An emergency fund is specifically designed to cover unforeseen expenses such as medical emergencies or urgent pet care, ensuring immediate access to cash without disrupting long-term investments. A buffer fund, on the other hand, provides a more flexible liquidity reserve to manage regular cash flow fluctuations and minor unexpected costs. Prioritizing an emergency fund for critical needs while maintaining a buffer fund for day-to-day liquidity ensures balanced financial security and effective cash management.

Table of Comparison

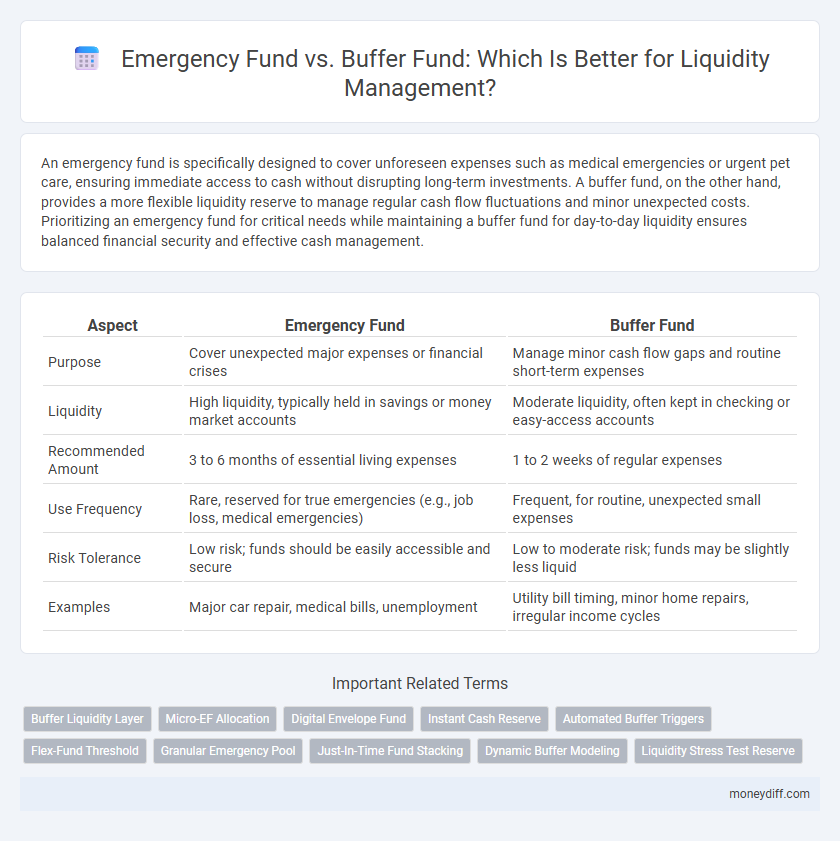

| Aspect | Emergency Fund | Buffer Fund |

|---|---|---|

| Purpose | Cover unexpected major expenses or financial crises | Manage minor cash flow gaps and routine short-term expenses |

| Liquidity | High liquidity, typically held in savings or money market accounts | Moderate liquidity, often kept in checking or easy-access accounts |

| Recommended Amount | 3 to 6 months of essential living expenses | 1 to 2 weeks of regular expenses |

| Use Frequency | Rare, reserved for true emergencies (e.g., job loss, medical emergencies) | Frequent, for routine, unexpected small expenses |

| Risk Tolerance | Low risk; funds should be easily accessible and secure | Low to moderate risk; funds may be slightly less liquid |

| Examples | Major car repair, medical bills, unemployment | Utility bill timing, minor home repairs, irregular income cycles |

Understanding Emergency Funds

Emergency funds are specifically designed to cover unforeseen expenses such as medical emergencies, job loss, or urgent home repairs, ensuring financial stability during crises. Buffer funds, however, serve as a short-term liquidity reserve for minor, predictable expenses like monthly bill fluctuations or small purchases. Understanding the distinct purposes of emergency funds versus buffer funds is essential for effective liquidity management and long-term financial resilience.

What is a Buffer Fund?

A buffer fund is a liquidity reserve designed to cover small, unexpected expenses or short-term cash flow gaps without disrupting regular financial plans. Unlike an emergency fund, which targets larger, unforeseen financial crises such as job loss or medical emergencies, a buffer fund provides quick-access cash to manage day-to-day financial fluctuations. Maintaining a buffer fund ensures smoother liquidity management by preventing unnecessary withdrawals from long-term investments or emergency savings.

Key Differences: Emergency Fund vs Buffer Fund

An Emergency Fund is a dedicated reserve to cover unexpected, significant financial crises like job loss or medical emergencies, ensuring long-term financial security. A Buffer Fund serves as a short-term liquidity cushion to manage routine cash flow fluctuations and minor expenses without disrupting daily finances. Key differences lie in their purpose, duration of use, and the amount set aside: Emergency Funds are larger and meant for severe contingencies, while Buffer Funds are smaller and intended for regular, short-term needs.

Why Liquidity Matters in Money Management

Liquidity matters in money management because it ensures immediate access to cash for unforeseen expenses, preventing financial strain or reliance on high-interest debt. An emergency fund serves as a dedicated reserve for significant, unexpected events, while a buffer fund manages everyday cash flow fluctuations to maintain smooth financial operations. Both funds enhance financial stability by addressing different liquidity needs, promoting prudent money management.

Setting Up an Emergency Fund: Best Practices

Setting up an emergency fund requires allocating three to six months' worth of essential living expenses in a highly liquid account, such as a savings or money market account, to ensure quick access during financial crises. Unlike buffer funds, which cover minor, short-term cash flow fluctuations, emergency funds are designed to safeguard against substantial, unpredictable events like job loss or medical emergencies. Regularly reviewing and adjusting the fund to match current expenses and potential risks enhances its effectiveness in long-term liquidity management.

Building a Buffer Fund: Strategies for Success

Building a buffer fund involves maintaining liquid assets specifically earmarked for short-term expenses, creating a financial cushion that complements an emergency fund designed for unexpected, significant disruptions. Effective strategies include regularly setting aside a fixed percentage of income, automating transfers to a separate savings account, and periodically reassessing fund adequacy based on evolving monthly expenses and financial obligations. Diverging from emergency funds, buffer funds prioritize immediate cash flow stability, enabling smoother liquidity management during routine financial fluctuations.

How Much to Allocate: Emergency Fund vs Buffer Fund

An Emergency Fund typically covers three to six months of essential living expenses, providing a financial safety net for unexpected situations such as job loss or medical emergencies. A Buffer Fund, on the other hand, is usually smaller, ranging from one to two months of discretionary expenses, and is designed to manage short-term cash flow fluctuations. Allocating funds between these two depends on individual financial stability, with a priority on fully funding the Emergency Fund before building a Buffer Fund for smoother liquidity management.

When to Use Each Fund: Real-Life Scenarios

Emergency funds are best used for unexpected, significant expenses like medical emergencies or job loss, ensuring financial stability during crises. Buffer funds, typically smaller and more accessible, handle minor, routine cash flow gaps such as delayed paychecks or unexpected car repairs. Using emergency funds for everyday expenses risks depletion, while buffer funds prevent unnecessary disruption to core savings.

Pitfalls to Avoid in Fund Management

Emergency funds must be distinctly separate from buffer funds to avoid liquidity risks during financial emergencies. Confusing these reserves can lead to inadequate cash flow, as buffer funds are often allocated for short-term operational costs rather than unexpected crises. Ensuring clear categorization and appropriate fund size prevents misuse and maintains financial stability.

Choosing the Right Liquidity Mix for Your Needs

An emergency fund is designed to cover unexpected expenses like medical emergencies or job loss, typically holding three to six months' worth of living expenses in easily accessible accounts. A buffer fund, in contrast, manages short-term liquidity fluctuations and operational cash flow, often kept in a linked checking or savings account for immediate access. Choosing the right liquidity mix involves assessing your risk tolerance, monthly expenses, and income stability to balance readily available cash with longer-term financial security.

Related Important Terms

Buffer Liquidity Layer

The buffer fund serves as an intermediate liquidity layer designed to cover short-term, unexpected expenses without dipping into the primary emergency fund, ensuring more strategic allocation of financial resources. Maintaining a well-structured buffer liquidity layer enhances financial resilience by bridging daily cash flow gaps and preserving the emergency fund for true crises.

Micro-EF Allocation

Micro emergency fund allocation targets liquid, low-risk assets designed for immediate access during unforeseen expenses, distinguishing it from a broader buffer fund that may include longer-term instruments. Prioritizing highly liquid options like savings accounts or money market funds within the micro-EF enhances quick accessibility and financial resilience in emergencies.

Digital Envelope Fund

An Emergency Fund is specifically allocated for unforeseen expenses such as medical emergencies or sudden job loss, ensuring immediate liquidity without disrupting long-term investments, whereas a Buffer Fund, often managed via Digital Envelope Fund systems, offers flexible spending allocations within preset digital categories to control budgeting and prevent overspending. Digital Envelope Funds enhance liquidity management by segmenting finances into distinct virtual envelopes, allowing precise tracking and optimization of emergency reserves and buffer allocations tailored to real-time financial needs.

Instant Cash Reserve

An Emergency Fund typically serves as a reserved pool of liquid assets meant to cover unexpected financial hardships, whereas a Buffer Fund is designed to manage short-term cash flow fluctuations and operational expenses. The Instant Cash Reserve within an Emergency Fund provides immediate liquidity, ensuring quick access to funds without disrupting long-term investments or incurring debt.

Automated Buffer Triggers

Automated buffer triggers enhance liquidity management by dynamically adjusting a buffer fund to cover short-term cash flow fluctuations, while an emergency fund serves as a static reserve for unexpected, large-scale financial crises. This system reduces reliance on manual monitoring, ensuring optimal liquidity levels without depleting the emergency fund reserved for major emergencies.

Flex-Fund Threshold

Emergency funds serve as a dedicated financial reserve for unforeseen expenses, while buffer funds provide extra liquidity to cover minor, predictable cash flow fluctuations; the Flex-Fund Threshold optimizes liquidity management by establishing a dynamic limit that balances accessibility with financial stability. This threshold helps individuals or businesses maintain sufficient reserves in emergency funds without unnecessarily tying up capital in buffer funds, enhancing overall cash flow efficiency.

Granular Emergency Pool

A Granular Emergency Pool offers a more detailed and segmented approach to liquidity management compared to a traditional Emergency Fund or Buffer Fund, allowing organizations to allocate specific reserves for distinct risk scenarios. This targeted strategy enhances financial resilience by ensuring immediate access to tailored funds for varied emergencies, optimizing overall cash flow stability.

Just-In-Time Fund Stacking

Emergency Fund serves as a financial safety net for unexpected expenses, while Buffer Fund provides immediate liquidity for routine cash flow gaps; Just-In-Time Fund Stacking optimizes liquidity by strategically layering these funds to ensure availability without excess idle cash. This approach enhances cash efficiency by allocating resources precisely when needed, minimizing opportunity costs and improving overall financial resilience.

Dynamic Buffer Modeling

Emergency funds are traditionally fixed reserves for unexpected expenses, whereas buffer funds utilize Dynamic Buffer Modeling to adjust liquidity in real-time based on cash flow variability and risk factors. This adaptive approach enhances financial resilience by optimizing fund allocation and minimizing liquidity shortfalls during emergencies.

Liquidity Stress Test Reserve

Liquidity Stress Test Reserves differentiate Emergency Funds and Buffer Funds by their specific purpose and liquidity requirements; Emergency Funds are set aside for unforeseen personal financial crises, ensuring immediate access to cash, while Buffer Funds are maintained by organizations to manage short-term liquidity fluctuations and cover operational expenses during stress scenarios. Effective liquidity management relies on conducting regular liquidity stress tests to calibrate these reserves accurately, optimizing cash availability without compromising financial stability.

Emergency Fund vs Buffer Fund for liquidity management. Infographic

moneydiff.com

moneydiff.com