An Emergency Fund is designed to cover unexpected, significant expenses such as medical emergencies or major car repairs, providing a financial safety net that prevents debt accumulation. A Rainy Day Reserve, on the other hand, is intended for smaller, anticipated expenses like minor home maintenance or short-term income interruptions, ensuring smooth cash flow without disrupting long-term savings. Both funds play crucial roles in money management by balancing immediate needs and financial stability during uncertain times.

Table of Comparison

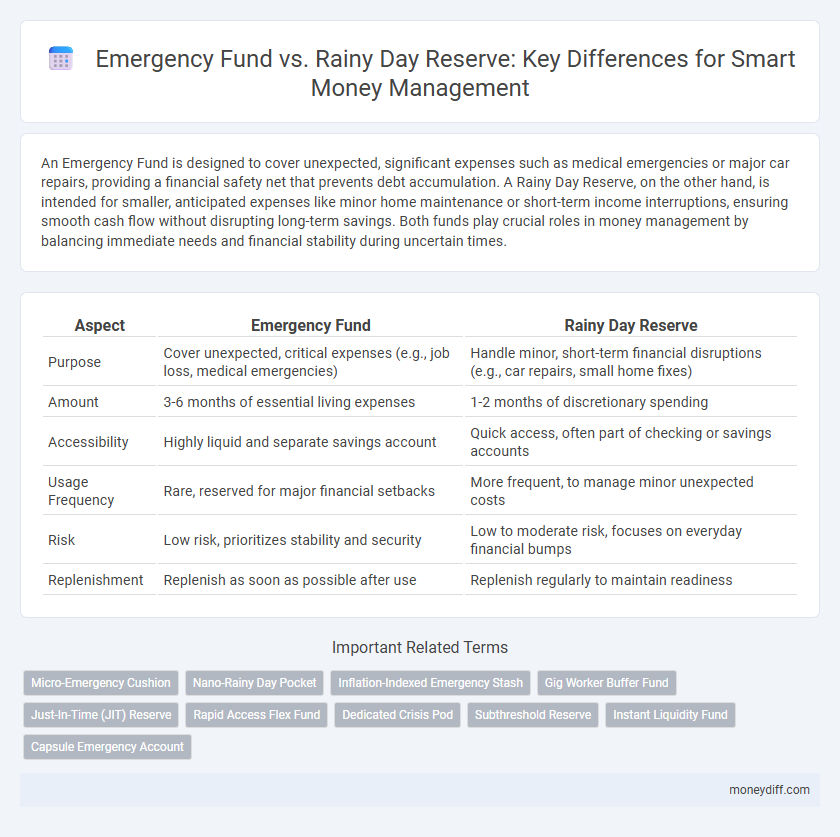

| Aspect | Emergency Fund | Rainy Day Reserve |

|---|---|---|

| Purpose | Cover unexpected, critical expenses (e.g., job loss, medical emergencies) | Handle minor, short-term financial disruptions (e.g., car repairs, small home fixes) |

| Amount | 3-6 months of essential living expenses | 1-2 months of discretionary spending |

| Accessibility | Highly liquid and separate savings account | Quick access, often part of checking or savings accounts |

| Usage Frequency | Rare, reserved for major financial setbacks | More frequent, to manage minor unexpected costs |

| Risk | Low risk, prioritizes stability and security | Low to moderate risk, focuses on everyday financial bumps |

| Replenishment | Replenish as soon as possible after use | Replenish regularly to maintain readiness |

Understanding Emergency Funds vs Rainy Day Reserves

An emergency fund is a dedicated savings pool designed to cover major, unexpected financial crises such as job loss or medical emergencies, typically amounting to three to six months of living expenses. A rainy day reserve, on the other hand, targets smaller, short-term expenses like car repairs or minor home maintenance, requiring less capital and quicker access. Differentiating between these two financial tools is crucial for effective money management, ensuring users allocate appropriate funds for both significant downturns and routine unexpected costs.

Key Differences Between Emergency Funds and Rainy Day Reserves

Emergency funds typically cover unexpected major expenses such as medical emergencies, job loss, or significant car repairs, aiming to maintain financial stability for three to six months of living expenses. Rainy day reserves are smaller pools of money set aside for minor, predictable costs like home maintenance, car servicing, or minor appliance repairs, often replenished quickly after use. The key difference lies in the purpose and size of the funds: emergency funds provide a financial safety net for severe, unforeseen crises, while rainy day reserves handle routine, short-term expenses.

Why You Need Both: Roles in Financial Planning

An Emergency Fund provides a dedicated financial buffer for unexpected, significant expenses like medical emergencies or job loss, ensuring long-term financial stability. A Rainy Day Reserve covers smaller, routine mishaps such as minor car repairs or temporary utility bill increases, helping to avoid disrupting your primary savings goals. Maintaining both funds optimizes money management by addressing different layers of risk and preserving overall financial health.

How Much to Save: Emergency Fund vs Rainy Day Reserve

An emergency fund typically requires saving three to six months' worth of essential living expenses to cover major unforeseen events like job loss or medical emergencies. In contrast, a rainy day reserve usually involves setting aside smaller amounts equivalent to one to two months of routine expenses, targeting minor, short-term financial setbacks such as car repairs or unexpected bills. Prioritizing the size and purpose of these funds helps in effective money management by ensuring appropriate financial cushioning for both major crises and everyday surprises.

When to Use Emergency Funds

Emergency funds are designed for significant, unexpected expenses such as medical emergencies, job loss, or major home repairs, providing a financial safety net that prevents debt accumulation. Rainy day reserves, typically smaller amounts set aside for minor, short-term expenses like car repairs or utility bills, should not deplete emergency funds. Use emergency funds only when facing substantial financial crises that disrupt your normal income or essential living expenses.

Typical Uses for a Rainy Day Reserve

A Rainy Day Reserve typically covers minor, unexpected expenses such as car repairs, small home maintenance costs, or temporary utility bill spikes. It is designed to manage short-term financial setbacks without disrupting monthly budgeting or long-term savings goals. This fund acts as a buffer to prevent the need to dip into more substantial emergency funds allocated for major financial crises.

Best Places to Keep Your Emergency Fund and Rainy Day Reserve

High-yield savings accounts offer an ideal location for both emergency funds and rainy day reserves, combining easy access with competitive interest rates that help grow your money safely. Money market accounts provide another secure option, delivering liquidity and slightly higher yields compared to traditional savings accounts. Avoid tying up emergency funds in investments with market risk or limited accessibility to ensure rapid availability during financial crises.

Building Your Emergency Fund: Step-by-Step Guide

Building your emergency fund begins with assessing your essential monthly expenses, aiming to save three to six months' worth for financial security during unexpected events. Prioritize automatic transfers to a dedicated, easily accessible savings account to ensure consistent growth and avoid spending temptation. Review and adjust contributions periodically based on changing expenses or income to maintain an adequate financial safety net.

Strategies for Growing a Rainy Day Reserve

Building a rainy day reserve requires a disciplined savings strategy that prioritizes setting aside a small, fixed percentage of income consistently. Automating transfers to a dedicated high-yield savings account accelerates fund growth while minimizing spending temptation. Regularly reviewing and adjusting contribution amounts in response to income changes ensures the reserve remains aligned with evolving financial needs and emergency fund goals.

Common Mistakes to Avoid With Emergency and Rainy Day Savings

Confusing emergency funds with rainy day reserves often leads to underpreparedness during genuine financial crises, as rainy day reserves are intended for small, predictable expenses while emergency funds cover major, unexpected costs. A common mistake is tapping into the emergency fund for routine expenses, which depletes the safety net needed for true emergencies. Another error is not regularly replenishing these funds after use, leaving one vulnerable during future financial challenges.

Related Important Terms

Micro-Emergency Cushion

A Micro-Emergency Cushion is a small, easily accessible fund designed to cover minor unexpected expenses, distinct from a larger Emergency Fund intended for significant financial crises. This Rainy Day Reserve acts as a frontline buffer, preventing the depletion of the primary Emergency Fund by handling everyday emergencies like car repairs or medical co-pays.

Nano-Rainy Day Pocket

The Emergency Fund serves as a substantial financial safety net covering major unexpected expenses, while the Nano-Rainy Day Pocket functions as a smaller, easily accessible reserve for minor, immediate cash needs. Managing a Nano-Rainy Day Pocket ensures quick liquidity without tapping into long-term Emergency Fund savings, optimizing overall money management and financial resilience.

Inflation-Indexed Emergency Stash

An inflation-indexed emergency fund ensures your savings maintain purchasing power during rising inflation, unlike a traditional rainy day reserve, which may lose value over time. Prioritizing an inflation-protected emergency stash helps safeguard financial stability by adjusting for cost-of-living increases in unexpected crises.

Gig Worker Buffer Fund

A Gig Worker Buffer Fund differs from a traditional Emergency Fund by providing a smaller, more flexible Rainy Day Reserve tailored to irregular income streams, ensuring immediate cash flow for unexpected expenses. This specialized reserve prioritizes liquidity and short-term accessibility, crucial for gig workers facing variable earnings and unsteady job security.

Just-In-Time (JIT) Reserve

An Emergency Fund is a carefully calculated, long-term financial safety net covering 3-6 months of essential expenses, whereas a Rainy Day Reserve functions as a short-term Just-In-Time (JIT) reserve designed for predictable, smaller unexpected costs like minor car repairs or medical copays. Prioritizing a JIT Rainy Day Reserve improves cash flow efficiency by addressing immediate financial needs without depleting the broader Emergency Fund, optimizing overall money management.

Rapid Access Flex Fund

An Emergency Fund is a rapidly accessible flexible fund designed to cover significant unexpected expenses like medical emergencies or major repairs, ensuring liquidity without disrupting long-term investments. In contrast, a Rainy Day Reserve typically holds smaller amounts for minor, non-urgent costs, offering less flexibility and immediate availability.

Dedicated Crisis Pod

A Dedicated Crisis Pod functions as a focused component of an emergency fund, specifically designed to cover unexpected, severe financial hardships beyond routine rainy day expenses. Unlike a general rainy day reserve, which manages minor, predictable disruptions, the Crisis Pod ensures substantial liquidity to address critical emergencies such as medical crises, job loss, or significant home repairs.

Subthreshold Reserve

A Subthreshold Reserve serves as a smaller, quick-access pool of funds within the broader Emergency Fund structure, designed to cover immediate, minor unexpected expenses without depleting the primary Emergency Fund. This targeted approach helps maintain financial stability by preventing frequent withdrawals from larger savings, optimizing money management through tiered reserves.

Instant Liquidity Fund

An Emergency Fund provides instant liquidity by holding easily accessible cash reserves designed to cover unforeseen expenses or income loss for three to six months. In contrast, a Rainy Day Reserve typically funds smaller, short-term unexpected costs and may not offer the same immediate access or financial stability during major emergencies.

Capsule Emergency Account

A Capsule Emergency Account acts as a dedicated fund specifically designed for unexpected, high-impact financial emergencies, distinguishing it from a Rainy Day Reserve, which covers smaller, routine expenses like minor car repairs or household needs. Prioritizing a well-funded Capsule Emergency Account ensures long-term financial stability by providing a robust safety net for significant events such as job loss or major medical bills.

Emergency Fund vs Rainy Day Reserve for money management. Infographic

moneydiff.com

moneydiff.com