Tracking every expense is essential for effective money management, while sneaky subscriptions often drain funds unnoticed and disrupt budgets. Identifying and eliminating these hidden recurring charges can significantly improve financial control and prevent overspending. Regularly reviewing bank statements and subscription services helps maintain transparency and ensures money is allocated wisely.

Table of Comparison

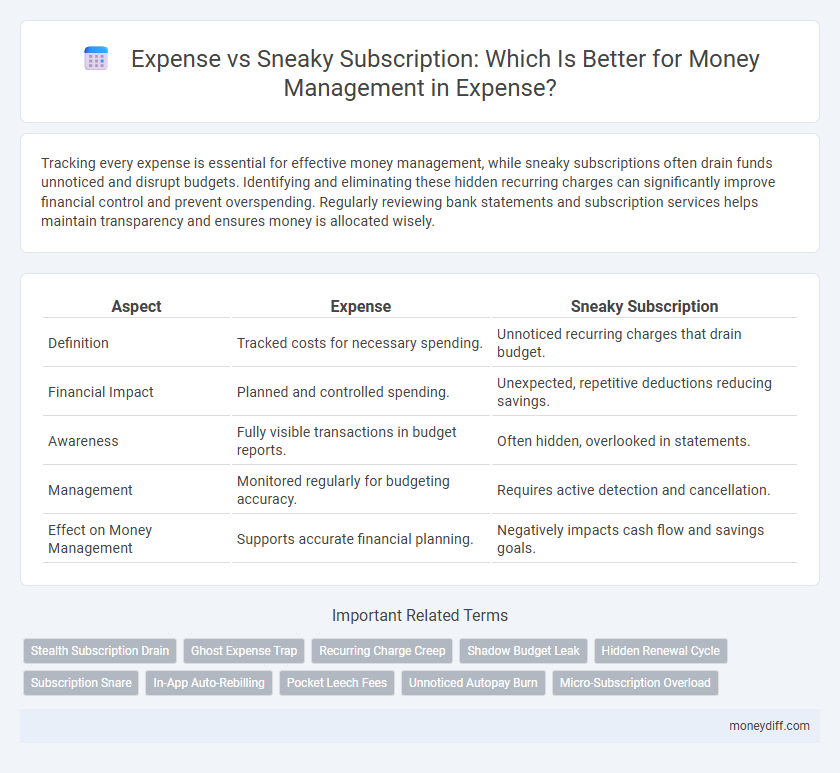

| Aspect | Expense | Sneaky Subscription |

|---|---|---|

| Definition | Tracked costs for necessary spending. | Unnoticed recurring charges that drain budget. |

| Financial Impact | Planned and controlled spending. | Unexpected, repetitive deductions reducing savings. |

| Awareness | Fully visible transactions in budget reports. | Often hidden, overlooked in statements. |

| Management | Monitored regularly for budgeting accuracy. | Requires active detection and cancellation. |

| Effect on Money Management | Supports accurate financial planning. | Negatively impacts cash flow and savings goals. |

Understanding Expenses vs Sneaky Subscriptions

Tracking expenses reveals clear spending patterns, while sneaky subscriptions often go unnoticed, gradually draining finances over time. Identifying recurring charges from streaming services, apps, or memberships helps distinguish genuine expenses from hidden subscriptions. Effective money management combines regular expense reviews with tools designed to detect and cancel these covert subscriptions.

Identifying Recurring Subscriptions in Monthly Budgets

Tracking recurring expenses is essential for effective money management, as sneaky subscriptions often go unnoticed in monthly budgets. Analyzing bank statements and credit card bills helps identify automatic payments for services like streaming platforms, gym memberships, or software licenses. Utilizing budgeting tools that categorize recurring charges can reveal hidden subscriptions and prevent unnecessary financial drain.

Hidden Costs: How Sneaky Subscriptions Drain Your Finances

Sneaky subscriptions often include hidden costs such as automatic renewals and small monthly fees that accumulate unnoticed, significantly draining financial resources over time. These concealed expenses create a persistent financial leak, making budget management difficult and reducing disposable income without clear awareness. Careful monitoring and regular auditing of recurring charges are essential to identify and eliminate these stealthy deductions.

Expense Tracking Techniques for Improved Money Management

Effective expense tracking techniques are essential for distinguishing between regular expenses and sneaky subscriptions that silently drain finances. Utilizing automated budgeting apps and regularly reviewing bank statements can help identify recurring hidden charges. Prioritizing detailed categorization of expenses improves financial awareness and supports better money management decisions.

Spotting and Canceling Unnecessary Subscriptions

Spotting sneaky subscriptions requires thorough expense tracking to identify recurring charges that drain your budget unnoticed. Utilizing expense management tools with subscription detection features helps highlight and categorize these hidden costs for easy review. Canceling unnecessary subscriptions promptly frees up funds, improving overall financial health and preventing future overspending.

The Psychological Impact of Subscriptions vs One-Time Expenses

Subscriptions often create a psychological illusion of low-cost commitment, leading to repeated unnoticed deductions that accumulate over time. One-time expenses trigger immediate awareness and stronger emotional reactions, making consumers more cautious about their spending. This difference influences money management behaviors, as sneaky subscriptions can undermine budgeting efforts by stealthily eroding finances without conscious recognition.

Expense Categorization: Fixed Costs versus Variable Subscriptions

Accurate expense categorization differentiates fixed costs, such as rent and utilities, from variable subscriptions that may fluctuate monthly, like streaming services or software plans. Identifying sneaky subscriptions hidden within variable expenses allows better tracking and prevents unnoticed financial leaks. Effective money management relies on monitoring recurring fixed costs while regularly reviewing subscription services to optimize spending and reduce unnecessary charges.

Preventing Subscription Creep in Your Financial Plan

Expense tracking provides a clear overview of monthly outflows, crucial for identifying sneaky subscriptions that quietly drain finances. Monitoring subscription payments with detailed expense reports helps detect unauthorized or forgotten recurring charges, preventing subscription creep. Implementing alerts for subscription renewals and regular expense reviews strengthens financial plans by keeping discretionary spending in check.

Smart Tools to Monitor and Manage Subscriptions

Smart tools for managing expenses use advanced algorithms to detect sneaky subscriptions that drain your budget unnoticed. These tools provide real-time alerts, detailed spending reports, and easy cancellation options to optimize money management. By integrating with your bank accounts and credit cards, they offer seamless oversight and control over recurring payments.

Creating a Sustainable Expense and Subscription Strategy

Creating a sustainable expense and subscription strategy involves tracking all recurring payments to identify sneaky subscriptions that drain finances unnoticed. Prioritizing essential subscriptions and setting clear budgeting limits helps maintain control over monthly expenses. Leveraging expense management tools to monitor spending patterns ensures long-term financial stability and minimizes unexpected costs.

Related Important Terms

Stealth Subscription Drain

Stealth subscription drain occurs when recurring charges from unnoticed or forgotten subscriptions slowly erode your budget, undermining effective money management. Tracking all expenses meticulously helps identify and eliminate these hidden costs, improving financial control and savings.

Ghost Expense Trap

Ghost Expense Trap occurs when sneaky subscriptions silently drain funds without immediate notice, undermining effective money management by creating untracked monthly expenses. Identifying and cancelling these hidden charges is crucial to maintaining accurate budgeting and preventing unexpected financial shortfalls.

Recurring Charge Creep

Recurring charge creep occurs when unnoticed subscriptions gradually increase overall expenses, undermining effective money management. Monitoring and regularly reviewing all recurring payments helps prevent sneaky subscriptions from draining financial resources.

Shadow Budget Leak

Hidden subscription fees create a shadow budget leak that quietly drains funds, making expense tracking ineffective and distorting financial planning accuracy. Identifying and canceling these sneaky subscriptions protects your budget integrity and enhances money management strategies.

Hidden Renewal Cycle

Hidden renewal cycles in sneaky subscriptions often cause unexpected charges that disrupt monthly budget planning, making expense tracking less accurate. Monitoring and canceling these subscriptions before renewal dates ensures better control over finances and prevents unplanned cash outflows.

Subscription Snare

Subscription Snare helps detect hidden recurring charges that traditional expense tracking often misses, preventing unexpected budget overruns. By automatically identifying sneaky subscriptions, it enables more accurate money management and optimized financial planning.

In-App Auto-Rebilling

In-app auto-rebilling often leads to sneaky subscriptions that can inflate expenses unnoticed, making it crucial to monitor recurring charges closely for effective money management. Tracking and categorizing these automatic payments helps identify hidden costs, enabling better control over personal finances and preventing budget overruns.

Pocket Leech Fees

Pocket Leech fees often mask themselves as sneaky subscriptions, quietly draining your finances under the guise of small, recurring expenses that can accumulate significantly over time. Monitoring and categorizing these hidden costs in your expense tracker ensures more accurate money management and prevents budget overruns caused by overlooked subscription fees.

Unnoticed Autopay Burn

Unnoticed autopay burns drain finances through recurring sneaky subscriptions that often go unnoticed in monthly expense tracking. Effective money management requires regularly auditing bank statements to identify and cancel these hidden automatic payments.

Micro-Subscription Overload

Micro-subscription overload significantly impacts money management by causing unnoticed, incremental expenses that accumulate over time, draining budgets without immediate awareness. Tracking and categorizing these small, recurring charges can reveal hidden spending patterns, enabling better control over personal finances and preventing unexpected financial strain.

Expense vs Sneaky Subscription for money management. Infographic

moneydiff.com

moneydiff.com