An Emergency Fund provides essential financial security by covering unexpected expenses such as vet bills or urgent pet care, ensuring you can handle unforeseen costs without stress. In contrast, a Freedom Fund offers greater flexibility, allowing you to invest in your pet's long-term well-being and lifestyle enhancements without compromising your daily budget. Both funds contribute to overall financial stability, but the Emergency Fund prioritizes immediate protection while the Freedom Fund supports ongoing enrichment.

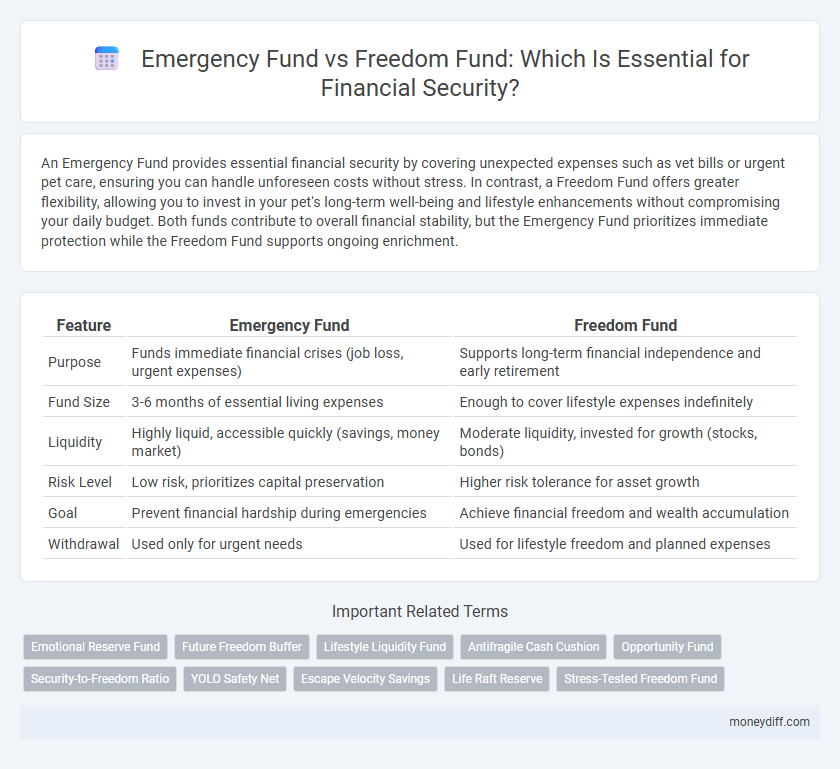

Table of Comparison

| Feature | Emergency Fund | Freedom Fund |

|---|---|---|

| Purpose | Funds immediate financial crises (job loss, urgent expenses) | Supports long-term financial independence and early retirement |

| Fund Size | 3-6 months of essential living expenses | Enough to cover lifestyle expenses indefinitely |

| Liquidity | Highly liquid, accessible quickly (savings, money market) | Moderate liquidity, invested for growth (stocks, bonds) |

| Risk Level | Low risk, prioritizes capital preservation | Higher risk tolerance for asset growth |

| Goal | Prevent financial hardship during emergencies | Achieve financial freedom and wealth accumulation |

| Withdrawal | Used only for urgent needs | Used for lifestyle freedom and planned expenses |

Understanding Emergency Funds and Freedom Funds

Emergency funds are specifically designed to cover unexpected expenses such as medical emergencies, car repairs, or job loss, typically holding three to six months' worth of living expenses in easily accessible accounts. Freedom funds differ by focusing on long-term financial independence, targeting goals like early retirement or lifestyle choices, often invested for growth rather than immediate liquidity. Both funds play crucial roles in financial security, with emergency funds providing short-term safety nets and freedom funds supporting sustained financial freedom.

Key Differences Between Emergency and Freedom Funds

Emergency funds prioritize immediate access to cash for unexpected expenses such as medical bills or car repairs, typically held in highly liquid accounts like savings or money market funds. Freedom funds focus on long-term financial independence, often invested in diversified portfolios with higher growth potential but less liquidity. The key differences lie in purpose, liquidity, and investment strategy, with emergency funds emphasizing safety and accessibility while freedom funds target wealth accumulation and future financial freedom.

Why You Need an Emergency Fund First

An emergency fund provides immediate financial security by covering unexpected expenses such as medical emergencies, car repairs, or sudden job loss, ensuring you avoid high-interest debt. In contrast, a freedom fund focuses on long-term goals like early retirement or financial independence but lacks the liquidity needed for urgent situations. Prioritizing an emergency fund stabilizes your financial foundation, making it easier to pursue freedom fund objectives without risking financial instability.

Building Your Emergency Fund: Best Practices

Building your emergency fund requires setting a realistic savings goal of three to six months' worth of essential expenses to cover unexpected financial shocks. Prioritize liquidity by keeping funds in high-yield savings accounts or money market accounts for quick access without penalties. Regularly automate contributions and periodically reevaluate your budget to adjust the fund size as your financial responsibilities evolve, ensuring ongoing financial security.

The Role of a Freedom Fund in Financial Independence

A Freedom Fund plays a crucial role in achieving true financial independence by providing a dedicated reserve that supports lifestyle choices rather than just covering emergencies. Unlike an Emergency Fund, which is primarily earmarked for unexpected expenses such as medical bills or urgent repairs, a Freedom Fund empowers individuals to pursue opportunities like career changes or entrepreneurship without financial constraints. This strategic allocation enhances long-term financial security by shifting the focus from reactive to proactive financial planning.

How Much to Save: Emergency Fund vs Freedom Fund

An emergency fund typically requires saving three to six months' worth of essential living expenses to cover unexpected financial setbacks such as job loss or medical emergencies. In contrast, a freedom fund aims for a larger savings goal, often equivalent to one to two years of expenses, providing greater financial independence and the ability to make life choices without immediate income pressure. Prioritizing an emergency fund first ensures immediate safety, while building a freedom fund supports long-term financial security and lifestyle flexibility.

When to Tap Into Each Fund

Tap into your Emergency Fund only during unexpected financial crises like job loss, medical emergencies, or urgent home repairs to maintain short-term financial stability. Use the Freedom Fund for planned life goals such as early retirement, travel, or major purchases that enhance long-term financial independence. Understanding the distinct purposes of each fund ensures optimal financial security and prevents depletion of critical reserves.

Balancing Contributions: Emergency vs Freedom Fund

Balancing contributions between an Emergency Fund and a Freedom Fund requires prioritizing liquidity and stability in the Emergency Fund to cover unexpected expenses, while allocating surplus savings to the Freedom Fund to build long-term financial independence. Optimal financial security involves maintaining three to six months of essential expenses in the Emergency Fund and regularly increasing the Freedom Fund to enhance wealth-building opportunities. Consistent evaluation of monthly budgets ensures sufficient funding for immediate needs without compromising future financial freedom.

The Psychological Impact of Financial Safety Nets

An emergency fund provides immediate financial security that reduces stress and anxiety during unexpected crises, fostering a sense of control over urgent expenses. A freedom fund, designed for long-term goals and lifestyle choices, enhances psychological well-being by promoting financial independence and reducing the fear of future uncertainties. Both funds serve distinct psychological roles, with emergency funds addressing short-term emotional relief and freedom funds supporting sustained mental resilience and confidence.

Which Fund Should Be Your Priority?

Emergency funds should be prioritized as the foundation of financial security, providing quick access to cash for unexpected expenses or job loss. Freedom funds, aimed at long-term wealth building and financial independence, are essential but secondary to ensuring stability through an emergency fund. Establishing 3 to 6 months of living expenses in an emergency fund reduces financial stress and prevents high-interest debt, making it the crucial first step before allocating resources to a freedom fund.

Related Important Terms

Emotional Reserve Fund

An Emergency Fund provides immediate financial support for unexpected expenses, ensuring short-term stability during crises, while a Freedom Fund acts as an Emotional Reserve Fund, offering long-term security and peace of mind by covering lifestyle choices and personal growth opportunities. Prioritizing an Emotional Reserve Fund enhances overall well-being by reducing stress and fostering emotional resilience beyond mere financial survival.

Future Freedom Buffer

An Emergency Fund provides immediate financial security for unexpected expenses, while a Freedom Fund, often referred to as a Future Freedom Buffer, is designed to sustain long-term financial independence by covering extended periods without income. Prioritizing a Future Freedom Buffer enhances financial resilience, enabling individuals to pursue opportunities without the constraint of urgent monetary needs.

Lifestyle Liquidity Fund

An Emergency Fund provides immediate access to cash for unexpected expenses such as medical emergencies or urgent home repairs, ensuring short-term financial stability. In contrast, a Freedom Fund, often referred to as a Lifestyle Liquidity Fund, supports longer-term financial independence by covering lifestyle expenses during career transitions or sabbaticals, prioritizing flexibility over immediate crisis management.

Antifragile Cash Cushion

An Emergency Fund provides immediate financial security by covering unexpected expenses, while a Freedom Fund enhances long-term resilience by enabling opportunities and growth beyond basic needs; together, they form an antifragile cash cushion that strengthens financial stability through volatility. Prioritizing both funds ensures a balanced approach to risk management and wealth preservation, optimizing adaptability in uncertain economic environments.

Opportunity Fund

An Emergency Fund is designed to cover unexpected expenses, providing immediate financial security, while a Freedom Fund prioritizes long-term opportunities and growth, often referred to as an Opportunity Fund. Allocating resources to an Opportunity Fund enables individuals to invest in ventures or assets that can generate substantial returns, enhancing financial freedom beyond basic emergency preparedness.

Security-to-Freedom Ratio

The Emergency Fund provides immediate financial security by covering essential expenses during unforeseen events, ensuring a solid Security-to-Freedom Ratio by prioritizing liquidity and risk mitigation. In contrast, the Freedom Fund emphasizes long-term financial independence and growth, balancing security with investments that enable lifestyle flexibility and future opportunities.

YOLO Safety Net

An Emergency Fund provides immediate financial security by covering unexpected expenses, while a Freedom Fund builds long-term resilience and independence, supporting lifestyle choices without financial stress. The YOLO Safety Net prioritizes a robust Emergency Fund to ensure peace of mind and rapid response to unforeseen events, laying the foundation for greater financial freedom.

Escape Velocity Savings

Escape Velocity Savings reflects the minimum emergency fund needed to cover unforeseen expenses while maintaining financial stability, whereas a Freedom Fund targets full financial independence beyond basic safety nets. Prioritizing Escape Velocity Savings ensures immediate protection against emergencies, serving as a critical foundation before accumulating wealth aimed at long-term freedom.

Life Raft Reserve

The Emergency Fund acts as a critical Life Raft Reserve, providing immediate financial security during unforeseen crises such as job loss or medical emergencies, with typically three to six months of essential living expenses saved. In contrast, the Freedom Fund focuses on longer-term financial independence and wealth building, allowing greater lifestyle flexibility beyond immediate survival needs.

Stress-Tested Freedom Fund

A Stress-Tested Freedom Fund goes beyond traditional Emergency Funds by not only covering unexpected expenses but also ensuring sustained financial freedom through diversified, resilient investments tailored to withstand economic downturns. This approach provides comprehensive financial security, minimizing stress by integrating robust liquidity with long-term growth potential.

Emergency Fund vs Freedom Fund for financial security. Infographic

moneydiff.com

moneydiff.com