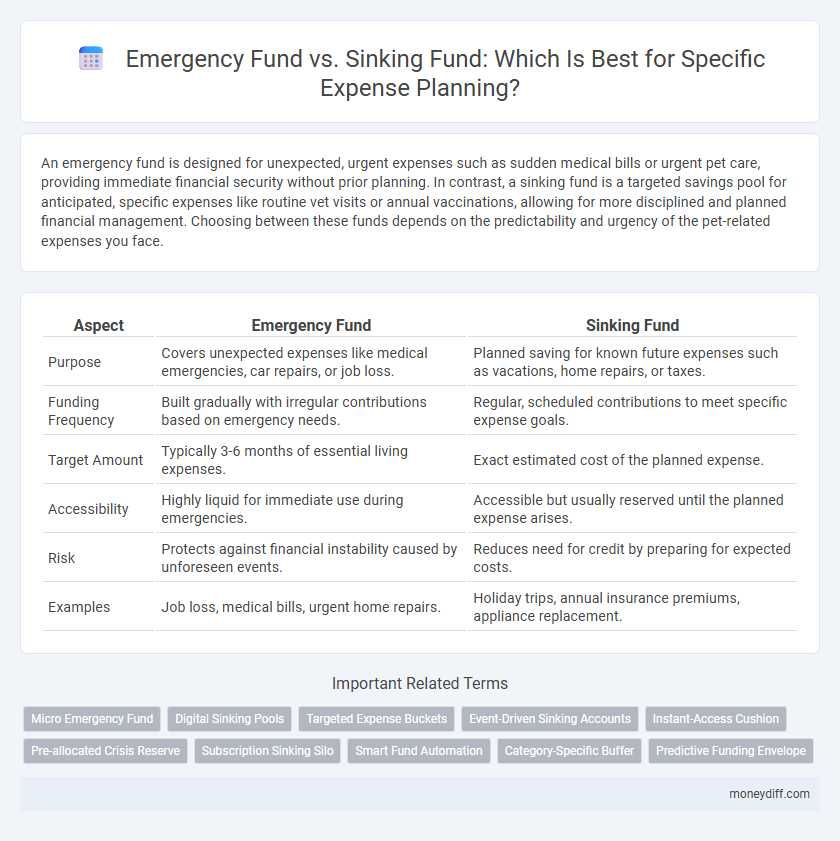

An emergency fund is designed for unexpected, urgent expenses such as sudden medical bills or urgent pet care, providing immediate financial security without prior planning. In contrast, a sinking fund is a targeted savings pool for anticipated, specific expenses like routine vet visits or annual vaccinations, allowing for more disciplined and planned financial management. Choosing between these funds depends on the predictability and urgency of the pet-related expenses you face.

Table of Comparison

| Aspect | Emergency Fund | Sinking Fund |

|---|---|---|

| Purpose | Covers unexpected expenses like medical emergencies, car repairs, or job loss. | Planned saving for known future expenses such as vacations, home repairs, or taxes. |

| Funding Frequency | Built gradually with irregular contributions based on emergency needs. | Regular, scheduled contributions to meet specific expense goals. |

| Target Amount | Typically 3-6 months of essential living expenses. | Exact estimated cost of the planned expense. |

| Accessibility | Highly liquid for immediate use during emergencies. | Accessible but usually reserved until the planned expense arises. |

| Risk | Protects against financial instability caused by unforeseen events. | Reduces need for credit by preparing for expected costs. |

| Examples | Job loss, medical bills, urgent home repairs. | Holiday trips, annual insurance premiums, appliance replacement. |

Understanding Emergency Funds: Definition and Purpose

An emergency fund is a financial safety net designed to cover unexpected and urgent expenses such as medical bills, car repairs, or job loss, providing immediate liquidity without resorting to debt. Unlike sinking funds, which are allocated for planned, specific expenses like a vacation or a new appliance, emergency funds remain flexible and accessible to address unplanned crises. Maintaining an emergency fund typically involves saving three to six months' worth of essential living expenses to ensure financial stability during unforeseen disruptions.

What Is a Sinking Fund? Key Differences Explained

A sinking fund is a savings strategy where money is set aside regularly to cover a specific future expense, differing from an emergency fund which is reserved for unexpected financial crises. Unlike emergency funds that provide flexible access for various urgent needs, sinking funds target predictable costs such as vacations, car repairs, or home maintenance by accumulating funds over time. This planned approach helps avoid debt and smooths out large expenses without compromising financial security intended for true emergencies.

Emergency Fund vs Sinking Fund: Core Distinctions

An emergency fund is designed to cover unexpected, urgent expenses such as job loss or medical emergencies, providing financial security in unforeseen situations. In contrast, a sinking fund is a savings allocation for planned, specific future expenses like a car purchase or vacation, allowing for intentional financial management without incurring debt. Understanding these core distinctions helps individuals prioritize liquidity and financial preparedness appropriately.

When to Use an Emergency Fund vs a Sinking Fund

An emergency fund is designed for unexpected, urgent financial crises such as medical emergencies or sudden job loss, providing immediate liquidity to cover unplanned expenses. A sinking fund, on the other hand, is best used for planned, specific expenses like saving for a vacation, car maintenance, or annual insurance premiums, allowing systematic accumulation of funds over time. Understanding the distinct purpose of each fund helps optimize financial planning by ensuring emergency funds are reserved for unforeseen events, while sinking funds manage predictable costs efficiently.

Building Your Emergency Fund: Essential Steps

An emergency fund provides a financial safety net for unexpected, urgent expenses like medical emergencies or job loss, while a sinking fund is designated for planned, specific future expenses such as a vacation or car repair. Building your emergency fund involves setting realistic savings goals, prioritizing liquidity by keeping funds in accessible accounts, and consistently contributing until reaching three to six months' worth of living expenses. Regularly reassessing your fund based on lifestyle changes and economic conditions ensures adequate protection and financial stability.

Creating Effective Sinking Funds for Planned Expenses

Creating effective sinking funds for planned expenses involves setting aside targeted amounts regularly to cover predictable costs like home repairs or vacations. Unlike emergency funds that handle unexpected financial shocks, sinking funds allow for deliberate budgeting, reducing the need for debt when known expenses arise. Allocating funds with clear goals and timelines optimizes financial stability and ensures readiness for specific future obligations.

How Much Should You Save in Each Fund?

Emergency funds typically require saving three to six months' worth of essential living expenses to cover unexpected financial emergencies, while sinking funds are allocated amounts tailored to specific future expenses, such as a $1,200 annual car maintenance or a $2,500 vacation. The emergency fund should maintain sufficient liquidity to handle sudden income loss or urgent costs, whereas sinking funds allow for gradual, planned contributions, often monthly, based on the total expected expense divided by the time until payment. Balancing both involves prioritizing a robust emergency fund first, then calculating sinking fund targets by dividing each anticipated cost by the months remaining until the purchase or bill due date.

Managing Multiple Funds: Best Practices and Tools

Effectively managing multiple funds requires clear categorization, with emergency funds reserved for unforeseen expenses and sinking funds allocated for specific planned costs like car repairs or vacations. Utilizing budgeting apps and spreadsheets can streamline tracking fund balances, contribution schedules, and withdrawal activities, ensuring disciplined savings. Regular reviews and automated transfers optimize fund growth and readiness, reducing the risk of fund overlap or shortfalls.

Common Mistakes in Emergency and Sinking Fund Planning

Confusing emergency funds with sinking funds often leads to misplaced financial priorities, as emergency funds should cover unexpected, urgent expenses while sinking funds target planned, specific costs like a new car or vacation. A common mistake is underfunding emergency reserves due to over-allocating to sinking funds, which compromises the ability to handle true emergencies. Properly distinguishing and adequately funding both ensures comprehensive financial preparedness and stress-free expense planning.

Strategic Benefits of Separating Emergency and Sinking Funds

Separating emergency and sinking funds enhances financial clarity and precision, ensuring immediate access to cash for unforeseen emergencies while systematically allocating money for planned expenses like home repairs or vacations. This distinction reduces the risk of prematurely depleting funds reserved for essential, strategic payments, thereby supporting better budget discipline and long-term financial stability. Maintaining distinct accounts facilitates targeted saving goals and simplifies tracking progress toward each financial objective, optimizing overall fund management.

Related Important Terms

Micro Emergency Fund

A Micro Emergency Fund is a small, readily accessible savings pool designed to cover minor unexpected expenses, distinguishing it from a Sinking Fund which is typically earmarked for planned, specific larger expenses over time. Prioritizing a Micro Emergency Fund ensures immediate liquidity for unforeseen costs without disrupting long-term financial goals set by sinking funds.

Digital Sinking Pools

Emergency funds provide a financial safety net for unexpected expenses, while sinking funds, particularly digital sinking pools, enable systematic savings for specific planned costs such as vacations or car repairs. Digital sinking pools optimize money management by allowing users to allocate funds into targeted categories, enhancing budget precision and ensuring readiness for upcoming financial obligations.

Targeted Expense Buckets

Emergency funds provide liquidity to cover unexpected financial emergencies, while sinking funds are dedicated savings for predetermined, targeted expense buckets such as car repairs or annual insurance premiums. Allocating money into sinking funds ensures disciplined saving for specific costs, reducing the risk of dipping into emergency reserves meant only for unforeseen crises.

Event-Driven Sinking Accounts

Event-driven sinking accounts allocate funds for known upcoming expenses, enabling precise financial planning and avoiding the depletion of an emergency fund reserved for unforeseen crises. Unlike emergency funds that cover unexpected events, sinking funds provide a targeted, disciplined approach to saving for predictable costs such as insurance premiums or vehicle maintenance.

Instant-Access Cushion

An Emergency Fund serves as an instant-access cushion designed to cover unexpected expenses like medical bills or urgent repairs, providing financial stability in unforeseen situations. In contrast, a Sinking Fund is a planned savings earmarked for specific future expenses, such as a vacation or home renovation, and typically does not require immediate liquidity.

Pre-allocated Crisis Reserve

An emergency fund serves as a readily accessible financial buffer for unexpected, urgent situations like medical emergencies or sudden job loss, while a sinking fund is a pre-allocated crisis reserve designed for specific, anticipated expenses such as home repairs or car maintenance. Allocating distinct amounts to an emergency fund versus sinking funds enhances precise expense planning and ensures liquidity is preserved for true financial crises.

Subscription Sinking Silo

An Emergency Fund provides immediate financial backup for unexpected expenses like medical emergencies or job loss, while a Subscription Sinking Fund is a targeted savings approach designed to accumulate money specifically for recurring subscription fees such as software or streaming services. Utilizing a Subscription Sinking Fund ensures consistent coverage of planned expenses without depleting the Emergency Fund, maintaining financial stability and better expense tracking.

Smart Fund Automation

Emergency Fund provides liquidity for unexpected financial crises, while a Sinking Fund targets specific future expenses through planned savings. Smart Fund Automation optimizes these funds by automatically allocating resources based on immediate needs and scheduled costs, enhancing financial stability and goal achievement.

Category-Specific Buffer

An emergency fund serves as a general financial safety net for unforeseen expenses, while a sinking fund is a category-specific buffer designed to accumulate savings for planned future costs like car repairs or holiday gifts. Maintaining distinct sinking funds within an emergency fund allows more precise money allocation and reduces risk of depleting reserves meant for true emergencies.

Predictive Funding Envelope

An emergency fund serves as a financial safety net for unforeseen expenses, while a sinking fund is a predictive funding envelope specifically designed to accumulate money for anticipated costs such as planned repairs or large purchases. Utilizing a sinking fund enables precise expense planning by dividing the total predicted cost into manageable, periodic contributions, ensuring funds are available when needed without compromising emergency reserves.

Emergency Fund vs Sinking Fund for specific expense planning. Infographic

moneydiff.com

moneydiff.com