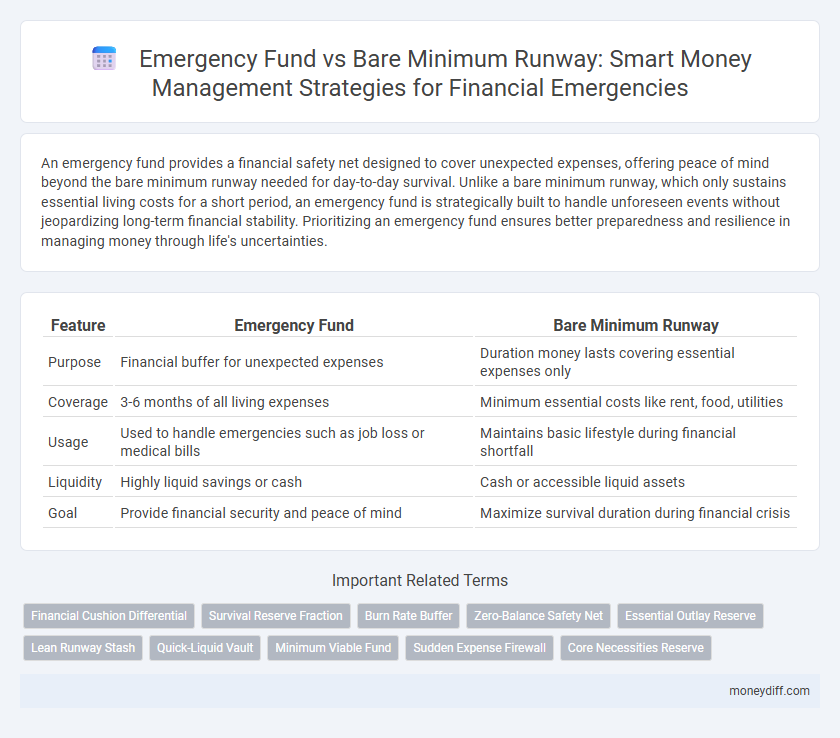

An emergency fund provides a financial safety net designed to cover unexpected expenses, offering peace of mind beyond the bare minimum runway needed for day-to-day survival. Unlike a bare minimum runway, which only sustains essential living costs for a short period, an emergency fund is strategically built to handle unforeseen events without jeopardizing long-term financial stability. Prioritizing an emergency fund ensures better preparedness and resilience in managing money through life's uncertainties.

Table of Comparison

| Feature | Emergency Fund | Bare Minimum Runway |

|---|---|---|

| Purpose | Financial buffer for unexpected expenses | Duration money lasts covering essential expenses only |

| Coverage | 3-6 months of all living expenses | Minimum essential costs like rent, food, utilities |

| Usage | Used to handle emergencies such as job loss or medical bills | Maintains basic lifestyle during financial shortfall |

| Liquidity | Highly liquid savings or cash | Cash or accessible liquid assets |

| Goal | Provide financial security and peace of mind | Maximize survival duration during financial crisis |

Defining Emergency Fund vs Bare Minimum Runway

An Emergency Fund is a financial safety net consisting of three to six months' worth of living expenses set aside to cover unexpected costs such as medical emergencies, job loss, or urgent home repairs. In contrast, the Bare Minimum Runway represents the shortest duration one's available cash can sustain essential living expenses without additional income, typically covering only essentials like rent, utilities, and food for one to two months. Understanding the distinction ensures better money management by balancing immediate survival needs with long-term financial resilience.

Key Differences Between Emergency Funds and Runways

Emergency funds are savings specifically set aside to cover unexpected financial emergencies, typically amounting to three to six months of essential living expenses, ensuring financial stability during unforeseen events. Bare minimum runway refers to the absolute minimum cash reserves a person or business requires to maintain operations for a short period, often calculated monthly and focused on survival rather than comfort. The key difference lies in purpose and scope: emergency funds provide broader financial security for various emergencies, while bare minimum runway targets sustaining minimal operations within a critical timeframe.

When to Prioritize Building an Emergency Fund

Prioritize building an emergency fund when your monthly essential expenses exceed your bare minimum runway, ensuring coverage for unforeseen events beyond basic survival costs. An emergency fund typically targets three to six months of living expenses, offering financial security during job loss or unexpected emergencies. Focus on emergency fund growth first if your current savings cover only the bare minimum runway, as this provides a buffer against long-term financial instability.

Situations Calling for a Bare Minimum Runway

Situations calling for a bare minimum runway typically involve urgent financial distress where immediate liquidity is crucial, such as sudden job loss, unexpected medical expenses, or emergency home repairs. Unlike a full emergency fund which covers 3 to 6 months of expenses, the bare minimum runway targets essential costs only, preserving enough cash flow to cover rent, utilities, food, and transportation for a short period. This approach prioritizes short-term survival and quick recovery, emphasizing rapid access to funds while minimizing non-essential spending.

Calculating the Ideal Emergency Fund Amount

Calculating the ideal emergency fund amount involves assessing monthly essential expenses and multiplying by a safe runway period, typically three to six months, to cover unforeseen financial hardships. The bare minimum runway focuses solely on necessary expenses such as rent, utilities, and groceries, whereas a comprehensive emergency fund also includes discretionary costs and potential unexpected expenses like medical bills. Prioritizing a well-rounded emergency fund ensures financial stability beyond just survival, enabling better preparedness for varied emergencies.

Estimating Your Bare Minimum Runway Needs

Estimating your bare minimum runway involves calculating essential monthly expenses necessary to sustain your basic lifestyle during financial emergencies, including rent, utilities, food, and healthcare. This focused financial buffer is typically smaller than a full emergency fund, designed to keep you afloat while seeking additional income or assistance. Knowing your exact bare minimum runway enables precise money management, ensuring you allocate funds efficiently for short-term survival without overcommitting resources.

Psychological and Financial Benefits of an Emergency Fund

An emergency fund offers a crucial psychological cushion by reducing stress and providing a sense of security during financial setbacks, unlike a bare minimum runway that merely covers immediate expenses. Financially, an emergency fund enhances stability by allowing individuals to handle unexpected costs without incurring debt or disrupting long-term investments. This proactive savings strategy promotes better money management and peace of mind in uncertain economic situations.

Risks of Relying Only on Bare Minimum Runway

Relying solely on a bare minimum runway exposes individuals to significant financial instability during unexpected emergencies such as job loss, medical crises, or urgent home repairs. Unlike a robust emergency fund that covers 3 to 6 months of essential expenses, a bare minimum runway often lacks cushion against prolonged income disruption, increasing the risk of debt accumulation or asset liquidation. Ensuring a well-funded emergency reserve mitigates the danger of financial stress and preserves long-term economic security.

Combining Both Strategies for Financial Stability

Combining an emergency fund with a bare minimum runway ensures optimal financial stability by covering unexpected expenses while sustaining essential living costs during extended income disruptions. An emergency fund typically covers 3 to 6 months of non-essential expenses, whereas a bare minimum runway focuses solely on critical expenses, often lasting 1 to 3 months. Integrating both strategies provides flexibility and security, enabling individuals to manage short-term emergencies without jeopardizing long-term financial health.

Common Mistakes in Managing Emergency Funds and Runway

Many individuals confuse their emergency fund with a bare minimum runway, leading to underfunded reserves that fail during prolonged financial crises. Common mistakes include setting insufficient amounts based on short-term expenses rather than realistic worst-case scenarios, and neglecting to adjust the fund with changing life circumstances or inflation. Effective money management requires clearly distinguishing an emergency fund--typically covering three to six months of essential expenses--from a bare minimum runway, which may only last weeks and lacks flexibility for unforeseen challenges.

Related Important Terms

Financial Cushion Differential

An emergency fund provides a robust financial cushion designed to cover unexpected expenses and income disruptions, while a bare minimum runway merely maintains essential monthly expenses without leaving room for unforeseen costs. This financial cushion differential highlights the importance of building an emergency fund to ensure greater stability and resilience during financial crises.

Survival Reserve Fraction

The Survival Reserve Fraction quantifies the proportion of essential expenses covered by an emergency fund, ensuring financial resilience during unexpected events. Unlike the Bare Minimum Runway, which calculates how long funds last without income, the Survival Reserve Fraction emphasizes maintaining a reserve aligned with survival needs, optimizing money management strategies.

Burn Rate Buffer

An Emergency Fund provides a financial safety net covering 3 to 6 months of essential expenses, whereas a Bare Minimum Runway focuses on the absolute lowest monthly burn rate necessary to sustain basic living costs. Prioritizing a Burn Rate Buffer enhances money management by ensuring sufficient funds to cover unexpected expenses without depleting core reserves.

Zero-Balance Safety Net

An Emergency Fund provides a financial cushion that covers unexpected expenses without depleting essential resources, whereas a Bare Minimum Runway focuses solely on sustaining basic living costs for a limited period. Employing a Zero-Balance Safety Net strategy prioritizes maintaining a minimal account balance, ensuring liquidity while avoiding reliance on credit or loans during emergencies.

Essential Outlay Reserve

An Emergency Fund differs from a Bare Minimum Runway by specifically targeting an Essential Outlay Reserve that covers critical expenses such as rent, utilities, groceries, and healthcare for at least three to six months. This Essential Outlay Reserve prioritizes financial stability by ensuring sufficient liquidity to manage unforeseen emergencies without compromising basic living standards.

Lean Runway Stash

A Lean Runway Stash is a financial buffer that goes beyond the bare minimum runway by covering essential expenses for three to six months, ensuring better stability during unexpected income disruptions. Unlike an Emergency Fund solely focused on urgent needs, a Lean Runway Stash prioritizes maintaining a streamlined budget to extend financial resilience while minimizing unnecessary expenditures.

Quick-Liquid Vault

A Quick-Liquid Vault acts as an essential component of an Emergency Fund, providing immediate access to cash for unexpected expenses without disrupting long-term investments. Unlike the Bare Minimum Runway, which covers only the absolute necessary expenses for a short period, a Quick-Liquid Vault ensures financial stability by balancing liquidity and accessibility with prudent money management strategies.

Minimum Viable Fund

A Minimum Viable Fund (MVF) acts as a bare minimum runway, covering essential expenses for a short period to prevent immediate financial crisis, while a traditional emergency fund typically aims for three to six months of living costs to provide broader security. Prioritizing an MVF allows individuals to quickly establish critical financial protection before scaling up to a full emergency fund for comprehensive stability.

Sudden Expense Firewall

An emergency fund acts as a Sudden Expense Firewall by covering unexpected costs without disrupting financial stability, whereas a bare minimum runway only sustains essential expenses for a short period. Maintaining a robust emergency fund ensures greater resilience against sudden financial shocks, preventing reliance on high-interest debt or asset liquidation.

Core Necessities Reserve

An Emergency Fund ensures financial stability by covering Core Necessities Reserve, including housing, food, utilities, and healthcare expenses, beyond the Bare Minimum Runway, which only supports immediate survival needs for a short period. Prioritizing a well-funded Core Necessities Reserve safeguards against unexpected income loss, providing a buffer that sustains essential living costs during extended financial hardship.

Emergency Fund vs Bare Minimum Runway for money management Infographic

moneydiff.com

moneydiff.com