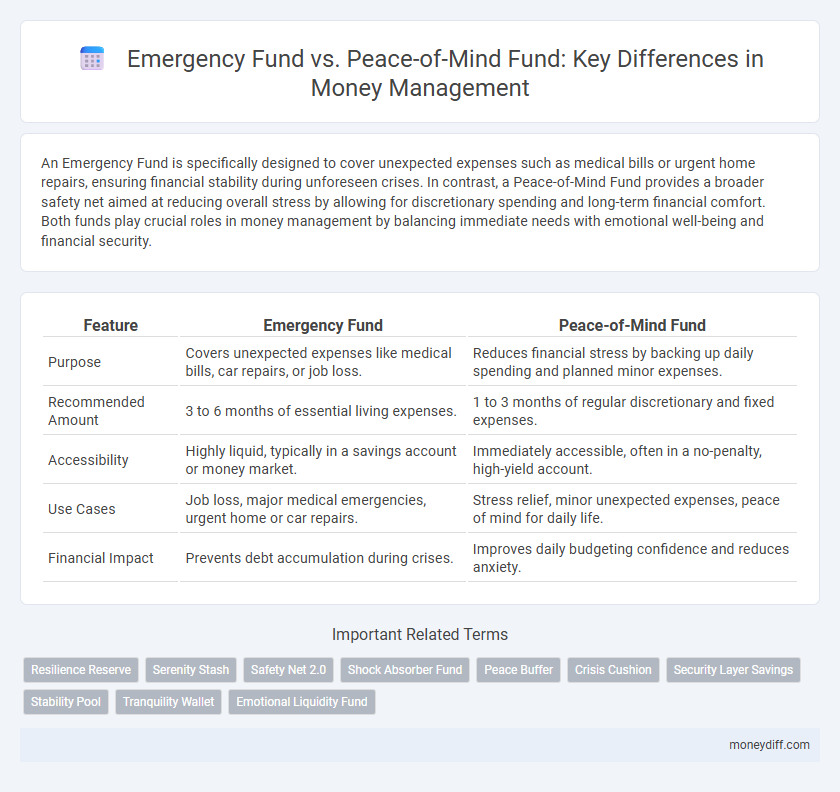

An Emergency Fund is specifically designed to cover unexpected expenses such as medical bills or urgent home repairs, ensuring financial stability during unforeseen crises. In contrast, a Peace-of-Mind Fund provides a broader safety net aimed at reducing overall stress by allowing for discretionary spending and long-term financial comfort. Both funds play crucial roles in money management by balancing immediate needs with emotional well-being and financial security.

Table of Comparison

| Feature | Emergency Fund | Peace-of-Mind Fund |

|---|---|---|

| Purpose | Covers unexpected expenses like medical bills, car repairs, or job loss. | Reduces financial stress by backing up daily spending and planned minor expenses. |

| Recommended Amount | 3 to 6 months of essential living expenses. | 1 to 3 months of regular discretionary and fixed expenses. |

| Accessibility | Highly liquid, typically in a savings account or money market. | Immediately accessible, often in a no-penalty, high-yield account. |

| Use Cases | Job loss, major medical emergencies, urgent home or car repairs. | Stress relief, minor unexpected expenses, peace of mind for daily life. |

| Financial Impact | Prevents debt accumulation during crises. | Improves daily budgeting confidence and reduces anxiety. |

Understanding Emergency Funds: A Safety Net Defined

An emergency fund serves as a financial safety net designed to cover unexpected expenses such as medical emergencies, car repairs, or sudden job loss, typically amounting to three to six months of living expenses. A peace-of-mind fund differs by providing additional discretionary cash reserves, aimed at reducing financial stress beyond urgent needs. Understanding the specific purpose and appropriate size of an emergency fund ensures effective money management and long-term financial stability.

What is a Peace-of-Mind Fund?

A Peace-of-Mind Fund is a subset of an Emergency Fund designed to cover unexpected but less urgent expenses, providing financial comfort beyond basic emergencies. It focuses on reducing anxiety by ensuring resources are available for non-critical situations like minor repairs, health checkups, or sudden travel needs. This proactive approach enhances overall money management by balancing immediate crisis coverage with ongoing financial security.

Key Differences Between Emergency Fund and Peace-of-Mind Fund

An Emergency Fund is a financial reserve specifically designated to cover unexpected expenses such as medical emergencies, car repairs, or job loss, typically amounting to three to six months of living expenses. In contrast, a Peace-of-Mind Fund serves broader, less urgent financial goals that alleviate stress by providing a cushion for smaller uncertainties and discretionary spending, usually with more flexible access. The key difference lies in their purpose and usage: Emergency Funds are strictly for critical, unforeseen events, whereas Peace-of-Mind Funds enhance emotional security by covering anticipated or minor financial disruptions.

Why an Emergency Fund is Essential for Financial Security

An Emergency Fund acts as a critical financial buffer that covers unexpected expenses such as medical bills, car repairs, or sudden job loss, ensuring stability during uncertain times. Unlike a Peace-of-Mind Fund, which may prioritize discretionary comforts, the Emergency Fund is specifically designed to protect against financial crises and prevent debt accumulation. Maintaining three to six months' worth of living expenses in this fund provides essential security and peace of mind by safeguarding your financial future.

The Psychological Benefits of a Peace-of-Mind Fund

A Peace-of-Mind Fund enhances financial security by reducing anxiety and stress associated with unexpected expenses, significantly improving mental well-being. Unlike a standard Emergency Fund limited to urgent needs, a Peace-of-Mind Fund offers a broader cushion, fostering confidence and better decision-making during financial uncertainties. This proactive approach to money management supports emotional resilience, contributing to overall stability in both personal and financial life.

How Much Should You Save in Each Fund?

An Emergency Fund typically requires three to six months' worth of essential living expenses to cover unexpected financial crises like job loss or medical emergencies. A Peace-of-Mind Fund complements this by holding an additional buffer, often one to two months of discretionary expenses, designed to reduce stress and provide extra financial comfort. Balancing both funds ensures a comprehensive safety net tailored to immediate needs and personal financial security goals.

When to Use Your Emergency Fund vs. Peace-of-Mind Fund

Use your Emergency Fund exclusively for unexpected, essential expenses such as medical emergencies, urgent home repairs, or job loss to ensure financial stability during crises. Reserve your Peace-of-Mind Fund for stress-relieving, non-essential situations like short-term vacations or minor lifestyle upgrades that improve well-being but don't threaten your financial security. Distinguishing these funds helps maintain liquidity for true emergencies while supporting mental health through controlled discretionary spending.

Building Your Emergency Fund: Practical Tips

Building your emergency fund requires a disciplined approach, focusing on setting aside three to six months' worth of essential living expenses in a high-yield savings account for quick access. Prioritize automatic transfers from your paycheck to ensure consistent growth without the temptation to spend. Regularly review and adjust your savings goal based on changes in your lifestyle, job stability, and financial obligations to maintain adequate coverage during unexpected events.

Incorporating Both Funds Into Your Money Management Strategy

Incorporating both an Emergency Fund and a Peace-of-Mind Fund into your money management strategy ensures comprehensive financial security by addressing immediate unexpected expenses and long-term emotional well-being. An Emergency Fund typically covers three to six months of essential living costs, safeguarding against job loss or urgent medical bills, while a Peace-of-Mind Fund provides for personal comforts or non-essential needs that reduce stress during difficult times. Balancing contributions to both funds optimizes financial resilience and supports mental health by offering practical security and emotional assurance.

Common Mistakes to Avoid With Emergency and Peace-of-Mind Funds

Confusing an emergency fund with a peace-of-mind fund often leads to misallocated resources that fail to meet urgent financial needs or personal comfort goals. A common mistake is underfunding the emergency savings, which should cover at least three to six months of essential expenses to ensure true financial security during unforeseen events. Avoid dipping into these funds for non-essential purchases, as this compromises their primary purpose and prolongs financial instability.

Related Important Terms

Resilience Reserve

The Resilience Reserve, often categorized under Emergency Funds, specifically targets unforeseen financial shocks by ensuring access to three to six months of essential living expenses, emphasizing liquidity and quick availability. Unlike a broader Peace-of-Mind Fund, which may include discretionary savings for comfort and long-term goals, the Resilience Reserve prioritizes financial stability and immediate risk mitigation during emergencies.

Serenity Stash

Serenity Stash enhances traditional Emergency Funds by prioritizing mental well-being alongside financial security, creating a Peace-of-Mind Fund designed to cover unexpected expenses without stress. This approach transforms money management into a holistic strategy that safeguards both assets and emotional stability during financial uncertainties.

Safety Net 2.0

An Emergency Fund acts as a crucial Safety Net 2.0, covering unexpected expenses like medical emergencies or car repairs, while a Peace-of-Mind Fund extends beyond immediate crises to support financial stability during prolonged uncertainties such as job loss or economic downturns. Prioritizing both funds in money management enhances resilience by addressing short-term shocks and sustained financial challenges.

Shock Absorber Fund

A Shock Absorber Fund, often categorized under Emergency Funds, is specifically designed to cover unexpected expenses like medical emergencies or urgent car repairs, ensuring financial stability without disrupting long-term savings goals. Unlike a Peace-of-Mind Fund, which provides comfort by covering minor, non-essential expenses, the Shock Absorber Fund focuses on immediate, high-impact financial shocks that require rapid access to cash.

Peace Buffer

A Peace-of-Mind Fund acts as a financial buffer beyond a traditional Emergency Fund, offering greater flexibility and reducing stress during unforeseen expenses or income disruptions. This buffer enhances money management by providing a cushion that covers not just emergencies but also unexpected lifestyle adjustments, promoting sustained financial stability.

Crisis Cushion

A Crisis Cushion, often considered part of an Emergency Fund, provides immediate financial resources specifically for unexpected crises such as job loss or urgent medical expenses, while a Peace-of-Mind Fund focuses more broadly on reducing stress through general financial stability. Prioritizing a Crisis Cushion enhances resilience against sudden disruptions by ensuring liquid assets are readily available for high-impact emergencies.

Security Layer Savings

An Emergency Fund serves as a critical security layer savings, providing immediate access to cover unexpected expenses like medical bills or urgent home repairs, thereby preventing financial disruption. A Peace-of-Mind Fund complements this by offering a buffer for less urgent, yet stress-reducing financial stability, ensuring long-term psychological comfort alongside emergency preparedness.

Stability Pool

An Emergency Fund serves as a financial Stability Pool, covering unexpected expenses like medical bills or urgent repairs, ensuring liquidity without disrupting long-term investments. A Peace-of-Mind Fund complements this by providing additional buffer for lifestyle disruptions, fostering emotional security beyond basic financial emergencies.

Tranquility Wallet

Tranquility Wallet differentiates between an Emergency Fund, designated strictly for unexpected expenses like medical bills or car repairs, and a Peace-of-Mind Fund that supports emotional well-being by covering less urgent needs such as occasional stress relief or small indulgences. This dual-fund approach enhances overall financial security and emotional resilience by ensuring immediate crises are managed separately from lifestyle comforts.

Emotional Liquidity Fund

An Emergency Fund provides financial security for unexpected expenses, while a Peace-of-Mind Fund emphasizes emotional liquidity by offering readily accessible money that reduces stress and anxiety during uncertain times. Emotional Liquidity Funds prioritize mental well-being alongside financial stability, making them crucial for holistic money management strategies.

Emergency Fund vs Peace-of-Mind Fund for money management. Infographic

moneydiff.com

moneydiff.com