An Emergency Fund is specifically designed to cover unexpected expenses such as urgent pet medical bills, providing a financial safety net for unplanned situations. In contrast, a Rainy Day Fund is intended for smaller, anticipated expenses like routine pet care or minor repairs, serving as a buffer for short-term, less urgent needs. Prioritizing an Emergency Fund ensures pets receive immediate care during crises without disrupting other financial goals.

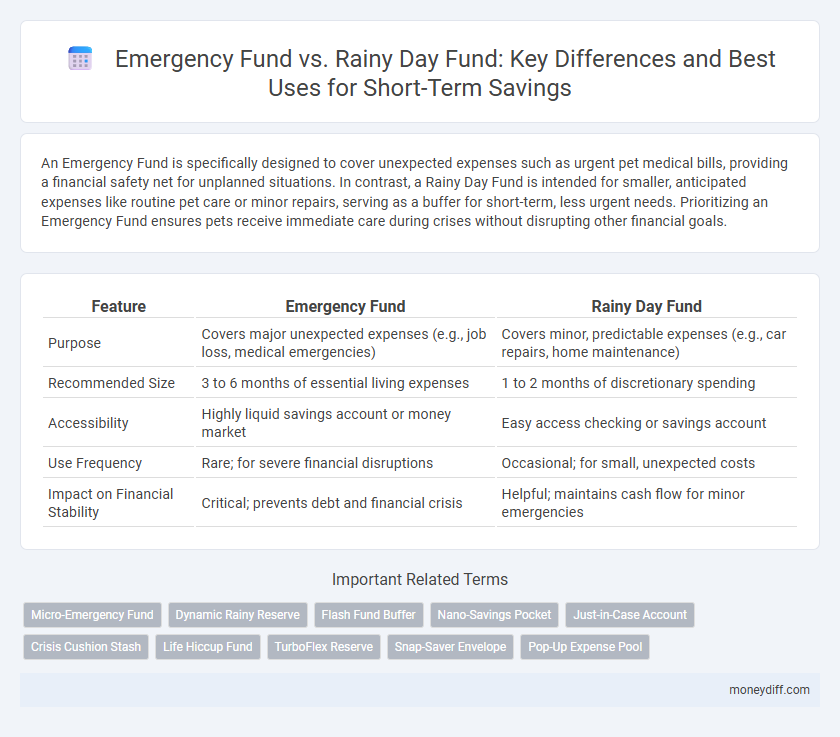

Table of Comparison

| Feature | Emergency Fund | Rainy Day Fund |

|---|---|---|

| Purpose | Covers major unexpected expenses (e.g., job loss, medical emergencies) | Covers minor, predictable expenses (e.g., car repairs, home maintenance) |

| Recommended Size | 3 to 6 months of essential living expenses | 1 to 2 months of discretionary spending |

| Accessibility | Highly liquid savings account or money market | Easy access checking or savings account |

| Use Frequency | Rare; for severe financial disruptions | Occasional; for small, unexpected costs |

| Impact on Financial Stability | Critical; prevents debt and financial crisis | Helpful; maintains cash flow for minor emergencies |

Understanding Emergency Funds and Rainy Day Funds

Emergency funds typically cover three to six months of essential living expenses to provide financial security during major unexpected events such as job loss or medical emergencies. Rainy day funds are smaller reserves designed for short-term, less severe expenses like car repairs or minor home maintenance. Understanding the distinction helps in effective financial planning by allocating appropriate savings based on the urgency and scale of potential expenses.

Key Differences Between Emergency and Rainy Day Funds

Emergency funds are designed to cover significant, unexpected expenses such as medical emergencies, job loss, or major home repairs, typically amounting to three to six months of living expenses. Rainy day funds, on the other hand, target smaller, short-term financial setbacks like minor car repairs or temporary bills, usually maintained at a lower and more flexible amount. The key difference lies in their purpose and size: emergency funds provide long-term financial security, while rainy day funds address immediate, less severe financial needs.

Core Purposes: When to Use Each Fund

Emergency funds are designed to cover major unexpected expenses such as medical emergencies, job loss, or urgent home repairs, typically providing three to six months of living expenses. Rainy day funds serve smaller, less critical financial setbacks like minor car repairs or temporary bills, usually offering savings for a few weeks to a month of expenses. Understanding these core purposes helps individuals allocate short-term savings appropriately for effective financial resilience.

Ideal Savings Targets for Short-Term Needs

An ideal Emergency Fund typically covers three to six months of essential living expenses, providing a financial cushion for major, unexpected crises such as job loss or medical emergencies. A Rainy Day Fund targets smaller, short-term expenses like minor car repairs or home maintenance, usually amounting to one to two months of discretionary spending. Prioritizing these distinct savings goals ensures liquidity for immediate needs while maintaining robust protection against larger financial shocks.

How to Build Your Emergency Fund

Building your emergency fund begins with setting a clear savings target, typically three to six months' worth of essential expenses, distinguishing it from a rainy day fund that covers smaller, short-term unexpected costs. Automate regular transfers from your checking account to a dedicated high-yield savings account to ensure consistent growth without disrupting your budget. Prioritize your emergency fund by reallocating bonuses, tax refunds, or extra income until you reach your savings goal, providing a financial safety net for true emergencies.

Tips for Growing a Rainy Day Fund Fast

Maximize contributions to your rainy day fund by setting automated transfers from your paycheck to ensure consistent growth. Prioritize high-yield savings accounts to boost interest earnings while maintaining liquidity for short-term needs. Reduce discretionary spending and redirect those savings into your fund to accelerate accumulation and enhance financial security.

Accessibility: Where to Keep Your Funds

Emergency funds should be kept in highly liquid accounts, such as high-yield savings accounts or money market accounts, ensuring immediate accessibility during unforeseen financial emergencies. Rainy day funds, designed for smaller, less urgent expenses, can be stored in slightly less liquid assets like short-term CDs or low-risk investment accounts to earn modest returns while remaining relatively accessible. Prioritizing easy access with minimal withdrawal penalties is crucial for both funds to effectively meet short-term financial needs.

Common Mistakes with Short-Term Savings

Many individuals mistakenly treat emergency funds and rainy day funds as interchangeable, leading to insufficient coverage when unexpected expenses arise. Confusing the two often results in underfunded emergency reserves not capable of sustaining prolonged financial hardship. Proper distinction ensures emergency funds cover significant crises, while rainy day funds address smaller, short-term expenses without depleting critical savings.

Combining Strategies for Financial Security

Emergency funds and rainy day funds serve distinct purposes within short-term savings, with emergency funds typically covering larger, unexpected expenses like medical bills, and rainy day funds addressing smaller, intermittent costs such as minor car repairs. Combining both strategies enhances financial security by ensuring access to adequate cash reserves for a wide range of unforeseen events. Allocating separate savings buckets optimized for differing expense severities reduces reliance on credit and promotes long-term stability.

Choosing the Right Fund for Your Situation

Emergency funds typically cover three to six months of essential living expenses, providing a financial cushion for unexpected major events like job loss or medical emergencies. Rainy day funds are smaller, designed for minor, short-term expenses such as car repairs or temporary utility bills. Choosing the right fund depends on your financial stability, monthly expenses, and how quickly you need access to cash for unforeseen situations.

Related Important Terms

Micro-Emergency Fund

A Micro-Emergency Fund is a small, easily accessible savings reserve designed to cover unexpected minor expenses such as medical co-pays or car repairs, providing immediate financial relief without disrupting long-term savings goals. Unlike a Rainy Day Fund, which handles larger, less frequent disruptions like job loss or major home repairs, the Micro-Emergency Fund focuses specifically on short-term liquidity to maintain daily financial stability.

Dynamic Rainy Reserve

A Dynamic Rainy Reserve differs from a traditional Emergency Fund by offering flexible, short-term savings designed to adapt to fluctuating financial needs and unexpected expenses. This approach prioritizes liquidity and quick access, making it ideal for immediate, non-catastrophic events while maintaining overall financial stability.

Flash Fund Buffer

A Flash Fund Buffer serves as a critical component of short-term savings, designed to cover immediate, unexpected expenses within days or weeks, unlike a traditional Emergency Fund that targets larger, long-term financial crises. This buffer acts as a Rainy Day Fund by providing quick access to cash for minor disruptions such as car repairs or medical co-pays, ensuring financial stability without tapping into more substantial savings.

Nano-Savings Pocket

Nano-Savings Pockets offer a flexible approach to short-term savings by allowing users to set aside small amounts regularly, making them ideal for building an Emergency Fund that covers unexpected expenses. Unlike a Rainy Day Fund, which is typically reserved for minor, non-urgent costs, an Emergency Fund in a Nano-Savings Pocket provides a financial safety net for critical situations requiring immediate access to larger sums.

Just-in-Case Account

An Emergency Fund serves as a Just-in-Case Account designed to cover unexpected, significant expenses such as medical emergencies or job loss, typically holding three to six months' worth of living expenses. In contrast, a Rainy Day Fund targets smaller, short-term financial needs like minor car repairs or household maintenance, offering quick access to cash without disrupting the main emergency savings.

Crisis Cushion Stash

A Crisis Cushion Stash serves as a more flexible and accessible emergency fund designed specifically for short-term savings, covering unexpected expenses without dipping into long-term reserves. Unlike a Rainy Day Fund, which targets minor, predictable costs, the Crisis Cushion Stash prioritizes immediate financial stability during urgent crises, providing quicker liquidity and peace of mind.

Life Hiccup Fund

A Life Hiccup Fund is a specific type of emergency fund designed to cover unexpected but smaller short-term expenses such as minor car repairs or temporary job interruptions, distinguishing it from a broader rainy day fund meant for general, less urgent savings. This fund ensures immediate financial stability without depleting long-term emergency reserves, providing targeted support during life's minor crises.

TurboFlex Reserve

TurboFlex Reserve offers a more dynamic approach to short-term savings compared to traditional Emergency Funds by enabling flexible access to funds for unexpected expenses, unlike Rainy Day Funds which are typically set aside for planned minor emergencies. Its adaptive structure prioritizes liquidity and quick availability, making it an ideal solution for managing both unforeseen financial challenges and short-term financial goals.

Snap-Saver Envelope

Snap-Saver Envelope is designed to distinguish between an Emergency Fund and a Rainy Day Fund by allocating short-term savings specifically for unexpected, minor expenses versus critical financial crises; the Emergency Fund covers significant, unforeseen events like job loss, while the Rainy Day Fund handles smaller, immediate needs such as car repairs or medical co-pays. This targeted approach maximizes financial preparedness by ensuring liquidity and quick access while preserving long-term security within Snap-Saver Envelope's streamlined savings management system.

Pop-Up Expense Pool

An Emergency Fund provides a financial safety net for unexpected, high-impact expenses like medical emergencies or job loss, typically requiring three to six months of living expenses saved. A Rainy Day Fund serves as a Pop-Up Expense Pool for smaller, short-term costs such as car repairs or home maintenance, usually maintained at a lower balance to cover immediate, unplanned expenses without disrupting long-term savings.

Emergency Fund vs Rainy Day Fund for short-term savings. Infographic

moneydiff.com

moneydiff.com