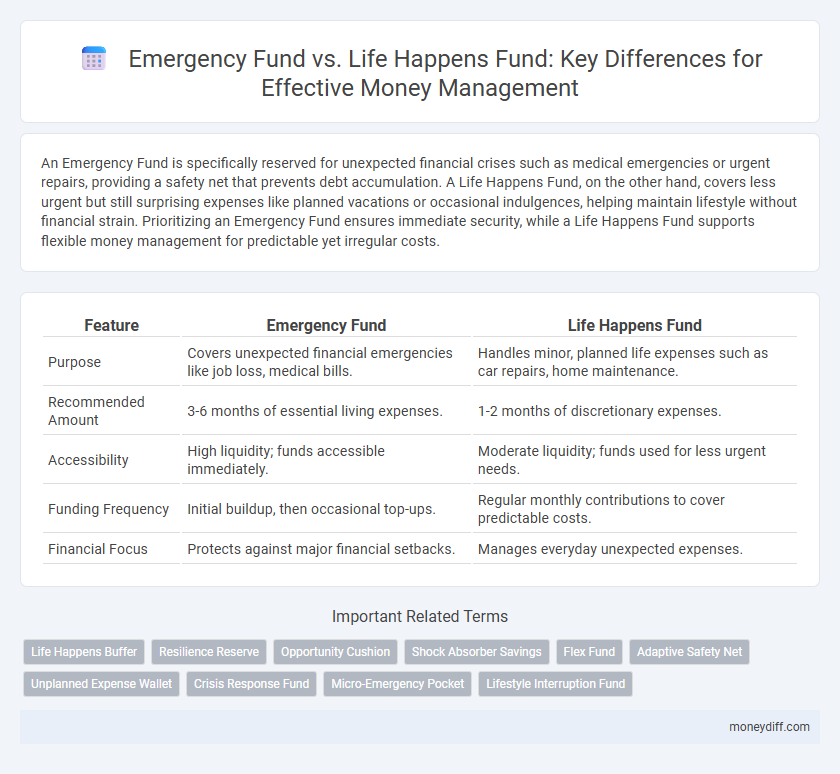

An Emergency Fund is specifically reserved for unexpected financial crises such as medical emergencies or urgent repairs, providing a safety net that prevents debt accumulation. A Life Happens Fund, on the other hand, covers less urgent but still surprising expenses like planned vacations or occasional indulgences, helping maintain lifestyle without financial strain. Prioritizing an Emergency Fund ensures immediate security, while a Life Happens Fund supports flexible money management for predictable yet irregular costs.

Table of Comparison

| Feature | Emergency Fund | Life Happens Fund |

|---|---|---|

| Purpose | Covers unexpected financial emergencies like job loss, medical bills. | Handles minor, planned life expenses such as car repairs, home maintenance. |

| Recommended Amount | 3-6 months of essential living expenses. | 1-2 months of discretionary expenses. |

| Accessibility | High liquidity; funds accessible immediately. | Moderate liquidity; funds used for less urgent needs. |

| Funding Frequency | Initial buildup, then occasional top-ups. | Regular monthly contributions to cover predictable costs. |

| Financial Focus | Protects against major financial setbacks. | Manages everyday unexpected expenses. |

Understanding Emergency Funds: Definition and Purpose

Emergency funds are savings specifically set aside to cover unexpected expenses such as medical emergencies, car repairs, or sudden job loss. Unlike a Life Happens Fund, which is designed for broader life events including planned expenses like vacations or education, emergency funds prioritize immediate financial security and liquidity. Establishing an emergency fund typically involves accumulating three to six months' worth of essential living expenses to ensure stability during unforeseen financial hardships.

What is a Life Happens Fund?

A Life Happens Fund is a flexible savings account designed to cover unplanned but non-emergency expenses, such as car repairs, home maintenance, or medical bills not covered by insurance. Unlike an Emergency Fund, which is reserved strictly for critical situations like job loss or major health crises, a Life Happens Fund provides financial cushioning for everyday unexpected costs, helping prevent disruptions to your budget. This fund improves overall money management by reducing reliance on credit and preserving the Emergency Fund for true emergencies.

Key Differences Between Emergency Fund and Life Happens Fund

An Emergency Fund is specifically designed to cover unforeseen expenses related to essential living costs, such as medical emergencies, car repairs, or job loss, aiming to provide financial stability during urgent situations. In contrast, a Life Happens Fund offers more flexible financial support for non-essential or anticipated irregular expenses like vacations, home improvements, or gifts. The primary difference lies in the purpose and urgency, with the Emergency Fund dedicated to immediate, critical needs and the Life Happens Fund accommodating planned or less critical expenditures.

When Should You Use an Emergency Fund?

Use an emergency fund exclusively for unexpected, urgent expenses like medical emergencies, car repairs, or job loss to maintain financial stability without accruing debt. A life happens fund covers planned but occasional costs such as vacations, home renovations, or new electronics, which do not require immediate attention. Accessing the emergency fund only during true financial crises ensures it remains intact when unforeseen hardships arise.

Common Uses for a Life Happens Fund

A Life Happens Fund commonly covers unexpected expenses such as minor home repairs, car maintenance, and occasional medical bills that fall outside of regular insurance coverage. It serves as a financial buffer for non-catastrophic but unforeseen events, supporting flexibility in day-to-day money management. Unlike a traditional Emergency Fund, which targets major crises like job loss or natural disasters, a Life Happens Fund addresses smaller-scale financial surprises.

Benefits of Separating Emergency and Life Happens Funds

Separating Emergency Funds from Life Happens Funds ensures clear financial boundaries, improving budgeting and reducing the risk of depleting critical savings during unforeseen crises. Emergency Funds are strictly reserved for urgent, unexpected expenses such as medical emergencies or job loss, whereas Life Happens Funds cover planned but irregular costs like home repairs or car maintenance. Maintaining distinct accounts enhances financial discipline and provides targeted protection, leading to greater overall money management efficiency.

How Much Should You Save in Each Fund?

For effective money management, an Emergency Fund should ideally cover three to six months of essential living expenses, ensuring financial stability during unexpected events like job loss or medical emergencies. A Life Happens Fund, by contrast, is more flexible and typically set at a smaller amount, around one to two months of discretionary spending, designed to handle less severe but unforeseen costs such as minor home repairs or car maintenance. Prioritizing these savings targets helps balance immediate financial resilience with preparedness for routine life challenges.

Tips for Building Both Funds Simultaneously

Allocate a fixed percentage of your monthly income to separate accounts for both your Emergency Fund and Life Happens Fund to ensure consistent growth. Prioritize high-yield savings accounts for liquidity and better interest returns, while setting clear goals for each fund's purpose and target amount. Automate transfers and regularly review your budget to balance contributions effectively without compromising essential expenses.

Mistakes to Avoid with Emergency and Life Happens Funds

Common mistakes to avoid with Emergency Funds and Life Happens Funds include underfunding them, which leaves individuals vulnerable during unexpected financial crises. Confusing these funds by using them interchangeably can disrupt financial planning, as Emergency Funds are designed for urgent, unforeseen expenses while Life Happens Funds cover planned but irregular costs. Neglecting to regularly reassess and adjust fund amounts based on changing life circumstances reduces their effectiveness and financial security.

Choosing the Right Fund for Unexpected Expenses

Emergency funds are designed to cover essential, unforeseen expenses like medical emergencies, car repairs, or job loss, typically maintaining three to six months' worth of living expenses. Life Happens Funds, by contrast, provide more flexible savings for unpredictable but non-essential costs such as home renovations or education, often with a broader scope and less strict usage guidelines. Selecting the right fund depends on prioritizing immediate financial stability through an emergency fund while supplementing with a Life Happens Fund for long-term, less urgent financial goals.

Related Important Terms

Life Happens Buffer

The Life Happens Buffer acts as a flexible financial cushion designed to cover unexpected, non-emergency expenses such as car repairs or minor home maintenance, distinguishing it from a traditional Emergency Fund which is reserved solely for critical, unforeseen crises like job loss or medical emergencies. This buffer enhances money management by reducing the likelihood of dipping into emergency savings for routine life events, thereby preserving financial stability and ensuring the Emergency Fund remains intact for true emergencies.

Resilience Reserve

A Resilience Reserve, often referred to as an Emergency Fund, is designed to cover unexpected expenses like medical emergencies or urgent repairs, providing financial stability during crises. In contrast, a Life Happens Fund is broader, prepared for planned life changes such as job transitions or education costs, making the Resilience Reserve a critical component for immediate financial resilience.

Opportunity Cushion

An Emergency Fund primarily covers unexpected expenses like medical bills or car repairs, ensuring financial stability without debt, while a Life Happens Fund acts as an Opportunity Cushion, providing the flexibility to seize spontaneous opportunities such as investment prospects or career changes. Prioritizing a Life Happens Fund enhances overall money management by balancing risk protection with growth potential.

Shock Absorber Savings

An Emergency Fund serves as a vital shock absorber savings, designed explicitly for unexpected expenses like medical emergencies, car repairs, or sudden job loss, providing immediate financial stability. In contrast, a Life Happens Fund is a broader savings approach encompassing planned irregular costs such as vacations or major home repairs, but lacks the targeted liquidity critical for urgent financial crises.

Flex Fund

A Flex Fund serves as a versatile alternative to traditional Emergency Funds and Life Happens Funds by covering unexpected expenses without strict limitations, promoting greater financial adaptability. Unlike rigid Emergency Funds that require strict allocation, a Flex Fund balances liquidity and accessibility, empowering more personalized money management strategies.

Adaptive Safety Net

An Emergency Fund provides a dedicated cash reserve specifically for unforeseen expenses such as medical emergencies or urgent home repairs, ensuring quick access to funds without debt. A Life Happens Fund acts as an adaptive safety net, offering flexible financial support for broader unpredictable life events like job loss or major life transitions, enabling greater resilience in money management.

Unplanned Expense Wallet

An Emergency Fund serves as a dedicated financial reservoir specifically for unplanned expenses such as medical emergencies or urgent home repairs, ensuring immediate liquidity without disrupting regular budgeting. In contrast, a Life Happens Fund covers broader unexpected life events beyond emergencies, but the Unplanned Expense Wallet within an Emergency Fund prioritizes quick access to cash for sudden, unavoidable costs.

Crisis Response Fund

A Crisis Response Fund differs from a traditional Emergency Fund by being specifically allocated for unexpected, large-scale events such as natural disasters or sudden job loss, providing targeted financial security. Unlike a Life Happens Fund, which covers general unforeseen expenses, a Crisis Response Fund ensures immediate access to resources critical for survival and recovery during severe emergencies.

Micro-Emergency Pocket

A Micro-Emergency Pocket within an Emergency Fund provides quick access to small amounts of cash for immediate, unexpected expenses, whereas a Life Happens Fund is designed to cover larger, unforeseen life events that require more substantial financial resources. Prioritizing a Micro-Emergency Pocket enhances daily financial resilience by preventing minor emergencies from escalating into significant debt.

Lifestyle Interruption Fund

A Lifestyle Interruption Fund differs from a traditional Emergency Fund by covering non-critical but significant disruptions such as temporary loss of income due to job transitions or extended travel delays. This fund typically holds three to six months of living expenses, ensuring financial stability while maintaining lifestyle standards during unforeseen interruptions.

Emergency Fund vs Life Happens Fund for money management. Infographic

moneydiff.com

moneydiff.com