An Emergency Fund is a dedicated savings pool designed to cover unexpected expenses such as medical bills or urgent car repairs, providing quick financial relief without disrupting daily budgeting. In contrast, a Crisis Stash is typically smaller and reserved specifically for severe situations like job loss or natural disasters, acting as a last-resort safety net when cash flow halts completely. Prioritizing an Emergency Fund ensures immediate urgent needs are met, while a Crisis Stash supports long-term stability during profound financial hardships.

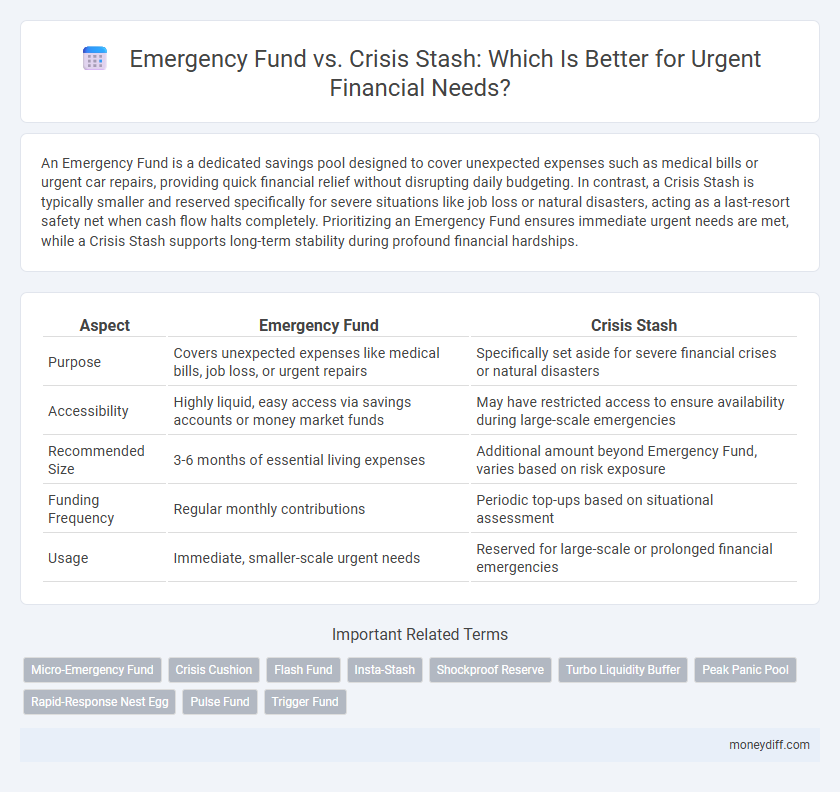

Table of Comparison

| Aspect | Emergency Fund | Crisis Stash |

|---|---|---|

| Purpose | Covers unexpected expenses like medical bills, job loss, or urgent repairs | Specifically set aside for severe financial crises or natural disasters |

| Accessibility | Highly liquid, easy access via savings accounts or money market funds | May have restricted access to ensure availability during large-scale emergencies |

| Recommended Size | 3-6 months of essential living expenses | Additional amount beyond Emergency Fund, varies based on risk exposure |

| Funding Frequency | Regular monthly contributions | Periodic top-ups based on situational assessment |

| Usage | Immediate, smaller-scale urgent needs | Reserved for large-scale or prolonged financial emergencies |

Understanding Emergency Funds: Purpose and Importance

An emergency fund is a dedicated savings reserve designed to cover unexpected expenses such as medical emergencies, car repairs, or job loss, ensuring financial stability during unforeseen events. Unlike a crisis stash, which may be informal and inconsistent, an emergency fund is systematically planned with a target amount typically covering three to six months of essential living expenses. Maintaining an emergency fund helps prevent debt accumulation and provides peace of mind by safeguarding against financial shocks.

What Is a Crisis Stash? Key Differences Explained

A Crisis Stash is a smaller, quickly accessible reserve of cash set aside specifically for immediate, unforeseen emergencies, distinct from a larger Emergency Fund designed to cover extended financial hardships. While an Emergency Fund typically covers three to six months of living expenses, a Crisis Stash focuses on covering urgent, short-term needs like minor medical bills or urgent home repairs. The key difference lies in liquidity and purpose: the Crisis Stash offers instant access with minimal disruption, whereas the Emergency Fund provides a broader safety net for sustained crises.

Emergency Fund vs Crisis Stash: Which Comes First?

An Emergency Fund should take priority over a Crisis Stash as it provides a structured financial safety net, typically covering three to six months of living expenses for unexpected events like job loss or medical emergencies. A Crisis Stash, often a smaller and more liquid reserve, supports immediate urgent needs such as car repairs or sudden small expenses. Building a solid Emergency Fund first ensures long-term stability before allocating funds to handle minor but urgent financial hiccups.

Pros and Cons of Maintaining Both Funds

Maintaining both an emergency fund and a crisis stash offers financial flexibility by separating everyday urgent needs from severe, unexpected events, allowing for tailored access without depleting all savings. The emergency fund covers routine urgent expenses like minor car repairs or medical visits, promoting peace of mind and liquidity, while the crisis stash is reserved for significant disruptions such as job loss or natural disasters, ensuring long-term stability. However, splitting savings can reduce the total amount available in either fund, potentially complicating cash flow management and requiring disciplined budgeting to maintain adequate balances in both accounts.

How Much Should You Save in an Emergency Fund?

An emergency fund should ideally cover three to six months of essential living expenses to provide a financial buffer during unexpected events such as job loss or medical emergencies. A crisis stash complements this by holding a smaller, easily accessible amount, typically one month's expenses, reserved for immediate urgent needs like car repairs or urgent bills. Determining the right amount depends on your income stability, monthly obligations, and individual risk tolerance, ensuring you have sufficient liquidity without over-allocating funds.

Crisis Stash: Ideal Amounts for Urgent Needs

A Crisis Stash typically ranges from $500 to $1,000, designed to cover smaller, immediate expenses like unexpected car repairs or medical bills. Unlike a full Emergency Fund that can cover several months of living expenses, the Crisis Stash provides quick financial relief without depleting long-term savings. Maintaining an accessible Crisis Stash ensures urgent needs are met promptly, reducing reliance on credit or loans during unexpected situations.

Where to Store Your Emergency Fund and Crisis Stash

An Emergency Fund should be stored in a highly liquid, low-risk account such as a high-yield savings account to ensure quick access during unexpected expenses. A Crisis Stash, designed for more immediate cash needs, is best kept in physical cash or a separate checking account for instant availability. Storing both separately helps maintain clear financial boundaries and ensures readiness for varying levels of urgent situations.

Common Mistakes in Managing Emergency and Crisis Funds

Common mistakes in managing emergency and crisis funds include failing to clearly differentiate between the two, leading to improperly allocated resources and inadequate financial coverage when urgent needs arise. Many individuals mistakenly tap into their emergency fund for non-emergency expenses, depleting resources meant for true crises, while others do not regularly replenish or update their funds according to changing financial situations. Proper management requires maintaining separate accounts with specific thresholds based on monthly expenses and potential crisis durations to ensure liquidity and readiness.

When to Use Your Emergency Fund vs Crisis Stash

Use your Emergency Fund for unexpected, unavoidable expenses such as medical emergencies, car repairs, or sudden job loss that require immediate financial attention. Reserve your Crisis Stash for rare, severe situations like natural disasters or prolonged economic downturns where larger sums are needed beyond regular unforeseen costs. Prioritizing fund usage based on the urgency and scale of the financial crisis ensures optimal financial resilience and stability.

Strategies to Build Both Funds Simultaneously

Building an emergency fund and a crisis stash simultaneously requires setting clear financial goals and allocating separate savings accounts for each to avoid commingling funds. Automating regular transfers based on income and adjusting contribution amounts during periods of financial stability ensures steady growth of both funds. Prioritizing high-yield savings accounts or liquid investments can maximize accessibility and returns, preparing individuals for both short-term urgent needs and prolonged financial crises.

Related Important Terms

Micro-Emergency Fund

A Micro-Emergency Fund typically covers small, immediate expenses like minor car repairs or urgent medical co-pays, providing quick access without disrupting long-term savings. Unlike a Crisis Stash, which is reserved for major financial shocks such as job loss or natural disasters, a Micro-Emergency Fund ensures liquidity for everyday unexpected costs, preserving overall financial stability.

Crisis Cushion

A Crisis Cushion serves as a specialized subset of an Emergency Fund, designed specifically for immediate, high-impact financial shocks such as sudden job loss or medical emergencies. Unlike a general Emergency Fund, a Crisis Cushion prioritizes liquidity and accessibility to provide rapid support during critical moments, ensuring that urgent needs are met without compromising long-term financial stability.

Flash Fund

The Emergency Fund is a dedicated savings pool designed to cover unforeseen expenses, while a Crisis Stash refers to a smaller, quickly accessible reserve for immediate urgent needs, often called a Flash Fund. A Flash Fund provides rapid liquidity during sudden financial shocks, ensuring immediate payment capability without disrupting long-term emergency savings.

Insta-Stash

An Emergency Fund typically covers unexpected expenses like medical bills or car repairs, while a Crisis Stash targets immediate cash needs during sudden financial shocks. Insta-Stash offers instant access to funds, bridging the gap between traditional Emergency Funds and urgent liquidity required in crisis situations.

Shockproof Reserve

A Shockproof Reserve, unlike a typical Emergency Fund, is specifically designed to cover sudden financial shocks beyond everyday emergencies, providing a more robust safety net during prolonged crises. This reserve ensures liquidity and quick access to funds for urgent needs, preventing depletion of regular savings and maintaining financial stability in severe situations.

Turbo Liquidity Buffer

An Emergency Fund provides a reliable financial safety net for unexpected expenses, while a Crisis Stash acts as an additional reserve for prolonged or severe financial disruptions. Utilizing a Turbo Liquidity Buffer enhances immediate access to cash by maintaining high-liquidity assets, ensuring rapid availability without penalties during urgent needs.

Peak Panic Pool

The Peak Panic Pool serves as a more immediate, accessible reserve compared to a traditional Emergency Fund, designed specifically for urgent, short-term crises requiring quick liquidity. While an Emergency Fund covers broader, long-term financial safety, the Peak Panic Pool targets sudden high-stress expenses like medical emergencies or urgent home repairs.

Rapid-Response Nest Egg

A Rapid-Response Nest Egg serves as an instantly accessible emergency fund tailored for urgent financial needs, distinct from a crisis stash which may include longer-term resources or less liquid assets. Prioritizing liquidity and immediacy, this emergency fund enables quick financial stability in unexpected situations without impacting long-term savings.

Pulse Fund

Pulse Fund provides immediate liquidity tailored for urgent expenses, distinguishing itself from a general emergency fund by targeting short-term financial shocks with fast access to cash. Unlike a crisis stash, which is often a cash reserve set aside for unpredictable hardships, Pulse Fund employs real-time income opportunities to replenish funds quickly, ensuring continuous financial readiness.

Trigger Fund

A Trigger Fund is a strategically allocated portion of an Emergency Fund, designed specifically to cover urgent, unforeseen expenses without disrupting long-term savings goals. Unlike a Crisis Stash, which may be reserved for prolonged financial hardships, the Trigger Fund provides immediate access to cash for short-term urgent needs, ensuring rapid response to emergencies.

Emergency Fund vs Crisis Stash for urgent needs. Infographic

moneydiff.com

moneydiff.com