An Emergency Fund provides a safety net for unexpected expenses, protecting your financial stability without dipping into investments or long-term savings. A FU Fund, built for financial independence, offers the freedom to walk away from toxic situations or jobs by covering living expenses for an extended period. Prioritizing an Emergency Fund ensures immediate security, while a FU Fund supports broader life choices and complete financial autonomy.

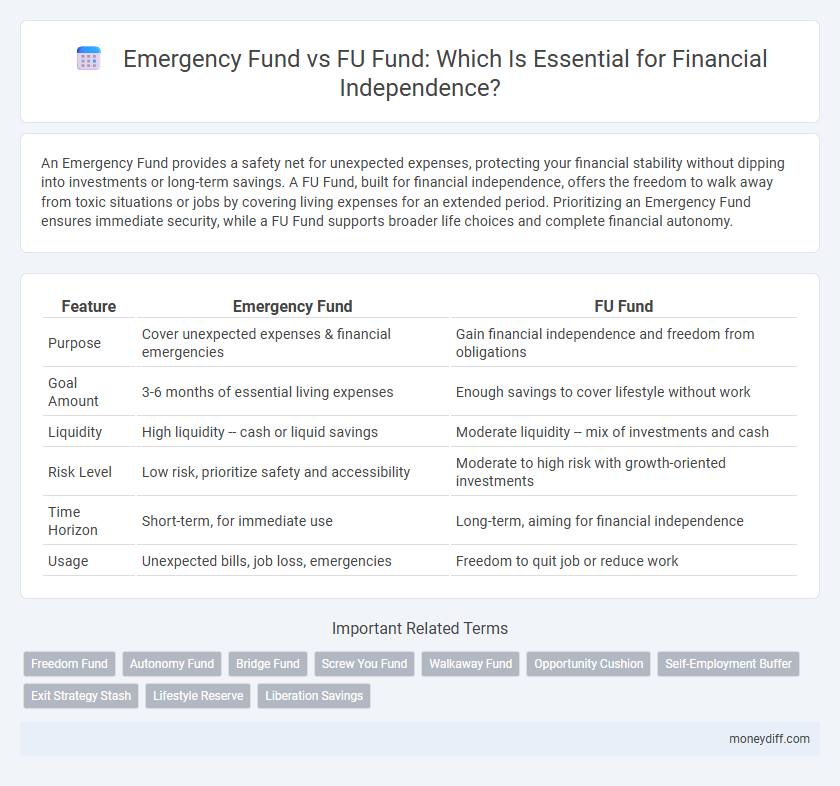

Table of Comparison

| Feature | Emergency Fund | FU Fund |

|---|---|---|

| Purpose | Cover unexpected expenses & financial emergencies | Gain financial independence and freedom from obligations |

| Goal Amount | 3-6 months of essential living expenses | Enough savings to cover lifestyle without work |

| Liquidity | High liquidity -- cash or liquid savings | Moderate liquidity -- mix of investments and cash |

| Risk Level | Low risk, prioritize safety and accessibility | Moderate to high risk with growth-oriented investments |

| Time Horizon | Short-term, for immediate use | Long-term, aiming for financial independence |

| Usage | Unexpected bills, job loss, emergencies | Freedom to quit job or reduce work |

Understanding Emergency Funds and FU Funds

Emergency Funds are designed to cover unexpected expenses such as medical emergencies, car repairs, or job loss, typically recommending three to six months of living expenses saved. FU Funds, on the other hand, are larger savings pools intended to provide financial independence by enabling individuals to walk away from unfavorable situations, emphasizing personal freedom and long-term security. Understanding the distinct purposes and risk tolerances of Emergency Funds and FU Funds is crucial for effective financial planning and achieving autonomy.

Key Differences Between Emergency Fund and FU Fund

An Emergency Fund typically covers three to six months of essential living expenses to protect against unforeseen events like job loss or medical emergencies, providing a financial safety net. In contrast, a FU Fund is a larger reserve aimed at achieving financial independence by offering the freedom to walk away from undesirable situations, such as toxic jobs or relationships, without immediate income concerns. The key difference lies in their purpose: Emergency Funds prioritize short-term security, whereas FU Funds emphasize long-term empowerment and lifestyle control.

Purpose and Goals of an Emergency Fund

An Emergency Fund is designed to cover unexpected expenses such as medical emergencies, car repairs, or sudden job loss, providing immediate financial security without incurring debt. Its primary goal is liquidity and accessibility, ensuring funds are available within short notice to handle urgent situations. Unlike a FU (Financial Independence) Fund, which targets long-term wealth accumulation and lifestyle freedom, an Emergency Fund's purpose is risk management and short-term financial stability.

The Role of FU Fund in Financial Independence

The FU Fund plays a critical role in achieving financial independence by providing a dedicated financial buffer that empowers individuals to confidently exit unfulfilling jobs or toxic environments. Unlike a traditional emergency fund focused solely on unforeseen expenses, the FU Fund strategically supports personal freedom and lifestyle choices by covering living costs during transitions. Establishing a FU Fund accelerates the path to financial autonomy by reducing dependency on regular income and enabling proactive career or life changes.

How Much Should You Save in Each Fund?

An emergency fund typically requires three to six months' worth of essential living expenses to cover unforeseen events such as job loss or medical emergencies, while a FU (Financial Independence) fund demands a larger, long-term savings goal calculated to sustain your desired lifestyle indefinitely, often 25 times annual expenses. Prioritizing the emergency fund ensures financial stability and peace of mind before aggressively growing the FU fund for wealth freedom. Balancing both funds according to your risk tolerance and financial goals is essential for achieving financial independence with security.

Building an Emergency Fund: Essential Strategies

Building an emergency fund requires setting aside three to six months' worth of essential expenses in a highly liquid account to ensure immediate access during financial crises. Prioritize consistent contributions and automate savings to maintain disciplined growth without compromising daily budget needs. Regularly reassess fund adequacy based on fluctuating living costs and unexpected financial obligations.

FU Fund: Empowering Your Financial Choices

The FU Fund empowers financial independence by prioritizing personal freedom over traditional emergency savings, enabling individuals to make bold life decisions without fear of financial setback. Unlike a conventional Emergency Fund, which focuses on covering unforeseen expenses, the FU Fund builds a buffer that allows for career changes, entrepreneurial risks, or leaving toxic environments with confidence. This approach redefines financial security by emphasizing proactive control over money to achieve true empowerment and flexibility.

When and How to Use Each Fund

Emergency funds are designed for unexpected, essential expenses such as medical emergencies, car repairs, or sudden job loss, providing immediate financial security without risking long-term investments. FU funds, aimed at achieving financial independence and personal empowerment, are used strategically to support life-changing decisions like quitting a toxic job or pursuing entrepreneurial ventures. Use the emergency fund strictly for urgent, unavoidable costs, while the FU fund should be accessed deliberately for planned, transformative financial moves that foster independence.

Common Mistakes to Avoid with Emergency and FU Funds

Common mistakes with Emergency Funds include underfunding the account to cover at least three to six months of essential expenses, which risks financial instability during unforeseen events. For FU Funds, a frequent error is using the fund prematurely or not clearly defining the intended purpose, undermining its role in providing true financial independence and personal empowerment. Both funds require strict discipline and clear boundaries to ensure they serve their distinct financial safety nets effectively.

Prioritizing Savings: Emergency Fund vs FU Fund

Prioritizing savings begins with establishing a fully funded emergency fund covering three to six months of essential expenses to ensure financial stability during unexpected events. Once the emergency fund is secured, building a FU Fund--a financial buffer aimed at providing independence and empowerment to walk away from toxic situations--becomes the next step. Balancing contributions between these funds maximizes security and freedom, aligning short-term protection with long-term financial independence goals.

Related Important Terms

Freedom Fund

An Emergency Fund provides financial security by covering unexpected expenses, typically three to six months of living costs, while a Freedom Fund (FU Fund) accelerates financial independence by enabling early retirement or lifestyle choices without reliance on traditional income. Prioritizing a Freedom Fund empowers individuals to build sustainable wealth and achieve long-term financial freedom beyond immediate emergencies.

Autonomy Fund

An Emergency Fund acts as a financial safety net for unforeseen expenses, typically covering three to six months of living costs, while a FU Fund, also known as an Autonomy Fund, is designed to empower complete financial independence by providing the means to walk away from unsatisfactory work or situations. Prioritizing an Autonomy Fund accelerates financial freedom by enabling autonomous decision-making without reliance on employment income, making it a strategic step beyond traditional emergency savings.

Bridge Fund

A Bridge Fund serves as a crucial financial buffer that covers short-term expenses during unexpected crises, ensuring stability without derailing long-term investment goals. Unlike a Flexible Use (FU) Fund designed for discretionary or lifestyle choices, an Emergency Fund emphasizes immediate liquidity and risk mitigation to protect financial independence.

Screw You Fund

The Emergency Fund serves as a crucial safety net covering 3 to 6 months of essential expenses, while the Screw You Fund, often larger, empowers financial independence by providing freedom to make bold choices without fear of income loss. Prioritizing a Screw You Fund accelerates autonomy, enabling one to walk away from unsatisfying jobs or toxic environments confidently.

Walkaway Fund

A Walkaway Fund, often contrasted with a traditional Emergency Fund and a FU Fund, provides a financial safety net that empowers individuals to exit toxic jobs or situations without fear, ensuring true financial independence and peace of mind. Unlike a standard Emergency Fund focused solely on unexpected expenses, a Walkaway Fund is deliberately sized to cover living costs long enough to pursue freedom and personal autonomy.

Opportunity Cushion

An Emergency Fund provides a financial safety net for unexpected expenses, while a FU Fund serves as an opportunity cushion to enable bold decisions and financial independence without fear of setbacks. Prioritizing an Opportunity Cushion through a FU Fund empowers individuals to take calculated risks, accelerating wealth-building beyond traditional emergency savings.

Self-Employment Buffer

An Emergency Fund typically covers 3 to 6 months of essential expenses to protect against unexpected job loss or medical emergencies, while a FU Fund is a more substantial financial buffer designed for complete self-sufficiency and independence, often covering 12 months or more. For self-employed individuals, a FU Fund acts as a critical safety net that accounts for income volatility, business risks, and extended periods without steady cash flow, ensuring long-term financial stability beyond basic emergency preparedness.

Exit Strategy Stash

An Emergency Fund provides quick liquidity to cover unexpected expenses without disrupting long-term investments, while a FU Fund, or financial independence fund, offers a strategic Exit Strategy Stash enabling early retirement or career freedom by ensuring sufficient capital for planned life changes. Prioritizing a well-funded Emergency Fund stabilizes financial resilience, whereas the FU Fund fuels proactive financial independence with a targeted savings buffer.

Lifestyle Reserve

An Emergency Fund covers 3-6 months of essential expenses, securing immediate financial stability during unforeseen events, while a FU Fund, often larger, acts as a Lifestyle Reserve supporting a complete break from toxic environments or jobs without income pressure. The Lifestyle Reserve prioritizes personal freedom and mental health, enabling financial independence beyond mere survival.

Liberation Savings

Liberation Savings emphasizes the importance of an Emergency Fund as a foundational financial buffer covering 3 to 6 months of essential expenses, providing immediate stability during unexpected events. FU Funds, designed for rapid financial independence, prioritize aggressive savings beyond basic emergencies, enabling individuals to break free from traditional constraints and achieve long-term liberation.

Emergency Fund vs FU Fund for financial independence. Infographic

moneydiff.com

moneydiff.com