Expense refers to any outflow of money incurred to operate a business or maintain personal finances, while variable spend specifically denotes costs that fluctuate based on usage or activity levels. Monitoring variable spend is crucial for money management as it allows for more precise budgeting and cost control by adjusting expenses according to income or demand changes. Differentiating between fixed expenses and variable spend helps optimize cash flow and improve financial decision-making.

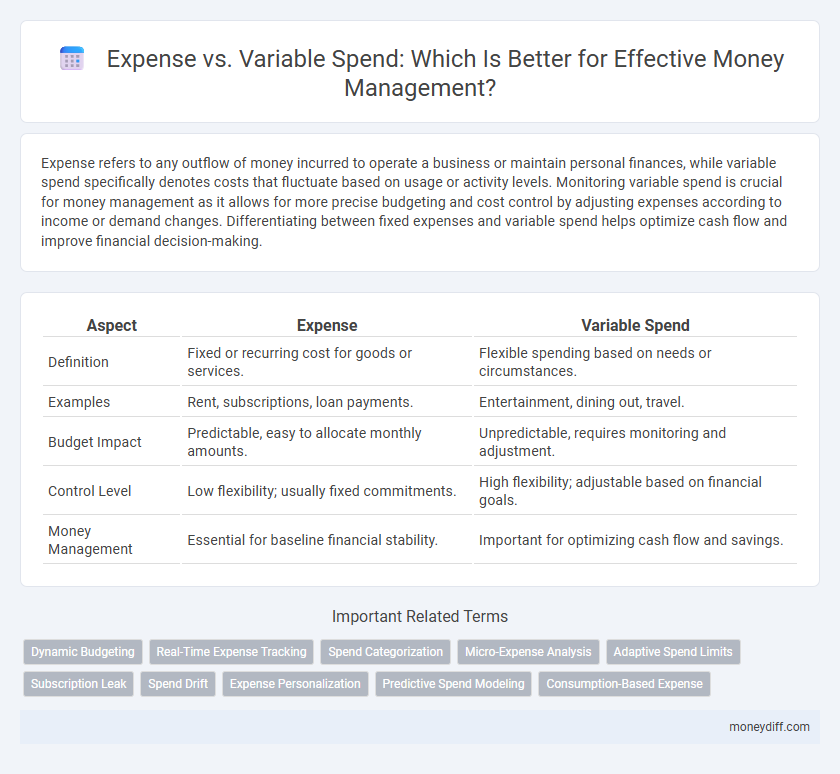

Table of Comparison

| Aspect | Expense | Variable Spend |

|---|---|---|

| Definition | Fixed or recurring cost for goods or services. | Flexible spending based on needs or circumstances. |

| Examples | Rent, subscriptions, loan payments. | Entertainment, dining out, travel. |

| Budget Impact | Predictable, easy to allocate monthly amounts. | Unpredictable, requires monitoring and adjustment. |

| Control Level | Low flexibility; usually fixed commitments. | High flexibility; adjustable based on financial goals. |

| Money Management | Essential for baseline financial stability. | Important for optimizing cash flow and savings. |

Understanding Expense vs Variable Spend

Expense refers to any outflow of money for goods or services that a business or individual incurs, typically recorded as fixed or recurring costs. Variable spend specifically denotes costs that fluctuate directly with usage or production levels, such as utility bills or raw materials, offering flexibility in budget adjustments. Differentiating between fixed expenses and variable spend is essential for accurate budgeting, cash flow management, and optimizing financial decision-making.

Key Differences Between Fixed Expenses and Variable Spend

Fixed expenses include consistent, predictable payments such as rent, insurance premiums, and loan installments that remain stable each month. Variable spend fluctuates based on usage or consumption, encompassing costs like utilities, groceries, and entertainment that can vary significantly. Understanding these key differences enables better budgeting and financial control by identifying which costs are controllable and which are obligations.

How to Identify Your Fixed Expenses

Fixed expenses remain constant regardless of usage or activity levels, such as rent, mortgage payments, and insurance premiums, making them easier to predict and budget for. To identify fixed expenses, review your monthly bills and bank statements for consistent charges that do not fluctuate significantly over time. Tracking these stable outflows distinguishes fixed expenses from variable spend, which varies based on consumption or discretionary choices like utilities, groceries, and entertainment.

Recognizing Variable Spend in Your Budget

Variable spend refers to expenses that fluctuate month to month, such as groceries, entertainment, and transportation, whereas fixed expenses remain constant, like rent or loan payments. Recognizing variable spend in your budget allows for more accurate cash flow management and helps identify opportunities for savings by adjusting discretionary spending. Tracking these expenses closely with tools or apps ensures better financial control and flexibility in money management.

The Role of Expense Tracking in Money Management

Expense tracking plays a crucial role in money management by distinguishing between fixed expenses and variable spend, enabling accurate budgeting and financial planning. Monitoring variable spend allows individuals to identify discretionary costs and adjust spending habits to optimize savings. Consistent expense tracking provides real-time insights, ensuring better control over cash flow and preventing overspending.

Strategies to Control Variable Spend

Controlling variable spend requires tracking discretionary expenses such as dining out, entertainment, and impulse purchases with detailed budgeting tools to identify spending patterns. Setting clear monthly limits and prioritizing essential variable costs helps prevent overspending and improve cash flow management. Utilizing expense tracking apps enhances visibility, enabling timely adjustments to reduce unnecessary costs and optimize overall money management.

Impact of Fixed Expenses on Financial Stability

Fixed expenses, such as rent, mortgage, and insurance premiums, create predictable financial obligations that support long-term budgeting and financial stability. Unlike variable spend, which fluctuates and can be adjusted, fixed expenses require consistent cash flow, affecting emergency fund requirements and debt management strategies. Maintaining control over fixed expenses helps prevent financial stress and supports sustainable wealth accumulation.

Budgeting Techniques for Managing Expenses and Variable Spend

Effective budgeting techniques distinguish between fixed expenses and variable spend to optimize money management. Tracking variable spend fluctuations helps adjust budgets dynamically, preventing overspending during high-cost periods. Utilizing envelope budgeting or zero-based budgeting methods ensures all expenses, both fixed and variable, align with financial goals for improved cash flow control.

Reducing Variable Spend Without Sacrificing Quality of Life

Focusing on reducing variable spend involves identifying discretionary costs such as dining out, entertainment, and impulse purchases while maintaining essential lifestyle activities. Implementing budgeting techniques like tracking expenses and setting spending limits helps control fluctuations without compromising quality of life. Prioritizing value-driven purchases and seeking cost-effective alternatives ensures financial discipline alongside personal satisfaction.

Balancing Fixed Expenses and Variable Spend for Financial Success

Balancing fixed expenses and variable spend is crucial for effective money management and achieving financial success. Fixed expenses like rent, utilities, and loan payments provide predictable monthly costs, while variable spend fluctuates based on discretionary choices such as dining out or entertainment. Monitoring and adjusting variable spend in relation to fixed expenses helps maintain budget stability, optimize savings, and prevent financial strain.

Related Important Terms

Dynamic Budgeting

Dynamic budgeting enhances money management by differentiating between fixed expenses and variable spend, allowing for real-time adjustments based on fluctuating financial needs. Tracking variable spend within dynamic budgets helps optimize cash flow and improve financial accuracy by aligning expenditures with actual income variations.

Real-Time Expense Tracking

Real-time expense tracking provides immediate visibility into variable spend, enabling precise management and control over fluctuating costs. By distinguishing between fixed expenses and variable spending patterns, individuals and businesses can optimize budgets and prevent overspending effectively.

Spend Categorization

Expenses categorize all financial outflows, while variable spend specifically highlights fluctuating costs tied to consumption patterns, enabling precise money management and budgeting strategies. Classifying spend accurately ensures better tracking of essential versus discretionary expenses, optimizing financial planning and control.

Micro-Expense Analysis

Micro-expense analysis breaks down variable spend into granular components, enabling precise tracking of fluctuating costs like utilities, groceries, and entertainment. This detailed approach enhances money management by identifying patterns and opportunities to optimize discretionary spending without impacting fixed expenses.

Adaptive Spend Limits

Adaptive Spend Limits dynamically adjust expense thresholds based on real-time cash flow and spending patterns, optimizing money management by controlling variable spend without rigid caps. This approach enhances financial flexibility while preventing overspending on fluctuating costs such as utilities, groceries, and discretionary purchases.

Subscription Leak

Expense management requires distinguishing fixed costs from variable spend to identify Subscription Leak, where recurring payments quietly drain funds without regular review. Monitoring variable spend, especially subscription services, helps prevent unnoticed financial waste and improves budget accuracy.

Spend Drift

Expense refers to fixed or recurring costs that remain consistent over time, while variable spend fluctuates based on consumption and usage patterns, directly impacting cash flow stability. Spend drift occurs when variable expenses unintentionally increase, leading to budget overruns and challenging accurate financial forecasting in money management.

Expense Personalization

Expense personalization enhances money management by distinguishing fixed expenses from variable spend, allowing tailored budgeting strategies that adapt to individual spending habits. Leveraging data analytics for personalized expense tracking improves cash flow control and financial decision-making.

Predictive Spend Modeling

Expense management differentiates fixed expenses from variable spend, with predictive spend modeling analyzing historical data to forecast fluctuations in variable costs, enabling more accurate budgeting. This approach leverages machine learning algorithms to identify spending patterns and anticipate future expenses, improving financial planning and cash flow optimization.

Consumption-Based Expense

Consumption-based expenses fluctuate directly with usage levels, making them a key factor in variable spend management. Monitoring these costs enables accurate budgeting and financial control, as they reflect real-time consumption of resources such as utilities, raw materials, and fuel.

Expense vs Variable Spend for money management. Infographic

moneydiff.com

moneydiff.com