An Emergency Fund is essential for covering unexpected expenses like medical bills or urgent pet care, ensuring financial stability during crises. In contrast, an Opportunity Fund is reserved for strategic investments or unique chances that may arise, allowing growth without jeopardizing essential safety nets. Prioritizing an Emergency Fund protects your pet's well-being by providing immediate financial security before considering discretionary opportunities.

Table of Comparison

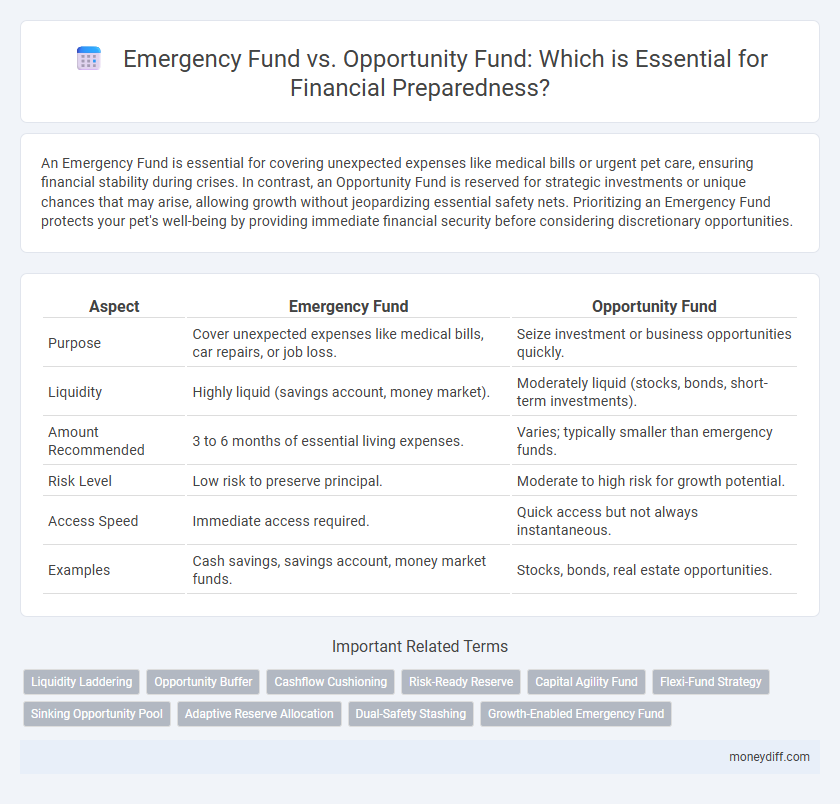

| Aspect | Emergency Fund | Opportunity Fund |

|---|---|---|

| Purpose | Cover unexpected expenses like medical bills, car repairs, or job loss. | Seize investment or business opportunities quickly. |

| Liquidity | Highly liquid (savings account, money market). | Moderately liquid (stocks, bonds, short-term investments). |

| Amount Recommended | 3 to 6 months of essential living expenses. | Varies; typically smaller than emergency funds. |

| Risk Level | Low risk to preserve principal. | Moderate to high risk for growth potential. |

| Access Speed | Immediate access required. | Quick access but not always instantaneous. |

| Examples | Cash savings, savings account, money market funds. | Stocks, bonds, real estate opportunities. |

Emergency Fund vs Opportunity Fund: Key Differences

An Emergency Fund is designed to cover unexpected expenses such as medical emergencies, car repairs, or job loss, typically equal to three to six months of living expenses. An Opportunity Fund, in contrast, is allocated for seizing timely financial opportunities like investments, business ventures, or special purchases and usually remains more flexible and accessible. The key difference lies in the purpose and usage, where the Emergency Fund prioritizes financial security and risk management, while the Opportunity Fund focuses on growth and capitalizing on potential gains.

Understanding the Purpose of Emergency Funds

Emergency funds provide immediate financial security by covering unexpected expenses such as medical emergencies, car repairs, or job loss, ensuring stability without incurring debt. In contrast, opportunity funds are reserved for strategic investments or timely ventures, allowing individuals to capitalize on potential growth opportunities without risking essential savings. Clearly distinguishing these funds enhances financial preparedness by balancing risk management with wealth-building potential.

The Role of Opportunity Funds in Financial Growth

Opportunity funds serve as strategic financial reserves designed to capitalize on unexpected investment prospects, fueling wealth accumulation beyond basic security measures. Unlike emergency funds that prioritize liquidity for urgent expenses, opportunity funds enable proactive growth by allocating capital towards high-return opportunities. Integrating opportunity funds into a financial plan enhances long-term portfolio diversification and accelerates financial independence.

How Each Fund Supports Financial Preparedness

Emergency funds provide a financial safety net by covering essential expenses during unexpected events like job loss or medical emergencies, ensuring immediate liquidity and reducing reliance on debt. Opportunity funds support financial preparedness by enabling individuals to capitalize on favorable investment or business opportunities without compromising their emergency savings. Together, these funds create a balanced financial strategy that safeguards against crises while fostering growth potential.

When to Use Emergency Funds and Opportunity Funds

Emergency funds are essential for covering unexpected expenses such as medical emergencies, job loss, or urgent home repairs, providing immediate financial security without incurring debt. Opportunity funds, however, are best utilized for strategic investments or time-sensitive financial opportunities like purchasing discounted assets or funding education that could yield future returns. Knowing when to deploy each fund ensures balanced financial preparedness, avoiding depletion of emergency reserves while capitalizing on growth opportunities.

Building Your Emergency Fund: Essential Steps

Building your emergency fund requires setting aside three to six months' worth of essential living expenses in a highly liquid, low-risk account to ensure fast access during financial crises. Prioritize consistent monthly contributions and automate savings to maintain steady growth without impacting your regular budget. Differentiate this fund from an opportunity fund, which is designed for strategic investments and carries higher risk, whereas the emergency fund focuses solely on financial security and immediate availability.

Growing Your Opportunity Fund: Best Strategies

Growing your Opportunity Fund requires disciplined saving and strategic investment in diversified assets such as stocks, bonds, and index funds to maximize returns over time. Unlike an Emergency Fund, which prioritizes liquidity and low risk, an Opportunity Fund aims for growth potential, leveraging compound interest and market appreciation. Regular contributions and rebalancing your portfolio ensure that your Opportunity Fund remains aligned with evolving financial goals and market conditions.

Balancing Emergency and Opportunity Funds for Stability

Balancing emergency and opportunity funds is crucial for financial stability, ensuring immediate access to cash during unexpected expenses while preserving growth potential through strategic investments. Emergency funds typically cover three to six months of essential living costs, providing a safety net against income interruptions. Opportunity funds, in contrast, allocate capital for timely investments or ventures that can enhance long-term wealth without compromising financial security.

Mistakes to Avoid with Emergency and Opportunity Funds

Common mistakes to avoid with emergency and opportunity funds include failing to clearly differentiate their purposes, which can lead to depleted savings during unexpected expenses or missed investment opportunities. Allocating emergency funds in high-risk assets undermines liquidity and stability, while keeping opportunity funds too liquid diminishes potential growth. Consistent review and appropriate allocation ensure both funds effectively support financial preparedness without compromising each other's objectives.

Creating a Financial Plan: Integrating Both Funds

Creating a financial plan that integrates both an emergency fund and an opportunity fund enhances overall financial preparedness by balancing risk management and growth potential. An emergency fund provides immediate liquidity to cover 3 to 6 months of essential expenses during unexpected events, reducing reliance on high-interest debt. Simultaneously, an opportunity fund allocates capital for investments or ventures that arise, allowing individuals to capitalize on financial opportunities without compromising their safety net.

Related Important Terms

Liquidity Laddering

Emergency funds prioritize immediate liquidity to cover unforeseen expenses, typically held in assets like savings accounts or money market funds for quick access. Opportunity funds occupy a lower rung on the liquidity ladder, allowing for strategic investments that balance accessibility with potential growth, enabling financial preparedness beyond emergencies.

Opportunity Buffer

An Opportunity Fund functions as a financial buffer specifically designed to seize unexpected investment or business opportunities without jeopardizing essential emergency savings. Unlike an Emergency Fund, which covers unforeseen expenses like medical bills or job loss, the Opportunity Fund enables strategic financial agility to capitalize on market dips or unique deals.

Cashflow Cushioning

An Emergency Fund provides a critical cashflow cushioning by covering unexpected expenses such as medical emergencies, car repairs, or sudden job loss, ensuring financial stability without incurring debt. In contrast, an Opportunity Fund is reserved for seizing timely investments or business opportunities, emphasizing growth rather than immediate financial security.

Risk-Ready Reserve

An Emergency Fund serves as a Risk-Ready Reserve designed to cover unexpected expenses such as medical emergencies, job loss, or urgent home repairs, ensuring financial stability during crises. In contrast, an Opportunity Fund focuses on capitalizing on investment or business opportunities, prioritizing growth potential over immediate risk mitigation.

Capital Agility Fund

The Emergency Fund ensures immediate access to liquid assets for unforeseen expenses, while the Capital Agility Fund--a form of Opportunity Fund--focuses on strategic investment opportunities that require quick capital deployment for growth potential. Prioritizing an Emergency Fund stabilizes financial security, whereas the Capital Agility Fund enhances financial preparedness by enabling agile responses to market opportunities without compromising liquidity.

Flexi-Fund Strategy

A Flexi-Fund Strategy balances an Emergency Fund's liquidity and safety with an Opportunity Fund's growth potential, ensuring financial preparedness for unexpected expenses while capitalizing on investment opportunities. Allocating assets between low-risk, easily accessible funds and higher-yield investments optimizes both security and flexibility in personal finance management.

Sinking Opportunity Pool

An Emergency Fund is designed to cover unexpected expenses like medical emergencies or job loss, typically consisting of 3 to 6 months of living expenses in liquid assets. In contrast, a Sinking Opportunity Pool acts as a strategic reserve for anticipated opportunities or investments, allowing for financial flexibility to seize favorable deals without compromising emergency preparedness.

Adaptive Reserve Allocation

An Emergency Fund provides immediate liquidity for unforeseen expenses like medical bills or job loss, whereas an Opportunity Fund is allocated for strategic investments or emerging market opportunities. Adaptive Reserve Allocation balances these funds dynamically, ensuring financial preparedness by adjusting reserve levels in response to changing personal risk profiles and market conditions.

Dual-Safety Stashing

An Emergency Fund provides immediate financial security by covering unforeseen expenses, while an Opportunity Fund is reserved for strategic investments or unexpected opportunities, enhancing long-term wealth. Dual-Safety Stashing involves maintaining separate reserves to ensure both liquidity for emergencies and capital for growth, optimizing financial preparedness and stability.

Growth-Enabled Emergency Fund

A Growth-Enabled Emergency Fund balances liquidity with strategic investments, ensuring accessible cash for emergencies while generating returns to combat inflation. This hybrid approach outperforms traditional cash-only emergency funds by preserving capital and enhancing long-term financial resilience.

Emergency Fund vs Opportunity Fund for financial preparedness. Infographic

moneydiff.com

moneydiff.com