An emergency fund is a dedicated savings reserve specifically set aside for unexpected expenses or financial crises, ensuring immediate access without disrupting daily finances. A financial buffer, while similar, often refers to a broader safety net that includes liquid assets and credit options, providing more flexibility but potentially involving higher risk or cost. Prioritizing an emergency fund builds a stronger foundation for financial stability by clearly separating urgent needs from general financial management.

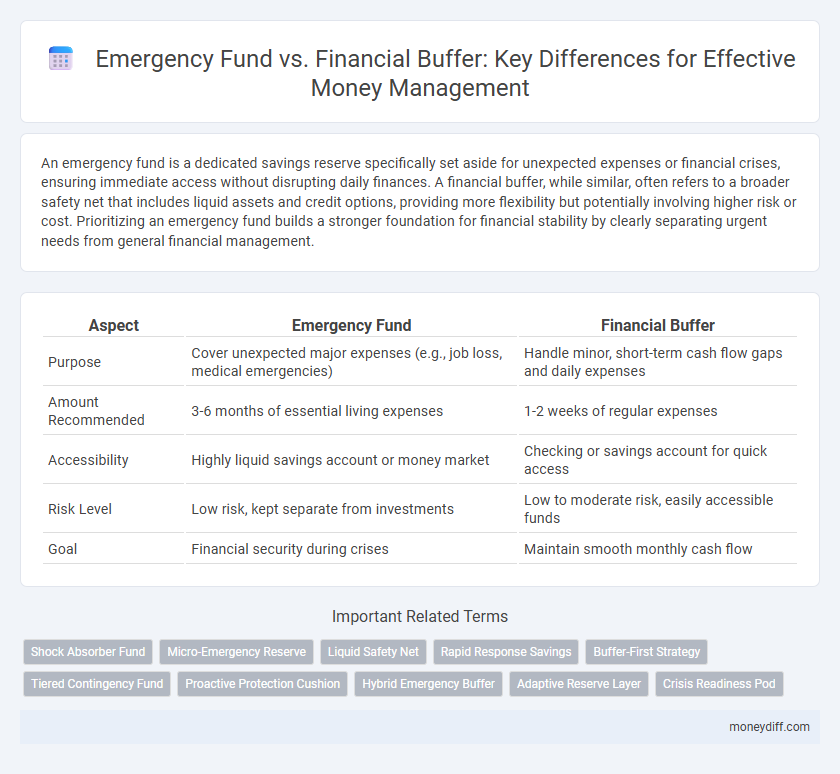

Table of Comparison

| Aspect | Emergency Fund | Financial Buffer |

|---|---|---|

| Purpose | Cover unexpected major expenses (e.g., job loss, medical emergencies) | Handle minor, short-term cash flow gaps and daily expenses |

| Amount Recommended | 3-6 months of essential living expenses | 1-2 weeks of regular expenses |

| Accessibility | Highly liquid savings account or money market | Checking or savings account for quick access |

| Risk Level | Low risk, kept separate from investments | Low to moderate risk, easily accessible funds |

| Goal | Financial security during crises | Maintain smooth monthly cash flow |

Defining Emergency Fund and Financial Buffer

An Emergency Fund is a dedicated savings pool specifically set aside to cover unexpected expenses such as medical emergencies, job loss, or urgent home repairs, typically amounting to three to six months of essential living costs. A Financial Buffer, on the other hand, refers to a more flexible reserve that can absorb minor financial shocks like irregular income or small, unplanned purchases without disrupting monthly budgeting. Both tools are crucial in money management but serve distinct roles: the Emergency Fund safeguards against significant financial crises, while the Financial Buffer supports everyday cash flow stability.

Key Differences Between Emergency Fund and Financial Buffer

An emergency fund is specifically designated for unexpected, urgent expenses such as medical emergencies or sudden job loss, providing financial security during crises. A financial buffer, on the other hand, serves as a flexible reserve that covers regular variations in income or expenses, such as delayed paychecks or minor home repairs. Key differences include the purpose, accessibility, and risk coverage, with emergency funds being more rigid and strictly for high-impact events, while financial buffers offer broader, short-term financial flexibility.

Why Both Are Essential in Money Management

An emergency fund provides a dedicated reserve specifically for unexpected expenses such as medical emergencies or job loss, ensuring financial stability during crises. A financial buffer, often a more flexible cash reserve, covers everyday cash flow fluctuations like delayed payments or minor unplanned costs. Maintaining both an emergency fund and a financial buffer enhances overall money management by combining long-term security with short-term liquidity, reducing the risk of financial stress and debt accumulation.

How to Calculate Your Ideal Emergency Fund

To calculate your ideal emergency fund, multiply your average monthly expenses by the recommended number of months to cover, typically three to six months. Include essential expenses such as housing, utilities, food, and transportation to ensure comprehensive coverage. Adjust the total based on job stability, income variability, and personal financial obligations.

Building an Effective Financial Buffer

Building an effective financial buffer involves setting aside liquid assets that cover at least three to six months of essential living expenses, ensuring quick access during unexpected financial setbacks. Unlike a traditional emergency fund, a financial buffer may include a combination of savings, low-risk investments, and readily available credit lines to increase financial flexibility. Prioritizing the establishment of a financial buffer enhances overall money management by reducing reliance on high-interest debt and providing a clearer strategy for financial stability.

Common Mistakes When Managing Emergency Funds

Confusing an emergency fund with a financial buffer often leads to underfunding essential reserves, risking insufficient cash during true emergencies. Many mistakenly tap into their emergency funds for non-urgent expenses, which diminishes preparedness for unexpected crises. Properly segregating emergency funds from general financial buffers ensures liquidity is preserved strictly for critical, unforeseen events.

When to Use an Emergency Fund vs a Financial Buffer

An Emergency Fund is designed for unexpected, high-impact financial crises such as medical emergencies, job loss, or major home repairs, ensuring liquidity in severe situations without accruing debt. A Financial Buffer, on the other hand, covers routine, smaller cash flow gaps like irregular expenses or temporary income fluctuations, providing day-to-day financial flexibility. Use the Emergency Fund for unforeseen events that threaten financial stability, while the Financial Buffer supports ongoing, short-term money management needs.

Strategies to Grow Your Financial Buffer

Building a robust financial buffer requires consistent savings habits, focusing on automatic transfers to a separate account dedicated solely to unexpected expenses. Leveraging high-yield savings accounts or low-risk investment options can accelerate growth while preserving liquidity for emergencies. Regularly reviewing and adjusting your savings goals ensures your financial buffer adapts to changing life circumstances and risk profiles.

Integrating Emergency Fund and Financial Buffer in Your Budget

Integrating an emergency fund and financial buffer in your budget enhances financial stability by addressing both unexpected crises and routine cash flow fluctuations. Allocating a specific portion of your income to a dedicated emergency fund ensures readiness for major unforeseen expenses, while maintaining a financial buffer provides liquidity for minor, day-to-day financial variances. This dual approach optimizes money management by balancing long-term security and immediate financial flexibility.

Tips to Maintain Both Funds for Financial Security

Maintaining both an emergency fund and a financial buffer requires consistent budgeting and automated savings contributions to ensure adequate liquidity during unforeseen expenses. Prioritize setting clear target amounts based on monthly expenses--typically three to six months for an emergency fund and one to two months for a financial buffer--to avoid financial stress. Regularly review and adjust these funds according to changes in income, expenses, and financial goals to sustain long-term financial security.

Related Important Terms

Shock Absorber Fund

A Shock Absorber Fund serves as a critical component within money management by providing immediate liquidity to cover unexpected expenses, distinguishing it from a broader Emergency Fund designed for long-term financial crises. This focused financial buffer enhances stability by absorbing sudden financial shocks, ensuring short-term cash flow remains uninterrupted without resorting to debt.

Micro-Emergency Reserve

A Micro-Emergency Reserve is a small, easily accessible portion of an emergency fund designed to cover minor, unexpected expenses without disrupting long-term financial stability. Unlike a broader financial buffer, which acts as a comprehensive safety net, this reserve targets everyday emergencies such as car repairs or medical co-pays, ensuring immediate liquidity without compromising larger savings goals.

Liquid Safety Net

An emergency fund serves as a liquid safety net specifically reserved for unexpected expenses, ensuring immediate access to cash without disrupting long-term investments. In contrast, a financial buffer may include less liquid assets and is intended to cover short-term cash flow fluctuations rather than sudden emergencies.

Rapid Response Savings

Rapid Response Savings serve as an immediate liquidity source, distinct from a traditional Emergency Fund, designed for unforeseen expenses like urgent repairs or sudden medical bills. While an Emergency Fund provides long-term financial security, a Financial Buffer offers quick access to cash, enhancing money management by minimizing reliance on high-interest debt.

Buffer-First Strategy

A Financial Buffer serves as an immediate liquidity reserve covering minor unexpected expenses, while an Emergency Fund targets larger, unforeseen financial crises, ensuring long-term stability. Adopting a Buffer-First Strategy prioritizes maintaining a readily accessible buffer to prevent the premature depletion of the more substantial, long-term Emergency Fund.

Tiered Contingency Fund

A Tiered Contingency Fund structures money management into layers of financial security, distinguishing an Emergency Fund as the immediate cash reserve for urgent expenses, while the broader Financial Buffer includes additional savings for less critical but foreseeable disruptions. This approach enhances liquidity management by categorizing funds based on accessibility and purpose, ensuring rapid access to emergency capital while maintaining reserves to stabilize finances over longer-term contingencies.

Proactive Protection Cushion

An Emergency Fund provides a dedicated financial cushion specifically designed to cover unexpected expenses such as medical emergencies or job loss, ensuring immediate access to cash without disrupting long-term investments. In contrast, a Financial Buffer functions as a flexible, short-term reserve tied to everyday cash flow fluctuations, offering proactive protection against minor financial disruptions while maintaining overall money management stability.

Hybrid Emergency Buffer

A Hybrid Emergency Buffer combines the stability of a traditional Emergency Fund with the flexibility of a Financial Buffer, offering quick access to cash while maintaining growth potential through diversified savings options. This approach optimizes money management by ensuring liquidity for unforeseen expenses and maximizing financial resilience through strategic asset allocation.

Adaptive Reserve Layer

The Emergency Fund serves as a foundational safety net covering essential expenses during unforeseen events, while the Financial Buffer, often referred to as the Adaptive Reserve Layer, provides flexible liquidity to manage irregular cash flow fluctuations without disrupting long-term savings. Prioritizing the Adaptive Reserve Layer enhances money management by allowing seamless financial adjustments, reducing reliance on high-interest debt, and maintaining overall fiscal stability.

Crisis Readiness Pod

The Crisis Readiness Pod emphasizes a well-structured emergency fund as a designated reserve covering three to six months of essential expenses, ensuring financial stability during unexpected hardships. Unlike a general financial buffer, this fund is specifically targeted for true crises, prioritizing liquidity and immediate accessibility to support critical needs without disrupting long-term investments.

Emergency Fund vs Financial Buffer for money management. Infographic

moneydiff.com

moneydiff.com