An Emergency Fund is specifically designed to cover unexpected, urgent expenses such as medical bills or car repairs, providing a financial safety net during crisis situations. In contrast, a Life Happens Fund is a broader savings reserve intended for less immediate, but still unplanned costs like home maintenance or occasional travel. Prioritizing an Emergency Fund ensures readiness for true emergencies before allocating resources to a Life Happens Fund for more flexible spending needs.

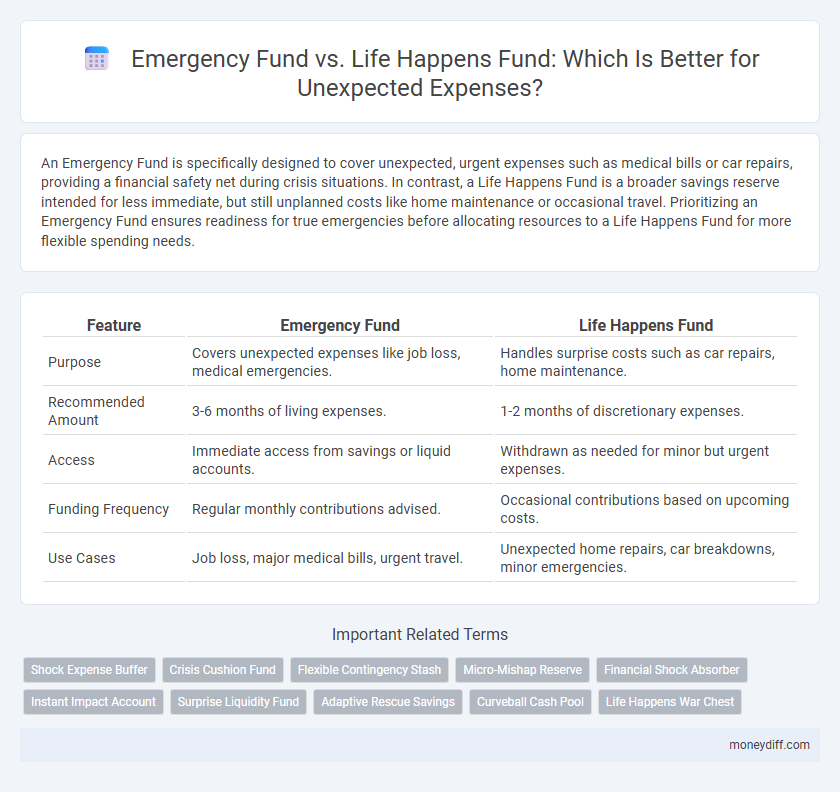

Table of Comparison

| Feature | Emergency Fund | Life Happens Fund |

|---|---|---|

| Purpose | Covers unexpected expenses like job loss, medical emergencies. | Handles surprise costs such as car repairs, home maintenance. |

| Recommended Amount | 3-6 months of living expenses. | 1-2 months of discretionary expenses. |

| Access | Immediate access from savings or liquid accounts. | Withdrawn as needed for minor but urgent expenses. |

| Funding Frequency | Regular monthly contributions advised. | Occasional contributions based on upcoming costs. |

| Use Cases | Job loss, major medical bills, urgent travel. | Unexpected home repairs, car breakdowns, minor emergencies. |

Emergency Fund vs Life Happens Fund: Key Differences

Emergency Fund typically covers essential expenses like rent, utilities, and groceries during unexpected income loss, whereas Life Happens Fund targets sudden non-essential shocks such as medical bills or car repairs. Emergency Funds are designed for short-term financial stability, usually covering three to six months of living expenses, while Life Happens Funds offer flexibility for one-off surprise costs that are not routine. Understanding these distinctions helps prioritize savings goals and ensures adequate financial preparedness for varied unforeseen events.

Why Both Funds Matter for Financial Stability

Emergency funds provide immediate access to cash for unexpected expenses such as medical emergencies or urgent home repairs, ensuring short-term financial security. Life Happens funds cover broader, unpredictable life events like job loss or major vehicle breakdowns, supporting medium to long-term stability. Maintaining both funds creates a comprehensive safety net that protects against diverse financial shocks and promotes sustained financial resilience.

The Purpose of an Emergency Fund Explained

An Emergency Fund is specifically designed to cover unexpected, essential expenses like medical emergencies, car repairs, or job loss, ensuring immediate financial stability without incurring debt. In contrast, a Life Happens Fund typically addresses broader and less urgent surprise costs, such as home improvements or planned life events. The primary purpose of an Emergency Fund is to provide a financial safety net that safeguards against unforeseen crises, maintaining cash flow when regular income is disrupted.

What is a Life Happens Fund?

A Life Happens Fund is a financial reserve specifically designed to cover unexpected life events such as medical emergencies, job loss, or major home repairs that go beyond typical emergency fund expenses. Unlike a general emergency fund that mainly addresses immediate, short-term financial crises, a Life Happens Fund provides a broader safety net for unpredictable, significant financial disruptions. This fund ensures greater financial stability by preparing individuals for a wide range of surprise costs linked to life's unforeseen challenges.

Situations Covered: Emergency Fund vs Life Happens Fund

An Emergency Fund primarily covers unexpected expenses such as medical emergencies, car repairs, or job loss, providing immediate financial security during crises. The Life Happens Fund, while also designed for unforeseen costs, typically addresses broader life disruptions including home repairs, pet emergencies, or urgent travel needs. Understanding these differences helps ensure adequate preparation for various surprise costs.

How Much to Save: Setting Fund Targets

Setting fund targets for an Emergency Fund typically involves saving three to six months' worth of essential living expenses to cover unexpected costs like job loss or medical emergencies. In contrast, a Life Happens Fund is designed for smaller, less frequent surprise expenses, with savings goals often ranging from $500 to $1,000. Prioritizing the Emergency Fund ensures financial stability during major crises, while the Life Happens Fund addresses minor disruptions without impacting long-term savings.

Prioritizing Savings: Which Fund Comes First?

Prioritizing savings between an Emergency Fund and a Life Happens Fund depends on financial stability and immediate risk exposure; an Emergency Fund typically takes precedence as it covers essential, unplanned expenses like medical emergencies or urgent home repairs. A Life Happens Fund, while valuable, generally addresses less critical surprise costs and can be funded after securing three to six months of living expenses in the Emergency Fund. Building a robust Emergency Fund first ensures financial resilience against the most severe disruptions before allocating resources to secondary savings goals.

Accessing Your Funds: Rules and Best Practices

Accessing your Emergency Fund typically requires no restrictions, offering immediate liquidity for surprise costs like medical bills or urgent home repairs, ensuring fast financial relief. In contrast, a Life Happens Fund may have specific withdrawal rules or recommended usage guidelines to maintain long-term financial stability and encourage responsible spending. Best practices include documenting expenses, avoiding non-essential withdrawals, and regularly replenishing your funds to stay prepared for future emergencies.

Common Mistakes to Avoid with Both Funds

Common mistakes with emergency funds and Life Happens Funds include underestimating the amount needed to cover unexpected expenses, leading to insufficient savings during crises. Many people also mix these funds with regular savings, which reduces their effectiveness in truly unforeseen events. Consistently failing to replenish funds after use further compromises financial security in future emergencies.

Building Resilience: Tips for Growing Your Funds

Building resilience in your finances requires distinct strategies for both Emergency Funds and Life Happens Funds. Emergency Funds prioritize liquidity and immediate access, typically covering 3-6 months of essential expenses, while Life Happens Funds address unpredictable or less frequent surprise costs like appliance repairs or medical copays. Consistently automating contributions, monitoring spending patterns, and adjusting fund targets according to lifestyle changes enhance growth and preparedness for unforeseen financial challenges.

Related Important Terms

Shock Expense Buffer

An Emergency Fund specifically targets unexpected financial shocks such as job loss or urgent medical bills, serving as a dedicated Shock Expense Buffer to maintain stability. In contrast, a Life Happens Fund covers broader surprise costs, including planned but variable expenses like home repairs or car maintenance, offering a flexible financial cushion.

Crisis Cushion Fund

A Crisis Cushion Fund serves as a targeted emergency reserve designed specifically to cover sudden, high-impact financial shocks such as job loss or major medical expenses, differentiating it from a broader Life Happens Fund that addresses routine surprise costs like minor repairs or unexpected bills. By prioritizing a Crisis Cushion Fund, individuals ensure a robust financial buffer that safeguards long-term stability during severe emergencies, optimizing preparedness beyond typical unexpected expenses.

Flexible Contingency Stash

A Flexible Contingency Stash, often called an Emergency Fund, provides immediate access to cash for unexpected expenses like car repairs or medical bills, ensuring financial stability without disrupting monthly budgets. In contrast, a Life Happens Fund is typically earmarked for larger, less frequent life events such as job loss or major home repairs, offering a broader financial safety net but less day-to-day flexibility.

Micro-Mishap Reserve

An Emergency Fund primarily covers larger, unexpected expenses like medical emergencies or job loss, while a Life Happens Fund, often referred to as a Micro-Mishap Reserve, is designed for smaller surprise costs such as minor car repairs or home maintenance. Maintaining a Micro-Mishap Reserve within your financial planning ensures quick access to funds for everyday emergencies without depleting your main Emergency Fund.

Financial Shock Absorber

An Emergency Fund serves as a dedicated financial shock absorber, providing immediate liquidity for unexpected expenses such as medical emergencies or urgent home repairs, whereas a Life Happens Fund offers a broader safety net for less predictable life events like career changes or extended travel. Maintaining a well-funded Emergency Fund ensures quick access to cash that shields your regular budget from financial disruptions, emphasizing stability and preparedness.

Instant Impact Account

An Emergency Fund provides immediate access to cash for unforeseen expenses, while a Life Happens Fund covers a broader range of unexpected life events, often requiring more time to access funds. The Instant Impact Account is designed to bridge this gap by offering rapid liquidity and flexibility, making it an essential tool for managing surprise costs effectively.

Surprise Liquidity Fund

A Surprise Liquidity Fund serves as a flexible reserve specifically designed to cover unexpected, non-recurring expenses that exceed typical emergency fund allocations. Unlike a traditional Emergency Fund, which safeguards against essential life disruptions like job loss or medical emergencies, the Surprise Liquidity Fund addresses sudden costs arising from unforeseen events such as urgent home repairs or surprise travel needs.

Adaptive Rescue Savings

Adaptive Rescue Savings offers a dynamic approach to managing surprise costs by combining the stability of an Emergency Fund with the flexibility of a Life Happens Fund, ensuring funds are readily available for unexpected events such as medical emergencies or urgent home repairs. This hybrid model prioritizes liquidity and adaptive contribution strategies, providing a more responsive financial cushion tailored to fluctuating life circumstances.

Curveball Cash Pool

Emergency Fund focuses on essential, immediate financial needs during unexpected hardships, while a Life Happens Fund covers broader surprise costs including lifestyle changes and opportunities. Curveball Cash Pool serves as a flexible hybrid, combining these funds to provide adaptable support for both urgent emergencies and unforeseen life events.

Life Happens War Chest

A Life Happens War Chest differs from a traditional Emergency Fund by covering a broader range of surprise costs including major home repairs, unexpected medical expenses, and sudden job loss, offering a more comprehensive financial safety net. This fund is strategically designed to not only address short-term emergencies but also to support long-term financial stability during life's unpredictable challenges.

Emergency Fund vs Life Happens Fund for surprise costs. Infographic

moneydiff.com

moneydiff.com