An Emergency Fund serves as a financial safety net for unexpected expenses, providing immediate access to cash during crises. Sleep Well Money, however, represents a broader financial cushion that ensures peace of mind by covering ongoing living expenses and long-term stability. Effective money management balances both, securing short-term emergencies while maintaining confidence in overall financial health.

Table of Comparison

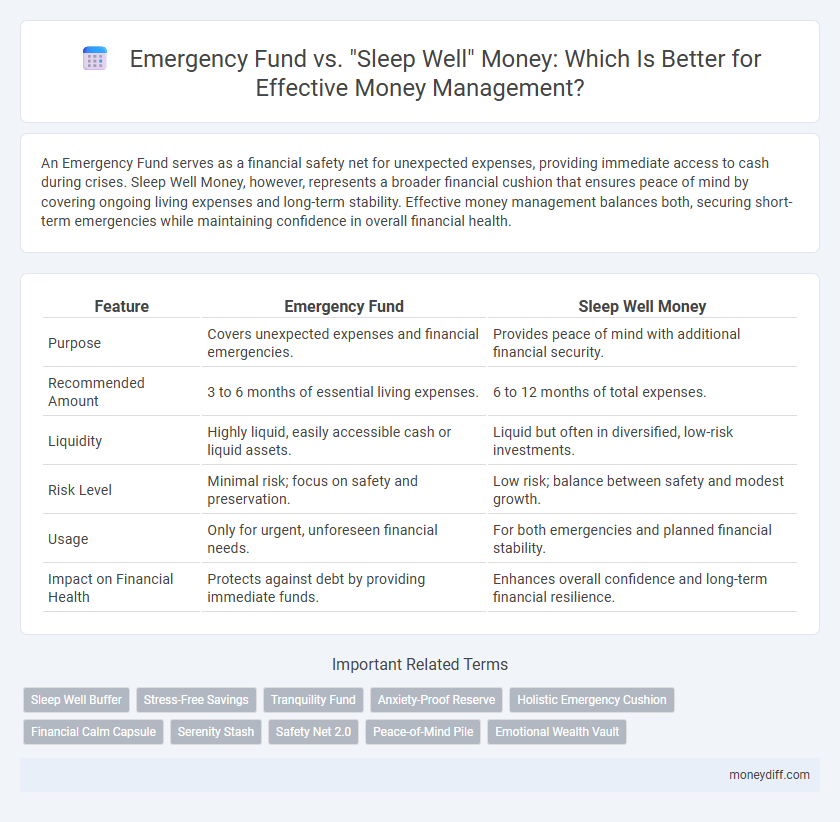

| Feature | Emergency Fund | Sleep Well Money |

|---|---|---|

| Purpose | Covers unexpected expenses and financial emergencies. | Provides peace of mind with additional financial security. |

| Recommended Amount | 3 to 6 months of essential living expenses. | 6 to 12 months of total expenses. |

| Liquidity | Highly liquid, easily accessible cash or liquid assets. | Liquid but often in diversified, low-risk investments. |

| Risk Level | Minimal risk; focus on safety and preservation. | Low risk; balance between safety and modest growth. |

| Usage | Only for urgent, unforeseen financial needs. | For both emergencies and planned financial stability. |

| Impact on Financial Health | Protects against debt by providing immediate funds. | Enhances overall confidence and long-term financial resilience. |

Understanding Emergency Funds: The Financial Safety Net

Emergency funds serve as a dedicated financial safety net, covering unexpected expenses such as medical emergencies, car repairs, or sudden job loss, typically recommending three to six months' worth of living expenses. Sleep Well Money, by contrast, emphasizes achieving peace of mind through sufficient savings that exceed basic emergency funds, ensuring long-term financial security and stress-free living. Understanding the purpose and appropriate size of an emergency fund helps individuals prioritize liquidity and accessibility, forming the foundation of effective money management.

What Is Sleep Well Money? Definition and Purpose

Sleep Well Money refers to a financial cushion designed to provide peace of mind by covering unexpected expenses and reducing anxiety related to money management. Unlike a traditional emergency fund, which strictly covers urgent and unforeseen costs, Sleep Well Money encompasses a broader scope, including funds set aside for personal comfort and mental wellbeing during financial uncertainties. Its primary purpose is to ensure individuals can maintain stability and restful confidence regardless of economic fluctuations or emergencies.

Key Differences Between Emergency Fund and Sleep Well Money

An emergency fund is a designated cash reserve specifically for unexpected, urgent expenses such as medical emergencies, car repairs, or job loss, typically covering three to six months of essential living costs. Sleep well money represents discretionary savings that provide financial comfort and reduced stress beyond basic emergencies, allowing for non-urgent expenditures or peace of mind. Key differences include the urgency and purpose of funds, with emergency funds being strictly for crises, while sleep well money serves as a buffer to improve overall financial confidence and lifestyle flexibility.

Why You Need Both: Protecting Your Financial Peace of Mind

An emergency fund provides immediate access to cash for unexpected expenses, ensuring short-term financial stability. Sleep well money builds a broader sense of security by covering ongoing living expenses and reducing anxiety about future uncertainties. Together, they create a comprehensive safety net that protects your financial peace of mind and supports long-term money management.

How Much Should You Save: Calculating Emergency Funds vs Sleep Well Money

Calculating the right amount for an emergency fund typically involves saving three to six months' worth of essential living expenses to cover unexpected events like job loss or medical emergencies. Sleep well money goes beyond this baseline by including additional savings that provide peace of mind, such as funds for mental health costs or financial goals, often amounting to six to twelve months of expenses. Prioritizing emergency fund calculations first ensures immediate financial security, while adjusting sleep well money allows for greater emotional comfort and long-term stability.

Where to Keep Your Emergency Fund and Sleep Well Money

Storing your emergency fund in a highly liquid, low-risk account such as a high-yield savings or money market account ensures quick access during unexpected financial setbacks. Sleep well money, intended for peace of mind beyond urgent needs, can be placed in slightly higher-yield, low-volatility investments like short-term bonds or conservative mutual funds to balance security and growth. Prioritizing accessibility for the emergency fund and moderate growth for sleep well money optimizes financial resilience and psychological comfort.

Common Mistakes in Building Emergency Fund and Sleep Well Money

Common mistakes in building an emergency fund include underestimating monthly expenses and neglecting liquidity, leading to insufficient coverage during financial crises. Sleep well money often suffers from over-investment in high-risk assets, compromising accessibility and peace of mind. Balancing adequate emergency savings with low-risk, easily accessible funds ensures stability and financial resilience.

Strategies to Quickly Build Both Emergency Fund and Sleep Well Money

Prioritize setting a clear savings goal and automate transfers to separate accounts labeled specifically for Emergency Fund and Sleep Well Money, ensuring consistent progress without overlap. Allocate income based on monthly expenses and discretionary spending, adjusting amounts dynamically during financial windfalls or lean periods to accelerate growth. Utilize high-yield savings accounts or low-risk investment options to maximize returns, maintaining liquidity for Emergency Fund and slightly higher risk tolerance for Sleep Well Money aimed at long-term security.

When to Use Emergency Funds versus Sleep Well Money

Emergency Funds are designed for unexpected, urgent expenses such as medical emergencies, car repairs, or sudden job loss, ensuring immediate financial stability without disrupting long-term goals. Sleep Well Money serves as a psychological cushion, representing discretionary savings that reduce anxiety but are not earmarked for emergencies, allowing for more flexible spending or investment opportunities. Using Emergency Funds should be limited to genuine crises, while Sleep Well Money can be tapped into for less critical comfort expenses or to avoid financial stress.

Emergency Fund and Sleep Well Money: A Foundation for Financial Security

An Emergency Fund provides a crucial financial safety net for unforeseen expenses such as medical emergencies, car repairs, or job loss, ensuring stability without resorting to debt. Sleep Well Money complements this by covering essential monthly living expenses like rent, utilities, and groceries, offering peace of mind and reducing financial stress. Together, they form a robust foundation for financial security, enabling individuals to handle both unexpected shocks and ongoing needs confidently.

Related Important Terms

Sleep Well Buffer

Sleep Well Money functions as a flexible buffer that exceeds the rigid constraints of a traditional Emergency Fund by covering unexpected expenses while maintaining peace of mind. This approach integrates psychological comfort with financial security, ensuring individuals can handle cash flow disruptions without stress.

Stress-Free Savings

Emergency funds provide immediate financial security for unexpected expenses, while Sleep Well Money offers a broader sense of peace by covering ongoing lifestyle costs, enhancing long-term stress-free savings. Prioritizing both ensures balanced money management, minimizing anxiety from emergencies and daily financial pressures.

Tranquility Fund

Tranquility Fund emphasizes a psychological safety net beyond the traditional Emergency Fund by providing consistent peace of mind through stable financial reserves tailored to personal comfort levels. Unlike a standard Emergency Fund, which covers unexpected expenses, a Tranquility Fund prioritizes mental well-being by ensuring available cash flow to reduce anxiety around money management uncertainties.

Anxiety-Proof Reserve

An Emergency Fund serves as a critical anxiety-proof reserve, providing immediate financial security during unexpected expenses and reducing stress by covering at least three to six months of essential living costs. Sleep Well Money, while also promoting financial peace, emphasizes a broader approach by incorporating long-term savings and investments aimed at overall life stability, but the Emergency Fund remains the foundational buffer for urgent fiscal crises.

Holistic Emergency Cushion

A Holistic Emergency Cushion combines the principles of an Emergency Fund and Sleep Well Money by ensuring both immediate financial liquidity and emotional peace of mind during unforeseen events. This approach integrates sufficient cash reserves with long-term financial strategies to offer comprehensive money management that mitigates stress and preserves stability.

Financial Calm Capsule

Emergency Fund provides immediate financial security for unexpected expenses, while Sleep Well Money serves as a broader safety net ensuring peace of mind during prolonged uncertainties; both concepts converge in the Financial Calm Capsule, a strategic approach that balances liquidity and stability to optimize money management. Prioritizing a well-funded Emergency Fund within this capsule enhances short-term resilience, while Sleep Well Money secures long-term financial tranquility.

Serenity Stash

Serenity Stash emphasizes the importance of distinguishing between an Emergency Fund, designed for unexpected financial crises, and Sleep Well Money, which provides ongoing peace of mind through financial stability. Building a Serenity Stash ensures targeted savings that cover urgent expenses while fostering long-term serenity and confidence in money management.

Safety Net 2.0

Emergency Fund provides a crucial financial buffer for unexpected expenses, while Sleep Well Money offers a more flexible safety net 2.0 designed to cover broader emotional and lifestyle peace of mind. Prioritizing Sleep Well Money alongside a traditional Emergency Fund enhances overall money management by integrating psychological security with immediate financial preparedness.

Peace-of-Mind Pile

A Peace-of-Mind Pile, commonly known as Sleep Well Money, is a designated cash reserve that provides emotional security beyond the basic Emergency Fund's financial safety net. This fund emphasizes psychological comfort, ensuring that unexpected expenses do not disrupt one's peace of mind or sleep quality, complementing the traditional Emergency Fund's role in money management.

Emotional Wealth Vault

Emergency Fund and Sleep Well Money both serve as financial safety nets, with the Emergency Fund focused on immediate, unexpected expenses while Sleep Well Money emphasizes emotional security and peace of mind. The concept of Emotional Wealth Vault highlights managing finances not just for survival but to foster long-term emotional well-being and reduce stress related to money.

Emergency Fund vs Sleep Well Money for money management. Infographic

moneydiff.com

moneydiff.com