Expense reports require manual entry and verification of receipts, often leading to delays and human errors in reimbursement processing. Expense automation streamlines this process by using software to capture, validate, and approve expenses in real-time, significantly improving accuracy and speeding up reimbursement cycles. By reducing administrative burden, expense automation ensures faster expense reconciliation and better compliance with company policies.

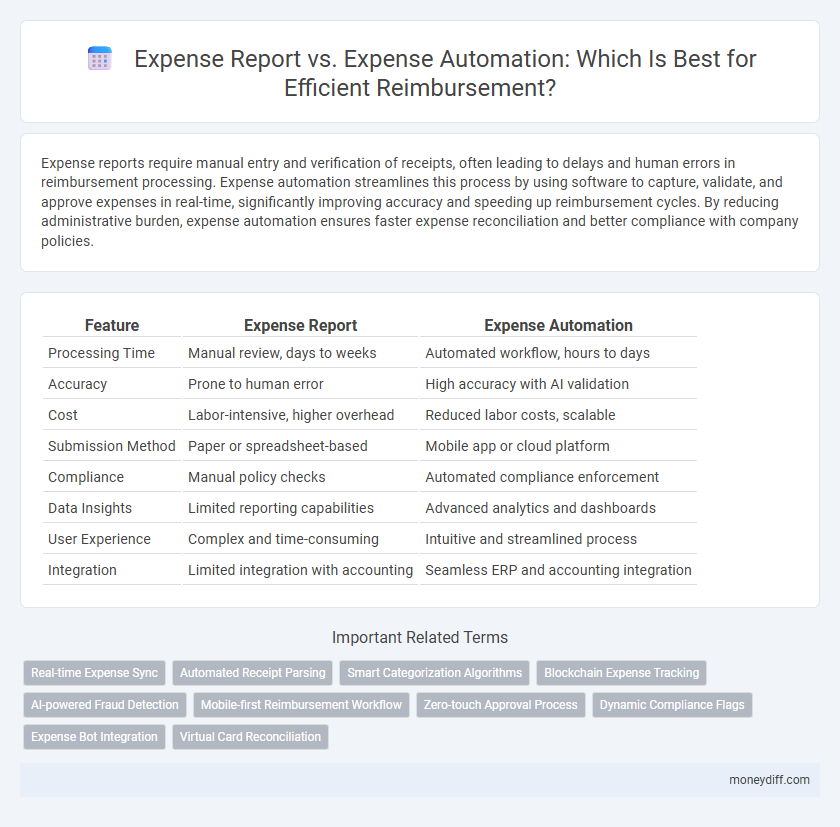

Table of Comparison

| Feature | Expense Report | Expense Automation |

|---|---|---|

| Processing Time | Manual review, days to weeks | Automated workflow, hours to days |

| Accuracy | Prone to human error | High accuracy with AI validation |

| Cost | Labor-intensive, higher overhead | Reduced labor costs, scalable |

| Submission Method | Paper or spreadsheet-based | Mobile app or cloud platform |

| Compliance | Manual policy checks | Automated compliance enforcement |

| Data Insights | Limited reporting capabilities | Advanced analytics and dashboards |

| User Experience | Complex and time-consuming | Intuitive and streamlined process |

| Integration | Limited integration with accounting | Seamless ERP and accounting integration |

Understanding Expense Reports: Traditional Methods Explained

Expense reports traditionally involve manual submission of receipts and detailed documentation for reimbursement, often requiring extensive review and approval from finance teams. These paper-based or spreadsheet-driven processes increase the risk of errors, delays, and compliance issues while burdening employees with time-consuming data entry tasks. Understanding this conventional method highlights the inefficiencies that expense automation addresses by streamlining approval workflows and improving accuracy in reimbursement management.

What is Expense Automation? Key Features and Benefits

Expense automation streamlines the reimbursement process by using software to capture, categorize, and approve expenses automatically, reducing manual errors and processing time. Key features include real-time expense tracking, receipt scanning with OCR technology, policy compliance checks, and seamless integration with accounting systems. Benefits consist of faster reimbursements, improved accuracy, enhanced visibility into spending patterns, and reduced operational costs.

Manual Expense Reporting: Common Challenges and Risks

Manual expense reporting often leads to errors, delayed reimbursements, and increased administrative workload, significantly impacting financial accuracy and operational efficiency. Paper-based or spreadsheet-driven processes are prone to lost receipts, inconsistent data entry, and compliance risks, resulting in potential audit failures and cost overruns. These challenges emphasize the need for adopting expense automation solutions that streamline approval workflows, enhance visibility, and reduce processing time.

Expense Automation: Streamlining the Reimbursement Process

Expense automation significantly streamlines the reimbursement process by digitizing expense report submission, approval, and payment workflows, reducing manual errors and processing time. Automated systems integrate with corporate credit cards, receipt capture apps, and accounting software, ensuring real-time expense tracking and compliance. This leads to faster reimbursements, enhanced accuracy, and improved financial control compared to traditional expense report methods.

Accuracy and Transparency: Manual vs Automated Expense Management

Manual expense reports often suffer from human errors and inconsistent data entry, reducing accuracy and causing delays in reimbursement. Automated expense management systems leverage AI and OCR technology to capture and categorize expenses instantly, enhancing both accuracy and transparency. Real-time tracking and audit trails in automated solutions ensure visibility, compliance, and faster approval processes compared to traditional manual methods.

Cost Efficiency: Comparing Administrative Expenses

Expense reports require manual data entry and verification, often leading to higher administrative costs and delayed reimbursements. Expense automation streamlines the submission and approval process, significantly reducing labor hours and minimizing errors. Companies adopting automated solutions experience a 30-50% decrease in administrative expenses related to expense management.

Employee Experience: Time Savings and User Convenience

Expense automation significantly enhances employee experience by reducing the time spent on manual data entry and report submission. Automated systems streamline expense report generation, allowing faster reimbursement and minimizing errors compared to traditional expense reports. Employees benefit from user-friendly interfaces and seamless integration with mobile apps, increasing convenience and satisfaction.

Compliance and Fraud Prevention: Automation Advantages

Expense automation enhances compliance by enforcing standardized policies and real-time validation of submitted claims, reducing human errors common in manual expense report processing. Automated systems use AI-driven anomaly detection to identify suspicious transactions and potential fraud, improving accuracy and risk management versus traditional methods. This technology streamlines audit trails with digital records, ensuring transparency and easier regulatory adherence for reimbursement processes.

Integration with Accounting Systems: Seamless Data Flow

Expense automation enhances reimbursement processes by enabling seamless data flow through direct integration with accounting systems, reducing manual entry errors and accelerating approval cycles. Unlike traditional expense reports, automated solutions sync real-time expense data with general ledger platforms such as QuickBooks, SAP, or Oracle, ensuring consistent and accurate financial records. This integration streamlines audit trails and improves compliance by maintaining up-to-date expense documentation across accounting workflows.

Choosing the Right Solution: Expense Report vs Automation

Selecting between traditional expense reports and expense automation hinges on factors like business size, transaction volume, and accuracy needs. Expense reports suit small-scale operations with limited expenses, offering manual control and familiar processes. Expense automation provides scalable efficiency, real-time tracking, and error reduction, ideal for organizations seeking faster reimbursement and streamlined compliance.

Related Important Terms

Real-time Expense Sync

Expense reports rely on manual data entry, causing delays and errors in reimbursement processing, whereas expense automation with real-time expense sync ensures instant transaction capture and accurate expense tracking. This continuous data synchronization accelerates approval workflows and improves financial visibility for faster, more efficient reimbursements.

Automated Receipt Parsing

Expense automation streamlines reimbursement by utilizing automated receipt parsing to accurately extract data such as vendor names, dates, and amounts, reducing manual entry errors and accelerating approval cycles. Expense reports generated through this technology improve compliance and provide real-time visibility into spending patterns for better financial management.

Smart Categorization Algorithms

Smart categorization algorithms in expense automation streamline reimbursement by accurately classifying expenses in real-time, reducing manual errors common in traditional expense reports. These algorithms leverage machine learning to analyze transaction data, enabling faster approvals and improving compliance with company policies.

Blockchain Expense Tracking

Blockchain expense tracking enhances transparency and security in expense reports by providing immutable records for reimbursement processes. Integrating expense automation with blockchain reduces errors and accelerates approval cycles, ensuring faster and tamper-proof expense reimbursements.

AI-powered Fraud Detection

Expense automation leverages AI-powered fraud detection to identify anomalies and suspicious patterns in real-time, significantly reducing the risk of fraudulent claims compared to manual expense reports. This advanced technology enhances accuracy and compliance while accelerating reimbursement processes by automatically flagging inconsistencies and ensuring policy adherence.

Mobile-first Reimbursement Workflow

Mobile-first reimbursement workflows streamline expense reporting by enabling real-time receipt capture, automated data extraction, and instant submission through dedicated apps, reducing manual errors and accelerating approval cycles. Expense automation leverages artificial intelligence to validate, categorize, and integrate expenses directly into financial systems, maximizing accuracy and minimizing processing time for faster employee reimbursements.

Zero-touch Approval Process

Expense automation streamlines reimbursement through a zero-touch approval process, eliminating manual data entry and reducing errors while accelerating expense report approval times. Advanced systems integrate AI-powered receipt scanning and policy compliance checks, ensuring accurate, real-time expense tracking and faster employee reimbursements.

Dynamic Compliance Flags

Expense reports often suffer from manual errors and delayed reimbursements due to inconsistent compliance checks, while expense automation leverages dynamic compliance flags to instantly detect policy violations and streamline approval processes. Integrating AI-driven compliance flags reduces fraud risk and accelerates reimbursement cycles by ensuring real-time adherence to company spending policies.

Expense Bot Integration

Expense report processes often suffer from delays and manual errors, whereas expense automation powered by expense bot integration streamlines reimbursement by instantly capturing, validating, and submitting expenses. Implementing an expense bot reduces administrative overhead, accelerates approval times, and improves accuracy by extracting data via OCR and syncing with corporate policies.

Virtual Card Reconciliation

Expense reports often lead to delayed reimbursements and manual errors, whereas expense automation streamlines the process by enabling real-time virtual card reconciliation that instantly matches transactions with receipts. Virtual card reconciliation reduces fraud risk and improves accuracy by automatically syncing virtual card payments with expense policies, accelerating approval workflows and financial transparency.

Expense Report vs Expense Automation for reimbursement Infographic

moneydiff.com

moneydiff.com