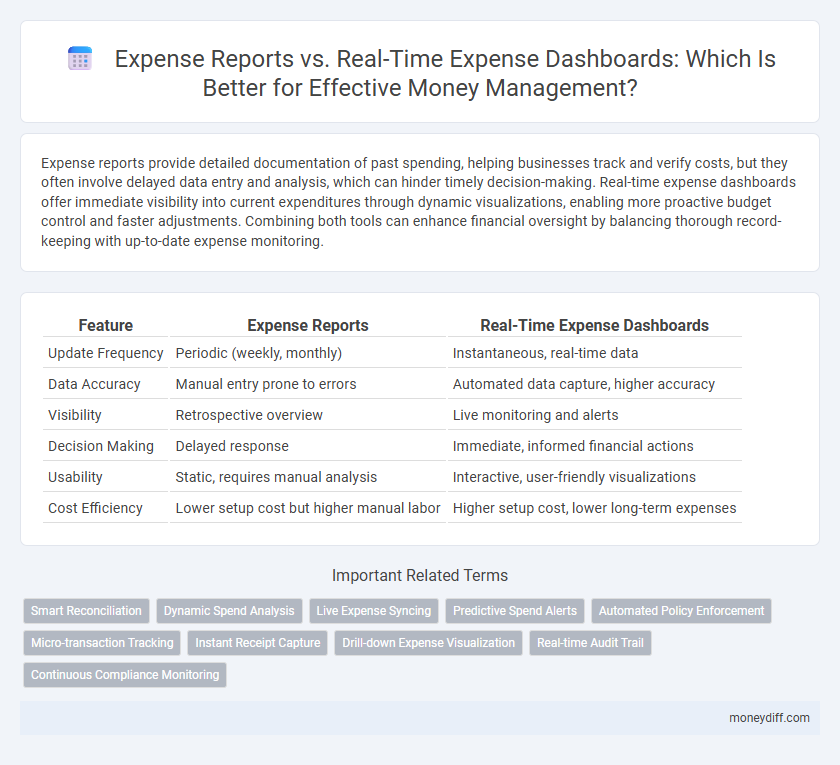

Expense reports provide detailed documentation of past spending, helping businesses track and verify costs, but they often involve delayed data entry and analysis, which can hinder timely decision-making. Real-time expense dashboards offer immediate visibility into current expenditures through dynamic visualizations, enabling more proactive budget control and faster adjustments. Combining both tools can enhance financial oversight by balancing thorough record-keeping with up-to-date expense monitoring.

Table of Comparison

| Feature | Expense Reports | Real-Time Expense Dashboards |

|---|---|---|

| Update Frequency | Periodic (weekly, monthly) | Instantaneous, real-time data |

| Data Accuracy | Manual entry prone to errors | Automated data capture, higher accuracy |

| Visibility | Retrospective overview | Live monitoring and alerts |

| Decision Making | Delayed response | Immediate, informed financial actions |

| Usability | Static, requires manual analysis | Interactive, user-friendly visualizations |

| Cost Efficiency | Lower setup cost but higher manual labor | Higher setup cost, lower long-term expenses |

Understanding Expense Reports: Traditional Approach to Money Tracking

Expense reports provide a detailed summary of past expenditures, categorizing costs for budgeting and financial analysis. This traditional approach relies on manual data entry, often causing delays in visibility and limiting real-time decision-making. Expense reports are essential for auditing and compliance but lack the immediacy offered by dynamic expense dashboards.

What Are Real-Time Expense Dashboards?

Real-time expense dashboards provide instantaneous tracking and visualization of financial transactions, enabling businesses to monitor spending patterns as they occur. These dashboards integrate with accounting systems and bank feeds to deliver up-to-date data on expenses, offering dynamic charts and alerts for budget variances. Compared to traditional expense reports, real-time dashboards enhance decision-making by providing immediate insights into spending behavior and cash flow management.

Key Differences Between Expense Reports and Real-Time Expense Dashboards

Expense reports provide detailed, periodic summaries of financial transactions, often used for auditing and compliance, while real-time expense dashboards offer instant visibility into current spending patterns through dynamic data visualization. Expense reports are static and typically retrospective, compiling data after the fact, whereas real-time dashboards enable proactive decision-making by tracking expenses as they occur. The integration of automated data feeds in dashboards enhances accuracy and timeliness, contrasting with the manual data entry and delayed updates common in traditional expense reports.

Accuracy and Timeliness: Expense Reports vs Dashboards

Expense reports often suffer from delays and manual errors, reducing accuracy and timeliness in financial tracking. Real-time expense dashboards provide instantaneous data updates, enabling precise monitoring and timely decision-making. Enhanced accuracy and immediacy through dashboards significantly improve overall money management efficiency.

Visibility and Control Over Spending

Expense reports provide historical data that helps analyze past spending patterns, but they often come with delays and limited visibility. Real-time expense dashboards offer immediate insights into current expenditures, enabling proactive control and faster decision-making. Enhanced visibility through real-time tracking reduces overspending risks and improves budget adherence.

Integration with Other Financial Tools

Expense reports provide detailed summaries of past expenditures but often lack seamless integration with real-time financial tools, limiting immediate cash flow insights. Real-time expense dashboards connect directly with accounting software, payroll systems, and budgeting platforms, enabling synchronized data updates and comprehensive financial oversight. This integration enhances accuracy in expense tracking and facilitates proactive money management decisions.

User Experience: Manual Entry vs Automated Tracking

Expense reports often require manual data entry, leading to time-consuming processes and increased chances of errors, which can frustrate users and delay financial insights. Real-time expense dashboards utilize automated tracking through connected bank accounts and receipt scanning, providing instantaneous updates and enhanced accuracy. This automation improves user experience by simplifying money management and enabling proactive financial decisions.

Scaling Money Management for Business Growth

Expense reports provide historical data that aids in tracking business spending patterns, but real-time expense dashboards offer dynamic insights essential for scaling money management. Leveraging real-time dashboards enables businesses to monitor cash flow instantly, identify cost-saving opportunities, and adjust budgets proactively to support growth objectives. Integrating real-time analytics with scalable financial tools ensures optimized resource allocation and enhances decision-making efficiency in expanding enterprises.

Security and Compliance Considerations

Expense reports often lag in providing up-to-date information, increasing risks of data breaches and compliance lapses due to delayed audits. Real-time expense dashboards enhance security by enabling immediate anomaly detection and enforcement of compliance policies through automated monitoring. Integration with encryption protocols and regulatory frameworks such as GDPR and SOX ensures robust control over sensitive financial data in real-time expense management systems.

Choosing the Right Solution for Your Money Management Needs

Expense reports provide detailed, retrospective summaries ideal for thorough financial analysis and compliance tracking, while real-time expense dashboards offer instant visibility into spending patterns, enabling proactive budget adjustments. Selecting the right solution depends on your organization's focus--whether detailed audit trails or adaptive, on-the-fly decision-making is prioritized. Integrating both tools can enhance overall money management by balancing comprehensive documentation with dynamic expense monitoring.

Related Important Terms

Smart Reconciliation

Expense reports provide historical data but often delay financial insights, whereas real-time expense dashboards enable instant visibility into spending patterns, enhancing money management efficiency. Smart reconciliation leverages AI algorithms to automatically match transactions with expense receipts, reducing errors and accelerating approval processes.

Dynamic Spend Analysis

Expense reports provide a historical overview of financial outflows, often delayed by manual processing, whereas real-time expense dashboards enable dynamic spend analysis with instant data visualization and updated transaction tracking. Leveraging real-time dashboards enhances money management by identifying spending patterns, detecting overspending promptly, and facilitating proactive budget adjustments.

Live Expense Syncing

Real-time expense dashboards with live expense syncing provide instant visibility into spending patterns, enabling proactive money management and immediate budget adjustments. Expense reports, while useful for historical analysis, lack the dynamic updates that allow businesses to react quickly to financial changes throughout the reporting period.

Predictive Spend Alerts

Real-time expense dashboards enhance money management by providing predictive spend alerts that identify potential budget overruns before they occur, enabling proactive financial decisions. Unlike traditional expense reports, these dashboards offer dynamic insights and immediate notifications, improving accuracy and control over cash flow.

Automated Policy Enforcement

Automated policy enforcement in real-time expense dashboards ensures immediate validation and compliance with company spending rules, reducing errors and preventing fraudulent claims more effectively than traditional expense reports. This automation accelerates approval workflows and enhances financial control by providing continuous monitoring and instant flagging of policy violations.

Micro-transaction Tracking

Expense reports offer detailed summaries of past transactions but often lack the immediacy needed for micro-transaction tracking, causing delays in identifying overspending or irregularities. Real-time expense dashboards integrate live data feeds to monitor micro-transactions instantly, enabling proactive money management and quicker financial decision-making.

Instant Receipt Capture

Expense reports often rely on manual entry and delayed submissions, which can lead to inaccuracies and slower reimbursement processes. Real-time expense dashboards equipped with instant receipt capture enable immediate transaction recording, enhancing accuracy and accelerating financial decision-making.

Drill-down Expense Visualization

Drill-down expense visualization in real-time expense dashboards enables detailed, on-the-spot analysis of spending patterns, improving accuracy and timeliness compared to traditional expense reports. This interactive approach enhances financial oversight by allowing managers to quickly identify cost drivers and anomalies within specific categories or time frames.

Real-time Audit Trail

Real-time expense dashboards provide an instantaneous audit trail, enabling businesses to monitor transactions as they occur and quickly identify discrepancies or unauthorized spending. Expense reports deliver historical data but lack the immediate visibility and proactive control offered by real-time auditing systems.

Continuous Compliance Monitoring

Real-time expense dashboards enable continuous compliance monitoring by providing instant visibility into spending patterns and policy adherence, reducing the risk of fraudulent or non-compliant transactions. Expense reports, generated periodically, often delay the detection of discrepancies, limiting timely corrective actions and increasing the likelihood of budget overruns.

Expense reports vs Real-time expense dashboards for money management. Infographic

moneydiff.com

moneydiff.com