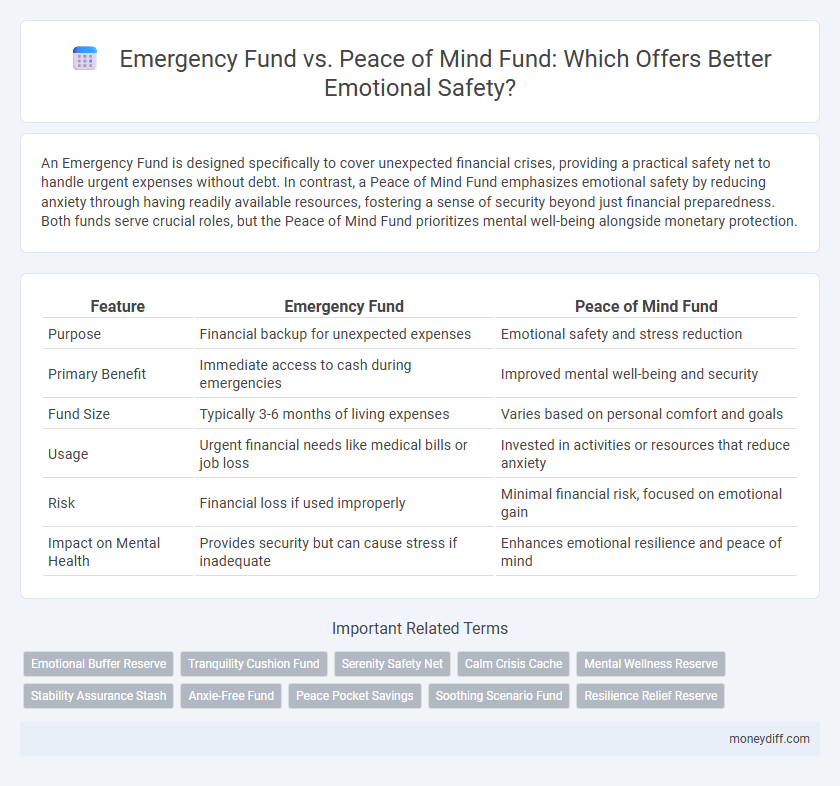

An Emergency Fund is designed specifically to cover unexpected financial crises, providing a practical safety net to handle urgent expenses without debt. In contrast, a Peace of Mind Fund emphasizes emotional safety by reducing anxiety through having readily available resources, fostering a sense of security beyond just financial preparedness. Both funds serve crucial roles, but the Peace of Mind Fund prioritizes mental well-being alongside monetary protection.

Table of Comparison

| Feature | Emergency Fund | Peace of Mind Fund |

|---|---|---|

| Purpose | Financial backup for unexpected expenses | Emotional safety and stress reduction |

| Primary Benefit | Immediate access to cash during emergencies | Improved mental well-being and security |

| Fund Size | Typically 3-6 months of living expenses | Varies based on personal comfort and goals |

| Usage | Urgent financial needs like medical bills or job loss | Invested in activities or resources that reduce anxiety |

| Risk | Financial loss if used improperly | Minimal financial risk, focused on emotional gain |

| Impact on Mental Health | Provides security but can cause stress if inadequate | Enhances emotional resilience and peace of mind |

Understanding Emergency Funds: The Basics

Emergency funds are financial reserves specifically set aside to cover unexpected expenses such as medical emergencies, car repairs, or job loss, ensuring short-term financial stability. Peace of Mind Funds extend beyond immediate emergencies by incorporating emotional and mental well-being into financial planning, reducing stress related to unpredictable life events. Understanding these basics helps individuals create a comprehensive safety net that addresses both practical needs and emotional security.

What is a Peace of Mind Fund?

A Peace of Mind Fund is a financial reserve specifically designed to provide emotional safety during unexpected life challenges, differing from a traditional Emergency Fund that focuses primarily on urgent expenses like medical bills or car repairs. It emphasizes psychological security by ensuring funds are readily available to reduce stress and anxiety when facing uncertainties. This type of fund allows individuals to handle emotional setbacks without financial pressure, fostering overall well-being.

Key Differences: Emergency Fund vs Peace of Mind Fund

An Emergency Fund typically covers unexpected financial crises like medical expenses or car repairs, ensuring liquidity during urgent situations. A Peace of Mind Fund, on the other hand, emphasizes emotional safety by providing a financial cushion aimed at reducing stress and anxiety related to future uncertainties. While both funds enhance financial security, the Emergency Fund is transaction-specific, whereas the Peace of Mind Fund prioritizes mental well-being through broader, proactive financial preparedness.

Emotional Safety and Financial Security

An Emergency Fund provides essential financial security by covering unexpected expenses such as medical bills or urgent home repairs, reducing stress during crises. A Peace of Mind Fund, focused more on emotional safety, supports mental well-being by ensuring funds are available for self-care, therapy, or stress-relief activities that reinforce emotional resilience. Both funds contribute to overall stability, but the Emergency Fund prioritizes immediate financial protection while the Peace of Mind Fund emphasizes sustained emotional safety.

Why Both Funds Matter for Mental Well-being

Emergency funds provide financial security during unexpected crises, reducing anxiety linked to monetary instability. Peace of Mind Funds focus on emotional safety, supporting mental health by covering costs related to therapy or stress relief activities. Combining both funds creates a comprehensive safety net that nurtures overall mental well-being and resilience.

How to Determine Your Emergency Fund Needs

Determining your emergency fund needs requires analyzing your monthly essential expenses, including housing, utilities, food, and medical costs, to cover at least three to six months of these expenditures. Assess emotional safety by considering a Peace of Mind Fund, which extends beyond financial stability to include resources for unforeseen mental health support or stress-relieving activities. Tailoring the emergency fund size to personal circumstances, job security, and emotional well-being ensures comprehensive preparedness for both financial and psychological emergencies.

Creating a Peace of Mind Fund: Steps and Strategies

Creating a Peace of Mind Fund involves setting aside financial resources specifically aimed at emotional safety during unforeseen hardships, distinct from a traditional Emergency Fund focused on immediate expenses. Steps include determining a target amount covering mental health support, stress-relief activities, and personal well-being needs, alongside establishing regular contributions and accessible savings. Strategies emphasize prioritizing self-care expenditures, maintaining liquidity for quick access, and periodically reassessing fund adequacy to align with evolving emotional and financial circumstances.

Psychological Benefits of Financial Preparedness

An Emergency Fund provides crucial financial security by covering unexpected expenses, reducing anxiety during crises and fostering a sense of control over unforeseen events. In contrast, a Peace of Mind Fund specifically targets emotional safety, emphasizing comfort and mental clarity through dedicated savings that alleviate stress related to potential financial instability. Both funds enhance psychological well-being by promoting preparedness, which strengthens resilience and supports overall mental health in times of uncertainty.

Building Both Funds: Practical Tips

Building both an Emergency Fund and a Peace of Mind Fund enhances financial and emotional resilience by addressing unforeseen expenses and reducing stress. Prioritize setting aside three to six months' worth of living expenses for emergencies, while allocating a smaller, flexible amount specifically for emotional well-being activities like therapy or relaxation. Consistent contributions, automated transfers, and revisiting fund goals quarterly ensure balanced growth and sustained security in both areas.

Common Mistakes to Avoid with Emergency and Peace of Mind Funds

Common mistakes to avoid with Emergency and Peace of Mind Funds include underestimating the amount needed, which can leave you financially vulnerable during unexpected events. Another frequent error is mixing these funds with regular savings, reducing their accessibility and purpose-specific value. Failing to regularly review and adjust the funds based on changing life circumstances can compromise their effectiveness in providing true financial and emotional security.

Related Important Terms

Emotional Buffer Reserve

An Emergency Fund provides financial security during unexpected expenses, while a Peace of Mind Fund acts as an Emotional Buffer Reserve, offering psychological comfort and reducing anxiety by ensuring access to resources in times of stress. Prioritizing an Emotional Buffer Reserve supports mental well-being alongside financial stability, promoting resilience during personal or financial crises.

Tranquility Cushion Fund

A Tranquility Cushion Fund emphasizes emotional safety by providing a financial buffer specifically designed to reduce stress during unforeseen events, unlike traditional emergency funds that primarily cover tangible expenses. This approach enhances mental well-being by addressing both immediate monetary needs and the psychological comfort of financial preparedness.

Serenity Safety Net

The Serenity Safety Net serves as a hybrid fund combining the financial security of an Emergency Fund with the emotional stability provided by a Peace of Mind Fund. This approach ensures that individuals not only cover unexpected expenses but also maintain emotional calm, reducing stress during financial crises.

Calm Crisis Cache

A Calm Crisis Cache enhances traditional Emergency Funds by prioritizing emotional safety alongside financial preparedness, offering resources tailored to reduce stress and anxiety during unexpected situations. This approach integrates mental well-being strategies with monetary reserves, fostering resilience and a balanced response in times of crisis.

Mental Wellness Reserve

An Emergency Fund provides financial security for unexpected expenses, while a Peace of Mind Fund, or Mental Wellness Reserve, specifically supports emotional safety by covering costs related to therapy, stress management, and mental health resources. Prioritizing a Mental Wellness Reserve enhances resilience and overall well-being, ensuring both financial stability and emotional balance during crises.

Stability Assurance Stash

The Stability Assurance Stash provides a dedicated Emergency Fund designed to cover unexpected financial crises, ensuring immediate access to critical resources and maintaining financial stability. Unlike a Peace of Mind Fund, which emphasizes emotional comfort, the Stability Assurance Stash prioritizes concrete financial security and swift relief during emergencies, reinforcing practical resilience over psychological reassurance.

Anxie-Free Fund

An Anxie-Free Fund differs from a traditional Emergency Fund by prioritizing emotional safety through readily accessible savings designed to reduce stress during unexpected financial challenges. This approach enhances mental well-being by addressing anxiety related to financial instability, offering peace of mind beyond basic emergency coverage.

Peace Pocket Savings

Peace Pocket Savings offers an innovative approach to financial security by emphasizing emotional safety alongside traditional emergency funds, ensuring users have quick access to funds that reduce stress during unexpected events. Unlike standard emergency funds focused solely on financial needs, Peace Pocket Savings integrates psychological well-being, promoting a balanced sense of preparedness and peace of mind.

Soothing Scenario Fund

The Soothing Scenario Fund enhances emotional safety by addressing immediate stressors beyond typical emergency expenses, providing a dedicated reserve for mental well-being during unexpected challenges. Unlike a standard Emergency Fund focused solely on financial crises, this fund supports proactive self-care and stress reduction to maintain peace of mind.

Resilience Relief Reserve

The Resilience Relief Reserve functions as a hybrid between an Emergency Fund and a Peace of Mind Fund, providing both financial security and emotional safety by addressing unexpected expenses while reducing stress and anxiety. Its strategic allocation enhances overall resilience, enabling individuals to recover swiftly from crises and maintain mental well-being during turbulent times.

Emergency Fund vs Peace of Mind Fund for emotional safety. Infographic

moneydiff.com

moneydiff.com