An Emergency Fund provides a financial safety net for unexpected expenses, ensuring stability during crises, while an Anti-Fragility Fund goes beyond by not only protecting assets but also enabling growth and resilience in volatile conditions. Managing money with an Emergency Fund focuses on risk minimization, whereas an Anti-Fragility Fund embraces uncertainty to capitalize on potential gains. Integrating both approaches can optimize financial security and adaptability in a fluctuating economic environment.

Table of Comparison

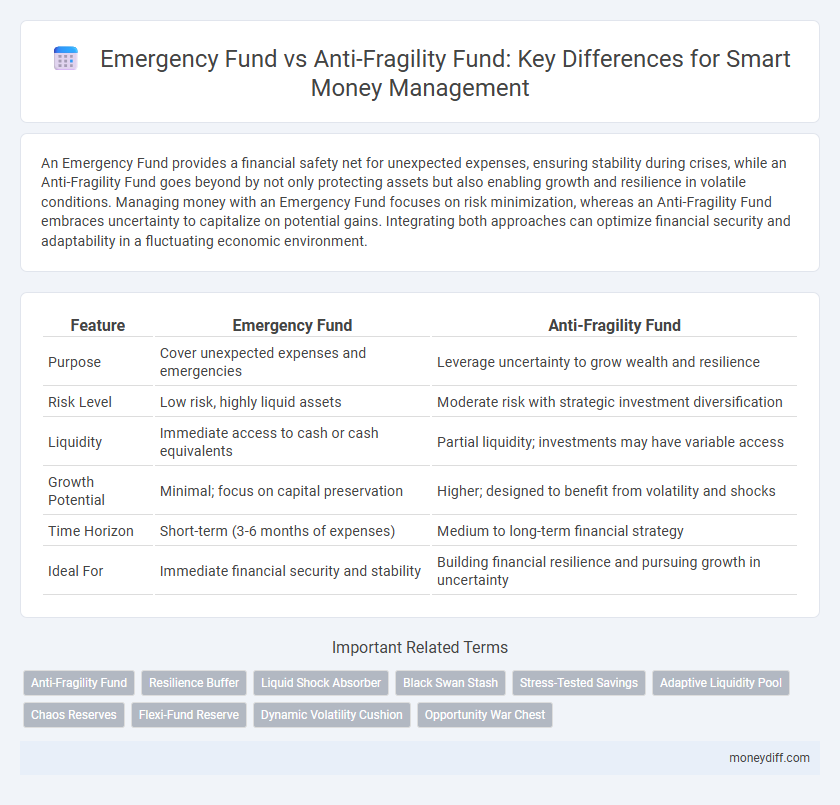

| Feature | Emergency Fund | Anti-Fragility Fund |

|---|---|---|

| Purpose | Cover unexpected expenses and emergencies | Leverage uncertainty to grow wealth and resilience |

| Risk Level | Low risk, highly liquid assets | Moderate risk with strategic investment diversification |

| Liquidity | Immediate access to cash or cash equivalents | Partial liquidity; investments may have variable access |

| Growth Potential | Minimal; focus on capital preservation | Higher; designed to benefit from volatility and shocks |

| Time Horizon | Short-term (3-6 months of expenses) | Medium to long-term financial strategy |

| Ideal For | Immediate financial security and stability | Building financial resilience and pursuing growth in uncertainty |

Understanding Emergency Funds: The Safety Net

An emergency fund serves as a financial safety net, providing immediate access to cash during unexpected expenses like medical emergencies or job loss, typically covering three to six months of living costs. Unlike an anti-fragility fund, which aims to grow stronger under stress by investing in volatile assets, an emergency fund prioritizes liquidity and stability to ensure security in times of crisis. Understanding emergency funds is crucial for effective money management, as they prevent reliance on high-interest debt and provide peace of mind during financial uncertainty.

What Is an Anti-Fragility Fund?

An Anti-Fragility Fund is a financial strategy designed to not only withstand economic shocks but also benefit from market volatility, enhancing wealth during crises. Unlike a traditional Emergency Fund, which focuses on liquidity and safety for unexpected expenses, an Anti-Fragility Fund leverages diversified investments that thrive under stress, such as options, volatility indices, or alternative assets. This approach aims to create financial resilience by turning uncertainty into opportunity, supporting long-term wealth growth and stability beyond mere preservation of capital.

Key Differences: Emergency Fund vs Anti-Fragility Fund

An Emergency Fund is designed to cover essential expenses during unexpected financial setbacks, typically held in highly liquid, low-risk accounts. In contrast, an Anti-Fragility Fund not only protects against shocks but also aims to benefit and grow from volatility by incorporating diverse, adaptive investment strategies. The key difference lies in purpose: Emergency Funds prioritize immediate stability, while Anti-Fragility Funds focus on resilience and growth through uncertainty.

Why Everyone Needs an Emergency Fund

An Emergency Fund provides immediate financial security by covering unexpected expenses such as medical bills, car repairs, or job loss, ensuring stability during crises. Unlike an Anti-Fragility Fund, which aims to grow stronger through disorder, an Emergency Fund prioritizes liquidity and accessibility to prevent debt accumulation. Maintaining at least three to six months of living expenses in a dedicated Emergency Fund is essential for effective money management and peace of mind.

Anti-Fragility Funds: Preparing for Opportunity

Anti-Fragility Funds enhance traditional emergency savings by not only providing financial security during crises but also capitalizing on volatility to generate wealth. This approach involves allocating resources in assets that benefit from market shocks, enabling proactive opportunity-driven growth rather than mere risk mitigation. Investors focusing on Anti-Fragility Funds prepare to thrive amid uncertainty, turning economic disruptions into strategic advantages.

How Much to Save in Each Fund

An effective money management strategy balances an Emergency Fund with an Anti-Fragility Fund by allocating three to six months' worth of essential living expenses to the Emergency Fund to cover immediate financial disruptions. In contrast, the Anti-Fragility Fund should be funded progressively over time, emphasizing investments or assets that grow stronger under stress, often starting with an amount equal to one month's discretionary income. Prioritizing the Emergency Fund ensures liquidity and safety, while the Anti-Fragility Fund builds financial resilience and long-term growth potential.

Where to Store Your Emergency and Anti-Fragility Funds

Emergency funds should be stored in highly liquid accounts such as high-yield savings or money market accounts to ensure quick access during financial emergencies. Anti-fragility funds, designed to grow stronger under stress, can benefit from a diversified allocation including ETFs, dividend-paying stocks, and short-term bonds to balance growth and risk. Prioritizing accessibility for emergency funds and strategic growth for anti-fragility funds optimizes overall financial resilience.

Benefits of Combining Both Funds

Combining an Emergency Fund with an Anti-Fragility Fund enhances financial resilience by providing immediate liquidity for unexpected expenses while simultaneously enabling wealth growth through strategic risk-taking. This dual approach ensures stability during crises and leverages market volatility to increase long-term financial strength. Integrating both funds optimizes risk management and financial security, fostering adaptability in uncertain economic environments.

When to Use Your Emergency Fund vs Anti-Fragility Fund

Use your Emergency Fund for unexpected, immediate financial crises such as medical emergencies, car repairs, or sudden job loss to cover essential expenses without incurring debt. Access the Anti-Fragility Fund for opportunities that strengthen financial resilience, like investing in skill development, business ventures, or market dips, enhancing long-term wealth and adaptability. Allocating funds strategically ensures short-term security with the Emergency Fund and promotes growth and robustness through the Anti-Fragility Fund.

Steps to Build Stronger Financial Resilience

Building a robust financial resilience starts with establishing an emergency fund covering three to six months of essential expenses to absorb unexpected financial shocks. To enhance this foundation, developing an anti-fragility fund involves diversifying assets and investing in opportunities that grow stronger under stress, such as inflation-protected securities and income-generating assets. Combining these strategies ensures liquidity during crises while simultaneously building wealth that thrives amid volatility.

Related Important Terms

Anti-Fragility Fund

An Anti-Fragility Fund goes beyond a traditional Emergency Fund by not only protecting against financial shocks but also enabling growth and resilience during economic volatility. This approach emphasizes dynamic asset allocation and cash flow flexibility, allowing individuals to capitalize on market opportunities while maintaining a safety net.

Resilience Buffer

An Emergency Fund provides a basic financial safety net to cover unexpected expenses, typically amounting to three to six months of living costs, but an Anti-Fragility Fund goes beyond by actively enhancing financial resilience through strategic investments that grow stronger under stress. This Resilience Buffer not only protects against shocks but also adapts to uncertainties, ensuring long-term stability and wealth preservation.

Liquid Shock Absorber

An Emergency Fund serves as a liquid shock absorber by providing readily accessible cash to cover unexpected expenses, ensuring financial stability without resorting to debt. In contrast, an Anti-Fragility Fund goes beyond liquidity by strategically allocating resources to investments that grow stronger under stress, optimizing long-term resilience in money management.

Black Swan Stash

An Emergency Fund provides immediate liquidity for predictable crises, whereas a Black Swan Stash focuses on anti-fragility by preparing for rare, high-impact financial events beyond standard emergencies. Incorporating a Black Swan Stash enhances resilience by safeguarding assets from unpredictable market shocks and systemic failures, complementing traditional emergency savings with strategic risk management.

Stress-Tested Savings

Stress-tested savings in an Emergency Fund provide a critical financial buffer against unexpected expenses by maintaining liquidity and immediate access to cash, while an Anti-Fragility Fund enhances money management by growing wealth through exposure to stressors and volatility, ultimately turning shocks into opportunities for financial gain. Comparing both, emergency funds prioritize stability and protection, whereas anti-fragility funds emphasize resilience and adaptive growth in fluctuating economic conditions.

Adaptive Liquidity Pool

An Emergency Fund provides immediate financial security by covering essential expenses during unexpected events, while an Anti-Fragility Fund incorporates an Adaptive Liquidity Pool designed to not only absorb shocks but also optimize growth opportunities under stress. This Adaptive Liquidity Pool dynamically reallocates assets to enhance resilience and capitalize on market volatility, ensuring long-term financial stability beyond traditional savings.

Chaos Reserves

Emergency Funds provide a safety net covering 3-6 months of essential expenses to absorb financial shocks, while Anti-Fragility Funds or Chaos Reserves actively leverage volatility to enhance wealth resilience and growth beyond mere survival. Chaos Reserves integrate adaptive strategies such as dynamic asset allocation and opportunistic investing, positioning money management to not just withstand but benefit from market uncertainties.

Flexi-Fund Reserve

A Flexi-Fund Reserve serves as a dynamic financial buffer that adapts to unexpected expenses, unlike a traditional Emergency Fund which typically holds a fixed amount for fixed risks. Emphasizing anti-fragility, a Flexi-Fund Reserve allows for strategic liquidity management, empowering individuals to not only withstand shocks but also capitalize on financial opportunities during crises.

Dynamic Volatility Cushion

An Emergency Fund provides a static financial safety net for unexpected expenses, whereas an Anti-Fragility Fund incorporates a Dynamic Volatility Cushion to adapt and grow through market fluctuations, enhancing resilience against economic shocks. This strategic approach leverages volatility to increase capital robustness rather than merely preserving it.

Opportunity War Chest

An Emergency Fund provides a financial safety net for unexpected expenses, while an Anti-Fragility Fund functions as an Opportunity War Chest that capitalizes on market downturns and investment opportunities. Prioritizing an Opportunity War Chest enhances money management by enabling proactive wealth growth through strategic risk-taking rather than mere preservation.

Emergency Fund vs Anti-Fragility Fund for money management Infographic

moneydiff.com

moneydiff.com