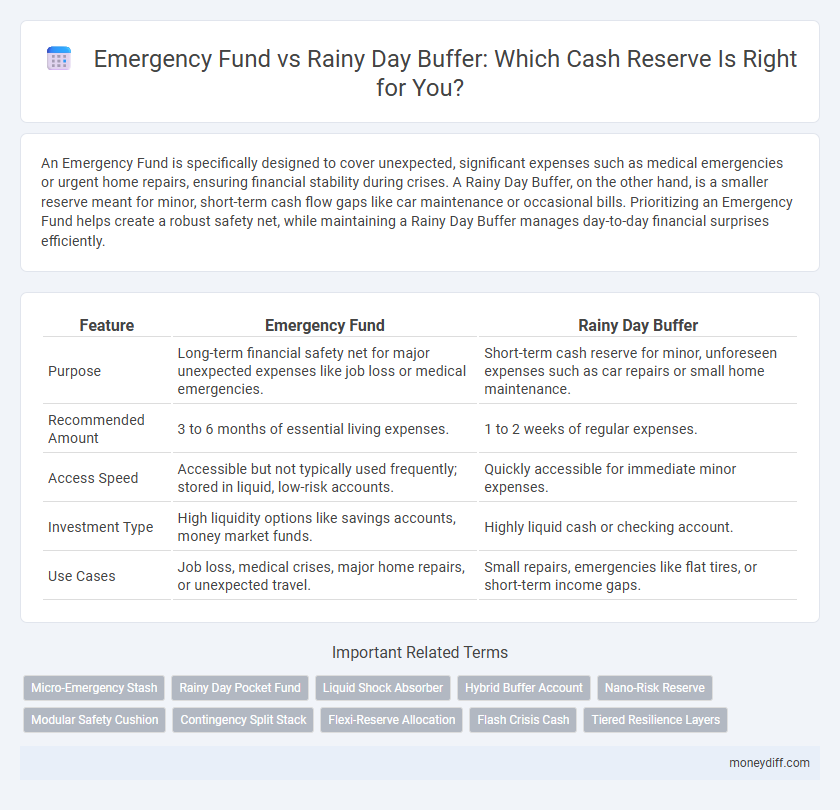

An Emergency Fund is specifically designed to cover unexpected, significant expenses such as medical emergencies or urgent home repairs, ensuring financial stability during crises. A Rainy Day Buffer, on the other hand, is a smaller reserve meant for minor, short-term cash flow gaps like car maintenance or occasional bills. Prioritizing an Emergency Fund helps create a robust safety net, while maintaining a Rainy Day Buffer manages day-to-day financial surprises efficiently.

Table of Comparison

| Feature | Emergency Fund | Rainy Day Buffer |

|---|---|---|

| Purpose | Long-term financial safety net for major unexpected expenses like job loss or medical emergencies. | Short-term cash reserve for minor, unforeseen expenses such as car repairs or small home maintenance. |

| Recommended Amount | 3 to 6 months of essential living expenses. | 1 to 2 weeks of regular expenses. |

| Access Speed | Accessible but not typically used frequently; stored in liquid, low-risk accounts. | Quickly accessible for immediate minor expenses. |

| Investment Type | High liquidity options like savings accounts, money market funds. | Highly liquid cash or checking account. |

| Use Cases | Job loss, medical crises, major home repairs, or unexpected travel. | Small repairs, emergencies like flat tires, or short-term income gaps. |

Understanding Emergency Funds vs Rainy Day Buffers

Emergency funds are typically larger cash reserves designed to cover significant unexpected expenses such as job loss or major medical emergencies, while rainy day buffers are smaller savings intended for minor, short-term financial disruptions like car repairs or utility bills. Understanding the distinction helps in allocating cash reserves appropriately, ensuring both immediate and long-term financial stability. Properly structured emergency funds and rainy day buffers together provide comprehensive financial protection against varying unforeseen events.

Key Differences Between Emergency Funds and Rainy Day Buffers

An emergency fund is a larger, long-term cash reserve designed to cover significant unexpected expenses such as medical emergencies, job loss, or major home repairs, typically amounting to three to six months of living expenses. In contrast, a rainy day buffer is a smaller, short-term reserve for minor, foreseeable expenses like car repairs, utility bills, or unexpected small purchases, usually covering a few hundred to one thousand dollars. The key difference lies in their purpose and scale: emergency funds provide financial security against major crises, while rainy day buffers manage routine financial disruptions.

When to Use an Emergency Fund

An emergency fund is designed for unexpected, severe financial crises such as job loss, medical emergencies, or major repairs, providing a safety net that covers three to six months of essential expenses. A rainy day buffer, in contrast, handles smaller setbacks like minor car repairs or short-term income fluctuations and typically involves a smaller amount of liquid cash. Use an emergency fund only for true financial emergencies to preserve its purpose and avoid depleting resources meant for long-term stability.

Ideal Situations for a Rainy Day Buffer

A rainy day buffer is ideal for covering unexpected but smaller expenses, such as minor car repairs or medical bills, typically ranging from a few hundred to a couple thousand dollars. This fund suits individuals with stable incomes and predictable monthly expenses, providing quick access to cash without tapping into long-term emergency savings. Maintaining a rainy day buffer minimizes reliance on credit and helps preserve the primary emergency fund for more severe financial crises like job loss or major medical emergencies.

How Much Cash Should You Reserve for Each?

An emergency fund typically requires three to six months' worth of living expenses to cover unexpected major financial setbacks, while a rainy day buffer usually holds one to two months' cash reserves for smaller, short-term disruptions. Financial experts recommend tailoring the emergency fund size based on job stability, income sources, and monthly obligations, whereas the rainy day buffer is maintained for routine, minor expenses like car repairs or utility bills. Prioritizing a sufficiently funded emergency fund before bolstering the rainy day buffer ensures comprehensive financial preparedness.

Setting Financial Goals for Cash Reserves

Setting financial goals for cash reserves involves distinguishing between an emergency fund and a rainy day buffer, each serving different purposes within your overall financial plan. An emergency fund typically covers 3 to 6 months of essential living expenses, designed to provide stability during major unexpected events like job loss or medical emergencies, while a rainy day buffer is a smaller, more liquid reserve intended for short-term, minor unexpected expenses such as car repairs or home maintenance. Prioritizing a well-funded emergency fund ensures long-term financial security, while maintaining a rainy day buffer helps manage immediate cash flow disruptions without tapping into more substantial savings.

Building an Effective Emergency Fund

An effective emergency fund should cover three to six months of essential living expenses, providing a financial cushion for unexpected, significant events like job loss or medical emergencies. In contrast, a rainy day buffer is a smaller cash reserve meant for minor, short-term expenses such as car repairs or sudden utility bills. Prioritizing a fully funded emergency fund ensures greater financial security and long-term stability during major emergencies.

Practical Strategies for Growing a Rainy Day Buffer

Maximizing your rainy day buffer requires consistent, automated savings from each paycheck directly into a high-yield savings account separate from everyday spending funds. Prioritize building three to six months' worth of essential expenses to ensure liquidity during unforeseen events without tapping into long-term investments. Utilizing budgeting apps to track discretionary spending helps identify surplus cash that can be redirected to accelerate growth of the buffer.

Common Mistakes When Managing Cash Reserves

A common mistake when managing cash reserves is confusing an emergency fund with a rainy day buffer, leading to underfunded financial protection. An emergency fund is typically three to six months of essential expenses, designed for major crises such as job loss or medical emergencies, whereas a rainy day buffer covers smaller, unexpected expenses like car repairs or minor home maintenance. Failing to distinguish between these two can result in inadequate savings, leaving individuals vulnerable during both minor disruptions and significant financial hardships.

Choosing the Right Reserve Strategy for Financial Security

An emergency fund typically covers three to six months of essential living expenses, providing substantial financial security during major unexpected events like job loss or medical emergencies. A rainy day buffer, usually a smaller cash reserve of one month's expenses, is designed for minor, short-term disruptions such as car repairs or utility bills. Selecting the right reserve strategy depends on personal financial stability, income reliability, and risk tolerance to ensure optimal cash flow management and peace of mind.

Related Important Terms

Micro-Emergency Stash

A Micro-Emergency Stash serves as a smaller, more accessible cash reserve within an Emergency Fund for immediate, unexpected expenses like minor car repairs or urgent medical needs. This Rainy Day Buffer complements the larger Emergency Fund by covering short-term cash flow gaps without tapping into long-term savings.

Rainy Day Pocket Fund

A Rainy Day Pocket Fund is a smaller, more accessible cash reserve designed for immediate, minor unexpected expenses such as car repairs or medical co-pays, distinct from a larger Emergency Fund intended for significant financial disruptions like job loss or major emergencies. Maintaining a Rainy Day Pocket Fund improves financial stability by covering everyday urgent costs without tapping into long-term savings or emergency reserves.

Liquid Shock Absorber

An Emergency Fund serves as a Liquid Shock Absorber designed to cover unexpected major expenses, typically maintaining three to six months of living costs in highly liquid assets. In contrast, a Rainy Day Buffer manages smaller, short-term cash flow interruptions with easily accessible funds targeting minor, often planned, financial disruptions.

Hybrid Buffer Account

A Hybrid Buffer Account combines the benefits of an Emergency Fund and a Rainy Day Buffer by offering immediate liquidity for unexpected expenses while maintaining a reserve for short-term cash flow fluctuations. This financial tool optimizes cash reserves through flexible access and targeted allocation, ensuring preparedness for both sudden emergencies and routine financial disruptions.

Nano-Risk Reserve

Emergency Fund typically covers 3-6 months of essential expenses for major financial disruptions, while a Rainy Day Buffer targets smaller, short-term cash needs like unexpected minor bills. Nano-Risk Reserve functions as a micro-emergency fund, strategically designed to cover immediate, low-impact costs, maintaining liquidity without tapping into larger reserves.

Modular Safety Cushion

An Emergency Fund serves as a long-term financial reserve designed to cover significant unexpected expenses or income loss, typically amounting to three to six months of essential living costs, while a Rainy Day Buffer acts as a modular safety cushion for smaller, short-term cash needs such as minor repairs or temporary bills. This layered approach enhances financial resilience by maintaining distinct cash reserves calibrated to the severity and immediacy of potential financial disruptions.

Contingency Split Stack

Emergency Fund and Rainy Day Buffer both serve as cash reserves but differ in purpose; Emergency Fund covers major unexpected expenses like medical emergencies or job loss, while Rainy Day Buffer handles smaller, short-term financial hiccups such as car repairs or minor home maintenance. Contingency Split Stack strategy allocates funds between these two reserves to optimize liquidity and financial security, ensuring immediate access to cash for both urgent emergencies and everyday surprises.

Flexi-Reserve Allocation

Flexi-Reserve Allocation allows a dynamic balance between an Emergency Fund and a Rainy Day Buffer, optimizing cash reserves for liquidity and unexpected expenses; this approach enhances financial resilience by providing immediate access to funds while maintaining long-term stability. Prioritizing flexible cash management strategies improves response to varied financial emergencies without compromising investment growth potential.

Flash Crisis Cash

Emergency funds are strategic cash reserves designed to cover significant, unexpected expenses or prolonged financial disruptions, whereas rainy day buffers address minor, short-term financial hiccups like routine car repairs or temporary income drops. Flash crisis cash focuses on immediate availability and liquidity, prioritizing quick access to funds during sudden emergencies such as job loss or medical emergencies, ensuring financial stability without debt reliance.

Tiered Resilience Layers

Emergency funds provide a primary layer of financial security designed to cover major unexpected expenses, while a rainy day buffer acts as a secondary reserve for smaller, more frequent cash shortfalls. Implementing tiered resilience layers ensures optimal cash reserve management by balancing immediate liquidity needs with long-term financial stability.

Emergency Fund vs Rainy Day Buffer for cash reserves. Infographic

moneydiff.com

moneydiff.com