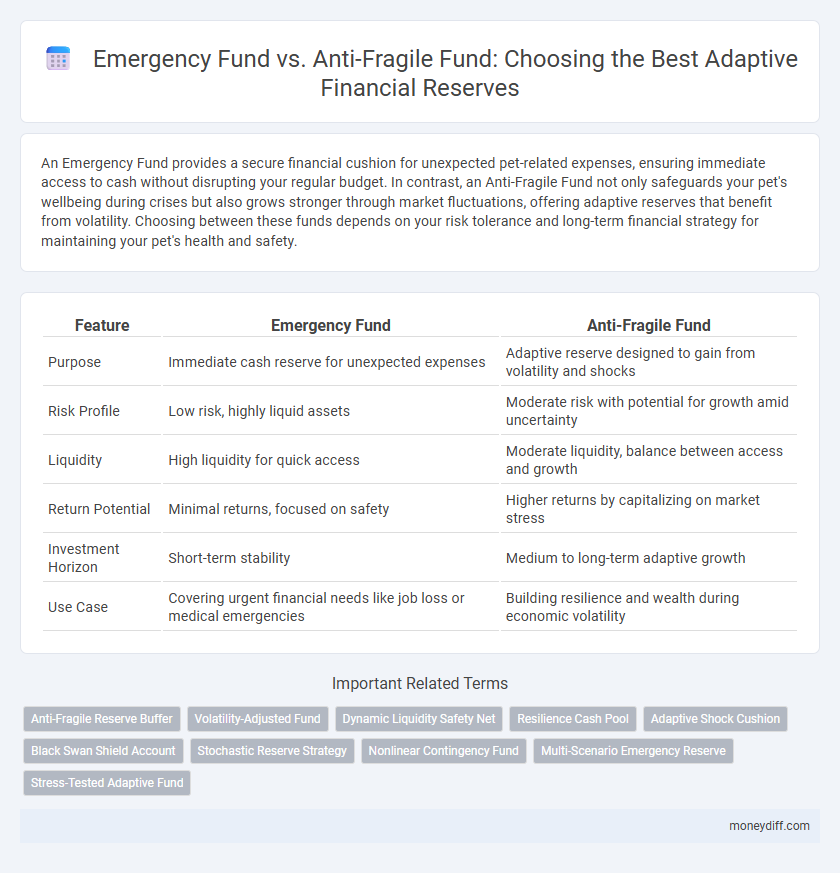

An Emergency Fund provides a secure financial cushion for unexpected pet-related expenses, ensuring immediate access to cash without disrupting your regular budget. In contrast, an Anti-Fragile Fund not only safeguards your pet's wellbeing during crises but also grows stronger through market fluctuations, offering adaptive reserves that benefit from volatility. Choosing between these funds depends on your risk tolerance and long-term financial strategy for maintaining your pet's health and safety.

Table of Comparison

| Feature | Emergency Fund | Anti-Fragile Fund |

|---|---|---|

| Purpose | Immediate cash reserve for unexpected expenses | Adaptive reserve designed to gain from volatility and shocks |

| Risk Profile | Low risk, highly liquid assets | Moderate risk with potential for growth amid uncertainty |

| Liquidity | High liquidity for quick access | Moderate liquidity, balance between access and growth |

| Return Potential | Minimal returns, focused on safety | Higher returns by capitalizing on market stress |

| Investment Horizon | Short-term stability | Medium to long-term adaptive growth |

| Use Case | Covering urgent financial needs like job loss or medical emergencies | Building resilience and wealth during economic volatility |

Understanding Emergency Funds: The Financial Safety Net

Emergency funds serve as essential financial safety nets, providing quick access to liquid cash for unexpected expenses such as medical emergencies or job loss. Anti-fragile funds, in contrast, are designed to not only withstand shocks but to grow stronger through volatility, incorporating adaptive investment strategies that balance risk and resilience. Understanding the distinction between these funds helps individuals build a comprehensive financial reserve that offers immediate security while promoting long-term financial adaptability.

Defining the Anti-Fragile Fund: Beyond Traditional Savings

An Anti-Fragile Fund transcends traditional emergency savings by not only preserving capital but also growing stronger amid economic volatility and unexpected challenges. Unlike standard Emergency Funds that focus on liquidity and safety, Anti-Fragile Funds allocate resources into adaptive, diversified assets designed to benefit from stressors and market disruptions. This strategic approach ensures reserves are not just reactive buffers but proactive growth mechanisms enhancing financial resilience over time.

Key Differences Between Emergency Funds and Anti-Fragile Funds

Emergency Funds prioritize liquidity and stability, offering immediate access to cash for unexpected expenses like job loss or medical emergencies, typically covering three to six months of essential living costs. Anti-Fragile Funds, in contrast, are designed to grow stronger under stress and volatility by allocating resources to diversified, high-risk, and high-reward investments that benefit from market fluctuations. Key differences include the purpose--immediate financial safety versus long-term resilience and growth--and the risk profile, with Emergency Funds emphasizing capital preservation and Anti-Fragile Funds embracing uncertainty to build adaptive reserves.

The Role of Adaptability in Modern Financial Planning

Emergency funds provide a crucial financial safety net for unexpected expenses, while anti-fragile funds enhance adaptability by growing stronger through market volatility and economic shocks. Incorporating anti-fragile strategies into reserve planning fosters resilience, allowing portfolios to recover and thrive under stress. Modern financial planning increasingly prioritizes adaptability, balancing traditional liquidity with dynamic growth opportunities to safeguard long-term wealth.

When to Use an Emergency Fund vs an Anti-Fragile Fund

An Emergency Fund provides a financial safety net for immediate, unexpected expenses such as medical emergencies, job loss, or urgent repairs, ensuring liquidity and short-term security. An Anti-Fragile Fund, in contrast, is designed to grow stronger in volatile or adverse conditions by investing in assets that benefit from market shocks, serving as an adaptive reserve for long-term financial resilience. Use an Emergency Fund for sudden, essential cash needs requiring stability, while an Anti-Fragile Fund fits when seeking to leverage uncertainty for wealth accumulation and protection against systemic risks.

Building an Emergency Fund: Best Practices

Building an emergency fund requires prioritizing liquidity and accessibility to cover unexpected expenses, with a recommended three to six months of living costs held in a high-yield savings account or money market fund. Unlike anti-fragile funds, which are designed to grow stronger under stress by taking calculated risks and diversifying across volatile assets, emergency funds focus on stability and immediate availability. Consistently contributing to this reserve and revisiting the fund's size and allocation during major life changes ensures financial resilience during economic downturns or personal crises.

Designing an Anti-Fragile Fund for Future Uncertainties

Designing an Anti-Fragile Fund involves creating adaptive reserves that not only withstand shocks but also grow stronger amid volatility, compared to traditional Emergency Funds that primarily protect against income disruptions. Incorporating diverse asset classes such as real assets, options strategies, and resilient growth equities enhances the fund's ability to capitalize on uncertainty and market stress. This strategic approach positions the Anti-Fragile Fund as a dynamic financial buffer designed to thrive through future economic fluctuations and unforeseen crises.

Advantages and Drawbacks: Emergency Fund vs Anti-Fragile Fund

An Emergency Fund provides liquidity and safety, ensuring immediate access to cash for unforeseen expenses, but often yields low returns and loses purchasing power due to inflation. An Anti-Fragile Fund, designed to benefit from volatility and economic stress, offers potential growth and resilience by adapting to market fluctuations, though it carries higher risk and less immediate availability of funds. Balancing these adaptive reserves involves weighing the guaranteed stability of emergency savings against the opportunistic growth of anti-fragile assets.

How to Integrate Both Funds Into Your Money Management Strategy

Integrate an Emergency Fund and an Anti-Fragile Fund by allocating liquid savings for immediate access while channeling adaptive reserves into diversified, high-resilience assets that grow under stress. Prioritize maintaining three to six months of essential expenses in your Emergency Fund, complemented by strategic investments aimed at capitalizing on economic volatility within the Anti-Fragile Fund. This dual approach optimizes liquidity and long-term financial strength, ensuring both protection and growth in uncertain market conditions.

Ensuring Financial Resilience: The Path to Adaptive Reserves

An Emergency Fund provides immediate liquidity to cover unexpected expenses, ensuring short-term financial stability during crises. In contrast, an Anti-Fragile Fund not only absorbs shocks but grows stronger under stress, incorporating diversified assets and adaptive strategies to enhance long-term financial resilience. Prioritizing adaptive reserves through an Anti-Fragile Fund fosters sustained wealth protection and dynamic recovery, essential for financial security in volatile environments.

Related Important Terms

Anti-Fragile Reserve Buffer

An Anti-Fragile Reserve Buffer transcends the traditional Emergency Fund by not only safeguarding assets during financial shocks but also capitalizing on volatility to strengthen reserves over time. This adaptive fund framework enhances resilience by dynamically adjusting allocations to mitigate risks and exploit market fluctuations, ensuring sustained financial stability.

Volatility-Adjusted Fund

An Emergency Fund provides immediate liquidity during financial setbacks, while an Anti-Fragile Fund is designed to grow stronger amid market volatility by leveraging volatility-adjusted strategies. Volatility-Adjusted Funds optimize adaptive reserves by dynamically reallocating assets to mitigate risks and capitalize on fluctuating market conditions, enhancing financial resilience beyond traditional safe-haven cash reserves.

Dynamic Liquidity Safety Net

An Emergency Fund provides a static cash reserve for immediate, predictable financial crises, while an Anti-Fragile Fund functions as a dynamic liquidity safety net, adapting and growing stronger through market volatility and unexpected disruptions. This adaptive reserve strategy enhances financial resilience by balancing liquidity with opportunities for growth, ensuring funds remain accessible yet robust against economic shocks.

Resilience Cash Pool

Emergency Fund typically provides a fixed cash reserve for unexpected expenses, ensuring immediate liquidity, whereas an Anti-Fragile Fund actively adapts and grows through market volatility to enhance long-term financial resilience. The Resilience Cash Pool combines these strategies by maintaining accessible funds while investing adaptively to withstand economic shocks and improve financial stability.

Adaptive Shock Cushion

An Emergency Fund provides liquidity to cover unexpected expenses, serving as a basic financial safety net, while an Anti-Fragile Fund functions as an Adaptive Shock Cushion by not only absorbing shocks but also leveraging stress to strengthen financial resilience over time. The Anti-Fragile Fund strategically adapts to volatility, ensuring enhanced capacity to withstand and benefit from economic disruptions compared to traditional Emergency Funds.

Black Swan Shield Account

Emergency Fund provides essential liquidity for unforeseen expenses, while an Anti-Fragile Fund, like the Black Swan Shield Account, leverages adaptive reserves designed to grow stronger amid market volatility and rare, high-impact events. The Black Swan Shield Account emphasizes dynamic risk management and capital resilience, enabling protection and potential gains during financial turbulence beyond typical emergency savings.

Stochastic Reserve Strategy

Emergency Fund centers on covering unexpected expenses with fixed liquid assets, while an Anti-Fragile Fund incorporates a Stochastic Reserve Strategy to dynamically adjust capital buffers based on probabilistic risk modeling and market volatility. This approach enhances adaptive resilience by optimizing reserve allocation through continuous scenario analysis and stochastic forecasting, ensuring financial stability under uncertain conditions.

Nonlinear Contingency Fund

An Emergency Fund provides a fixed financial buffer for predictable crisis scenarios, while an Anti-Fragile Fund operates as a Nonlinear Contingency Fund designed to adapt dynamically to unpredictable, high-impact events by allocating resources that grow stronger under volatility. This adaptive reserve strategy emphasizes resilience through scalable capital deployment, enabling individuals or organizations to thrive amid complex, non-linear disruptions.

Multi-Scenario Emergency Reserve

A Multi-Scenario Emergency Reserve enhances financial resilience by combining traditional Emergency Fund liquidity with the adaptive growth characteristics of an Anti-Fragile Fund, allowing buffers to not only withstand crises but also improve under stress. This hybrid approach optimizes capital allocation for diverse contingencies, balancing immediate access with strategic risk-absorbing capacity tailored to fluctuating economic environments.

Stress-Tested Adaptive Fund

A Stress-Tested Adaptive Fund merges principles of an Emergency Fund with Anti-Fragile strategies, designed to endure and grow under economic stress while providing liquidity for unforeseen expenses. This approach prioritizes resilience and flexibility, using diverse assets and scenario analysis to optimize adaptive reserves beyond traditional cash savings.

Emergency Fund vs Anti-Fragile Fund for adaptive reserves. Infographic

moneydiff.com

moneydiff.com