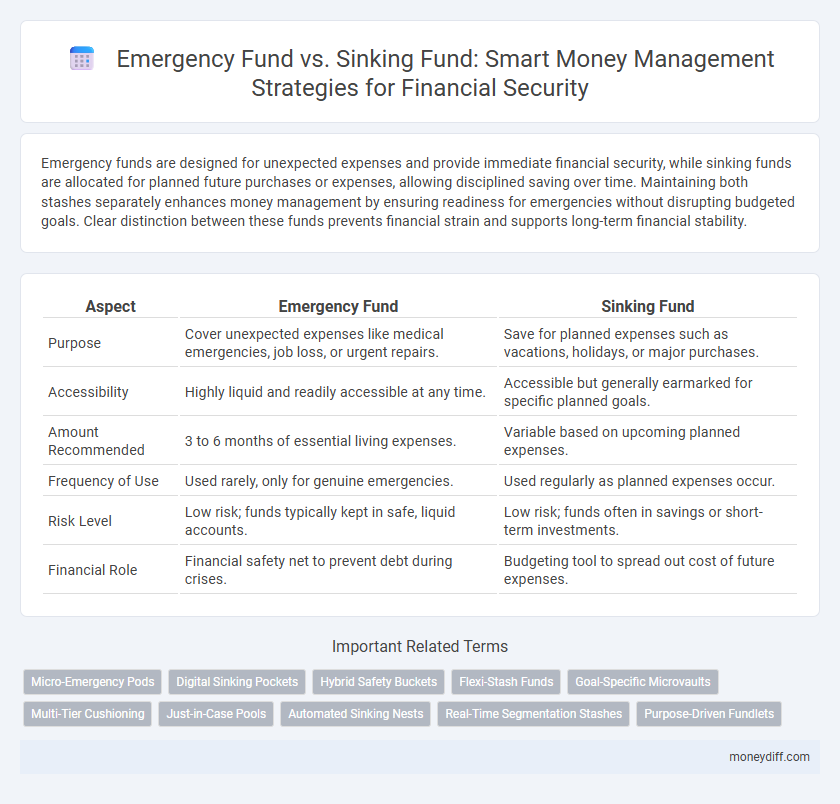

Emergency funds are designed for unexpected expenses and provide immediate financial security, while sinking funds are allocated for planned future purchases or expenses, allowing disciplined saving over time. Maintaining both stashes separately enhances money management by ensuring readiness for emergencies without disrupting budgeted goals. Clear distinction between these funds prevents financial strain and supports long-term financial stability.

Table of Comparison

| Aspect | Emergency Fund | Sinking Fund |

|---|---|---|

| Purpose | Cover unexpected expenses like medical emergencies, job loss, or urgent repairs. | Save for planned expenses such as vacations, holidays, or major purchases. |

| Accessibility | Highly liquid and readily accessible at any time. | Accessible but generally earmarked for specific planned goals. |

| Amount Recommended | 3 to 6 months of essential living expenses. | Variable based on upcoming planned expenses. |

| Frequency of Use | Used rarely, only for genuine emergencies. | Used regularly as planned expenses occur. |

| Risk Level | Low risk; funds typically kept in safe, liquid accounts. | Low risk; funds often in savings or short-term investments. |

| Financial Role | Financial safety net to prevent debt during crises. | Budgeting tool to spread out cost of future expenses. |

Understanding Emergency Funds: Purpose and Importance

Emergency funds serve as a financial safety net designed to cover unexpected expenses such as medical emergencies, car repairs, or job loss, ensuring stability without incurring debt. Unlike sinking funds, which are allocated for planned future expenses like vacations or large purchases, emergency funds prioritize liquidity and immediate accessibility to protect against unforeseen financial shocks. Maintaining an emergency fund with three to six months' worth of living expenses is crucial for effective money management and long-term financial security.

What Are Sinking Funds? Key Concepts Explained

Sinking funds are specialized savings accounts designated for specific future expenses, helping individuals allocate money systematically over time to avoid financial strain. Unlike emergency funds that cover unexpected crises, sinking funds target planned costs such as vacations, car repairs, or annual insurance premiums. This proactive money management strategy ensures funds are readily available when required, reducing reliance on credit or loans.

Emergency Fund vs Sinking Fund: Core Differences

Emergency funds provide immediate financial security by covering unexpected expenses such as medical emergencies or job loss, while sinking funds are designated savings for planned future expenses like vacations or home repairs. Emergency funds require liquidity and readily accessible cash, typically held in savings accounts, whereas sinking funds can be more flexible in timing and amount accumulation. The core difference lies in their purpose: emergency funds mitigate financial shocks, whereas sinking funds facilitate budgeting for anticipated, non-urgent costs.

When to Use an Emergency Fund: Real-Life Scenarios

Emergency funds are essential for unexpected expenses such as medical emergencies, car repairs, or sudden job loss, providing immediate financial security without resorting to debt. Unlike sinking funds, which are allocated for planned expenses like vacations or home improvements, emergency funds should remain liquid and easily accessible for truly unforeseen situations. Maintaining three to six months' worth of living expenses in an emergency fund ensures preparedness during real-life financial crises.

Smart Uses for Sinking Funds: Planned Expenses Made Easy

Sinking funds enable strategic saving for planned expenses like annual insurance premiums, holiday gifts, or vehicle maintenance, ensuring funds are readily available without disrupting emergency savings. Unlike emergency funds designated for unexpected crises, sinking funds promote disciplined budgeting by allocating money across multiple anticipated costs throughout the year. This proactive approach reduces financial stress and enhances money management by separating routine expenses from true emergencies.

Building Both: How to Strategize Savings for Each

Emergency funds provide immediate liquidity for unexpected expenses, while sinking funds allocate money toward planned future costs like vacations or car repairs. To strategically build both, prioritize establishing an emergency fund covering three to six months of living expenses before funneling excess savings into sinking funds for specific goals. Regularly reassess and adjust contributions to maintain optimal balances aligned with your financial timelines and risk tolerance.

How Much Should You Save: Emergency vs Sinking Funds

Emergency funds typically require three to six months' worth of essential living expenses to cover unexpected financial emergencies such as job loss or medical bills. Sinking funds, on the other hand, are allocated for planned future expenses like car repairs or vacations and are usually smaller, based on the cost of the anticipated purchase divided by the months until the expense occurs. Prioritizing a fully funded emergency fund before building sinking funds ensures financial stability during unforeseen crises.

Common Mistakes: Mixing Up Emergency and Sinking Funds

Mixing up emergency funds and sinking funds is a common money management mistake that can jeopardize financial stability. Emergency funds are meant for unexpected expenses like medical bills or job loss, while sinking funds are allocated for planned future purchases such as home repairs or vacations. Confusing the two can lead to overspending or insufficient reserves when urgent financial needs arise, underscoring the importance of clearly separating these savings for optimal financial preparedness.

Budgeting Tips: Allocating Income for Both Fund Types

Allocating income effectively between emergency funds and sinking funds enhances financial stability by addressing immediate crises and planned expenses separately. Prioritize building an emergency fund with three to six months' worth of living expenses before directing excess income to sinking funds for future purchases or debt payments. Consistent budgeting that dedicates specific income percentages to each fund ensures balanced resource allocation and readiness for unexpected events.

Maximizing Financial Security: Integrating Emergency and Sinking Fund Strategies

Maximizing financial security involves integrating emergency funds and sinking funds as complementary money management strategies. An emergency fund provides immediate liquidity for unforeseen expenses, ideally covering three to six months of essential living costs, while sinking funds allocate targeted savings for predictable future expenses like vacations or major repairs. Combining these stashes enhances financial resilience by ensuring both sudden emergencies and planned expenditures are adequately funded without disrupting overall financial stability.

Related Important Terms

Micro-Emergency Pods

Emergency Fund and Sinking Fund stashes serve distinct roles in money management, with Emergency Funds specifically designed to cover unexpected financial crises, while Sinking Funds are allocated for planned expenses over time. Micro-Emergency Pods enhance financial resilience by segmenting emergency savings into smaller, targeted reserves, ensuring immediate access to funds for specific urgent needs without depleting the main emergency reserve.

Digital Sinking Pockets

Emergency funds provide immediate liquidity for unforeseen expenses, while digital sinking pockets offer a structured approach to saving for specific future financial goals by segmenting funds digitally. Utilizing digital sinking pockets enhances money management by allowing users to allocate and track savings targets efficiently within a single platform.

Hybrid Safety Buckets

Emergency Fund and Sinking Fund stashes serve distinct roles in money management, with Emergency Funds providing liquid safety nets for unforeseen expenses and Sinking Funds earmarked for planned future costs. Hybrid Safety Buckets combine these approaches by allocating resources to both immediate emergencies and predictable financial obligations, optimizing liquidity and financial stability simultaneously.

Flexi-Stash Funds

Flexi-Stash Funds provide a versatile solution by combining the liquidity of Emergency Funds with the targeted savings approach of Sinking Funds, allowing for accessible cash in unforeseen situations while earmarking money for planned expenses. This flexible financial strategy enhances money management by ensuring funds are readily available without sacrificing long-term savings goals.

Goal-Specific Microvaults

Emergency funds provide essential liquidity for unplanned expenses, while sinking funds are goal-specific microvaults designed to systematically save for anticipated costs such as vacations or car repairs. Utilizing sinking funds enhances money management by allocating targeted resources, preventing disruption to emergency reserves and promoting disciplined saving habits.

Multi-Tier Cushioning

Emergency Fund serves as immediate financial protection covering 3-6 months of essential expenses for unexpected disruptions, while a Sinking Fund targets planned future expenses by accumulating specific savings over time. Multi-Tier Cushioning combines both by allocating funds into distinct layers: an emergency buffer, short-term sinking reserves for upcoming costs, and long-term savings, optimizing overall money management and financial resilience.

Just-in-Case Pools

Emergency funds serve as Just-in-Case pools designed to cover unexpected expenses such as medical emergencies or sudden job loss, providing immediate financial security without planned use. In contrast, sinking funds are strategically allocated savings for foreseeable expenses like home repairs or vacations, ensuring disciplined money management by spreading out costs over time.

Automated Sinking Nests

Automated sinking nests enhance money management by systematically allocating funds for specific future expenses, distinguishing them from emergency funds which cover unexpected financial crises. This structured approach promotes disciplined savings, reduces financial stress, and prevents depletion of emergency reserves.

Real-Time Segmentation Stashes

Emergency Fund stashes prioritize liquidity for immediate, unforeseen expenses, whereas Sinking Fund stashes allocate money for planned future costs. Real-Time Segmentation stashes enhance money management by dynamically categorizing funds, enabling precise tracking and instant adjustments between emergency and sinking allocations.

Purpose-Driven Fundlets

Emergency funds are designed to cover unexpected expenses like medical emergencies or job loss, providing financial security during unforeseen events, while sinking funds are purpose-driven stashes allocated for planned future expenses such as car repairs or vacations. Differentiating these fundlets enhances money management by ensuring liquidity for urgent needs and strategic saving for anticipated costs.

Emergency Fund vs Sinking Fund Stashes for money management Infographic

moneydiff.com

moneydiff.com