The cash envelope system offers a tangible way to control spending by allocating physical cash into labeled envelopes for different expenses, helping users avoid overspending. In contrast, the digital envelope system uses budgeting apps to categorize funds electronically, providing real-time tracking and convenient access without handling cash. Both methods enhance money management by promoting disciplined budgeting, but digital envelopes offer greater flexibility and integration with modern financial tools.

Table of Comparison

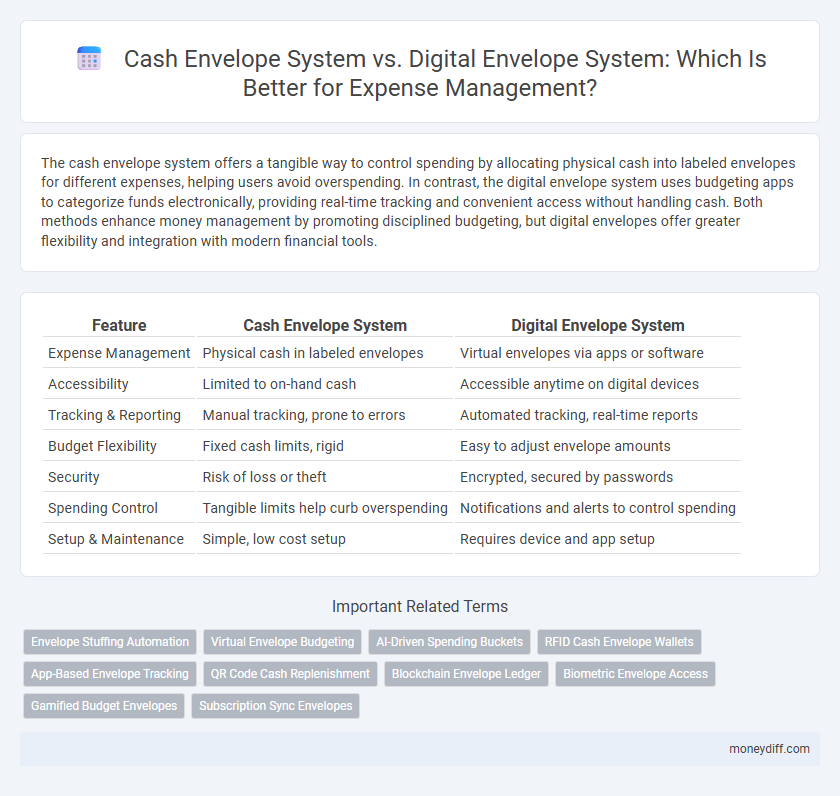

| Feature | Cash Envelope System | Digital Envelope System |

|---|---|---|

| Expense Management | Physical cash in labeled envelopes | Virtual envelopes via apps or software |

| Accessibility | Limited to on-hand cash | Accessible anytime on digital devices |

| Tracking & Reporting | Manual tracking, prone to errors | Automated tracking, real-time reports |

| Budget Flexibility | Fixed cash limits, rigid | Easy to adjust envelope amounts |

| Security | Risk of loss or theft | Encrypted, secured by passwords |

| Spending Control | Tangible limits help curb overspending | Notifications and alerts to control spending |

| Setup & Maintenance | Simple, low cost setup | Requires device and app setup |

Introduction to Envelope Budgeting Methods

The cash envelope system uses physical envelopes to allocate specific amounts of cash for different spending categories, promoting disciplined cash handling and preventing overspending. In contrast, the digital envelope system utilizes budgeting apps or software that virtualize these envelopes, allowing real-time tracking and automated expense categorization. Both methods enhance financial control by enforcing spending limits, but digital systems offer enhanced convenience and data analytics for more precise budget adjustments.

What is the Cash Envelope System?

The Cash Envelope System is a budgeting method where physical cash is allocated into separate envelopes, each designated for specific spending categories like groceries, entertainment, or transportation. This tangible approach helps users visually track and control their expenses, reducing overspending by limiting expenditures to the cash available in each envelope. It promotes disciplined money management by encouraging conscious spending and preventing debt accumulation through reliance on physical cash instead of digital transactions.

What is the Digital Envelope System?

The Digital Envelope System is a modern money management method that allocates funds into virtual categories or "envelopes" using budgeting apps or software. It helps track and control expenses by assigning specific amounts to each category, mirroring the traditional cash envelope method but with enhanced convenience and automation. This system provides real-time updates, reduces the risk of overspending, and offers seamless integration with bank accounts and digital payments.

How Cash Envelopes Support Money Discipline

Cash envelope systems promote money discipline by providing a tangible, visual method to control spending through pre-allocated physical cash for specific expense categories. This approach limits overspending by making the remaining budget visible and real, enhancing awareness and self-control. Unlike digital envelope systems, cash envelopes reduce reliance on electronic transactions, minimizing impulsive purchases and encouraging mindful financial decisions.

Benefits of Going Digital with Envelope Budgeting

Digital envelope systems streamline expense tracking by automatically categorizing transactions and providing real-time budget updates, enhancing accuracy and convenience. They offer seamless integration with bank accounts and mobile apps, enabling users to monitor spending anytime and receive alerts to prevent overspending. Digital methods reduce the hassle of handling physical cash, increase security through encryption, and support customizable budgeting categories for personalized financial control.

Security and Privacy: Cash vs. Digital Envelopes

Cash envelope systems offer enhanced privacy since transactions occur offline without digital footprints, reducing the risk of data breaches and unauthorized access. Digital envelope systems provide convenience and real-time tracking but are vulnerable to hacking, phishing, and potential exposure of sensitive financial data. Choosing between the two depends on balancing the need for privacy with the advantages of digital security measures like encryption and multi-factor authentication.

Accessibility and Convenience Comparison

Cash envelope systems provide tangible, physical control over spending, making it accessible without internet or devices, ideal for those preferring hands-on budgeting. Digital envelope systems offer enhanced convenience through mobile apps, automated tracking, and instant updates, accessible anytime and anywhere with internet connectivity. While cash envelopes limit overspending by physical constraints, digital systems allow for flexible adjustments and detailed expense categorization on the go.

Expense Tracking Accuracy: Manual vs. Digital

Cash envelope systems provide tactile control and immediate visual insight, which can enhance expense tracking accuracy through physical separation of funds. Digital envelope systems utilize automated categorization and real-time updates, reducing human error and offering detailed expense analytics. Digital methods often outperform manual tracking by synchronizing transactions instantly, improving accuracy and financial discipline.

Which System Fits Different Lifestyle Needs?

The cash envelope system suits individuals who prefer tangible money control and are aiming to curb overspending by physically separating funds for different expense categories. In contrast, the digital envelope system aligns with tech-savvy users seeking convenience, real-time tracking, and integration with budgeting apps for seamless financial management. Choosing between these systems depends on lifestyle preferences such as the need for physical cash handling versus digital accessibility and automation.

Final Verdict: Choosing the Right Envelope System for You

The Cash Envelope System offers tangible control over spending by physically dividing money into categories, which helps users curb overspending and build budgeting habits. The Digital Envelope System provides convenience and real-time tracking through apps, allowing for easier adjustments and integration with bank accounts. Selecting the right system depends on individual preferences for hands-on discipline versus digital flexibility in managing expenses effectively.

Related Important Terms

Envelope Stuffing Automation

The cash envelope system relies on physically stuffing cash into labeled envelopes to manage budgets, which can be time-consuming and prone to human error. Digital envelope systems automate this process by allocating funds electronically to virtual envelopes, enhancing accuracy, convenience, and real-time expense tracking.

Virtual Envelope Budgeting

Virtual envelope budgeting offers enhanced flexibility and real-time tracking compared to the traditional cash envelope system, allowing users to allocate funds digitally across various spending categories without carrying physical cash. This method integrates seamlessly with banking apps and budgeting software, providing automated alerts and detailed expense reports to optimize money management and improve financial discipline.

AI-Driven Spending Buckets

AI-driven digital envelope systems enhance money management by automatically categorizing expenses into virtual spending buckets, providing real-time budget tracking and predictive analytics. This approach offers greater flexibility and accuracy compared to the traditional cash envelope system, which relies on physical cash allocation and manual monitoring.

RFID Cash Envelope Wallets

RFID cash envelope wallets enhance traditional cash envelope systems by providing secure, contactless access to physical currency, reducing the risk of theft and loss while maintaining budget discipline. Unlike digital envelope systems that rely on apps and virtual transactions, RFID wallets offer tangible control over spending with added technology-driven security features.

App-Based Envelope Tracking

App-based envelope tracking offers real-time monitoring, automatic expense categorization, and seamless synchronization across multiple devices, enhancing budget accuracy compared to traditional cash envelopes. Digital envelope systems also reduce the risk of overspending by providing instant notifications and detailed spending reports, optimizing personal finance management.

QR Code Cash Replenishment

The Cash envelope system provides a tangible way to control spending by allocating physical cash into labeled envelopes, whereas the Digital envelope system enhances convenience by using QR Code Cash Replenishment to instantly fund budget categories through mobile payments. QR Code Cash Replenishment streamlines money management by enabling seamless, real-time transfers into digital envelopes, reducing the risk of overspending and improving transaction tracking.

Blockchain Envelope Ledger

The Blockchain Envelope Ledger enhances the traditional Cash Envelope System by securely digitizing budget categories, enabling transparent, immutable tracking of expenses without physical cash limitations. This Digital Envelope System leverages smart contracts to automate fund allocations and real-time spending alerts, optimizing financial discipline and reducing errors in money management.

Biometric Envelope Access

Biometric envelope access enhances security in both cash and digital envelope systems by ensuring only authorized users can withdraw funds, minimizing theft and misuse. The digital envelope system with biometric authentication offers real-time tracking and easy budget adjustments, while cash envelopes provide tangible control but lack flexibility and instant oversight.

Gamified Budget Envelopes

Gamified budget envelopes enhance the cash envelope system by integrating digital tracking and interactive rewards, increasing user engagement and adherence to spending limits. This hybrid approach combines tangible cash allocation with app-based notifications and challenges, promoting disciplined expense management and financial literacy.

Subscription Sync Envelopes

The Cash Envelope System provides tangible budget control by allocating physical cash into designated envelopes, but lacks real-time tracking and automatic updates. Digital Envelope Systems, especially those with Subscription Sync Envelopes, streamline expense management by automatically syncing recurring payments and adjusting budgets in real time, enhancing accuracy and reducing manual effort.

Cash envelope system vs Digital envelope system for money management. Infographic

moneydiff.com

moneydiff.com