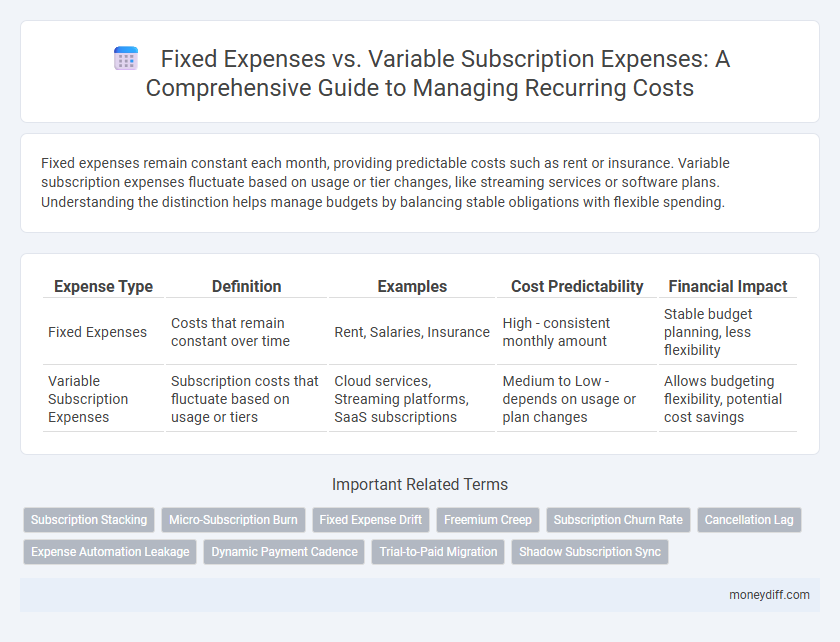

Fixed expenses remain constant each month, providing predictable costs such as rent or insurance. Variable subscription expenses fluctuate based on usage or tier changes, like streaming services or software plans. Understanding the distinction helps manage budgets by balancing stable obligations with flexible spending.

Table of Comparison

| Expense Type | Definition | Examples | Cost Predictability | Financial Impact |

|---|---|---|---|---|

| Fixed Expenses | Costs that remain constant over time | Rent, Salaries, Insurance | High - consistent monthly amount | Stable budget planning, less flexibility |

| Variable Subscription Expenses | Subscription costs that fluctuate based on usage or tiers | Cloud services, Streaming platforms, SaaS subscriptions | Medium to Low - depends on usage or plan changes | Allows budgeting flexibility, potential cost savings |

Understanding Fixed vs Variable Subscription Expenses

Fixed subscription expenses remain constant each billing cycle, such as a monthly software license fee, providing predictable budgeting for businesses. Variable subscription expenses fluctuate based on usage or tier changes, including costs like pay-as-you-go cloud services or incremental user licenses. Understanding the distinction between fixed and variable subscription expenses helps organizations manage cash flow effectively and optimize financial planning.

Key Differences Between Fixed and Variable Subscriptions

Fixed subscription expenses are consistent, recurring charges such as monthly software licenses or gym memberships, providing predictable budgeting and stable cash flow management. Variable subscription expenses fluctuate based on usage or service tiers, like cloud storage fees or pay-per-use streaming plans, requiring flexible expense tracking and adjustment. Understanding these key differences helps businesses optimize cost control and align spending with operational needs.

Common Examples of Fixed Subscription Expenses

Common examples of fixed subscription expenses include monthly streaming services like Netflix and Spotify, gym memberships, and cloud storage plans such as Google Drive or Dropbox. These fixed costs remain consistent each billing cycle, providing predictable budgeting for individuals and businesses. Unlike variable subscription expenses, fixed subscriptions typically do not fluctuate based on usage or consumption.

Identifying Variable Subscription Expenses in Your Budget

Variable subscription expenses fluctuate monthly based on usage or service tiers, unlike fixed expenses that remain constant each billing cycle. Identifying these variable subscriptions requires reviewing service agreements and usage reports to pinpoint costs tied to consumption or changing features. Tracking these expenses helps optimize budgeting by highlighting opportunities to adjust or cancel underutilized subscriptions.

How Fixed Expenses Impact Financial Planning

Fixed expenses, such as rent, insurance, and loan payments, provide a predictable foundation for budgeting and financial planning by establishing consistent monthly obligations. These stable costs enable individuals and businesses to allocate resources more effectively, minimizing financial uncertainty and facilitating long-term savings strategies. In contrast, variable subscription expenses can fluctuate, but fixed expenses set the baseline for essential financial commitments and cash flow management.

Managing Variable Subscription Costs Effectively

Managing variable subscription costs effectively involves monitoring usage patterns and adjusting plans to avoid unnecessary charges. Fixed expenses provide predictable budgeting, but variable subscription expenses require regular review of service features and cost-benefit analysis. Implementing tools for automated alerts and consolidating duplicate subscriptions can significantly reduce overall expenditure in this category.

Strategies to Minimize Unnecessary Subscription Expenses

Review fixed expenses regularly to identify non-essential subscriptions, prioritizing cost-effective plans aligned with actual usage patterns. Implement automated tracking tools to monitor and analyze variable subscription expenses for timely cancellation of unused or underutilized services. Negotiate with service providers for bundled packages or discounted rates to reduce overall subscription costs while maintaining necessary features.

Tracking and Reviewing Subscription Payments

Tracking fixed expenses provides a stable baseline for budgeting as these costs remain consistent each month, enhancing financial predictability. Variable subscription expenses, however, require meticulous monitoring due to fluctuating fees and usage-based charges that can impact overall spending. Regularly reviewing subscription payments helps identify unnecessary services, avoid redundant costs, and optimize expense management.

Budgeting Tips for Balancing Fixed and Variable Expenses

Fixed expenses such as rent, insurance, and loan payments provide predictable costs essential for stable budgeting, while variable subscription expenses like streaming services or monthly software fees can fluctuate, impacting financial flexibility. Monitoring and categorizing these expenses separately enables better allocation of income, ensuring fixed costs are covered before adjusting variable subscriptions to match budget goals. Regularly reviewing variable subscription usage and negotiating or canceling unnecessary services helps maintain a balanced budget and prevents overspending.

Making Smarter Choices with Subscription Services

Fixed expenses remain constant each month, providing budget stability, while variable subscription expenses fluctuate based on usage or tier changes, impacting overall spending unpredictably. Analyzing subscription usage data and identifying underutilized services enable smarter decisions to optimize costs and reduce unnecessary expenses. Prioritizing essential subscriptions and negotiating plans aligned with actual needs enhances financial control and sustains long-term budget health.

Related Important Terms

Subscription Stacking

Fixed expenses remain constant each month, providing predictable budgeting, while variable subscription expenses fluctuate based on usage or tier changes, often leading to subscription stacking--a scenario where multiple overlapping services increase overall costs unnecessarily. Monitoring and consolidating these subscriptions reduces stacking, optimizing cash flow and expense management.

Micro-Subscription Burn

Fixed expenses represent consistent, recurring costs such as rent and utilities, while variable subscription expenses fluctuate based on usage or service tiers, directly impacting micro-subscription burn rates. Monitoring micro-subscription burn optimizes budget allocation by identifying patterns in variable subscription expenses, allowing businesses to adjust usage or cancel underutilized services, ultimately reducing overall expenditure.

Fixed Expense Drift

Fixed Expense Drift occurs when predictable fixed expenses gradually increase over time without proper adjustment, causing budget distortions and reduced financial efficiency. Variable subscription expenses fluctuate based on usage or plan changes, requiring ongoing monitoring to prevent unexpected cost surges and maintain accurate expense management.

Freemium Creep

Fixed expenses remain constant regardless of usage, while variable subscription expenses fluctuate based on service tiers or user activity, often leading to unexpected cost increases known as Freemium Creep. This phenomenon occurs when initially free or low-cost subscriptions gradually require payment for premium features, resulting in escalating monthly expenses that can strain budgets.

Subscription Churn Rate

Fixed expenses remain constant regardless of subscription churn rate, while variable subscription expenses fluctuate directly with subscriber retention and cancellations. Monitoring subscription churn rate is crucial for managing variable costs and optimizing revenue forecasting in subscription-based business models.

Cancellation Lag

Fixed expenses maintain consistent costs each billing cycle, whereas variable subscription expenses fluctuate based on usage or plan changes; cancellation lag in subscriptions often causes delayed expense cessation, leading to unexpected charges beyond the intended cancellation date. Understanding the cancellation lag period is crucial for accurate budgeting and avoiding overspending in variable subscription expenses compared to stable fixed expenses.

Expense Automation Leakage

Fixed expenses remain constant regardless of usage, while variable subscription expenses fluctuate based on consumption, often leading to hidden costs and expense automation leakage. Automating expense tracking with real-time analytics helps identify and minimize subscription overcharges and unused services, reducing overall financial waste.

Dynamic Payment Cadence

Fixed expenses represent consistent, predictable costs such as rent or insurance that recur on a regular schedule, while variable subscription expenses fluctuate based on usage or changing plans. Dynamic payment cadence allows businesses to adapt subscription fees in real-time, optimizing cash flow management and aligning payments closely with service consumption patterns.

Trial-to-Paid Migration

Fixed expenses represent consistent costs like rent or salaried staff that remain stable regardless of usage, while variable subscription expenses fluctuate based on user activity and plan changes, particularly impacting trial-to-paid migration metrics. Effective management of trial-to-paid migration hinges on analyzing variable subscription expenses to optimize conversion rates and forecast recurring revenue growth accurately.

Shadow Subscription Sync

Fixed expenses remain constant each billing cycle, providing predictable budget allocation, while variable subscription expenses fluctuate based on usage or plan changes, complicating financial forecasting. Shadow Subscription Sync technology enables real-time tracking and synchronization of these variable expenses, ensuring accurate expense management and preventing unexpected charges.

Fixed Expenses vs Variable Subscription Expenses for Expense Infographic

moneydiff.com

moneydiff.com