Expense management directly impacts a company's runway, as controlling costs extends the time a business can operate before needing additional funding. Tracking expenses helps forecast cash flow accurately, ensuring that runway calculations are realistic and actionable. Reducing unnecessary expenses lengthens runway, providing more flexibility for growth and strategic decisions.

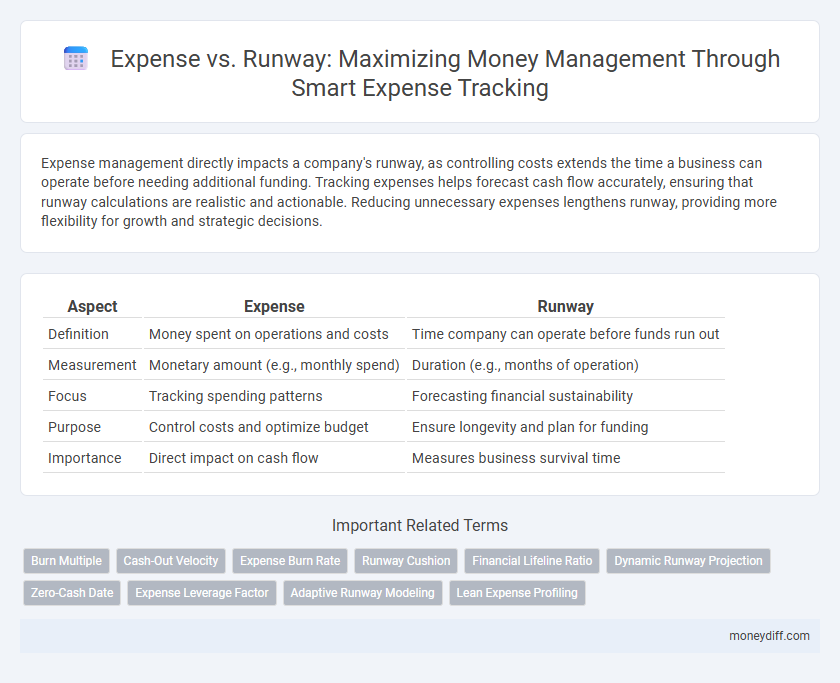

Table of Comparison

| Aspect | Expense | Runway |

|---|---|---|

| Definition | Money spent on operations and costs | Time company can operate before funds run out |

| Measurement | Monetary amount (e.g., monthly spend) | Duration (e.g., months of operation) |

| Focus | Tracking spending patterns | Forecasting financial sustainability |

| Purpose | Control costs and optimize budget | Ensure longevity and plan for funding |

| Importance | Direct impact on cash flow | Measures business survival time |

Understanding Expense and Runway: Key Definitions

Expense refers to the total amount of money spent over a specific period, including operational costs, salaries, and other financial outflows. Runway indicates the length of time a company can sustain its current level of expenses before exhausting its available cash reserves. Understanding both concepts is crucial for effective financial planning and ensuring long-term business viability.

Why Tracking Expenses Matters for Financial Stability

Tracking expenses provides crucial insight into cash flow, enabling precise budgeting and preventing overspending that can shorten a startup's runway. Understanding the relationship between monthly expenses and available runway helps forecast how long funds will last, ensuring timely adjustments to avoid financial shortfalls. Consistent expense monitoring supports financial stability by maintaining control over spending and extending operational longevity.

How to Calculate Your Financial Runway

Calculating your financial runway involves dividing your total cash reserves by your average monthly expenses, providing a clear timeline before funds are depleted. Tracking all fixed and variable expenses accurately ensures a precise runway estimation, helping to manage capital efficiently. Monitoring runway regularly enables proactive adjustments to spending and funding strategies, securing business sustainability.

Expense vs Runway: The Critical Relationship

Expense management directly impacts a startup's runway, as higher expenses reduce the available time before funds are depleted. Monitoring burn rate alongside runway length enables accurate forecasting and strategic decision-making to extend operational longevity. Prioritizing cost control while maintaining growth initiatives optimizes financial sustainability and investor confidence.

Common Expense Categories That Impact Runway

Common expense categories that impact financial runway include payroll, rent, utilities, and marketing costs, which typically constitute the largest portions of monthly expenditures. Variable expenses such as inventory purchases, travel, and software subscriptions also influence cash flow and duration of runway. Careful monitoring and adjustment of these expenses are critical to extending runway and maintaining business solvency.

Tools for Monitoring Expenses and Projecting Runway

Expense tracking tools like Mint and YNAB provide detailed categorization and real-time updates, enabling precise monitoring of spending habits. Runway calculators integrate current expense data with projected income to estimate the duration funds will last, which is critical for cash flow management. Combining these tools helps businesses optimize budgets and make informed financial decisions to extend their operational runway.

Strategies to Reduce Expenses and Extend Runway

Implementing cost-cutting strategies such as negotiating vendor contracts, minimizing discretionary spending, and adopting energy-efficient practices effectively reduces expenses. Prioritizing essential expenditures and leveraging technology for automation further extend the financial runway. Monitoring cash flow closely and adjusting budgets proactively ensures sustainable money management and longer operational endurance.

Mistakes to Avoid When Managing Expenses and Runway

Misjudging burn rate by underestimating expenses can drastically shorten runway, risking premature depletion of funds. Overlooking variable costs and failing to adjust budgets as expenses fluctuate often leads to inaccurate financial forecasting. Neglecting to maintain a contingency reserve or emergency fund increases vulnerability during unexpected downturns, compromising overall money management stability.

Real-World Examples: Expense Control and Runway Extension

Effective expense control directly impacts runway extension by reducing monthly burn rate, allowing startups more time to reach profitability or secure funding. For instance, a SaaS company cutting non-essential software subscriptions and renegotiating vendor contracts extended its runway by six months, providing critical operational buffer. In another case, a manufacturing firm optimized raw material usage, decreasing expenses by 15% and significantly prolonging financial sustainability during market downturns.

Actionable Tips to Balance Expenses and Maximize Runway

Track all variable and fixed expenses monthly to identify cost-saving opportunities and prevent budget overruns. Prioritize essential spending and negotiate payment terms with vendors to extend cash runway while maintaining operational efficiency. Regularly update financial forecasts to adjust spending plans, ensuring runway maximization for sustained business growth.

Related Important Terms

Burn Multiple

Burn Multiple measures the efficiency of cash burn relative to revenue growth, indicating how many dollars are spent for each dollar of net new revenue. A lower Burn Multiple signifies better money management by extending runway and reducing excessive expenses during business scaling.

Cash-Out Velocity

Cash-Out Velocity measures the rate at which a company's available cash is spent, directly impacting its runway and financial stability. Monitoring this metric enables precise adjustments in expenses to extend operational runway and ensure sustainable money management.

Expense Burn Rate

Expense burn rate measures the speed at which a company spends its available cash, directly impacting its runway duration before needing additional funding. Accurately tracking expense burn rate enables better financial forecasting and decision-making to extend operational runway.

Runway Cushion

Runway cushion is the buffer of additional months a company can operate beyond its calculated runway, crucial for managing expenses effectively during financial uncertainty. Maintaining a healthy runway cushion ensures sufficient liquidity to cover fixed and variable costs, minimizing the risk of insolvency while allowing strategic flexibility in budgeting and spending decisions.

Financial Lifeline Ratio

The Financial Lifeline Ratio measures how long a company can cover its expenses with available cash, directly correlating runway length to current spending levels. Maintaining a low expense rate extends runway, ensuring sustained operational liquidity and stability.

Dynamic Runway Projection

Dynamic runway projection calculates the evolving financial runway by continuously adjusting for real-time expenses and revenue fluctuations, enabling more accurate money management. This method helps businesses anticipate funding needs, optimize spending, and extend operational longevity by integrating dynamic expense tracking with cash flow forecasts.

Zero-Cash Date

Expense management directly impacts the zero-cash date, which is the point when available funds are depleted if no additional revenue occurs. Accurately forecasting expenses extends the runway, providing more time to secure financing or increase income before reaching this critical financial threshold.

Expense Leverage Factor

Expense Leverage Factor quantifies how effectively a company uses its expenses to extend its financial runway, measuring the cost efficiency and sustainability of operations. Lower Expense Leverage Factor indicates higher efficiency, allowing businesses to maximize runway duration by minimizing expenses relative to available capital.

Adaptive Runway Modeling

Adaptive Runway Modeling dynamically adjusts expense forecasts based on real-time cash flow and market conditions, optimizing the runway duration to extend financial sustainability. This approach enhances decision-making by correlating expenditure patterns directly with runway projections, enabling proactive budget adjustments to prevent premature depletion of resources.

Lean Expense Profiling

Lean Expense Profiling prioritizes minimizing non-essential costs to extend the financial runway, ensuring sustainable cash flow during growth phases. This approach aligns expense management with core business activities, optimizing resource allocation and delaying the need for additional funding.

Expense vs Runway for money management. Infographic

moneydiff.com

moneydiff.com