Emergency Fund is designed to cover unexpected expenses like medical emergencies or urgent home repairs, providing financial security during crises. Opportunity Reserve, however, is money set aside to seize future investment or business opportunities, promoting growth rather than safety. Differentiating these funds ensures balanced money management by safeguarding stability while enabling proactive financial decisions.

Table of Comparison

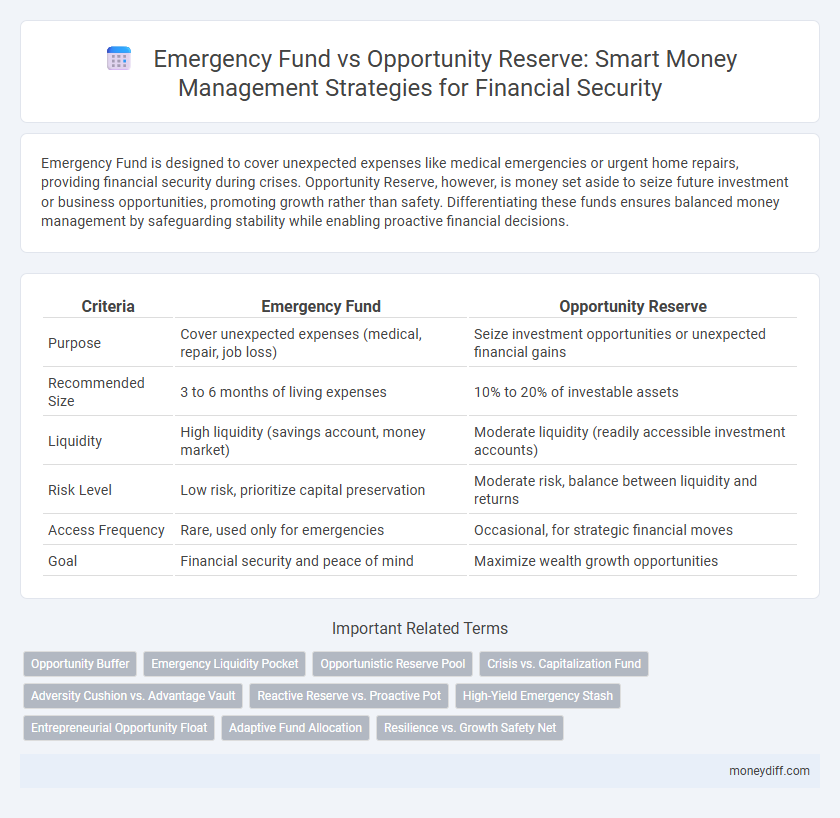

| Criteria | Emergency Fund | Opportunity Reserve |

|---|---|---|

| Purpose | Cover unexpected expenses (medical, repair, job loss) | Seize investment opportunities or unexpected financial gains |

| Recommended Size | 3 to 6 months of living expenses | 10% to 20% of investable assets |

| Liquidity | High liquidity (savings account, money market) | Moderate liquidity (readily accessible investment accounts) |

| Risk Level | Low risk, prioritize capital preservation | Moderate risk, balance between liquidity and returns |

| Access Frequency | Rare, used only for emergencies | Occasional, for strategic financial moves |

| Goal | Financial security and peace of mind | Maximize wealth growth opportunities |

Understanding Emergency Funds: The Safety Net

Emergency funds serve as a crucial safety net, providing immediate access to cash for unexpected expenses like medical emergencies, car repairs, or sudden job loss. Unlike opportunity reserves, which are invested to capitalize on potential financial gains, emergency funds prioritize liquidity and stability to ensure financial security without risking asset loss. Maintaining an emergency fund of three to six months' worth of living expenses helps individuals avoid debt and preserve long-term financial health during crises.

Opportunity Reserves Explained: Investing in Possibilities

Opportunity Reserves serve as a strategic financial buffer distinct from Emergency Funds, allocated specifically for seizing investment opportunities or business ventures that arise unexpectedly. Unlike Emergency Funds, which prioritize liquidity and risk mitigation for unforeseen expenses, Opportunity Reserves are invested in higher-yield assets to capitalize on potential growth and wealth-building possibilities. Properly managing Opportunity Reserves enhances financial flexibility by balancing security with the potential for significant returns on timely investments.

Key Differences Between Emergency Funds and Opportunity Reserves

Emergency funds provide financial security during unexpected expenses such as medical emergencies, unemployment, or urgent home repairs, typically covering three to six months of living expenses. Opportunity reserves, in contrast, are set aside to capitalize on investment or business opportunities, focusing on liquidity for growth rather than safety. The primary difference lies in their purpose: emergency funds prioritize stability and risk mitigation, while opportunity reserves emphasize flexibility and potential financial gain.

Building Your Emergency Fund: Best Practices

Building your emergency fund requires setting aside three to six months' worth of essential living expenses in a highly liquid account, such as a savings or money market account, to ensure immediate access during unexpected financial crises. Different from an opportunity reserve, which allocates funds for potential investments or market opportunities, the emergency fund prioritizes stability and security by minimizing risk and maintaining sufficient cash flow. Regularly reviewing and adjusting contributions, automating savings deposits, and avoiding premature withdrawals are best practices to strengthen this financial safety net effectively.

How to Set Up an Opportunity Reserve

Setting up an Opportunity Reserve involves identifying a specific portion of your savings separate from your Emergency Fund, typically ranging from 5% to 10% of your monthly income, to capitalize on unexpected financial opportunities such as investments or business ventures. Allocate funds into a highly liquid and low-risk account, ensuring quick access while maintaining growth potential. Regularly review and adjust the reserve based on your financial goals and changing market conditions to optimize readiness for emerging opportunities.

When to Use Your Emergency Fund vs Opportunity Reserve

Use your emergency fund strictly for unforeseen expenses like medical emergencies, car repairs, or sudden job loss to ensure financial stability. Access your opportunity reserve for calculated investments or time-sensitive opportunities that can potentially increase your net worth without jeopardizing your essential financial safety net. Maintaining clear boundaries between these funds preserves liquidity in emergencies while leveraging growth prospects strategically.

Risk Management: Protecting Your Financial Stability

An emergency fund provides a critical safety net by covering unexpected expenses such as medical emergencies or job loss, ensuring immediate financial stability. In contrast, an opportunity reserve allocates funds for strategic investments or business opportunities, posing higher risk but potential for growth. Prioritizing an emergency fund enhances risk management by safeguarding against financial shocks before pursuing wealth-building opportunities.

Opportunity Costs: Balancing Security and Growth

An Emergency Fund provides immediate financial security by covering unexpected expenses, but holding excessive cash may lead to significant opportunity costs due to low interest or returns. An Opportunity Reserve focuses on strategic investments that balance liquidity with growth potential, allowing for wealth accumulation even during uncertain times. Effective money management requires evaluating the trade-off between safety and higher returns to optimize both security and financial growth.

Integrating Both Funds into Your Financial Plan

Integrating both an emergency fund and an opportunity reserve into your financial plan enhances overall money management by balancing liquidity and growth potential. An emergency fund typically covers 3 to 6 months of essential expenses, securing financial stability during unexpected events, while an opportunity reserve allows you to capitalize on investment or business opportunities without disrupting your safety net. Allocating distinct contributions to each fund ensures you maintain financial resilience while positioning yourself to seize potential gains effectively.

Choosing the Right Allocation for Your Money Goals

An emergency fund serves as a safety net for unexpected expenses, ensuring financial stability during crises, while an opportunity reserve is set aside to capitalize on potential investments or business ventures. Prioritizing an emergency fund with 3-6 months' worth of essential living expenses creates a strong financial foundation before allocating funds to an opportunity reserve. Balancing these allocations depends on individual risk tolerance, cash flow needs, and specific money goals to optimize security and growth potential simultaneously.

Related Important Terms

Opportunity Buffer

An Emergency Fund provides financial security for unexpected expenses, while an Opportunity Reserve, also known as an Opportunity Buffer, is strategically set aside to capitalize on immediate investment or business opportunities. Maintaining a well-balanced Opportunity Buffer enables proactive wealth growth without compromising the stability offered by a traditional Emergency Fund.

Emergency Liquidity Pocket

An Emergency Fund serves as a critical Emergency Liquidity Pocket, ensuring immediate access to cash for unforeseen expenses or financial shocks, while an Opportunity Reserve is strategically allocated to capitalize on investments or market opportunities. Prioritizing liquidity in the Emergency Fund safeguards financial stability and prevents the need to liquidate long-term assets under unfavorable conditions.

Opportunistic Reserve Pool

An Emergency Fund provides a safety net for unexpected expenses, ensuring financial stability during crises, while an Opportunity Reserve emphasizes liquidity to quickly capitalize on investment or business opportunities. Prioritizing an Opportunistic Reserve Pool allows for agile money management by balancing risk mitigation with potential high-return ventures.

Crisis vs. Capitalization Fund

An Emergency Fund is a dedicated financial buffer designed to cover unexpected crises such as medical emergencies, job loss, or urgent home repairs, ensuring immediate liquidity and financial stability. In contrast, an Opportunity Reserve serves as a strategic Capitalization Fund aimed at seizing investment opportunities or business expansions, emphasizing growth potential rather than crisis mitigation.

Adversity Cushion vs. Advantage Vault

An Emergency Fund serves as an Adversity Cushion, providing immediate financial protection against unexpected expenses such as medical emergencies or job loss, ensuring stability during crises. In contrast, an Opportunity Reserve acts as an Advantage Vault, strategically set aside to capitalize on investment opportunities or ventures, maximizing financial growth potential without compromising essential liquidity.

Reactive Reserve vs. Proactive Pot

An Emergency Fund acts as a reactive reserve specifically allocated to cover unexpected expenses like medical bills or urgent home repairs, ensuring financial stability under stress. In contrast, an Opportunity Reserve is a proactive pot designed to capitalize on investment opportunities or strategic purchases, enabling wealth growth while managing liquidity.

High-Yield Emergency Stash

A High-Yield Emergency Fund prioritizes liquidity and safety, providing immediate access to cash for unforeseen expenses while earning competitive interest, unlike an Opportunity Reserve which is geared towards investing in market opportunities and may carry higher risk. Maintaining a dedicated emergency stash in high-yield savings accounts ensures financial stability and avoids the potential losses and delays associated with liquidating investment assets during emergencies.

Entrepreneurial Opportunity Float

Emergency Fund ensures financial security during unexpected expenses, while Opportunity Reserve specifically supports Entrepreneurial Opportunity Float, allowing entrepreneurs to capitalize on time-sensitive business investments without risking essential savings. Maintaining a distinct Opportunity Reserve enhances cash flow flexibility, enabling prompt response to market opportunities and fostering sustainable business growth.

Adaptive Fund Allocation

Emergency Fund and Opportunity Reserve serve distinct purposes in money management; Emergency Fund ensures liquidity for unforeseen expenses, while Opportunity Reserve allocates capital for potential investments or advantageous financial opportunities. Adaptive Fund Allocation balances these by dynamically adjusting reserves based on risk tolerance, market conditions, and cash flow needs to optimize financial resilience and growth potential.

Resilience vs. Growth Safety Net

An emergency fund provides a resilience safety net by covering unexpected expenses, ensuring financial stability during crises, while an opportunity reserve focuses on growth by allocating money for potential investments and financial opportunities. Balancing both funds optimizes money management, safeguarding immediate needs and enabling future wealth-building potential.

Emergency Fund vs Opportunity Reserve for money management Infographic

moneydiff.com

moneydiff.com