Receipts provide a tangible record of expenses but are prone to loss, damage, and require manual handling, which can be time-consuming. Digital scanning captures and stores expense data efficiently, reducing errors and simplifying categorization for faster reimbursement processes. Embracing digital solutions streamlines expense recording and enhances accuracy in financial tracking.

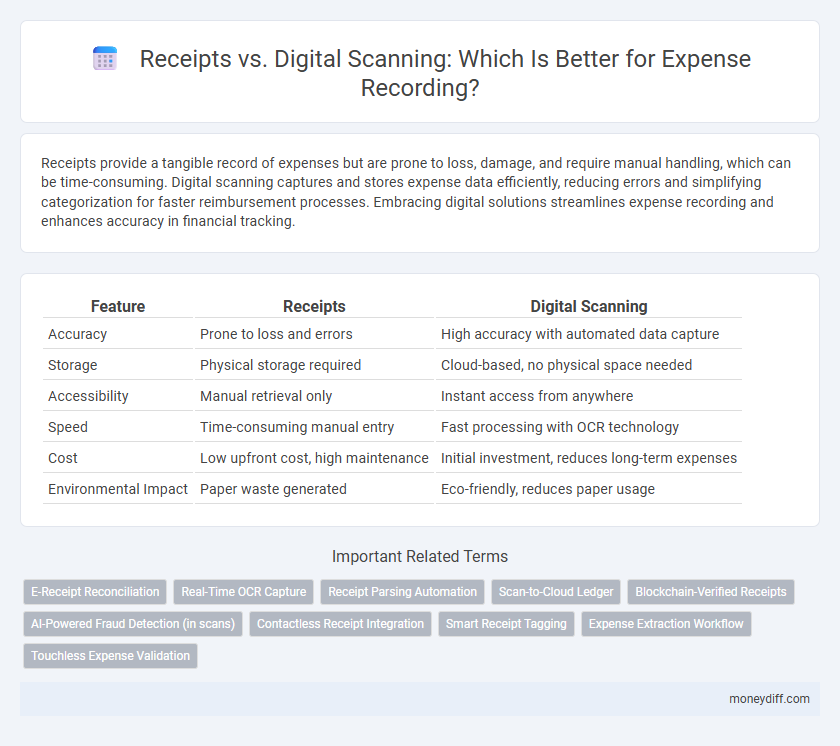

Table of Comparison

| Feature | Receipts | Digital Scanning |

|---|---|---|

| Accuracy | Prone to loss and errors | High accuracy with automated data capture |

| Storage | Physical storage required | Cloud-based, no physical space needed |

| Accessibility | Manual retrieval only | Instant access from anywhere |

| Speed | Time-consuming manual entry | Fast processing with OCR technology |

| Cost | Low upfront cost, high maintenance | Initial investment, reduces long-term expenses |

| Environmental Impact | Paper waste generated | Eco-friendly, reduces paper usage |

Introduction to Expense Recording Methods

Expense recording methods include traditional receipt collection and digital scanning technologies, both integral for accurate financial tracking. Receipts provide tangible proof of transactions while digital scanning enhances efficiency by converting paper documents into searchable electronic records. Businesses leveraging digital scanning experience reduced manual errors and streamlined expense management through automated data capture.

Understanding Paper Receipts in Expense Management

Paper receipts remain a crucial element in expense management due to their legal validity and detailed transaction information, including vendor name, date, amount, and tax details. Proper storage and organization of physical receipts are essential for audit compliance and reimbursement accuracy. While digital scanning offers convenience, understanding the structure and importance of paper receipts ensures reliable expense tracking and financial record integrity.

The Rise of Digital Scanning for Expense Tracking

Digital scanning technology revolutionizes expense tracking by enabling instantaneous capture and organization of receipts, reducing manual errors and improving accuracy. Integration of OCR (Optical Character Recognition) software extracts key data points, streamlining expense reporting and enhancing real-time visibility into spending patterns. Businesses adopting digital scanning witness increased efficiency and reduced administrative costs compared to traditional paper receipt management.

Accuracy Comparison: Receipts vs Digital Scanning

Receipts provide a tangible record that can be manually verified for accuracy, but they are prone to human errors such as misplacement or illegible handwriting. Digital scanning utilizes OCR (Optical Character Recognition) technology to extract data automatically, significantly reducing transcription errors and enhancing data accuracy in expense recording. Studies indicate that digital scanning improves accuracy rates by up to 90% compared to traditional receipt handling, streamlining expense management processes.

Efficiency and Time-Saving Benefits

Digital scanning of receipts significantly enhances efficiency by automating data extraction and minimizing manual entry errors, reducing the time spent on expense recording by up to 70%. Utilizing optical character recognition (OCR) technology, scanned receipts streamline categorization and integration with accounting software, enabling faster approval workflows. This method outperforms traditional paper receipt handling by accelerating expense reimbursement processes and improving real-time expense tracking accuracy.

Storage and Organization: Paper vs Digital

Physical receipts require substantial storage space and are prone to damage or loss, making organization cumbersome and retrieval time-consuming. Digital scanning transforms receipts into searchable, cloud-stored files that facilitate efficient categorization and instant access. Enhanced metadata tagging and integration with expense management software optimize record-keeping and audit readiness.

Security and Data Privacy Concerns

Receipts pose a risk of loss or damage, compromising the accuracy and security of expense records, while digital scanning offers encrypted storage solutions that enhance data privacy and prevent unauthorized access. Digital platforms often comply with stringent data protection regulations such as GDPR and HIPAA, ensuring secure handling and retention of sensitive financial information. However, reliance on digital devices introduces potential cybersecurity threats like hacking or data breaches, requiring robust encryption and multi-factor authentication to safeguard expense data.

Integration with Accounting Software

Receipts provide a traditional, tangible record of expenses but often require manual entry into accounting software, increasing the risk of errors and time spent on reconciliation. Digital scanning technology automates data capture by extracting key information from receipts and seamlessly integrating it with accounting platforms like QuickBooks and Xero, enhancing accuracy and efficiency. This integration streamlines expense tracking, reduces manual workload, and accelerates financial reporting cycles.

Environmental Impact: Paper vs Digital Solutions

Paper receipts contribute significantly to deforestation and landfill waste, generating substantial carbon emissions throughout their production and disposal lifecycle. Digital scanning solutions drastically reduce paper usage by converting receipts into electronic records, minimizing environmental footprint and promoting sustainable expense management. Embracing digital expense recording aligns with green initiatives by lowering energy consumption and reducing overall resource depletion compared to traditional paper methods.

Choosing the Best Expense Recording Method for Your Needs

Choosing the best expense recording method depends on accuracy, convenience, and long-term accessibility. Receipts provide a tangible audit trail and are widely accepted for tax purposes, but digital scanning offers faster processing, automatic data extraction, and cloud storage for easier retrieval. Evaluating your business size, volume of expenses, and integration with accounting software will help determine whether physical receipts or digital scanning best meet your tracking and reporting needs.

Related Important Terms

E-Receipt Reconciliation

E-Receipt reconciliation streamlines expense recording by automatically matching digital receipts with corresponding transactions, reducing manual entry errors and enhancing audit accuracy. This process integrates seamlessly with expense management software, accelerating reimbursement cycles and ensuring compliance with company policies.

Real-Time OCR Capture

Real-time OCR capture revolutionizes expense recording by instantly converting physical receipt data into digital formats, reducing manual entry errors and accelerating reimbursement processes. This technology enhances accuracy and efficiency compared to traditional receipt management, enabling seamless integration with expense management software for real-time tracking and auditing.

Receipt Parsing Automation

Receipt parsing automation enhances expense recording by converting physical receipt data into structured digital formats, reducing manual entry errors and accelerating reimbursement processes. Advanced Optical Character Recognition (OCR) technology extracts key details such as vendor name, date, and amount, enabling seamless integration with expense management systems.

Scan-to-Cloud Ledger

Receipts captured through Scan-to-Cloud Ledger technology enable instant digitization and automatic categorization, reducing manual entry errors and streamlining expense tracking. This cloud-based scanning solution enhances real-time access to verified transaction data, improving accuracy and compliance in expense recording processes.

Blockchain-Verified Receipts

Blockchain-verified receipts enhance expense recording by providing tamper-proof, time-stamped digital proofs that ensure authenticity and prevent fraud, unlike traditional paper receipts susceptible to loss or alteration. Integrating blockchain with digital scanning streamlines verification processes, increases transparency, and simplifies audit trails for more efficient and secure expense management.

AI-Powered Fraud Detection (in scans)

AI-powered digital scanning accelerates expense recording by automatically extracting data from receipts while simultaneously applying advanced fraud detection algorithms to identify manipulated or counterfeit documents. This technology enhances accuracy and security, reducing manual errors and preventing expense fraud more effectively than traditional paper receipt methods.

Contactless Receipt Integration

Contactless receipt integration streamlines expense recording by automatically capturing and digitizing transaction data without manual input, reducing errors and saving time compared to traditional paper receipts. This technology leverages OCR and NFC to directly import receipt details into expense management systems, enhancing accuracy and enabling real-time financial tracking.

Smart Receipt Tagging

Smart receipt tagging enhances expense recording accuracy by automatically extracting and categorizing key data from digital scans of receipts, reducing manual entry errors and saving time. This technology improves compliance and audit readiness by ensuring all expense details are consistently captured and easily accessible.

Expense Extraction Workflow

Expense extraction workflow benefits from digital scanning by automating data capture from receipts, enhancing accuracy and efficiency in expense recording. Digital systems reduce manual entry errors and enable faster processing through optical character recognition (OCR), streamlining the overall expense management process.

Touchless Expense Validation

Touchless expense validation leverages advanced OCR and AI technologies to convert paper receipts into accurate digital records, reducing manual entry errors and accelerating expense processing. Digital scanning streamlines compliance by instantly extracting key data points such as vendor, date, and amount, ensuring faster approval workflows compared to traditional receipt management.

Receipts vs Digital Scanning for expense recording Infographic

moneydiff.com

moneydiff.com