difficult to maintain long-term records. These issues contribute to inaccuracies and inefficiencies in managing budgets and expenses.

Digital Envelope Apps: Features and Functionality

Digital envelope apps streamline expense organization by allowing users to allocate budgets into virtual envelopes, ensuring precise spending control and real-time tracking. These apps offer features such as automatic transaction categorization, multi-device synchronization, and customizable spending alerts that enhance financial discipline. Integration with banking platforms and detailed reporting tools provide users with comprehensive insights into their spending habits, improving overall budget management efficiency.

Security Considerations: Paper vs Digital Systems

Paper envelope systems offer tangible security by physically isolating cash, reducing the risk of digital hacking but increasing vulnerability to loss or theft. Digital envelope systems employ encryption and password protection, enhancing data privacy and reducing physical risks but requiring vigilance against cyber threats such as phishing and malware. Choosing between the two depends on balancing physical security concerns with the effectiveness of cybersecurity measures.

Which Envelope System Suits Your Financial Habits?

The traditional envelope system suits individuals who prefer tangible cash management and find physical separation of funds effective for budget control. The digital envelope system appeals to tech-savvy users who value automation, real-time tracking, and seamless integration with banking apps. Choosing the right envelope system depends on your financial habits, such as your comfort with technology and desire for hands-on versus automated expense organization.

Making the Switch: Transitioning to a Digital Envelope System

Transitioning from a traditional Envelope System to a Digital Envelope System streamlines expense management by automating budget tracking and enabling real-time spending updates across multiple devices. Digital platforms integrate seamlessly with bank accounts and credit cards, reducing manual errors and providing detailed analytics for better financial decisions. Users benefit from customizable categories, alerts for overspending, and enhanced security features, making the switch an efficient upgrade for organized expense control.

Related Important Terms

Envelope Budgeting 2.0

Envelope Budgeting 2.0 enhances traditional envelope systems by integrating digital platforms that enable real-time tracking, automated categorization, and seamless syncing across devices for more accurate expense organization. This hybrid approach combines the tactile control of physical envelopes with the efficiency and analytics of digital tools, optimizing budget adherence and financial insight.

Virtual Envelope Management

Virtual envelope management in digital envelope systems allows users to allocate budget categories electronically, enhancing real-time tracking and reducing the risk of overspending compared to traditional envelope systems. These systems integrate seamlessly with banking apps, providing instant updates and automated expense categorization for optimized financial control.

Multi-Envelope Syncing

The Digital Envelope System enables seamless multi-envelope syncing across devices, ensuring real-time updates and precise tracking of categorized expenses, unlike the traditional Envelope System which relies on physical cash and manual adjustments. This synchronization enhances budget accuracy and provides instant insights into spending patterns, making digital management more efficient for complex financial organization.

Cashless Envelope System

The Digital Envelope System enhances traditional cash envelope budgeting by using apps to allocate and track expenses without physical cash, ensuring real-time spending controls and seamless integration with bank accounts. This cashless approach reduces the risk of overspending, provides instant notifications on budget limits, and simplifies financial management through automated categorization and expense reporting.

Hybrid Envelope Tracking

Hybrid Envelope Tracking combines physical cash envelopes with digital budgeting apps to optimize expense organization, offering real-time tracking and tangible spending limits. This method enhances control over finances by integrating the psychological impact of cash handling with the convenience and analytical power of digital tools.

Automated Envelope Allocation

Automated Envelope Allocation in Digital Envelope Systems streamlines expense organization by automatically categorizing and distributing funds into predefined virtual envelopes based on spending patterns and budget limits. This advanced automation reduces manual errors and time spent tracking expenses compared to the traditional physical Envelope System, enhancing financial control and accuracy.

AI-Driven Expense Envelopes

AI-driven digital envelope systems enhance expense organization by automatically categorizing transactions and optimizing budget allocations based on spending patterns. These systems provide real-time insights and predictive analytics, improving financial discipline and reducing manual effort compared to traditional envelope methods.

Digital Sinking Funds

Digital sinking funds enhance expense organization by allowing users to allocate and track savings toward future bills or purchases within separate virtual envelopes, increasing financial discipline and clarity. This system offers real-time updates, automation of transfers, and integration with budgeting apps, making it more efficient and adaptable than traditional envelope methods.

Envelope Gamification

The Envelope System enhances expense organization by physically dividing budgets into labeled envelopes for cash spending, promoting disciplined financial management through tangible limits. Digital Envelope Systems gamify this process by integrating interactive goals, rewards, and real-time tracking, increasing user engagement and motivation to adhere to budget constraints more effectively.

Real-Time Envelope Notifications

The Digital Envelope System offers real-time envelope notifications that instantly update users on spending limits and remaining balances, enhancing budget control and reducing overspending risks. In contrast, the traditional Envelope System lacks immediate alerts, relying on manual checks that delay financial adjustments and increase the chances of budget mismanagement.

Envelope System vs Digital Envelope System for expense organization. Infographic

moneydiff.com

moneydiff.com