An emergency fund is designed to cover unexpected expenses, such as medical bills or urgent pet care, ensuring financial stability during crises. An opportunity fund, on the other hand, is reserved for seizing potential investments or purchases without jeopardizing daily financial security. Prioritizing an emergency fund before building an opportunity fund creates a solid foundation for balanced and proactive financial planning.

Table of Comparison

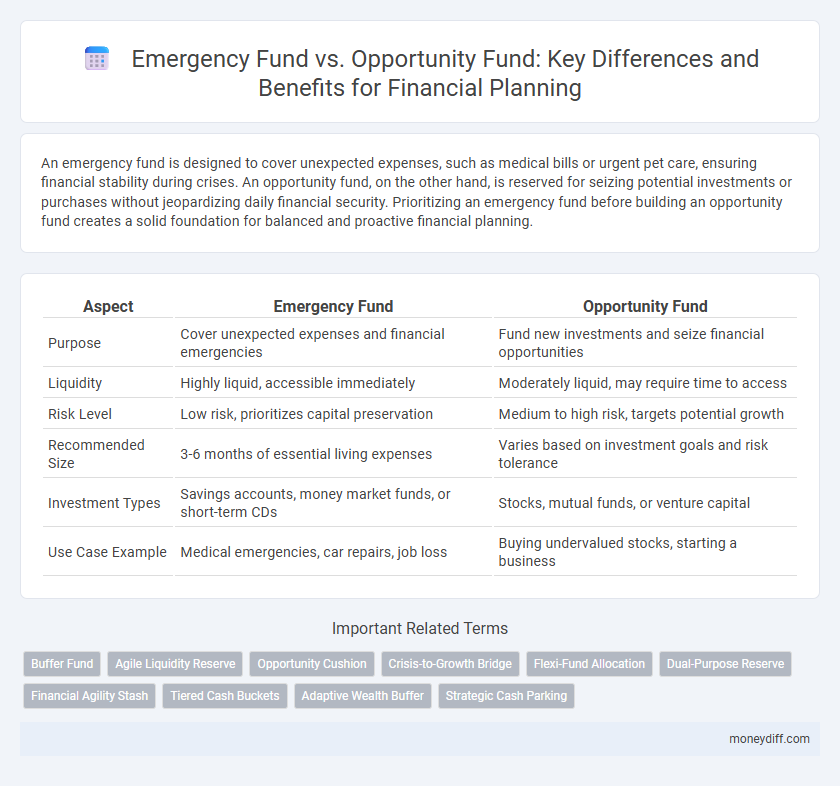

| Aspect | Emergency Fund | Opportunity Fund |

|---|---|---|

| Purpose | Cover unexpected expenses and financial emergencies | Fund new investments and seize financial opportunities |

| Liquidity | Highly liquid, accessible immediately | Moderately liquid, may require time to access |

| Risk Level | Low risk, prioritizes capital preservation | Medium to high risk, targets potential growth |

| Recommended Size | 3-6 months of essential living expenses | Varies based on investment goals and risk tolerance |

| Investment Types | Savings accounts, money market funds, or short-term CDs | Stocks, mutual funds, or venture capital |

| Use Case Example | Medical emergencies, car repairs, job loss | Buying undervalued stocks, starting a business |

Understanding Emergency Funds: Purpose and Importance

An emergency fund acts as a financial safety net, covering unexpected expenses such as medical bills, car repairs, or job loss, ensuring stability without incurring debt. It typically holds three to six months' worth of living expenses, providing immediate liquidity and peace of mind in times of crisis. Unlike opportunity funds, which are earmarked for investments or seizing financial opportunities, emergency funds prioritize accessibility and risk-free assets to safeguard financial well-being.

What is an Opportunity Fund?

An Opportunity Fund is a financial reserve set aside to capitalize on unexpected investments or financial opportunities, distinct from an Emergency Fund, which covers urgent and unforeseen expenses. Unlike Emergency Funds that prioritize liquidity and safety, Opportunity Funds often allow for higher risk and potential growth to maximize returns when favorable situations arise. Integrating an Opportunity Fund into financial planning provides flexibility to act quickly on market dips, business ventures, or unique investment prospects without compromising essential emergency savings.

Key Differences: Emergency Fund vs Opportunity Fund

An Emergency Fund is a reserved cash amount designed to cover unexpected expenses such as medical emergencies, car repairs, or job loss, ensuring financial stability during crises. In contrast, an Opportunity Fund is allocated for seizing potential investments or business opportunities, emphasizing growth rather than security. The key differences lie in their purpose, risk tolerance, and liquidity requirements: Emergency Funds prioritize immediate access and safety, while Opportunity Funds accept higher risk for potential financial gains.

How to Build an Emergency Fund Effectively

Building an emergency fund effectively requires setting a realistic savings goal equal to three to six months of essential living expenses and automating regular contributions to a dedicated high-yield savings account. Prioritize liquidity and low-risk assets to ensure immediate access during unexpected financial crises, distinguishing it from an opportunity fund, which targets higher returns through investment vehicles and is not intended for urgent cash needs. Consistently monitoring and adjusting the fund based on changing expenses enhances financial resilience and safeguards against reliance on high-interest debt.

Strategies for Growing an Opportunity Fund

An Opportunity Fund is designed to capitalize on unexpected financial prospects, requiring targeted strategies such as regular contributions exceeding basic savings, diversified investments in low-risk assets, and periodic reassessment of available funds to align with market opportunities. Unlike an Emergency Fund, which prioritizes liquidity and immediate access, an Opportunity Fund can afford moderate risk to enhance growth potential through vehicles like high-yield savings accounts, mutual funds, or ETFs. Consistent monitoring and adjustment of investment allocations help maximize returns while maintaining readiness to seize investment advantages.

When to Use Your Emergency Fund

Use your emergency fund exclusively for unexpected, essential expenses such as medical emergencies, job loss, or urgent home repairs to maintain financial stability. Avoid tapping into this fund for investment opportunities or discretionary spending, which are better suited for an opportunity fund designed to capitalize on market or personal financial chances. Maintaining clear distinctions between emergency and opportunity funds ensures preparedness while maximizing financial growth potential.

Optimal Situations for Deploying an Opportunity Fund

An Opportunity Fund is optimally deployed when investors have a stable Emergency Fund of 3 to 6 months' living expenses, enabling them to capitalize on unexpected investment opportunities without jeopardizing financial security. This fund is ideal for seizing market dips, sudden business ventures, or unique asset acquisitions that require immediate liquidity beyond emergency needs. Maintaining a clear distinction between the Emergency Fund and Opportunity Fund ensures financial flexibility and maximizes growth potential in volatile economic conditions.

Balancing Both Funds in Your Financial Plan

Balancing an emergency fund and an opportunity fund in your financial plan requires allocating adequate savings to cover 3 to 6 months of essential expenses for unexpected events, while also setting aside capital for potential investments or ventures that could yield higher returns. Prioritizing liquidity and accessibility in the emergency fund ensures financial stability during crises, whereas the opportunity fund should maintain a moderate risk profile tailored to growth prospects. Strategic distribution between these funds enhances overall financial resilience and empowers timely decision-making in both emergencies and investment opportunities.

Common Mistakes with Emergency and Opportunity Funds

Confusing emergency funds with opportunity funds can lead to financial instability by using savings meant for urgent expenses on investments or non-essential purchases. A common mistake is underfunding emergency funds, which should ideally cover three to six months of living expenses to provide a safety net during unexpected events. Conversely, opportunity funds are often overemphasized, causing individuals to neglect liquidity needed for emergencies, ultimately compromising financial resilience.

Actionable Steps to Start Both Funds Today

Allocate a fixed percentage of your monthly income to establish both an emergency fund covering at least three to six months of essential expenses and an opportunity fund aimed at capturing future investment prospects. Use separate high-yield savings accounts to maintain clear boundaries, ensuring immediate liquidity for emergencies while preserving capital growth potential for opportunities. Automate transfers and regularly review fund balances to adjust contributions based on changing financial goals and market conditions.

Related Important Terms

Buffer Fund

An Emergency Fund serves as a critical buffer fund designed to cover unexpected expenses such as medical emergencies, car repairs, or sudden job loss, ensuring financial stability without incurring debt. In contrast, an Opportunity Fund targets potential investments or business ventures, emphasizing growth rather than security, making the Emergency Fund essential for foundational financial planning.

Agile Liquidity Reserve

An Emergency Fund serves as an agile liquidity reserve designed to cover unexpected expenses and maintain financial stability during crises, while an Opportunity Fund is targeted toward seizing investment or business opportunities without risking essential savings. Prioritizing an Emergency Fund ensures immediate cash availability, reducing financial stress and preserving long-term wealth-building strategies.

Opportunity Cushion

An Opportunity Cushion serves as a strategic financial reserve distinct from an Emergency Fund, designed to capitalize on investment opportunities or unexpected ventures without jeopardizing essential living expenses. Maintaining a dedicated Opportunity Cushion enables proactive wealth growth while ensuring that liquidity remains intact for genuine emergencies.

Crisis-to-Growth Bridge

Emergency funds provide immediate financial security during crises by covering essential expenses, while opportunity funds enable capitalizing on growth prospects without jeopardizing stability. Strategically balancing both funds creates a crisis-to-growth bridge, ensuring resilience during emergencies and agility to seize investment opportunities for long-term financial success.

Flexi-Fund Allocation

Emergency funds prioritize liquidity and stability by maintaining three to six months' worth of essential expenses in easily accessible accounts, ensuring immediate availability during crises. Opportunity funds focus on flexibility and growth, allocated to moderately liquid assets like short-term bonds or low-risk mutual funds to quickly capitalize on unexpected investment opportunities without compromising emergency reserves.

Dual-Purpose Reserve

A Dual-Purpose Reserve combines the stability of an Emergency Fund with the growth potential of an Opportunity Fund, ensuring immediate financial security while enabling quick access to capital for unexpected investment prospects. This strategic blend optimizes liquidity and readiness, balancing risk management with the agility needed for seizing time-sensitive opportunities in financial planning.

Financial Agility Stash

An Emergency Fund provides immediate financial security for unexpected expenses like medical bills or car repairs, while an Opportunity Fund is designed to capitalize on timely investment or business opportunities without disrupting essential savings. Establishing a Financial Agility Stash by balancing both funds ensures preparedness for emergencies and the flexibility to seize growth prospects, enhancing overall financial resilience.

Tiered Cash Buckets

Emergency funds prioritize liquidity and stability, typically held in low-risk Tier 1 cash buckets to cover 3-6 months of essential expenses, ensuring immediate access during financial crises. Opportunity funds, often placed in higher-yield Tier 2 or Tier 3 cash buckets, allow for strategic investment opportunities with moderate risk tolerance, balancing growth potential against accessibility in comprehensive financial planning.

Adaptive Wealth Buffer

Emergency Fund serves as a critical Adaptive Wealth Buffer, providing immediate liquidity to cover unforeseen expenses and financial shocks without disrupting long-term investments. Opportunity Fund, in contrast, is designed to capitalize on market openings and growth potential, supplementing financial planning by balancing risk readiness with proactive wealth accumulation.

Strategic Cash Parking

An Emergency Fund is essential for covering unexpected expenses and financial setbacks, maintaining liquidity in a low-risk, easily accessible account, while an Opportunity Fund, used for strategic cash parking, is allocated for potential investments or business opportunities requiring quick capital deployment. Differentiating these funds in financial planning ensures stability through risk-managed reserves and agility by strategically positioning cash to capitalize on market or investment opportunities.

Emergency Fund vs Opportunity Fund for financial planning. Infographic

moneydiff.com

moneydiff.com