Emergency Fund provides a financial safety net specifically for unexpected pet emergencies, ensuring immediate access to funds for veterinary care and urgent expenses. Life Happens Fund offers broader lifestyle protection, covering various unforeseen events beyond pets, such as job loss or major repairs. Prioritizing an Emergency Fund ensures pet owners can address critical pet-related incidents without disrupting overall financial stability.

Table of Comparison

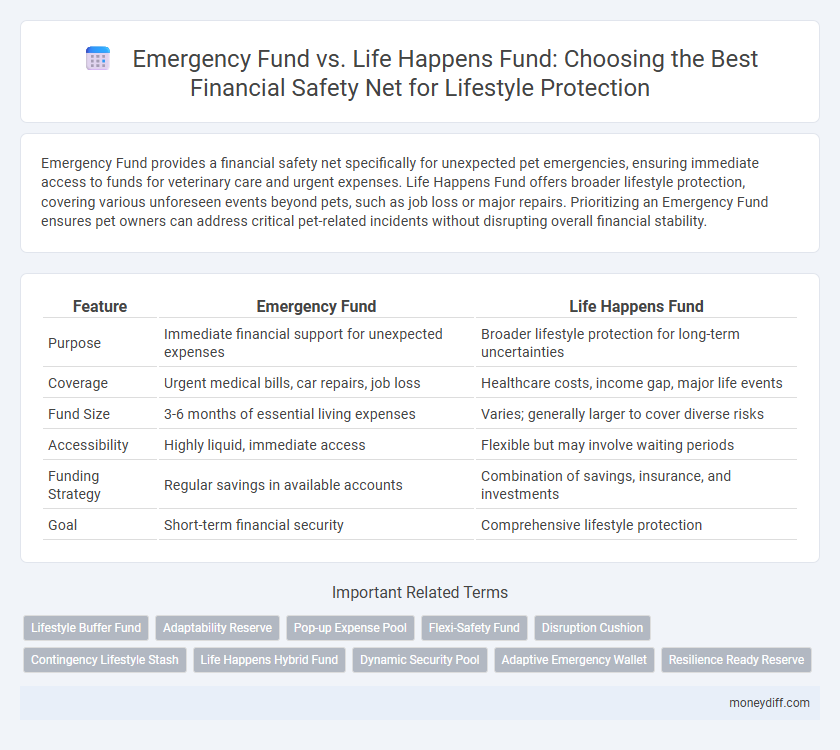

| Feature | Emergency Fund | Life Happens Fund |

|---|---|---|

| Purpose | Immediate financial support for unexpected expenses | Broader lifestyle protection for long-term uncertainties |

| Coverage | Urgent medical bills, car repairs, job loss | Healthcare costs, income gap, major life events |

| Fund Size | 3-6 months of essential living expenses | Varies; generally larger to cover diverse risks |

| Accessibility | Highly liquid, immediate access | Flexible but may involve waiting periods |

| Funding Strategy | Regular savings in available accounts | Combination of savings, insurance, and investments |

| Goal | Short-term financial security | Comprehensive lifestyle protection |

Understanding Emergency Funds: The Basics

An emergency fund typically covers essential expenses such as rent, utilities, and groceries for three to six months, serving as a financial safety net during sudden income loss or unexpected costs. Life Happens Fund extends beyond emergencies to include planned or periodic life events like medical bills, car repairs, or family obligations, offering broader lifestyle protection. Understanding the basics involves recognizing that an emergency fund is a foundational component of personal finance stability, while a Life Happens Fund complements it by addressing diverse, non-routine expenses.

What Is a Life Happens Fund?

A Life Happens Fund specifically covers unexpected lifestyle changes such as job loss, medical emergencies, or major home repairs, going beyond the typical expenses covered by a standard emergency fund. Unlike a traditional emergency fund, which is designed primarily for short-term financial crises, a Life Happens Fund provides a broader safety net to maintain your overall quality of life during prolonged disruptions. This fund ensures you have resources to support essential lifestyle needs and prevent financial setbacks in uncertain life circumstances.

Emergency Fund vs Life Happens Fund: Key Differences

Emergency Fund consists of readily accessible savings designed to cover unexpected expenses like medical bills, car repairs, or job loss, typically equaling three to six months of living costs. Life Happens Fund focuses on planned but irregular expenses such as home maintenance, insurance deductibles, or holiday gifts and is usually funded with smaller, regular contributions. The key difference lies in purpose and immediacy: Emergency Fund targets sudden financial shocks requiring immediate liquidity, whereas Life Happens Fund prepares for foreseeable lifestyle-related costs without disrupting long-term savings.

Why Both Funds Matter for Lifestyle Protection

Emergency Fund and Life Happens Fund serve distinct yet complementary roles in lifestyle protection by addressing immediate financial crises and unexpected life events, respectively. An Emergency Fund typically covers short-term essential expenses such as rent, utilities, and groceries for three to six months, ensuring stability during sudden income loss. The Life Happens Fund extends this protection by preparing for larger, unpredictable costs like medical emergencies, major repairs, or job retraining, making both funds crucial for comprehensive financial resilience.

Prioritizing Savings Goals: Where to Start

Emergency funds should be prioritized before allocating money to a Life Happens Fund because they provide immediate financial security during unexpected expenses like medical emergencies or job loss. A standard recommendation is to save three to six months' worth of living expenses in an accessible account for emergency funds, ensuring liquidity and stability. After securing an emergency fund, individuals can focus on a Life Happens Fund, which supports lifestyle protection through insurance premiums or long-term savings.

How Much Should You Save in Each Fund?

An adequate Emergency Fund typically covers three to six months of essential living expenses to protect against unexpected financial disruptions such as job loss or medical emergencies. A Life Happens Fund, designed for more significant, less predictable events like major home repairs or extended unemployment, generally requires saving an additional three to twelve months of expenses. Prioritizing the buildup of a fully funded Emergency Fund before allocating resources to a Life Happens Fund ensures a balanced and effective approach to lifestyle protection.

Best Practices for Building an Emergency Fund

Building a robust Emergency Fund requires setting aside three to six months' worth of essential living expenses in a highly accessible account, providing immediate financial support during unexpected events. Unlike a Life Happens Fund, which may cover broader lifestyle disruptions including long-term goals or non-essential expenses, an Emergency Fund prioritizes liquidity and quick access to cash for urgent needs like medical emergencies or job loss. Consistent monthly contributions, automatic transfers, and regular fund reviews ensure the Emergency Fund remains sufficient to protect your lifestyle from sudden financial shocks.

Smart Strategies for Growing a Life Happens Fund

A Life Happens Fund differs from a traditional Emergency Fund by encompassing broader lifestyle protection beyond immediate crises, including unexpected opportunities and planned major expenses. Smart strategies for growing a Life Happens Fund emphasize consistent, automated contributions, diversified investment vehicles with moderate risk, and regular fund adjustments aligned with evolving life goals. This approach ensures long-term financial resilience and flexibility for both emergencies and significant life events.

Common Mistakes When Managing Lifestyle Protection Funds

Common mistakes when managing emergency funds and Life Happens funds for lifestyle protection include conflating the two, leading to misallocation of resources and insufficient coverage during crises. Many individuals treat these funds interchangeably, overlooking their distinct purposes--emergency funds target immediate, unexpected expenses, while Life Happens funds cover broader lifestyle disruptions. Failing to maintain appropriate balances for each fund can result in financial strain during emergencies and prolonged life events, undermining effective lifestyle protection.

Integrating Emergency and Life Happens Funds for Financial Security

Integrating an Emergency Fund with a Life Happens Fund enhances financial security by addressing both unexpected crises and everyday life disruptions. An Emergency Fund typically covers essential expenses during sudden job loss or medical emergencies, while a Life Happens Fund manages smaller, unplanned costs like car repairs or minor home maintenance. Combining these funds ensures comprehensive lifestyle protection, reduces financial stress, and strengthens long-term resilience against financial shocks.

Related Important Terms

Lifestyle Buffer Fund

A Lifestyle Buffer Fund acts as a financial cushion specifically designed to maintain your standard of living during unexpected life events, bridging the gap between a traditional Emergency Fund and a Life Happens Fund. Unlike a basic Emergency Fund that covers essential expenses, the Lifestyle Buffer Fund safeguards discretionary spending, ensuring lifestyle consistency despite income disruptions.

Adaptability Reserve

An Emergency Fund provides a financial safety net for unforeseen expenses like medical bills or car repairs, while a Life Happens Fund serves as an Adaptability Reserve, offering broader lifestyle protection to cover income disruptions or major life changes. Prioritizing an Adaptability Reserve ensures flexibility to adjust financial planning amid evolving personal and economic circumstances.

Pop-up Expense Pool

An Emergency Fund is designed to cover unexpected, short-term financial disruptions such as medical emergencies or urgent repairs, while a Life Happens Fund serves as a pop-up expense pool for lifestyle protection, addressing sudden lifestyle changes like job loss or major life events. Prioritizing an Emergency Fund ensures immediate liquidity, whereas a Life Happens Fund provides a flexible buffer for longer-term adjustments in income or living expenses.

Flexi-Safety Fund

A Flexi-Safety Fund combines the core purpose of an Emergency Fund with the broader coverage of a Life Happens Fund, offering versatile financial protection for unexpected lifestyle disruptions beyond basic emergencies. This dynamic approach ensures liquidity for urgent needs while accommodating unforeseen life events such as job loss, medical expenses, or sudden repairs, maintaining stability without compromising long-term financial goals.

Disruption Cushion

An Emergency Fund serves as a disruption cushion by covering unexpected expenses like medical emergencies, car repairs, or job loss, ensuring financial stability without lifestyle compromise. A Life Happens Fund extends beyond immediate emergencies, providing a broader safety net for ongoing lifestyle protection during prolonged disruptions or major life changes.

Contingency Lifestyle Stash

A Contingency Lifestyle Stash serves as a dedicated segment within an Emergency Fund, specifically designed to protect regular lifestyle expenses during unexpected disruptions, distinguishing it from a broader Life Happens Fund that covers only critical emergencies like medical or job loss. Prioritizing this fund ensures immediate access to cash for maintaining rent, utilities, groceries, and other essential daily costs, thereby providing a vital financial buffer for lifestyle continuity.

Life Happens Hybrid Fund

The Life Happens Hybrid Fund combines the traditional Emergency Fund's quick-access savings with an investment component designed for long-term lifestyle protection, offering both liquidity and growth potential. This hybrid approach ensures individuals are financially prepared for immediate emergencies while simultaneously building a safety net that supports future lifestyle needs beyond unexpected expenses.

Dynamic Security Pool

An Emergency Fund primarily covers immediate, unexpected expenses like medical emergencies or car repairs, while a Life Happens Fund acts as a Dynamic Security Pool designed to provide ongoing financial support for lifestyle protection during prolonged disruptions such as job loss or major life changes. This dynamic fund adapts to evolving needs by maintaining liquidity and flexibility, ensuring comprehensive coverage beyond short-term emergencies.

Adaptive Emergency Wallet

An Adaptive Emergency Wallet offers a flexible approach to emergency funds by dynamically adjusting the reserve based on lifestyle changes and unexpected events, ensuring tailored financial protection. Unlike a traditional Life Happens Fund, which is a fixed lump sum, this adaptive method optimizes liquidity and accessibility while maintaining sufficient coverage for varying emergency scenarios.

Resilience Ready Reserve

An Emergency Fund serves as a Resilience Ready Reserve, providing immediate financial stability for unexpected expenses, while a Life Happens Fund offers broader lifestyle protection for ongoing, less predictable events. Prioritizing an Emergency Fund ensures liquidity and quick access to cash, reinforcing financial resilience during critical situations.

Emergency Fund vs Life Happens Fund for lifestyle protection. Infographic

moneydiff.com

moneydiff.com