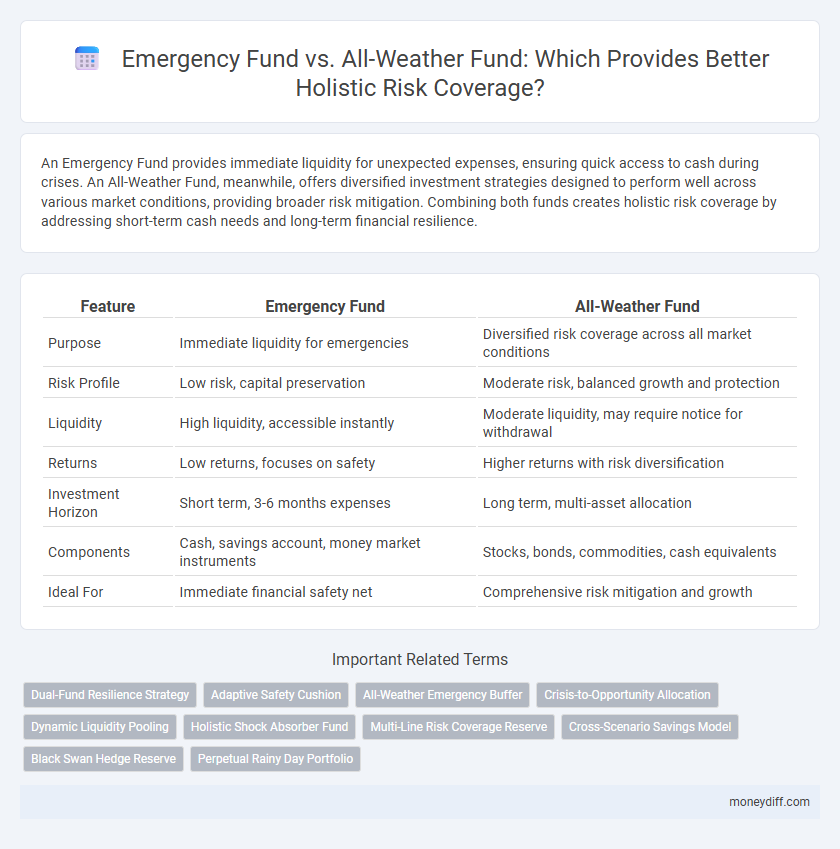

An Emergency Fund provides immediate liquidity for unexpected expenses, ensuring quick access to cash during crises. An All-Weather Fund, meanwhile, offers diversified investment strategies designed to perform well across various market conditions, providing broader risk mitigation. Combining both funds creates holistic risk coverage by addressing short-term cash needs and long-term financial resilience.

Table of Comparison

| Feature | Emergency Fund | All-Weather Fund |

|---|---|---|

| Purpose | Immediate liquidity for emergencies | Diversified risk coverage across all market conditions |

| Risk Profile | Low risk, capital preservation | Moderate risk, balanced growth and protection |

| Liquidity | High liquidity, accessible instantly | Moderate liquidity, may require notice for withdrawal |

| Returns | Low returns, focuses on safety | Higher returns with risk diversification |

| Investment Horizon | Short term, 3-6 months expenses | Long term, multi-asset allocation |

| Components | Cash, savings account, money market instruments | Stocks, bonds, commodities, cash equivalents |

| Ideal For | Immediate financial safety net | Comprehensive risk mitigation and growth |

Understanding Emergency Funds: The Basics

Emergency funds consist of liquid assets set aside to cover unexpected expenses or financial emergencies, typically amounting to three to six months' worth of essential living costs, ensuring immediate access without market risk. All-weather funds aim to balance risk across various economic conditions by diversifying investments, but may not provide the instant liquidity necessary for emergencies. Understanding this distinction clarifies why emergency funds serve as a foundational financial safety net, while all-weather funds function as long-term growth vehicles with holistic risk coverage.

What Is an All-Weather Fund?

An all-weather fund is a diversified investment portfolio designed to perform well across various market conditions, including inflation, deflation, growth, and recession. Unlike a traditional emergency fund, which holds cash or cash equivalents for immediate liquidity, an all-weather fund balances assets like equities, bonds, commodities, and cash to provide growth and risk mitigation over time. This strategy aims to offer holistic risk coverage, combining capital preservation with moderate returns to protect against multiple financial uncertainties.

Key Differences Between Emergency and All-Weather Funds

Emergency funds prioritize liquidity and safety, typically held in easily accessible savings accounts to cover unexpected expenses within three to six months. All-weather funds diversify across asset classes like stocks, bonds, and commodities to balance risk and returns in various market conditions, targeting long-term wealth preservation. The key difference lies in emergency funds prioritizing immediate financial security, while all-weather funds aim for comprehensive risk management through diversified investments.

Short-Term vs. Long-Term Risk Coverage

An emergency fund primarily addresses short-term financial risks by providing immediate liquidity for unexpected expenses such as medical emergencies or urgent home repairs. In contrast, an all-weather fund is designed for long-term risk coverage, offering diversified investment strategies that protect against market volatility, inflation, and economic downturns. Combining both funds creates a holistic risk management approach, ensuring stability during immediate crises and sustained growth for future financial security.

Liquidity Needs: When to Access Each Fund

An emergency fund provides immediate liquidity for unforeseen expenses such as medical emergencies or job loss, ensuring quick access without market risk. An all-weather fund, while diversified to withstand various market conditions, is generally suited for long-term financial goals and may require a longer time horizon to liquidate without significant loss. Prioritizing the emergency fund for short-term liquidity needs and the all-weather fund for sustained growth creates a balanced approach to holistic risk coverage.

Building an Emergency Fund: Strategies & Tips

Building an emergency fund requires setting aside three to six months' worth of essential living expenses in a highly liquid, low-risk account to ensure immediate access during financial crises. Unlike all-weather funds, which diversify across asset classes to manage market volatility, emergency funds prioritize safety and liquidity over high returns. Consistency in monthly contributions and automatic transfers streamline fund growth, providing robust financial security for unexpected events.

Crafting Your All-Weather Fund: Essential Elements

Crafting your All-Weather Fund involves combining liquidity, diversification, and low volatility assets to ensure holistic risk coverage across market cycles. Essential elements include a mix of cash equivalents, high-quality bonds, and inflation-protected securities, providing stability during economic downturns and protection against inflation. Balancing these components enhances financial resilience, outperforming a traditional Emergency Fund limited to short-term cash needs.

Common Pitfalls in Risk Mitigation Funds

Emergency funds often fall short in holistic risk coverage due to limited liquidity and low inflation protection compared to all-weather funds, which diversify across asset classes like equities, bonds, and commodities. Common pitfalls include underestimating emergency cash needs, overconcentration in low-yield instruments, and ignoring market volatility impacts on the fund's real value. Integrating an all-weather fund strategy addresses these risks by balancing growth and safety, ensuring robust capital preservation during economic downturns and inflationary periods.

Integrating Both Funds for Comprehensive Financial Safety

Integrating an emergency fund with an all-weather fund enhances comprehensive financial safety by combining immediate liquidity with diversified, long-term risk management. An emergency fund provides quick access to cash for unforeseen expenses, while an all-weather fund offers stable returns across market cycles, balancing income and growth. Utilizing both funds together ensures financial resilience against temporary shocks and prolonged economic volatility, optimizing overall risk coverage.

Final Verdict: Choosing the Right Fund for Your Goals

Emergency funds prioritize liquidity and accessibility to cover immediate, unexpected expenses, while all-weather funds focus on diversified asset allocation to withstand various market conditions. Selecting the ideal fund depends on your risk tolerance, financial goals, and time horizon, with emergency funds best suited for short-term safety nets and all-weather funds appropriate for long-term wealth preservation. Balancing both can provide comprehensive financial security, addressing immediate liquidity needs and sustained growth across market cycles.

Related Important Terms

Dual-Fund Resilience Strategy

Emergency Fund provides immediate liquidity for unforeseen expenses, while All-Weather Fund diversifies investments across asset classes to hedge against various market conditions; combining both in a Dual-Fund Resilience Strategy ensures comprehensive financial security by balancing short-term access and long-term growth. This approach mitigates risks from emergencies and market volatility, optimizing portfolio stability and cash flow management.

Adaptive Safety Cushion

An Emergency Fund acts as an Adaptive Safety Cushion by providing immediate liquidity for unexpected expenses, while an All-Weather Fund offers diversified asset allocation to withstand market volatility and broader financial risks. Combining both ensures holistic risk coverage by balancing readily accessible cash reserves with strategic investment stability.

All-Weather Emergency Buffer

An All-Weather Emergency Buffer combines the liquidity of a traditional emergency fund with diversified assets to provide holistic risk coverage across various economic conditions. By integrating cash reserves with low-volatility investments like Treasury Inflation-Protected Securities (TIPS) and high-quality bonds, this strategy ensures capital preservation and growth potential during market downturns and inflationary periods.

Crisis-to-Opportunity Allocation

Emergency funds provide liquidity for immediate financial crises, while all-weather funds diversify across asset classes to balance risk and opportunity over time. Crisis-to-opportunity allocation leverages emergency reserves to invest strategically during market downturns, enhancing long-term portfolio resilience.

Dynamic Liquidity Pooling

Emergency Fund emphasizes immediate access to cash to cover unexpected expenses, whereas All-Weather Fund utilizes Dynamic Liquidity Pooling by reallocating assets across market conditions to balance risk and return while maintaining sufficient liquidity. This approach enhances holistic risk coverage by merging short-term liquidity needs with diversified investment strategies for long-term financial resilience.

Holistic Shock Absorber Fund

An Emergency Fund provides immediate liquidity for unexpected expenses, while an All-Weather Fund offers diversified asset allocation to protect against various market conditions, creating a Holistic Shock Absorber Fund that balances short-term cash needs with long-term financial stability. Combining both strategies enhances resilience by covering sudden emergencies and mitigating broader financial shocks across economic cycles.

Multi-Line Risk Coverage Reserve

An Emergency Fund provides immediate liquidity for unexpected personal expenses, while an All-Weather Fund offers diversified, multi-line risk coverage reserves to hedge against economic volatility, market fluctuations, and diverse financial emergencies. Combining both ensures comprehensive financial resilience by addressing short-term cash needs and long-term risk management simultaneously.

Cross-Scenario Savings Model

Emergency Fund provides immediate liquidity for unforeseen expenses, while an All-Weather Fund employs diversified assets to mitigate risks across economic cycles; integrating both within a Cross-Scenario Savings Model ensures comprehensive financial resilience by balancing short-term access and long-term growth. This model optimizes capital allocation to protect against market volatility, income disruption, and emergency needs simultaneously.

Black Swan Hedge Reserve

An Emergency Fund provides immediate liquidity for unforeseen personal financial crises, whereas an All-Weather Fund, like the Black Swan Hedge Reserve, offers holistic risk coverage by strategically balancing assets to withstand extreme market events and economic downturns. The Black Swan Hedge Reserve specifically targets rare, high-impact financial disruptions, enhancing portfolio resilience beyond the scope of traditional emergency savings.

Perpetual Rainy Day Portfolio

Emergency funds provide immediate liquidity for unexpected expenses, while All-Weather Funds, like the Perpetual Rainy Day Portfolio, offer diversified asset allocation designed to withstand various economic conditions and market volatility. The Perpetual Rainy Day Portfolio integrates cash, bonds, and inflation-protected securities to deliver holistic risk coverage, ensuring long-term financial resilience beyond short-term emergencies.

Emergency Fund vs All-Weather Fund for holistic risk coverage. Infographic

moneydiff.com

moneydiff.com