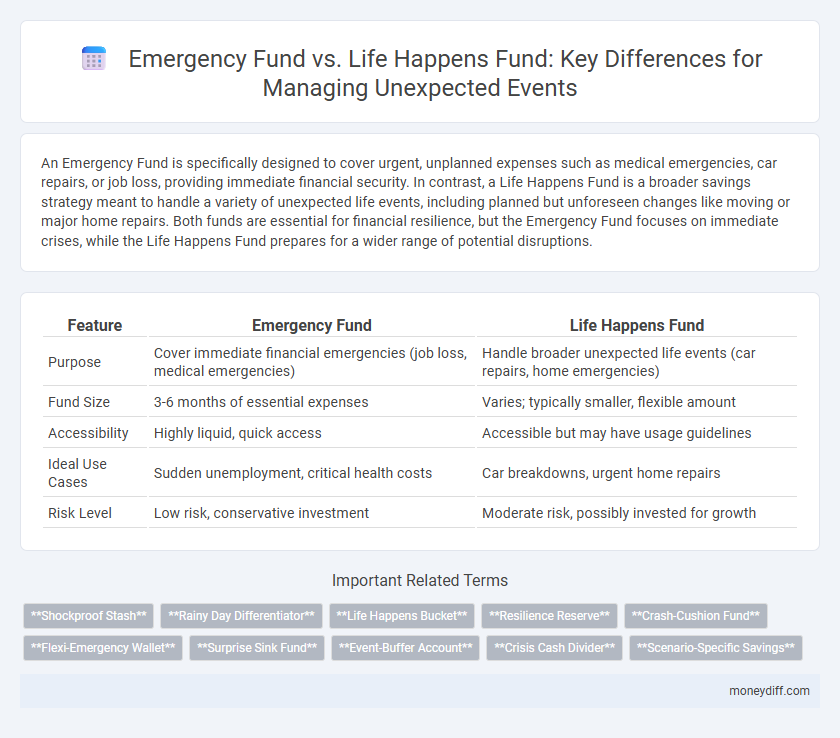

An Emergency Fund is specifically designed to cover urgent, unplanned expenses such as medical emergencies, car repairs, or job loss, providing immediate financial security. In contrast, a Life Happens Fund is a broader savings strategy meant to handle a variety of unexpected life events, including planned but unforeseen changes like moving or major home repairs. Both funds are essential for financial resilience, but the Emergency Fund focuses on immediate crises, while the Life Happens Fund prepares for a wider range of potential disruptions.

Table of Comparison

| Feature | Emergency Fund | Life Happens Fund |

|---|---|---|

| Purpose | Cover immediate financial emergencies (job loss, medical emergencies) | Handle broader unexpected life events (car repairs, home emergencies) |

| Fund Size | 3-6 months of essential expenses | Varies; typically smaller, flexible amount |

| Accessibility | Highly liquid, quick access | Accessible but may have usage guidelines |

| Ideal Use Cases | Sudden unemployment, critical health costs | Car breakdowns, urgent home repairs |

| Risk Level | Low risk, conservative investment | Moderate risk, possibly invested for growth |

Defining Emergency Funds and Life Happens Funds

Emergency Funds are financial reserves designed to cover essential living expenses during unforeseen events such as job loss, medical emergencies, or urgent home repairs, typically amounting to three to six months of living costs. Life Happens Funds, on the other hand, are designated for non-critical, unexpected life events like car breakdowns, minor medical bills, or sudden travel expenses, helping to avoid debt for smaller disruptions. While both funds provide financial security, Emergency Funds prioritize long-term stability, whereas Life Happens Funds address more immediate, less severe financial surprises.

Key Differences Between Emergency Fund and Life Happens Fund

An Emergency Fund is a reserved amount of money specifically set aside to cover essential living expenses during unforeseen financial hardships, such as job loss or medical emergencies. The Life Happens Fund, conversely, is designed for broader unexpected life events like major home repairs or car breakdowns, often encompassing planned but irregular expenses. Key differences lie in their purpose, with Emergency Funds targeting critical survival needs and Life Happens Funds offering flexibility for varying unplanned costs beyond immediate essentials.

Purpose of Each Fund in Personal Finance

Emergency Funds are specifically designed to cover immediate, essential expenses such as job loss, medical emergencies, or urgent home repairs, providing a financial safety net during unforeseen crises. Life Happens Funds, in contrast, are intended for broader, less urgent unexpected costs like car maintenance, minor health issues, or unplanned travel, helping to manage day-to-day financial surprises. Differentiating these funds ensures tailored financial planning, protecting both short-term stability and ongoing financial resilience.

What Qualifies as an Emergency vs. a Life Happens Event

Emergency funds cover urgent, unforeseen expenses such as medical emergencies, car repairs, or job loss that require immediate liquidity. Life Happens funds address less critical but disruptive events like home renovations, routine medical procedures, or planned travel delays. Distinguishing an emergency from a Life Happens event hinges on the immediacy and necessity of expenses impacting financial stability.

Recommended Savings Amounts for Each Fund

Emergency Fund savings typically cover three to six months of essential living expenses to ensure financial stability during unforeseen job loss or emergencies. Life Happens Fund, designed for broader unexpected events like major repairs or medical bills, often requires a larger amount based on individual risk factors, commonly suggested at six to twelve months of expenses. Experts recommend maintaining both funds separately, with a minimum of $1,000 in an Emergency Fund and scaling the Life Happens Fund according to lifestyle and potential unexpected costs.

How to Prioritize Building Your Funds

Prioritize building your Emergency Fund first as it covers essential expenses like rent, utilities, and groceries during financial crises, typically amounting to three to six months of living costs. The Life Happens Fund serves as a secondary safety net, addressing less predictable or larger unforeseen expenses such as medical bills or major car repairs. Focusing on the Emergency Fund ensures immediate financial stability before allocating resources to the broader, less urgent Life Happens Fund.

Accessing and Using Your Funds Wisely

An Emergency Fund provides immediate access to cash for urgent, unforeseen expenses without penalties or delays, ensuring quick financial relief during crises. A Life Happens Fund typically emphasizes broader financial planning for life events, but may have restrictions or longer access times, making it less flexible for sudden emergencies. Using your Emergency Fund wisely means reserving it strictly for critical, unplanned costs, thereby maintaining financial stability and avoiding debt.

Pros and Cons: Emergency Fund vs. Life Happens Fund

An Emergency Fund offers quick access to cash specifically set aside for immediate, unforeseen expenses such as medical bills or car repairs, providing financial stability and peace of mind; however, it requires disciplined saving and can tie up funds that might earn higher returns elsewhere. A Life Happens Fund, often supported by organizations and community programs, provides assistance during larger-scale or less predictable life events, offering broader support but sometimes with eligibility requirements or limited funds. Evaluating both options helps balance liquidity and coverage, ensuring preparedness for various unexpected financial challenges.

Common Mistakes in Managing Unexpected Event Funds

Common mistakes in managing Emergency Funds versus Life Happens Funds include underestimating the amount needed for true emergencies and failing to regularly adjust the fund based on changing expenses or life circumstances. Many individuals confuse the two funds by using Life Happens Funds for routine, non-critical expenses instead of reserving Emergency Funds strictly for unforeseen, high-impact events like medical emergencies or job loss. Neglecting to separate these funds often leads to depleted resources during genuine crises, reducing financial stability and recovery speed.

Tips to Maintain and Grow Both Funds Efficiently

Separate Emergency Funds and Life Happens Funds to address distinct unexpected events, ensuring each has clear goals and withdrawal criteria. Regularly automate contributions to both accounts to build balances consistently without manual effort. Periodically review and adjust fund amounts based on lifestyle changes, inflation, and upcoming expenses to maintain optimal financial security.

Related Important Terms

Shockproof Stash

Shockproof Stash serves as a hybrid between a traditional Emergency Fund and a Life Happens Fund, offering immediate liquidity for unforeseen expenses while also covering broader financial disruptions. It prioritizes accessibility and flexibility, ensuring preparedness for both minor emergencies and significant life changes without depleting essential savings.

Rainy Day Differentiator

An Emergency Fund is specifically designed to cover essential expenses during immediate financial crises, typically equal to three to six months of living costs, whereas a Life Happens Fund acts as a broader Rainy Day Differentiator, providing flexible resources for less critical but unexpected events like car repairs or minor medical bills. The key distinction lies in the Emergency Fund's strict purpose for urgent stability, while the Life Happens Fund offers supplementary financial cushioning for unpredictable, non-emergency situations.

Life Happens Bucket

The Life Happens Fund serves as a flexible savings bucket designed specifically for unplanned, yet non-emergency expenses like car repairs, home maintenance, or medical bills, offering targeted financial preparedness beyond a traditional Emergency Fund. This specialized fund ensures liquidity and peace of mind by covering significant unexpected costs that don't qualify as true emergencies but still require immediate access to cash.

Resilience Reserve

A Resilience Reserve serves as a specialized emergency fund designed to cover unforeseen life events with sufficient liquidity and flexibility, ensuring financial stability during crises. Unlike a general Life Happens Fund, the Resilience Reserve emphasizes rapid access to cash and strategic allocation to maintain long-term financial health.

Crash-Cushion Fund

A Crash-Cushion Fund serves as an essential buffer distinct from a Life Happens Fund by providing immediate liquidity specifically for emergency expenses such as unforeseen medical bills or sudden job loss, ensuring financial stability without disrupting long-term savings. This targeted emergency fund emphasizes quick access and sufficient coverage typically covering three to six months of living expenses to mitigate financial shocks effectively.

Flexi-Emergency Wallet

The Flexi-Emergency Wallet offers a versatile alternative to traditional Emergency Funds and Life Happens Funds by providing instant access to cash for unexpected events without the rigid limitations of fixed savings accounts. This dynamic solution ensures financial agility during emergencies, allowing users to manage unforeseen expenses with ease and flexibility.

Surprise Sink Fund

A Surprise Sink Fund specifically targets small, unexpected expenses without depleting your primary Emergency Fund, offering a dedicated buffer for minor financial surprises such as car repairs or medical co-pays. This fund complements the broader Life Happens Fund by preventing small shocks from escalating into larger financial emergencies.

Event-Buffer Account

An Emergency Fund primarily covers essential, immediate expenses like medical bills or car repairs during unforeseen situations, while a Life Happens Fund acts as a broader Event-Buffer Account to manage larger, less frequent events such as job loss or major home repairs. Maintaining an adequately funded Event-Buffer Account ensures financial stability without disrupting long-term investments during unexpected life events.

Crisis Cash Divider

The Crisis Cash Divider strategically allocates resources between an Emergency Fund, reserved for essential, unavoidable expenses, and a Life Happens Fund, which covers less predictable, non-critical financial disruptions. This division ensures immediate access to liquidity during crises while maintaining flexible support for everyday unexpected costs, optimizing financial resilience.

Scenario-Specific Savings

Scenario-specific savings such as Emergency Funds are designed to cover essential, unforeseen expenses like medical emergencies or job loss, while Life Happens Funds address broader unexpected life events, including major repairs or family needs. Prioritizing an Emergency Fund ensures quick access to liquid cash for immediate crises, providing financial stability without compromising long-term savings goals.

Emergency Fund vs Life Happens Fund for unexpected events. Infographic

moneydiff.com

moneydiff.com